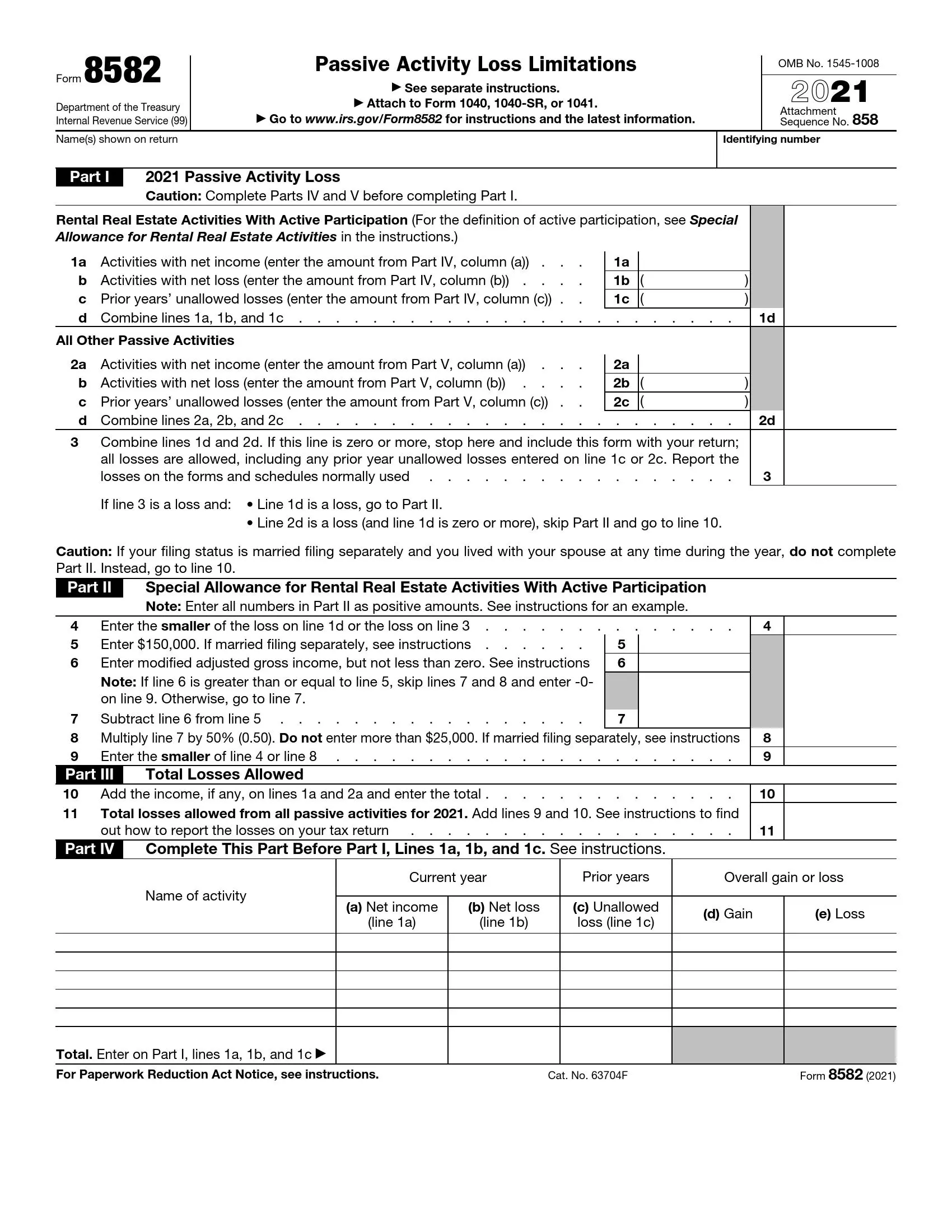

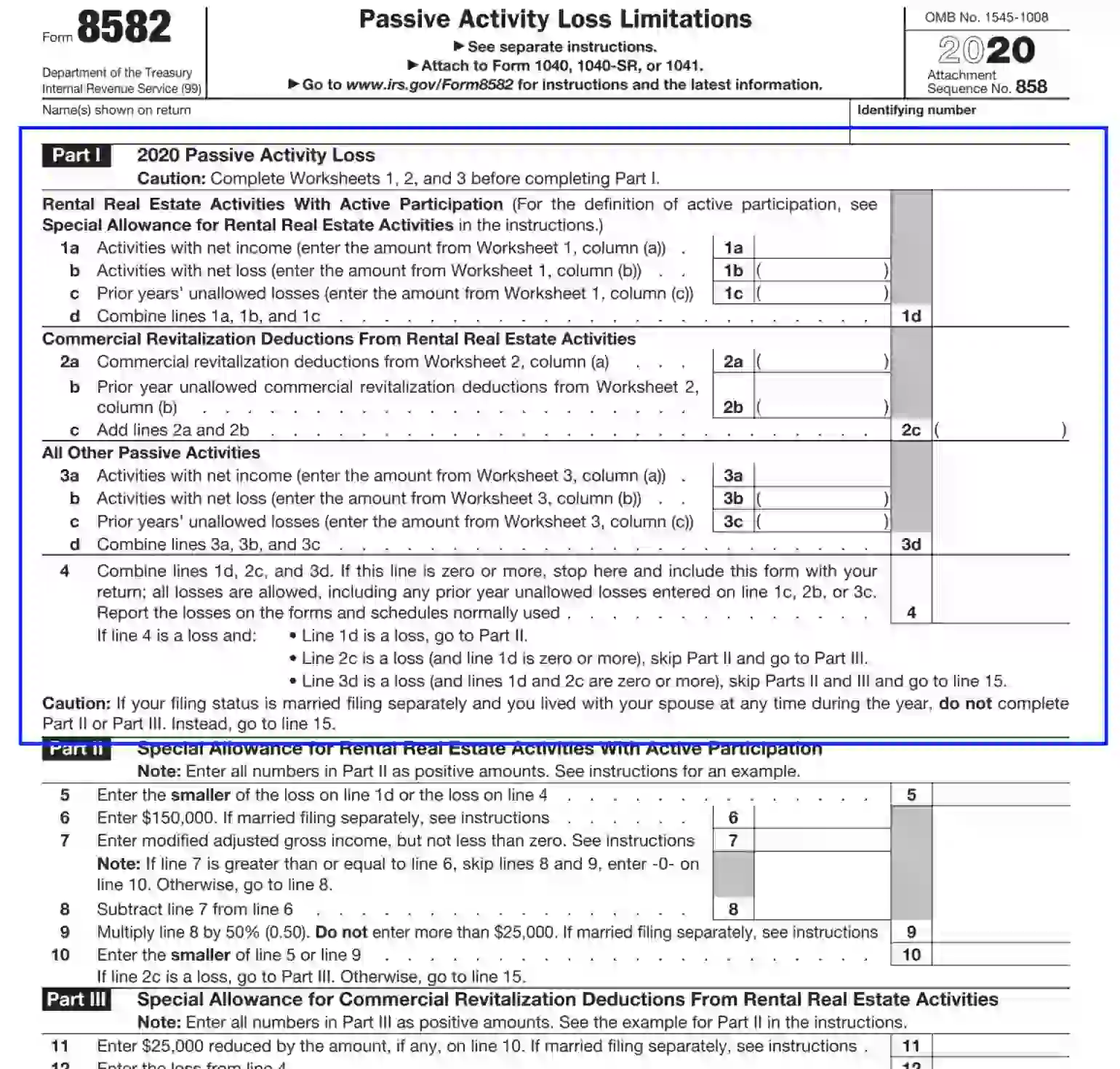

IRS Form 8582, titled “Passive Activity Loss Limitations,” is a tax form individuals, estates, and trusts use to report passive activity income and losses. This form calculates taxpayers’ allowable passive activity loss deduction on their tax returns.

