New Mexico Last Will and Testament Form

A New Mexico last will and testament is a legal instrument that contains the instructions of an individual (called the testator) concerning their property distribution in case of their demise. The document must be made in the form prescribed by NM law and signed in front of two competent witnesses attesting to the process.

A thought-out and appropriately created last will can often be essential to those you love and your relations after your passing. So, consider having one even if you don’t have a lot of property to pass on or don’t anticipate dying any soon.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

New Mexico Will Requirements and Laws

| Requirements | State laws | |

| Statutes | Chapter 45 – Uniform Probate Code; Article 2 – Intestate Succession and Wills | |

| Definitions | 45-1-201. Definitions | |

| Signing requirement | Two witnesses | 45-2-502. Execution; witnessed wills |

| Age of testator | 18 or older or an emancipated minor | 45-2-501. Who may make will |

| Age of witnesses | 18 or older | 45-2-505. Who may witness |

| Self-proving wills | Allowed | 45-2-504. Self-proved will |

| Handwritten wills | Recognized if witnessed according to the state law | 45-2-502. Execution; witnessed wills |

| Oral wills | Not recognized | |

| Holographic wills | Not recognized | |

| Registering a will | Possible with the clerk of any district court in New Mexico (The fee is county-specific) | 45-2-515. Deposit of will with court in testator’s lifetime |

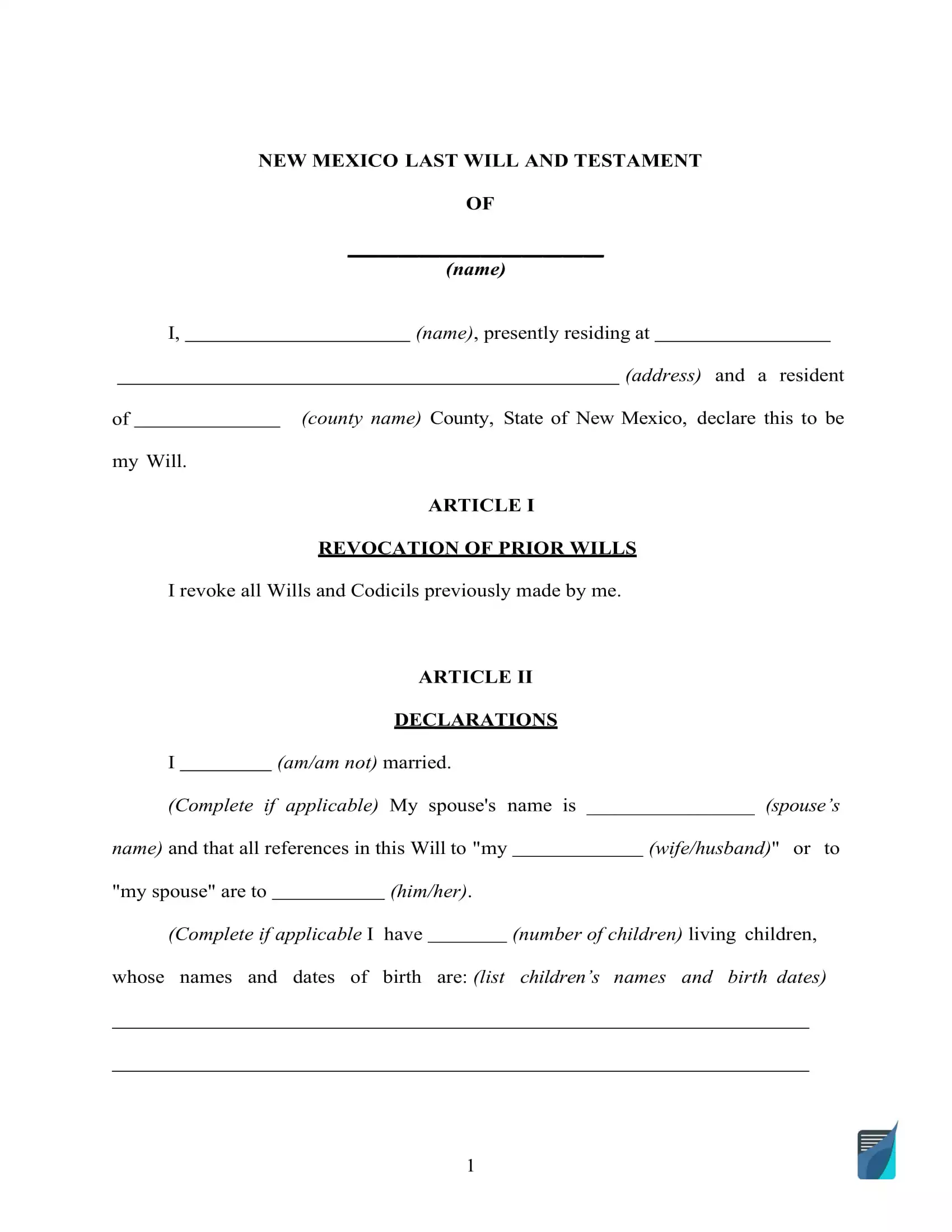

How to Write a New Mexico Last Will and Testament

1. Think about your options. Make a decision if you would like to hire an attorney or prepare your last will and testament yourself (either by using a template or our document builder). Consulting a law firm might be recommended if you have a large estate that would be too complex to plan out yourself.

