Form 3520 is a tax document used by U.S. persons to report certain transactions with foreign trusts and the receipt of large gifts or bequests from certain foreign persons. This form is required when a U.S. person:

- Receives a substantial gift or bequest from a foreign individual or estate,

- Creates or transfers money or assets to a foreign trust,

- Receives distributions from a foreign trust.

It ensures that all such transactions are reported to the Internal Revenue Service (IRS), aiding in compliance with U.S. tax laws and regulations. The primary purpose of Form 3520 is to assist the IRS in identifying and obtaining information about international financial transactions that could affect U.S. tax liabilities. This includes understanding the nature and terms of U.S. ownership of foreign trusts and monitoring the movement of wealth across borders through substantial gifts or bequests. By requiring detailed disclosures, the IRS seeks to prevent tax evasion and ensure that all applicable taxes on international transactions are paid or reported.

Other IRS Forms for Trusts and Estates

The IRS requires certain categories of taxpayers to notify the Service of their acquisitions and actions. Check what other information these categories of taxpayers might need to report using other IRS forms.

How to Fill Out the Form

Filling this template out is not that easy, so we recommend hiring a professional contractor to do it for you: for one, it can be a tax expert who works as a freelancer. The template contains six pages full of various lines and charts to fill out; you are also required to do some math which can be considered complicated.

To avoid difficulties and mistakes, delegate the document creation to a person who is confident enough and has relevant skills. Even though we will provide you with basic guidance below, there are many peculiarities and numbers to figure out.

