IRS Form 4952 is a tax form taxpayers use to calculate and report their investment interest expense deduction. This deduction applies to individuals and certain entities who have incurred interest expenses on loans to purchase or carry investment property, such as stocks, bonds, mutual funds, or rental properties. Form 4952 helps taxpayers determine the amount of investment interest they can deduct on their tax returns, subject to certain limitations and restrictions outlined by the Internal Revenue Service (IRS).

When completing Form 4952, taxpayers must provide detailed information about their investment interest expenses, including the amount of interest paid, the type of investment property financed with the loan, and any related income generated from the investments. The form also requires taxpayers to calculate the deductible amount of investment interest based on their net investment income, which may include interest, dividends, capital gains, and other investment-related income. By accurately completing Form 4952, taxpayers can claim the appropriate deduction for investment interest expenses, reducing their taxable income and potentially lowering their overall tax liability.

How to Complete the Template

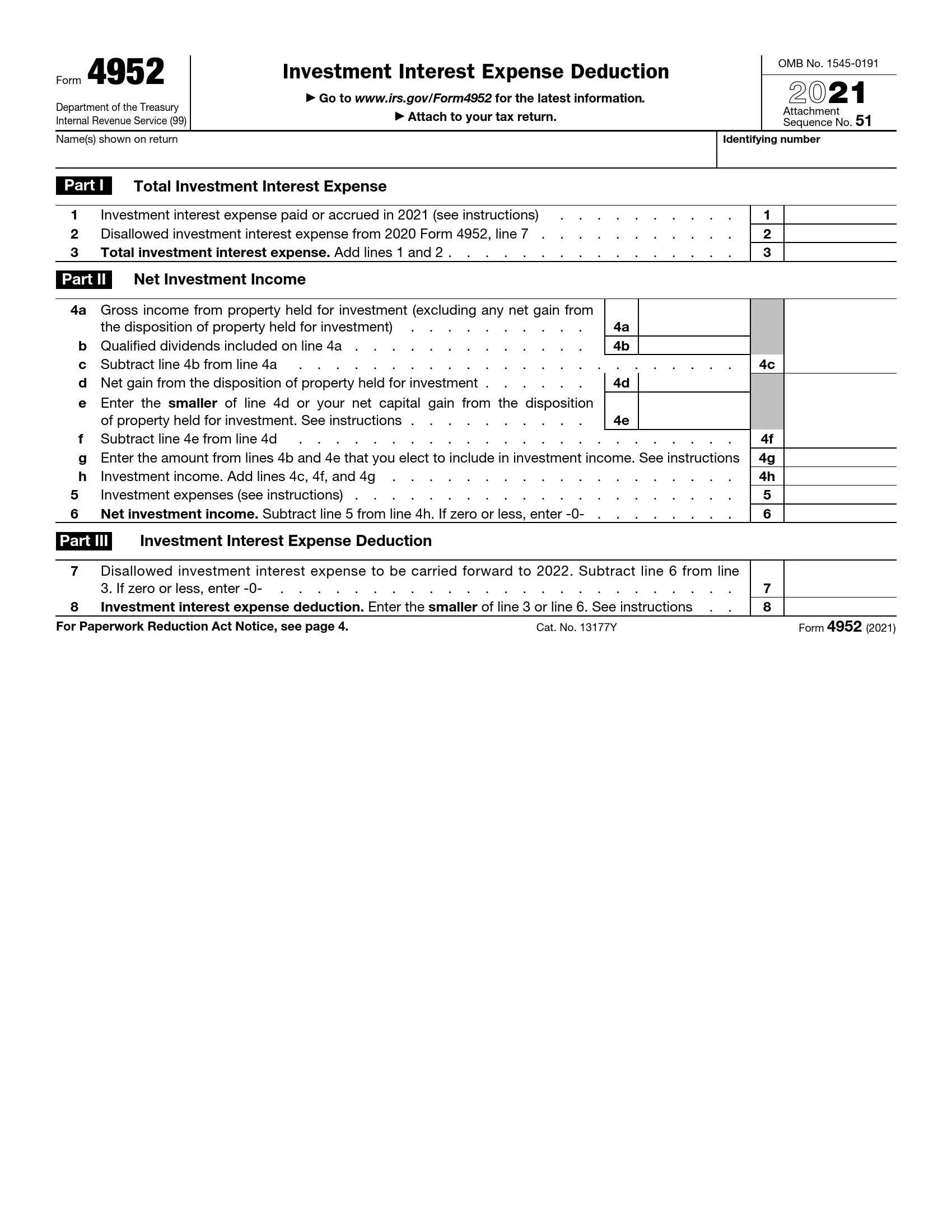

The template itself has just one page and three parts where you should describe your interest charges, revenues, and deductions. You probably can create the document on your own if you constantly deal with things tied to investments without any external help and have an excellent level of financial literacy.

Even if so, there still might be questions because some template points might be unclear. You should know that the form’s third and fourth pages provide broad instructions that address almost every line you need to fill out. Also, we usually recommend getting professional help when you try to create this form; maybe hiring a freelancer who specializes in taxation and relevant issues is a good idea.

Before you start, remember that your template has to be effective because the Service issues its forms every year and normally updates the year itself on the first page. If you do not have any or discover that your form does not fit, use our form-building software to get your IRS Form 4952. The software will provide you with the actual template, and you will not need to visit the Service’s resources.

Open the downloaded file and use our manual below to see what the form consists of and what details one should include there.

Identify Yourself

If you do not insert your name and identifying number at the document’s top, it will be impossible for the Service to recognize you. Enter the required data and proceed to the next part.

Determine Your Expenses

The form begins with the expenses you had because of your investment interest. Check the Service’s guide to count them correctly. You need to include the costs in the considered year (both covered and yet unpaid) and in the previous year (take them from the form you submitted last year). Sum both numbers and insert the total in the part’s last line.

Define Your Income

You have to count the net income you received from your investments throughout the year. Provide the required numbers line by line (gross income, dividends, net gain, and needed calculations). Then, sum all income items as written in the form, deduct the costs defined in the first part, and write the result in the “total” line.

Count the Deduction

Now, you can understand how much can be deducted. Calculate numbers as indicated in lines 7 and 8 of the third part and enter your results in these lines.

You will probably think that there are more pages to fill out; however, that was it because the form’s second page is blank for a reason. As you know, the pages left contain only instructions you can read if something is unclear; you do not have to fill out anything there as well.