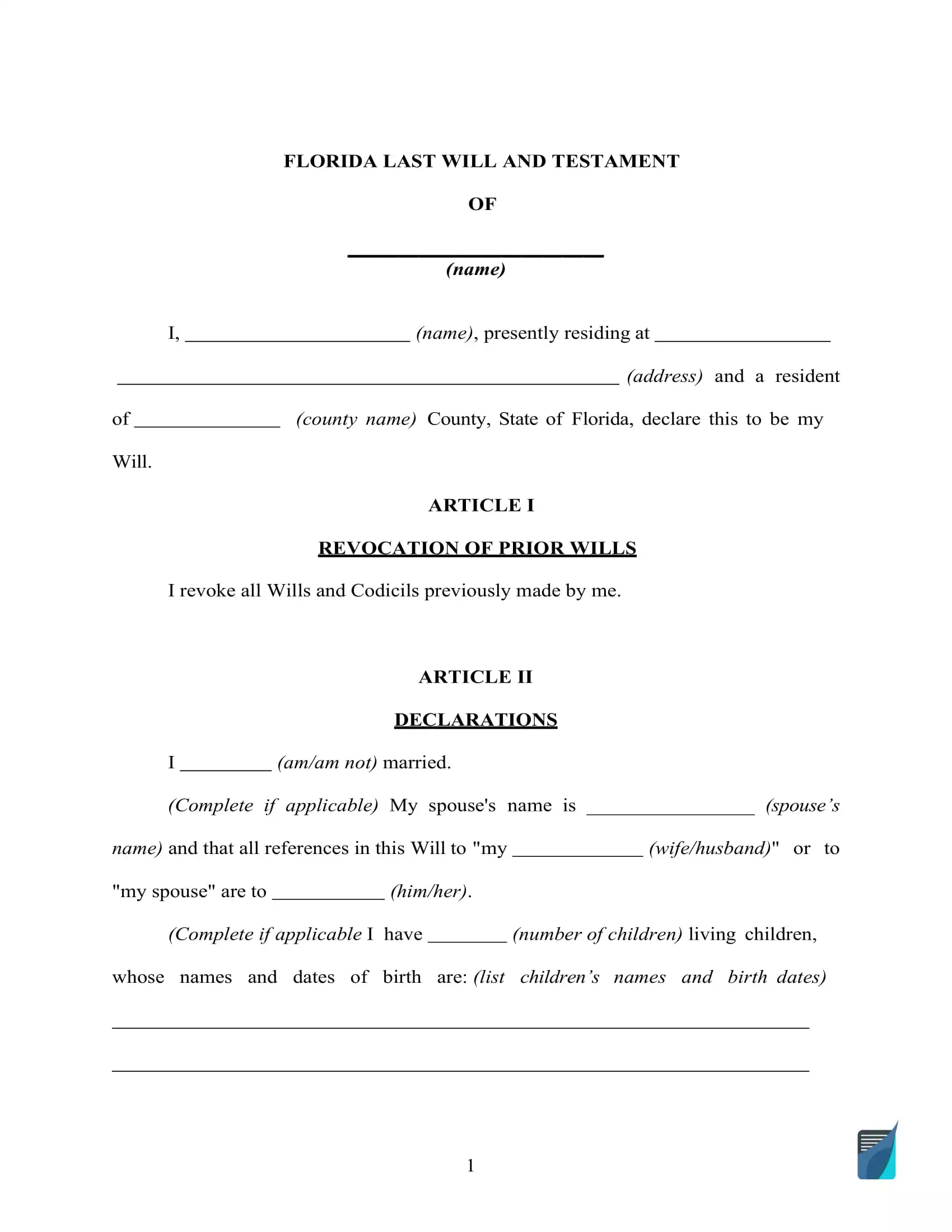

Florida Last Will and Testament Form

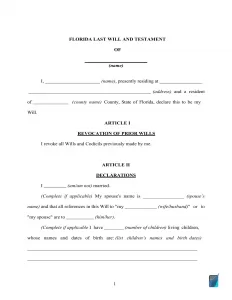

A Florida last will is a legally binding document that expresses the testator’s final wishes in the form approved by the state law and ascertains the appropriate distribution of the will creator’s estate upon their demise.

A thought-out and appropriately written last will and testament will be vital to your loved ones and your relations upon your death, even if you don’t possess a large number of assets.

Below, you can find a Florida last will and testament form for download and the information that should solve your slightest uncertainties in regard to estate planning, different types of will, and the ways to write a valid document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Florida Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Chapter 732 – Probate Code: Intestate Succession and Wills; Part V – Wills | |

| Definitions | Chapter 731 – Probate Code: General Definitions | |

| Signing requirement | Two witnesses | 732.502 Execution of wills |

| Age of testator | 18 and older or an emancipated minor | 732.501 Who may make a will |

| Age of witnesses | 18 and older | 732.504 Who may witness |

| Self-proving wills | Allowed | 732.503 Self-proof of will |

| Handwritten wills | Might be accepted if witnessed according to state law | 732.502 Execution of wills |

| Oral wills | Not recognized | |

| Holographic wills | Not recognized | |

How to Write a Florida Last Will and Testament

1. Think about your options. Prior to beginning, you’ll want to decide if you’d like to use the services of a legal professional or prepare the entire thing on your own. In case you would like to make the will by yourself, pick the type you’ll go for: a handwritten (holographic) will or perhaps a free last will and testament form.