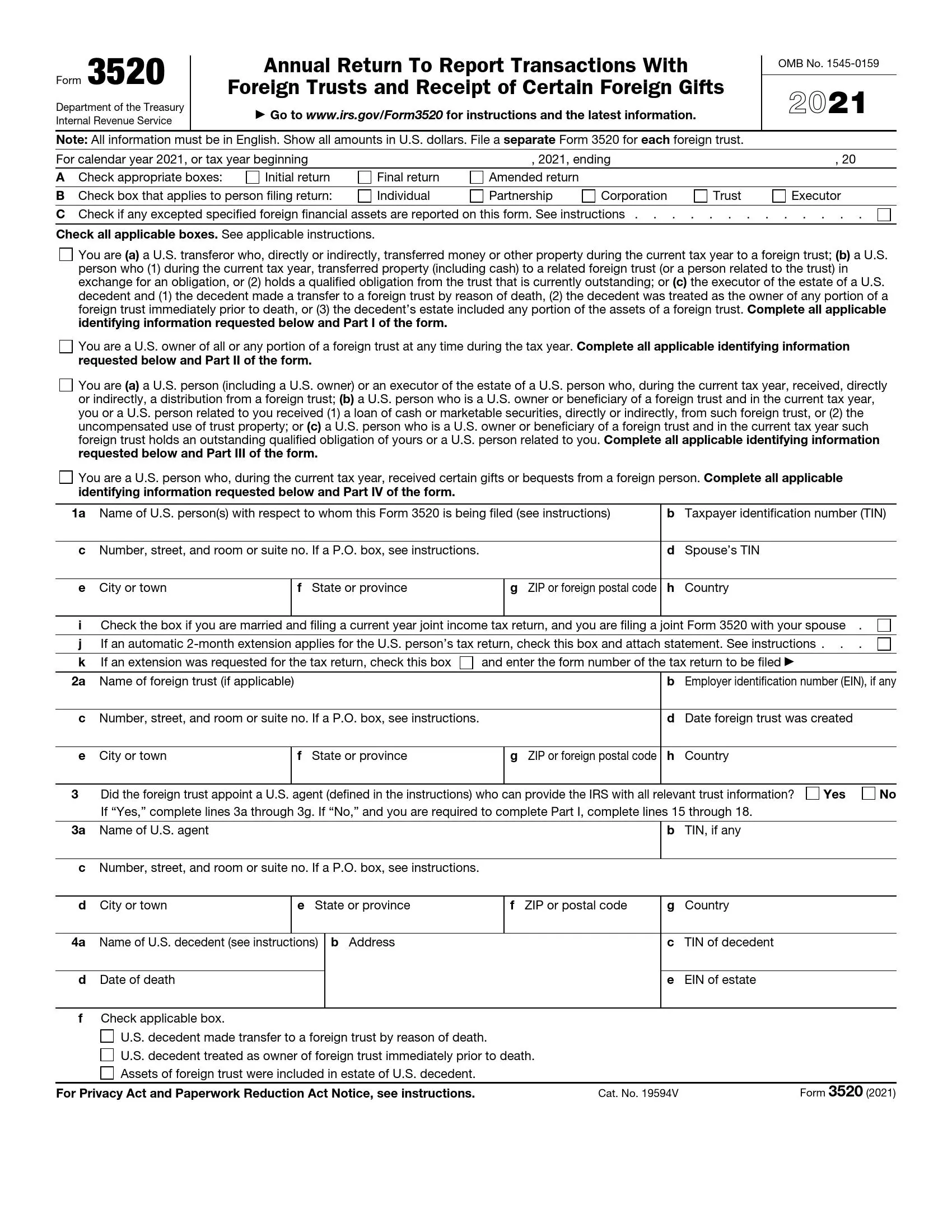

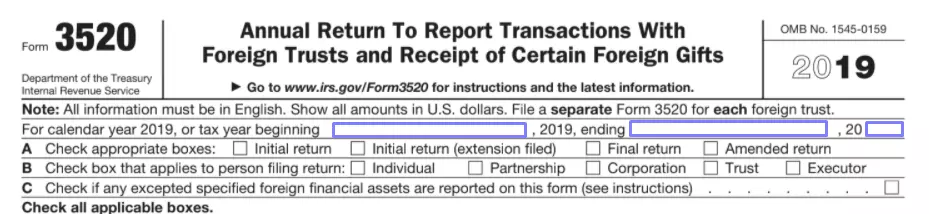

1. Get the Correct Form Template

As usual, you must ensure that you are filling out the template’s correct version. The Service updates its forms annually, and you can find the form there. However, since you are here and reading our review, there is a convenient solution we suggest generating IRS Form 3520 with our form-building software. The process is quick and easy, and you will not need to open an additional tab or two in your browser.

2. Read the Information Note

Before completing, check the note on the top of the first page. Every detail you insert should be written in English, and the money should be expressed in US dollars equivalent. If you have more than one trust to inform about, prepare a form for each of them.

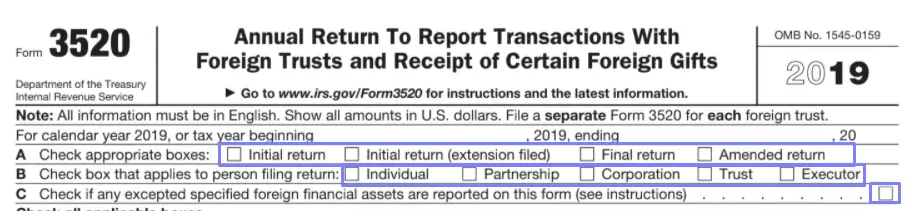

3. Indicate the Tax Year

The form must be made for either a calendar or a tax year. If you use a tax year, write its terms in the designated line.

4. Check the Relevant Options

You will see a set of boxes to choose and mark that state this form’s purpose and who files the document. Pick those that are relevant to your case and check them.

5. Choose the Options Describing You

You will see four boxes with statements that describe people who must make this document. Read them all carefully and mark all that apply. From these statements, you will also find out which form’s parts you must fill out. For each subsequent part, the Service provides instructions and filling recommendations.

6. Add Your Personal Info

After you have described yourself by choosing an appropriate option, proceed to the block where you will add details about yourself.

Enter your name, ID number, and complete physical address (including the country). If you plan to send this record together with your spouse, insert their name and ID number, too. Mark the corresponding box, proving that you file the document jointly.

Indicate the Service center where you have submitted your tax return. If you had asked for a postponement in sending your return, check the box below and write what form you will provide later.