2. Specify your information. The first step is establishing the testator by providing their full name, together with the residential information (city, county, and state). Go over the information you entered as well as the rest of the passage to check if there are no mistakes or typos.

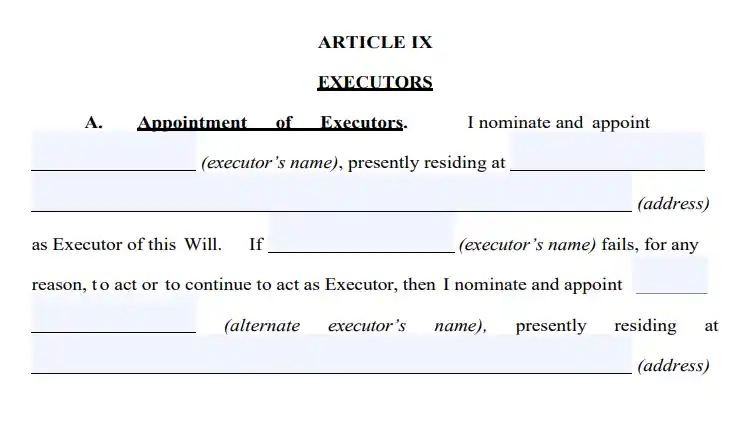

3. Indicate the executor. Appoint the executor of your property by entering their specifics: full legal name and place of residence, which should typically be in the same state the testator lives in mainly because it would be easier for someone from the same state to handle the required duties.

Although it isn’t required, it’s a good idea to appoint an additional person to perform the duty of your executor in the event the first one is unwilling or not capable of carrying out your last will and testament.

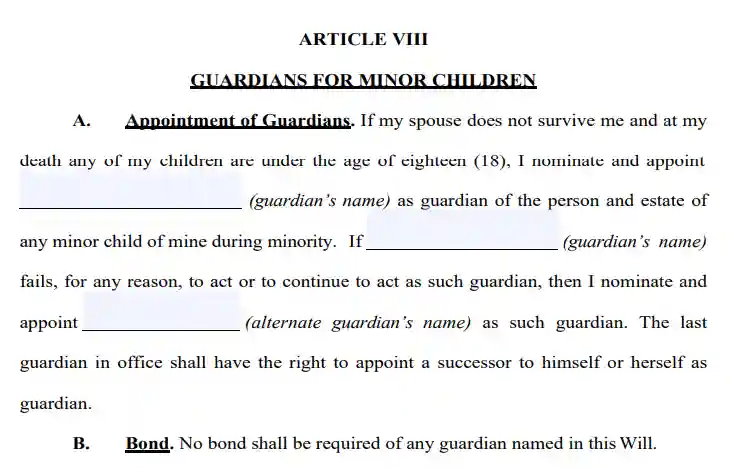

4. Choose the guardian (optional). It is possible to choose a trusted person as a guardian if you have minor or dependent children that must be taken care of. If there are no directions pertaining to exactly who should take care of your kids, the guardian will be selected by the court.

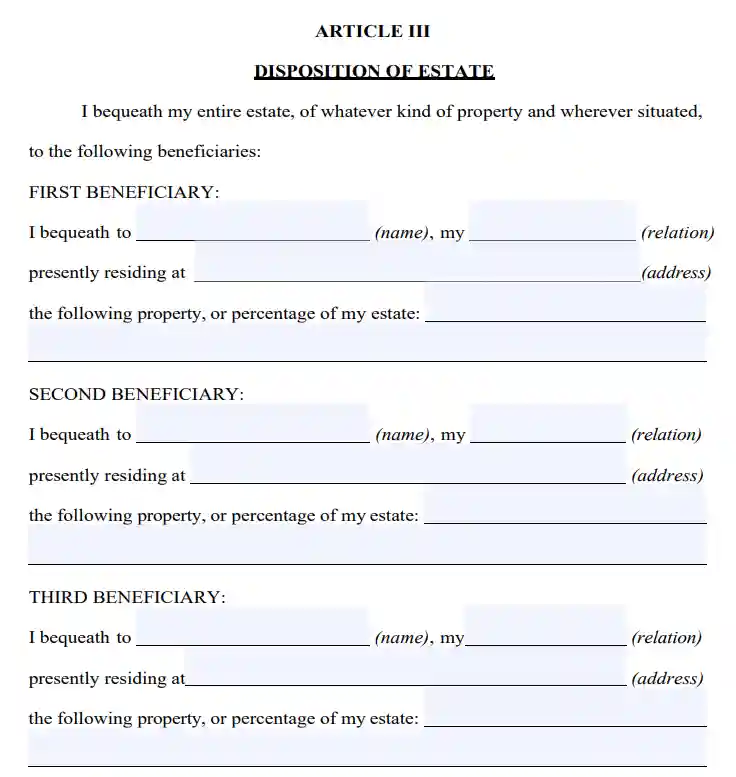

5. Establish your beneficiaries. This is where you establish those who will receive your assets. Enter their full names, places of residence, and your relationship with them (spouse, child, friend, etc.).

