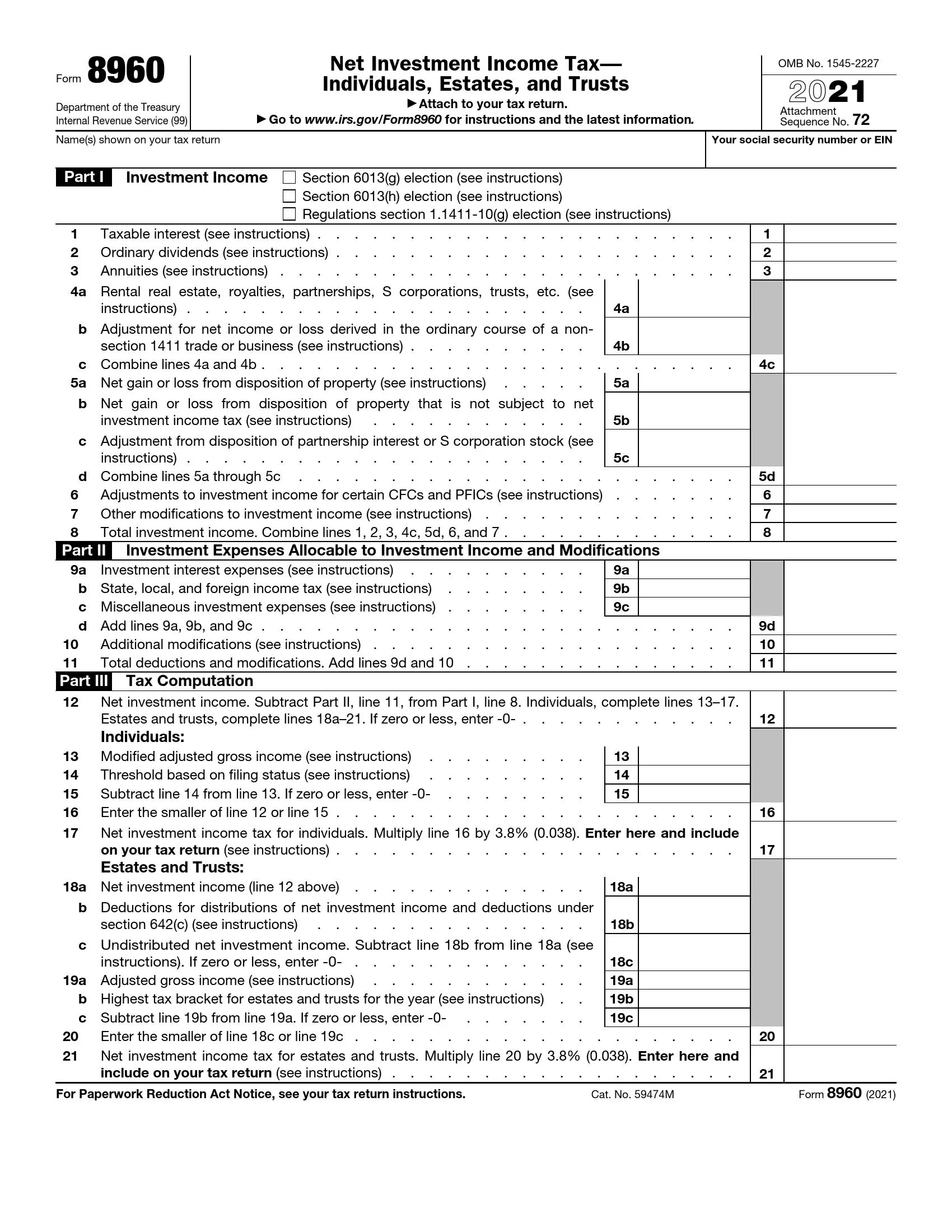

IRS Form 8960, officially known as “Net Investment Income Tax—Individuals, Estates, and Trusts,” is designed for taxpayers to calculate and report their Net Investment Income Tax (NIIT). The NIIT is a 3.8% tax on the lesser of the taxpayer’s net investment income or the amount by which their modified adjusted gross income exceeds certain threshold amounts which vary based on filing status, such as married filing jointly or single.

The purpose of Form 8960 is to ensure compliance with the tax provisions under the Affordable Care Act, which introduced the NIIT to help fund Medicare. The form is used by individuals, estates, and trusts to determine the amount of investment income subject to the tax, which includes interests, dividends, capital gains, rental and royalty income, and certain other passive activities.

How to Fill out Form 8960

First of all, you should obtain an up-to-date form template. We suggest using our latest from-building software to create an already customized PDF document and edit it online. It is very convenient, and it will save you plenty of time.

The form comprises three parts. The first part is dedicated to the various types of earnings that the IRS considers net investment income. The second part subtracts particular deductible costs that relate to investment income reported in the previous part. And part three contains respective information on tax computation. Let us follow the filing process step-by-step to learn how to complete the form correctly.

Introduce the Taxpayer

At the top of the form, you, as the taxpayer, need to indicate your full legal name as shown in your original tax return (or names, if it was a joint tax return) and Social Security Number (SSN).