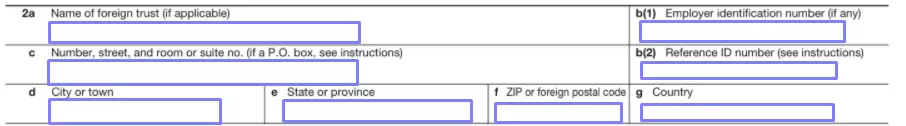

7. Enter the Trust’s Info (If Any)

If you are reporting the trust transactions or ownership (not foreign gifts), you must tell about the trust. Insert its name, address (with a country), employer identification number (EIN), and reference ID number (check the Service’s guide to define it).

If the trust has assigned an American agent, answer affirmatively by marking the needed box and introduce the agent below. Write their name, address, and ID number.

This form can be sent on behalf of a deceased person. If so, add the decedent’s details below: name, address, date of death, TIN (tax identification number), and estate’s EIN. Choose the applicable option describing the decedent below and mark the box.

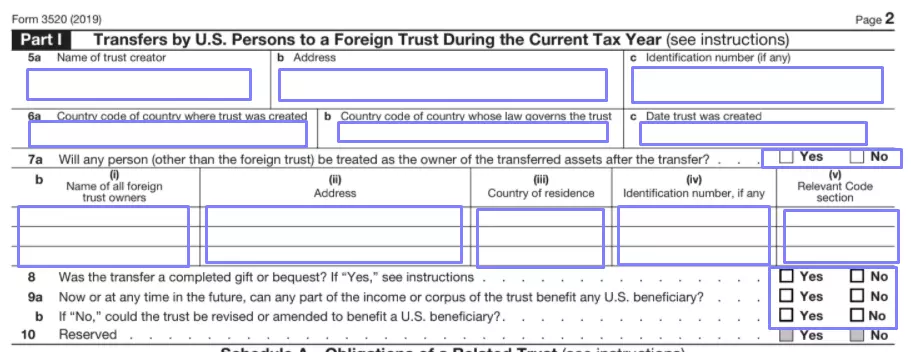

8. Complete Part I (If Applicable)

Begin the first part completion if you have determined that you need to complete it. Here, you will describe in detail transfers made by the American people to the considered trust.

Insert the trust creator’s name, address, ID number, the trust’s foundation date, the country’s codes of where the trust is established, and the country of jurisdiction.

If there are foreign trust owners, list them in a special chart (write their names, addresses, IDs, countries of residence, and the applicable Code section defining that all details are placed correctly). Then, answer a couple of “yes or no” questions below.

If you wonder what Code sections to choose, read the US Code, Title 26, Sections 671–679, and pick one of them.

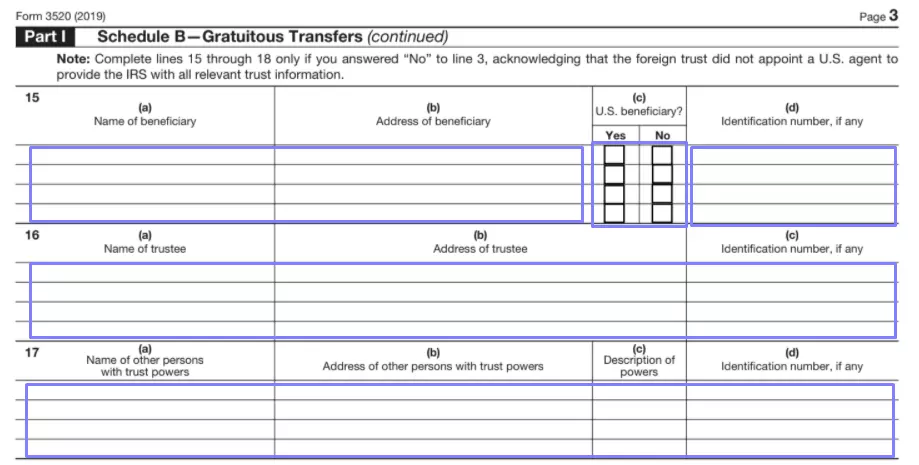

9. Fill Out the Schedules

The form’s Part I has Schedules A, B, C; read the Service’s guide to see the details on how to complete these blocks. The first schedule is dedicated to trust’s obligations; the second is for gratuitous transfers; the third is about qualified obligations during the considered tax year.

