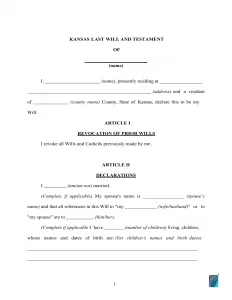

Free Kansas Last Will and Testament Form

A Kansas last will form is a legally binding document that expresses the testator’s final wish in the form prescribed by the state law and ascertains the lawful distribution of the will creator’s property subsequently after their demise.

It is generally recommended that you prepare a last will. Even if you do not have a lot of assets, a last will might help your family situation and turn out to be vital to your household upon your death.

Here, we provide a free downloadable Kansas last will and testament template in DOC and PDF formats and answers to numerous frequent questions you might have relating to this particular estate planning instrument. You can also use our tool to create a personalized will tailored to your needs.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Kansas Last Will Laws and Requirements

| Requirements | State laws | |

| Definitions | Chapter 59 – Probate Code; Article 1-102 – Definitions | |

| Statutes | Chapter 59 – Probate Code; Article 6 – Wills | |

| Signing requirement | Two witnesses | 59-606. Execution and attestation; self-proved wills and codicils; affidavits; form |

| Age of testator | 18 and older | 59-601. Who may make will |

| Age of witnesses | 18 and older | 59-607. Competency of witness |

| Self-proving wills | Allowed | 59-606. Execution and attestation; self-proved wills and codicils; affidavits; form |

| Handwritten wills | Might be recognized if witnessed according to state law | |

| Oral wills | Recognized under certain circumstances | 59-608. Nuncupative will |

| Holographic wills | Not recognized | 59-606. Execution and attestation; self-proved wills and codicils; affidavits; form |