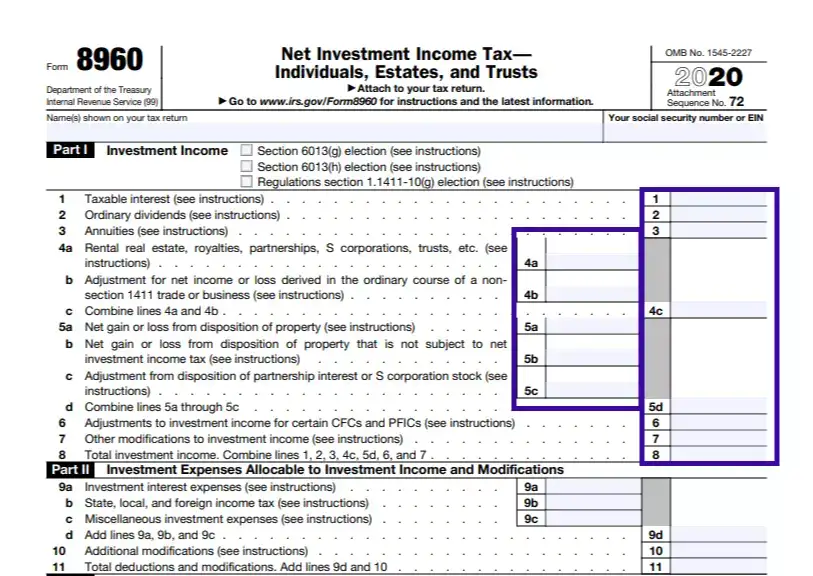

Indicate the Investment Income Type

As we have mentioned above, wages and self-employment earnings are not considered net investment income. Instead, the IRS identifies interest, dividends, monthly rental and lease payments (for the landlords), royalties, and profits from trading stocks as such income.

We strongly advise you to read the instructions on the official IRS website before you start to fill in any information in the first part of the form, as some of the terms may sound unfamiliar to you. Please note that you need to combine the amounts indicated in two or more other lines to fill in certain gaps.

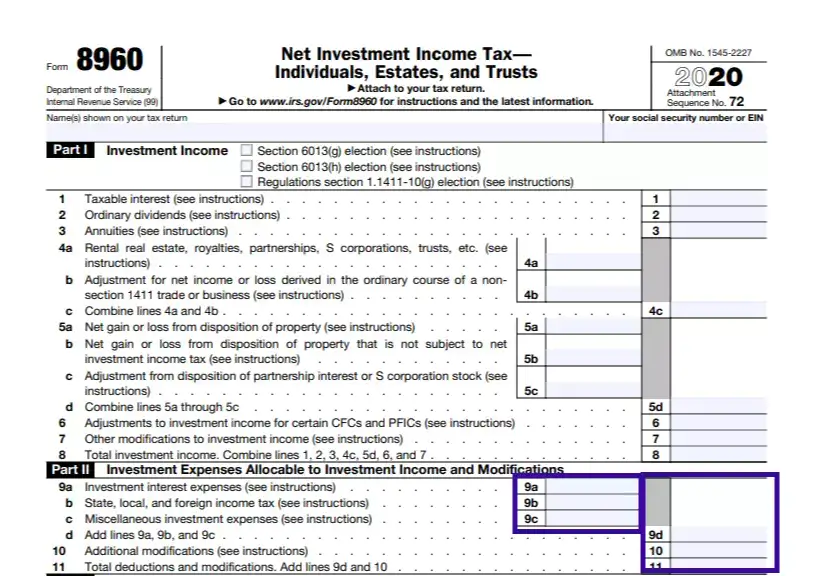

Enter the Investment Expenses and Modifications

In Part II of the form, you need to indicate all the deductible income expenses and modifications. Let us specify that such expenses may cover the services of a financial adviser, federal and state income taxes, and brokerage fees. However, the IRS might recognize the interest rates you pay on funds as a deductible income cost in some cases.

For more details, please check with the IRS website. Other than that, fill in the necessary gaps with the corresponding cost amounts.

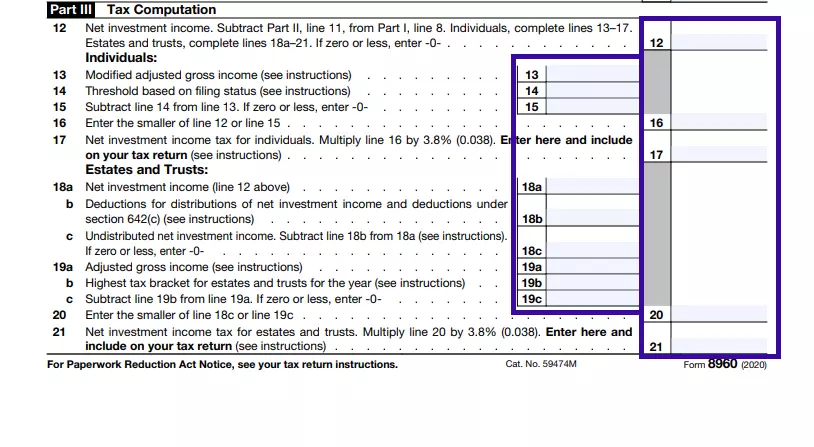

Calculate and Insert Net Investment Income

Of course, calculating your net investment income is the most significant part and the primary reason for filing the form. That is why you should be very careful when entering the amounts in this section. Follow the steps and instructions outlined here and use the previous sections to insert the necessary amounts. Note that you may also need your tax return form to insert certain information, so keep that somewhere at hand.

Refer to Tax Return Instruction (If Needed)

If you want to gain extra privacy on your investment income information, you need to comprise and file the Privacy Notice (under the Paperwork Reduction Act of 1995). It might be especially relevant to business entities that possess significant investments and do not want their competitors to find out any sensitive information. Under the Act, any authorities and entities will have to ask the IRS permission to request any investment-related information of the subject taxpayer.

See the tax return instruction to learn how to do that correctly.