Provide all the needed details. If there is at least one line you are unsure about, seek help from the Service or tax consultants.

10. Prepare Part II (If Applicable)

Move to Part II if, in the beginning, you have defined that you need to complete it.

In the chart, list all foreign trust owners. Enter their names, addresses, countries of tax residence, ID numbers (if there are any), and the applicable Code section (671–679 as above).

State additional details about the trust (its foundation date, the country where it was established, and other required items). Answer two questions about the trust below. If you need to attach additional forms when submitting this document, remember to prepare those forms in advance.

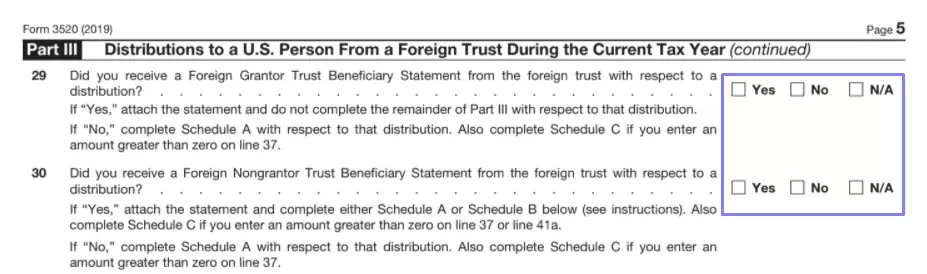

11. Complete Part III (If Applicable)

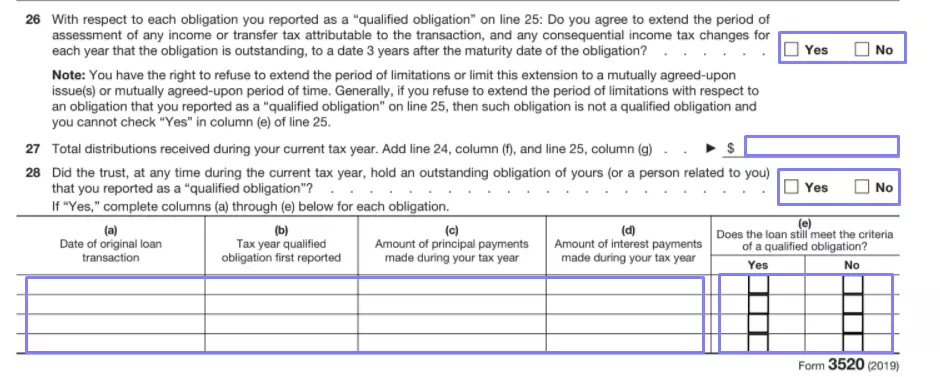

Scroll to Part III if you are required to fill it out. You will tell about the distributions from a foreign trust during the considered year here.

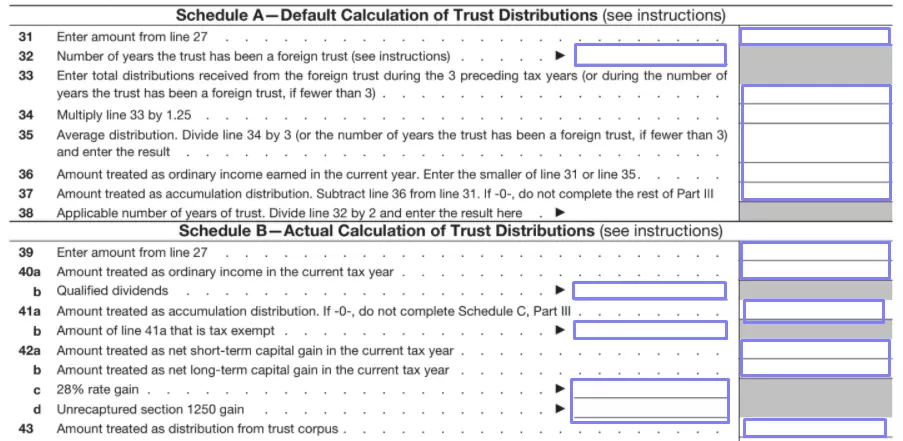

Mention each distribution that occurred as the chart requires. Then, answer about specific loans and complete another chart about them (if there were any such loans during the year). Reply to all questions under the chart as the template demands. After this, count all distributions and interest charges using Schedules from A to C below.