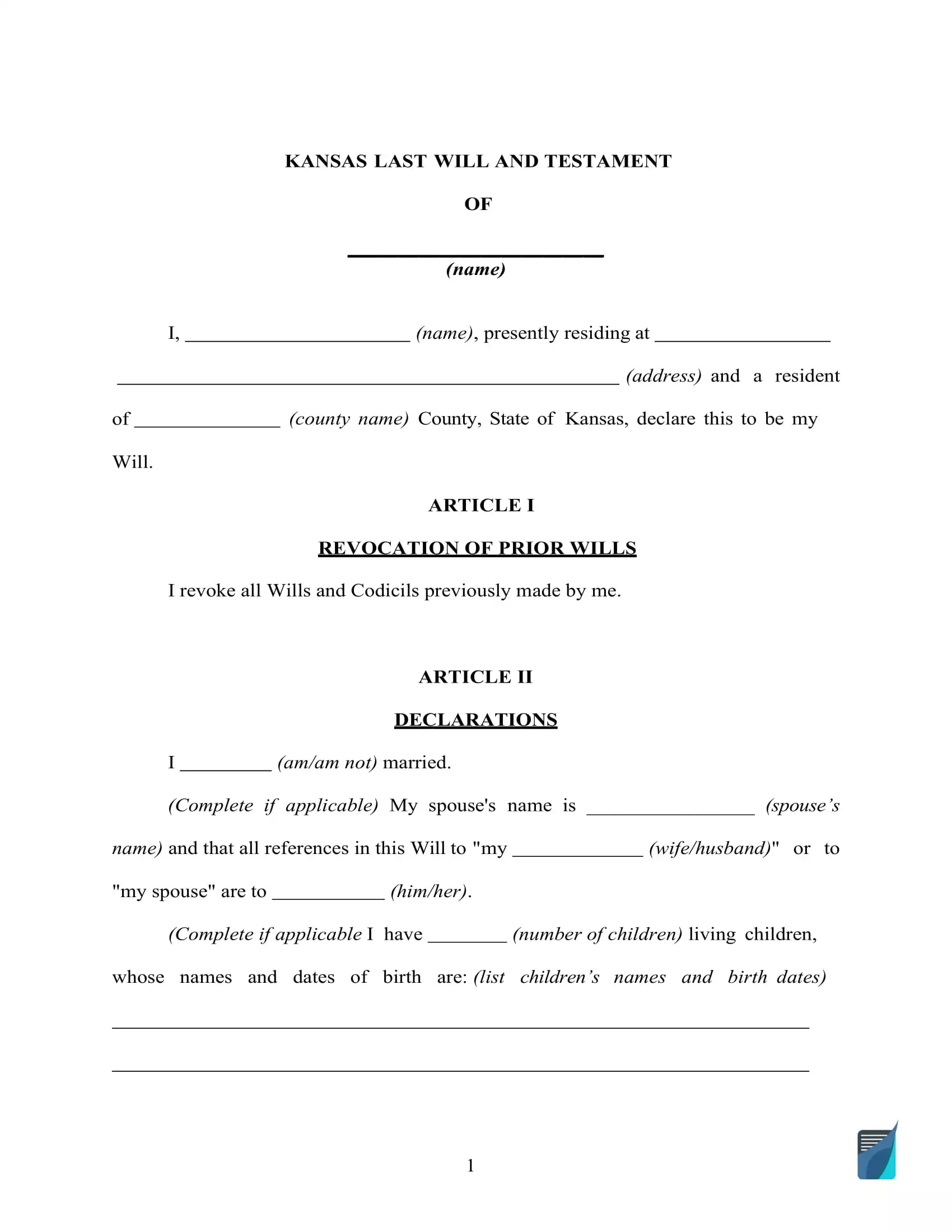

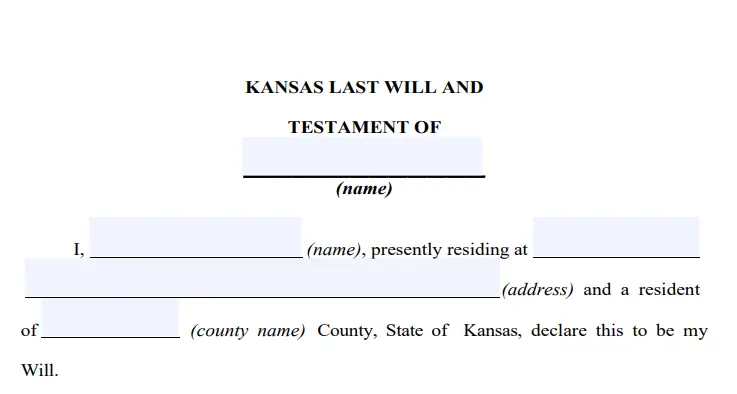

How to Write a Kansas Last Will and Testament

1. Consider your possibilities. One thing to think about, first, is if you would like to write the entire document by hand or try a fillable Kansas will form available online.

2. Specify your information. Fill in your full name and address (the city, county, and state of residence) to establish the testator of the last will and testament. Go over the remaining part of the section, including the information you have written along with the “Expenses and Taxes” subsection.

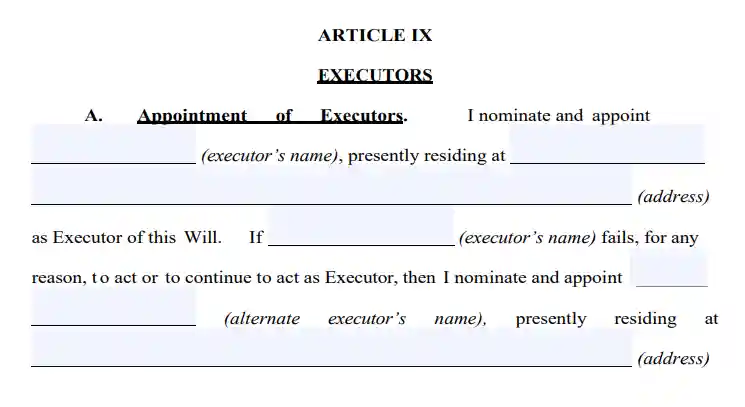

3. Appoint the executor (or executrix). Choose the executor of your property and enter their particulars: full legal name and place of residence, which will normally be in the same state the testator lives considering that nearly all states impose special regulations on out-of-state executors. Although not mandatory, it’s a wise decision to choose an additional person to perform the duty of an executor in the event the first one is unwilling or incapable of executing your last will and testament.