6. Allocate the property. You can indicate which of the beneficiaries gets this or that piece of property. Otherwise, the assets will be distributed equally among the inheritors. Property could include cash, shares, real estate, company control, money for unresolved debts, and any tangible things of monetary worth that count among your possessions. But, shared and living trust property and assets, as well as your life insurance, can’t be put into your last will.

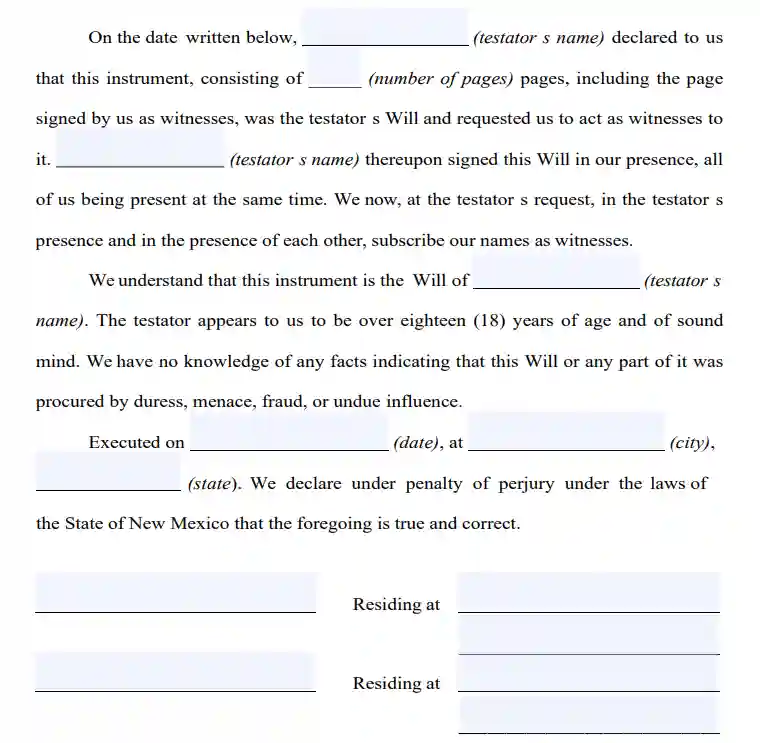

7. Sign and ask witnesses to finalize the document. New Mexico Annotated Statutes (45-2-502) specify that at least two witnesses must sign a will for it to be deemed valid. You’ll be able to name someone as a witness only when they’re older than 18 years and are disinterested in the bequest, which means they are not among your beneficiaries.

Note: Consider picking witnesses younger than you to ensure that they will still be around if the will is contested in court or if any other problem occurs.

Now, you (as well as your two competent witnesses) have to sign the paper after writing your full legal addresses and names. Make sure you check each paragraph carefully beforehand.

Create a Free New Mexico Last Will and Testament Online

Frequently Asked Questions

Does a will have to be notarized in New Mexico

No, in New Mexico, you don’t need to notarize your will. Nonetheless, you’ll need a notary public acknowledgment if you would like to make your last will self-proving by attaching an affidavit to it. A self-proving will makes probate quicker since the court can admit it without getting in contact with the witnesses who signed it.

Is a handwritten will legal in New Mexico

Yes, a handwritten will can be valid in New Mexico but only if it meets the requirements of Section 45-2-502 “Execution; witnessed wills” of New Mexico Statutes.

What is testamentary capacity?

Testamentary capacity is a set of requirements you have to meet that relate to your legal and mental capabilities in order to make your last will and modify it if needed. To be testamentary capable, the testator must understand the following:

- What a last will is

- What their estate is

- Who the beneficiaries are

Is it allowed to disinherit your spouse?

No, should you want to disinherit your marriage partner, it would most likely be unfeasible via a simple will clause. New Mexico is a community property state where the surviving spouse has rights to both community and separate property (Section 45-2-102 – Share of the spouse).

One possible way for you to disinherit your marriage partner would be to conclude a prenuptial or postnuptial contract where the spouse would agree to receive none of your possessions. The other way is to get a divorce while you still can and agree to same during negotiations.

Can I revise a will after signing it in New Mexico?

Yes, you are allowed to modify or revoke your last will and testament in case you are not obligated by a legal contract not to. Write your changes in a codicil and attach it to your will in case you don’t need to change a lot. But if there are many revision points, it is better to create a new will instead.

Are wills public record in New Mexico

Yes, after the testator dies and their will is filed, a copy of such a will becomes a public record and can be requested in your local probate court.

| Related documents | Cases when you might want to make one |

| Codicil | Your last will requires one or a number of small modifications. |

| Self-proving affidavit | You wish the probate to be quicker when the time comes. |

| Living will | You would like to express your wishes concerning end-of-life health care and life-prolonging measures. |

| Living trust | You want to avoid probate by putting your property in a trust. |