12. Describe the Gifts in Part IV

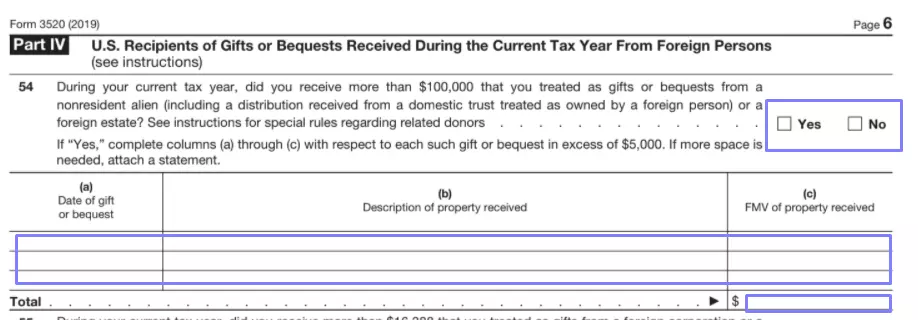

Jump to Part IV if it is relevant for you. You will describe the foreign gifts here.

For starters, answer if you received gifts with a total value of 100,000 US dollars during the accounting year from non-residents of the US (or foreign estates). Mark the “Yes” or “No” box depending on your response. If the answer is affirmative, provide details in the chart under the question.

In the chart, include all gifts which have a value of over 5,000 dollars. You have enough space to indicate three such gifts. If you need more space, attach a statement to this document. Add the date when each contribution was received, the gift’s description, and fair market value. Insert the total sum of all gifts’ values in the designated line.

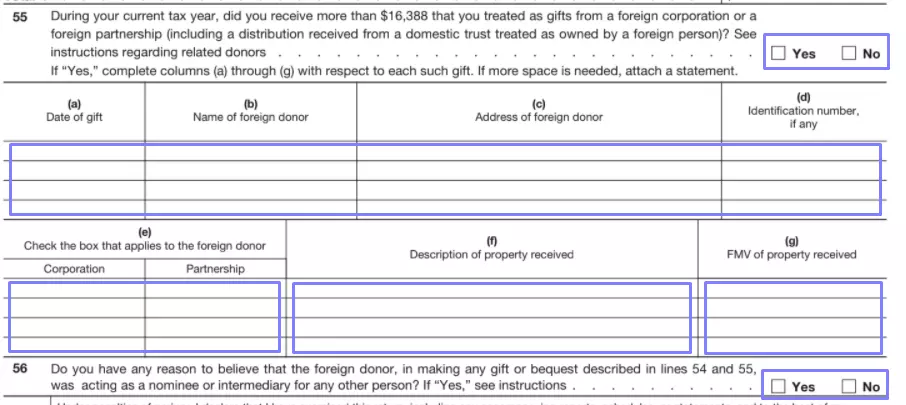

If you received gifts of a certain value from a foreign corporation or partnership, proceed to the next block and fill it out, defining the date you received each gift and the giver’s name, address, and ID number. Choose each giver’s type. Then, describe every received gift and add its value as well. Finally, answer a “yes or no” question about the donors under the chart.

13. Sign the Document

When all the needed parts are filled out, you must leave your signature on the form to prove that all details you have inserted are true and correct. Sign, write your title and date the form.

If a paid specialist (preparer) has prepared your form, they should sign and date the form below, adding other details: their name, the company’s name, EIN, contact phone number, and address of the employer, or their Preparer tax ID number if they are self-employed.

How Do I Submit the Form and When?

You have to use regular mail to deliver IRS Form 3520. The current filing address can be found on the Revenue Service’s official website.

The deadline coincides with the one applicable to your tax return submission. In 2021, you must deliver the document no later than April 15 if you use a calendar year. For a tax year, choose the middle (day 15) of its fourth month.

If you have asked for an extension for your tax return, you will have another deadline. Consult with the Service to ensure that you send the form in proper terms. Remember that you will face penalties if you do not request a postponement in time or do not send your tax documents before their submission deadlines.