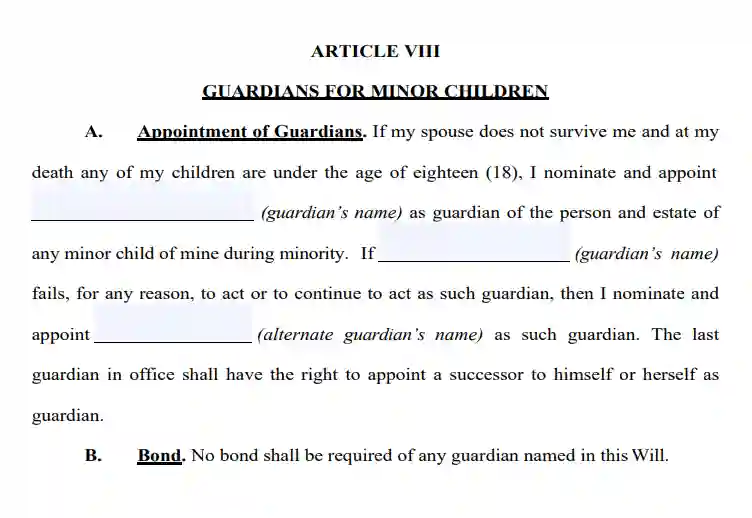

4. Establish the guardian (optional). It’s possible to appoint a trusted person as a guardian in case you’ve got minor or dependent children that need to be taken care of. In case there are no directions pertaining to what person should look after your kids, the guardian will be chosen by the court.

5. Specify your beneficiaries. This is where you indicate those who will receive your assets. For every beneficiary, indicate the following particulars: full legal name, address, and the way they are related to you.

6. Distribute possessions. Write down your belongings and describe the way you wish to distribute them among your beneficiaries in case you’ve got something on your mind aside from dividing the estate commensurately. Assets may include cash, stocks, real estate, company ownership, money for unpaid arrears, and any tangible things of commercial value you possess. Please notice that there are things that cannot be distributed in the will, such as shared and living will assets and life insurance.