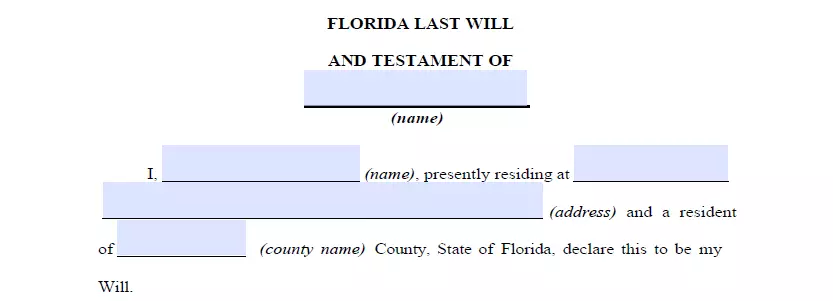

2. Indicate your details. Add your full name and address (the city, county, and state of residence) to ascertain the testator of the last will and testament. Go through the remaining portion of the section, including the details you’ve entered and the “Expenses and Taxes” subsection.

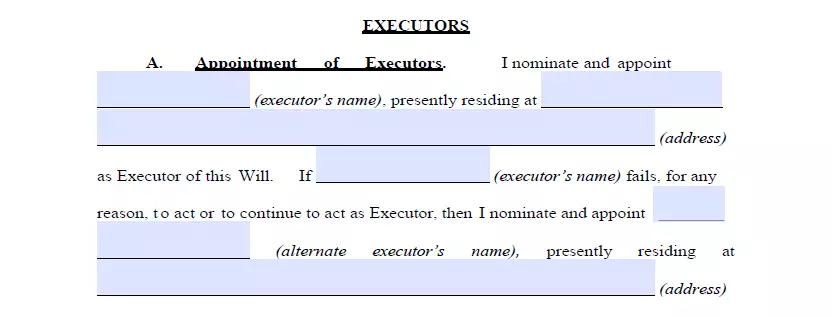

3. Establish the executor (or executrix). Now it is time to decide on the executor of your last will, the person liable for making sure all things you lay out in this document are realized. To do that, you need to enter the executor’s full name, along with their residence details (city, county, and state). Be sure to choose a person who resides in the same state as you do. Otherwise, there’ll be a lot more red tape and unnecessary hassle connected with the procedure because of different special policies every state has in terms of out-of-state executors. As a precaution, it is possible to appoint a substitute executor of your last will and testament. That way, you will be able to be certain that even if the originally appointed executor is not able to carry out their obligations, there is a second dependable person you can rely on.

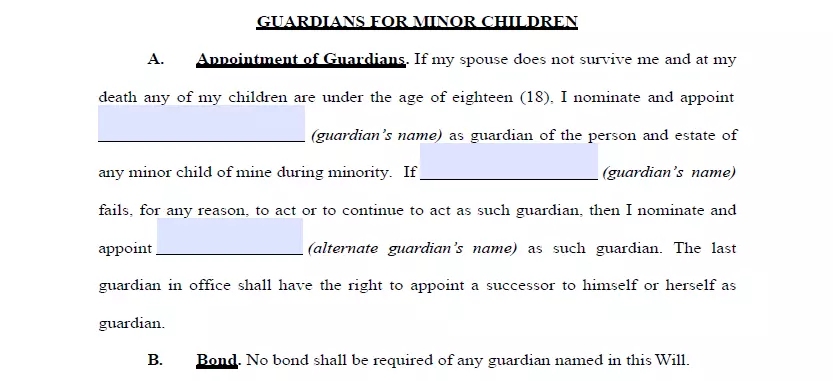

4. Choose the guardian (optional). You are able to specify a trusted person as a guardian in case you’ve got minor or dependent children that must be taken care of. In case there are no directions pertaining to who exactly should take care of your children, the guardian will be appointed by the court.

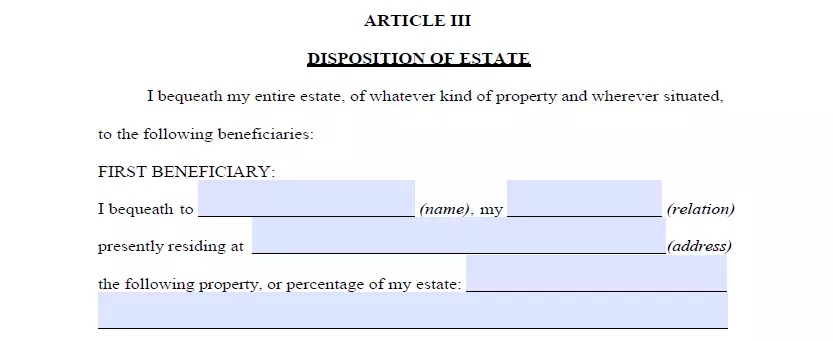

5. Specify your beneficiaries. At this point, indicate those people to whom you leave your estate, that is, your beneficiaries. Fill out their full names, places of residence, and your connection to them (e.g., spouse, child, friend).