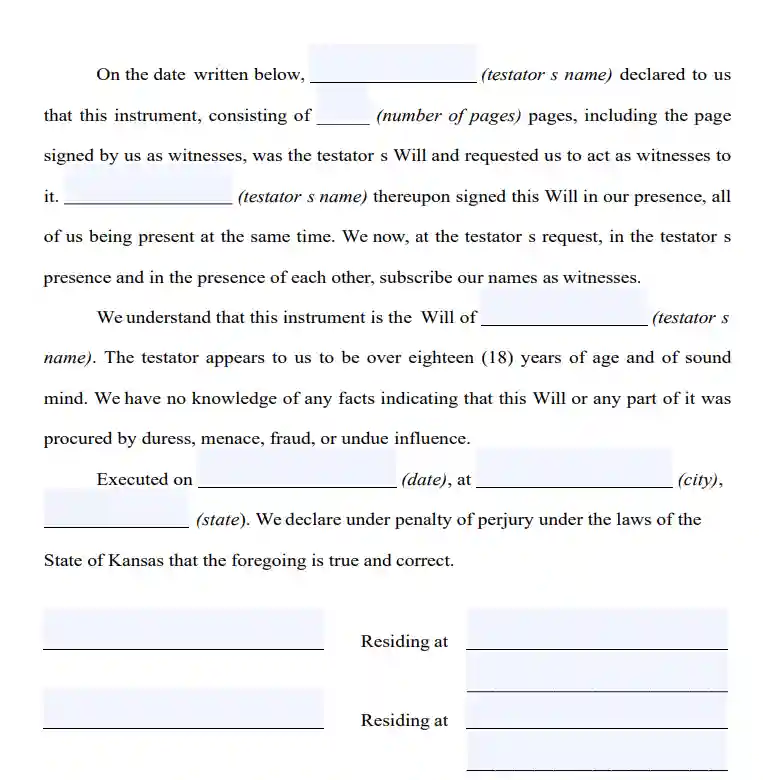

7. Ask witnesses to sign the document. In accordance with the Kansas Statute, for any last will to be valid, it has to be signed by two witnesses. Only a person who isn’t your beneficiary and is of 18 years or more could be picked as a witness. Think about selecting witnesses who are younger than you to make sure that they will be around in the event the will is contested in court or if some other problem arises. After a complete review of every paragraph in your last will and testament, all signatories (you and the two witnesses) must write their names and full addresses and sign the paper.

Create a Kansas Last Will

Frequently Asked Questions

Is last will notarization needed by Kansas Statute?

In Kansas, it’s not necessary to attest to your will. But, you will need a notary public if you would like to make your last will self-proving by attaching a corresponding affidavit to it. Making your will self-proving might be a good choice since it expedites the probate and gives an extra layer of certainty in case the will’s credibility is questioned.

Exactly what does it imply to be testamentary capable?

The testator has to fulfill testamentary capacity requirements to be able to write and modify their last will, including being of sound mind.

Usually, in most states, to create a last will and testament, you ought to be of sound mind and at least 18 years old. “Sound mind” means that you don’t have any type of mental illness (dementia, senility, insanity, etc.) that prevents you from having an understanding of the outcomes of your doings.

In Kansas, will I need a self-proving affidavit?

It is not strongly necessary in Kansas. However, if you choose to add a self-proving affidavit, it can be quite useful since this document acts as a substitute for in-court testimony of witnesses in the course of probate.

Can you leave out your children or spouse from a last will?

In Kansas, there is no such thing as community or marital property. That means that all the possessions acquired or improved in the marriage are not required to be equally shared between the two spouses. Kansas law allows disinheriting your marriage partner. Still, your spouse will be admitted to possessing a particular minimum amount of your property.

Besides your husband or wife, Kansas law enables you to disinherit any other members of your family. By including particular disinheritance paragraphs to your last will and testament, you’ll be able to cut off your adult children or other members of the family from obtaining any of your belongings.

Can I modify a typewritten last will after signing it (in Kansas)?

Yes, it is possible.

A person who wrote the will can alter or destroy their will anytime. The only case that may not allow you to do so is when this action is outlawed under the contract you entered.

What will be the consequences of losing a last will and testament?

In case the last will and testament has been lost or damaged, in line with Kansas law, the court can admit it. However, the probate court will be not likely to accept anything except for the initial version of the last will to probate.

Based on Kansas law (59-2228), the will’s absence is regarded as its revocation. This suggests that the trustee will need to provide evidence of the will’s validity, which in turn might be found to be quite complicated.

For a holographic will, you will need sworn witnesses and testimony to show. This will make things even more troublesome. In addition to that, you are also to provide evidence of why the last will and its contents cannot be delivered in ways that will also prove it has not been annulled.

In what way does a physically impaired individual sign his or her last will and testament?

Based on the Kansas Estate Code (59-606), it’ll be possible for an individual to sign his or her will, providing it is your (as a testator) instruction and with you present. It is possible to give a special directive by several means, which include voice communication, a positive answer to a question, or body gestures.

It is possible to get a notary to sign the name of a testator who is physically unable to do so in case the testator guides the notary public in the presence of a witness. It is important to note that these witnesses cannot have an interest (equitable or legal) in any properties and assets that are the subject or might be influenced by this document (the will).

| Related documents | When to create it |

| Codicil | There are a few minor adjustments you would like to make to your last will. |

| Self-proving affidavit | You want to save time and money for your will’s witnesses. |

| Living will | You would like to be sure your end-of-life treatment is carried out in line with your wishes. |

| Living trust | You want to skip probate by putting your assets in the possession of a trust. |

Last Will and Testament Forms for Other States