6. Designate possessions. Write down your assets and describe the way in which you wish to distribute them amongst your beneficiaries in case you’ve got something in mind apart from dividing the property commensurately. Cash, stocks, realty, business ownership, money for arrearage, as well as any physical items of financial value you possess can be brought up in the will. Please be aware that there are things that can’t be distributed in your will, for instance, joint and living will assets and life insurance.

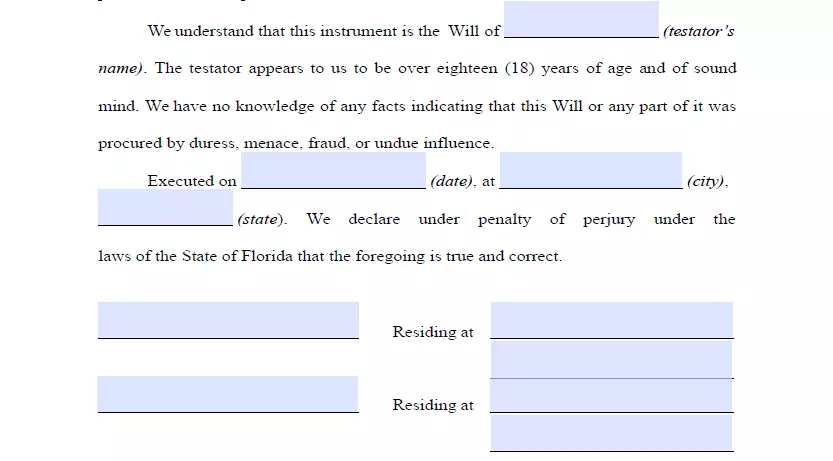

7. Continue with the witnesses signing the document. Florida laws specify that a minimum of two witnesses have to sign a last will so that it is considered valid. Only somebody who isn’t your beneficiary and is of 18 years or more can be chosen as a witness. Consider selecting witnesses younger than you to make sure that they will likely be present in the event the will is contested in court or if any other problem arises. After a careful revision of each passage in your will, all parties involved (you and the two witnesses) must write their full names and full addresses and sign the will.

Create a Free Florida Last Will

Frequently Asked Questions

Do I have to attest my will in Florida for it to be valid?

A last will and testament in Florida is valid without any notarization. However, if you wish to attach a self-proving affidavit to the last will and testament, you’ll need to attest it. Making your will self-proving is usually a great option since it expedites the probate and gives yet another layer of certainty should the will’s credibility be doubted.

What's testamentary capacity?

In most states, to make a will, you must be of sound mind and no less than 18 years of age. These requirements are called testamentary capacity. “Sound mind” means that you don’t have any kind of mental illness that doesn’t allow you to fully understand the aftermaths of your actions (creating a will in this case).

Is a child or spouse disinheritance allowed?

If you want to disinherit your marriage partner, the law allows you to do it. Florida is not a community property state. Hence, you can disinherit your spouse, but your marriage partner will be admitted to possessing a certain minimum of your assets, which includes your home.

As for the others, it is legal in the state of Florida to disinherit members of the family in the last will. This applies to your adult children and any other members of the family; to do so, you will have to include disinheritance sections to your last will and testament document that will clearly outline your intentions.

In Florida, is it possible to change a typewritten will after signing it?

Yes, you’re allowed to adjust it. As outlined by Florida Law, you’re allowed to alter or revoke your last will and testament if you aren’t obligated by a lawful contract (e.g., a separation agreement) that prohibits you from doing so.

What will happen in case I have lost my last will?

In case the will has been lost or damaged, according to Florida law (Rule 5.510), the court can admit it. However, only the original of the last will and testament is likely to be recognized by the probate court.

The process of probating a lost or destroyed last will is often complex, and it entails far more than just submitting a petition. The decision of whether the presumption of revocation exists and is rebutted is a factually demanding examination. Case example – Balboni v. LaRocque, 991 So. 2d 993, 995 (Fla. 4th DCA 2008).

| Related documents | Times when you may need to have one |

| Codicil | You want to slightly change your last will without writing a new document from scratch. |

| Self-proving affidavit | You wish the probate to be easier when it’s necessary. |

| Living will | You want to be sure that, if you’re incapacitated, you are treated exactly how you’d like to. |

| Living trust | You would like to skip probate by putting your assets in the possession of a trust. |

Last Will and Testament Forms for Other States