The primary purpose of Form 8582 is to help taxpayers determine the amount of passive activity losses they can deduct against their passive activity income. Passive activities are business activities the taxpayer does not materially participate in, such as rental real estate activities or investments in limited partnerships. Form 8582 helps taxpayers determine if they are subject to the limitations of passive activity loss and calculate the amount of any losses that can be deducted in the current tax year. By completing this form, taxpayers can accurately report their passive activity income and losses and determine their overall tax liability.

Other IRS Forms for Trusts and Estates

The Form 8582 is a must-have for individuals, estates, and trusts who have passive activity deductions. Look through some other iRS forms that are mandatory for the same category of taxpayers.

How to Fill Out IRS Form 8582

We inspire you to use our form-building online tools to generate and fill out instantly the PAL Limitations 8582 Form. The latest updates are available through our portal or on the IRS official website. Make use of the illustrated guide below to complete the referenced document correctly and with minimal effort.

The form consists of four parts and several worksheets supplying the document. It is vital to fill out worksheets 1, 2, and 3 prior to completing Part I. All worksheet sections should be included in the Form 8582 set and served to the IRS.

Fulfill Worksheet 1 through 3

Worksheets 1 through 3 are needed to define if the activity was generally profitable or commercially unfeasible during the tax year at issue. If the activity appeared to be income-generating, provide corresponding records in the report by entering the total amounts.

Should the business be unprofitable, you need to enter the relevant data in unit 16 of Form 8582 and complete the applicable Worksheets 4 through 7. Define each project, the unit number that the preparer uses to provide the amount details and fulfill the table.

- Worksheet 4 is completed when the amounts regarding real property rent and lease are indicated on lines 10 or 14 of the 8582 paperwork.

- Worksheet 5 is needed to allocate any losses shown in previous worksheets.

- Worksheet 6 is important to allocate any losses identified by worksheet 5 if the preparer doesn’t have to report any transaction separately. Also, the data must be reported within one document or schedule. If the preparer uses more than one form to submit the losses and activities, they should fill out worksheet 7 instead of worksheet 6.

- Worksheet 7 is devoted to entering the unallowed and allowed losses for each listed activity.

Explain the Activity Loss Part

This section is needed to compute the net gains and net losses combined. Use the referenced form above worksheets to fill out units 1 through 4. In case the preparer completes the forms separately from the spouse and lived with the spouse during the tax year at issue or any part of the referenced period, ensure to leave units 5 through 14 blank and proceed directly to Part IV.

The Activity Loss section covers the below-listed aspects:

- Rental real property activities with active participation

- Commercial revitalization decreases

- Other passive activity types losses

Active participation in rental real property passive activities gives the privilege to discharge up to 25,000 US dollars of loss from nonpassive activities. It means that the percentage of the annual gains from rental real property practices must exceed 10 percent of all annual revenue.

Submit the Special Allowance Existence (If Applicable)

The preparer must be eligible to submit Part II and Part III special allowances. You are empowered to provide this kind of info only if a married person is preparing the form separately from the spouse. The referenced sections comprise the following aspects:

- The maximal loss allowed from rental business

- The maximum value of commercial revitalization deduction

It is vital to submit only amounts that exceed zero.

Enter the Total Loss Values

Part IV is directly completed after Part I if the preparer is qualifying to skip sections II and III, which means they are married but filing the paperwork separately from the husband or wife.

Here, you need to compute all loss values from the passive businesses defined by Part I of Form 8582 allowed for the tax period at issue. Make use of the completed worksheet sections to determine the unallowed unprofitable amounts which you should bring forward. The allowed loss must be computed and entered immediately in the tax reports and corresponding schedules.

Disclose the PAL Stipulations Document

As Form 8582 doesn’t require authorization, section IV is the last to complete. Once all necessary data is entered, the preparer should send the document with the tax report that requests to include Form 8582.

As a rule, all persons (qualifying business organizations) who prepare reports 1040, 1040-SR, or 1041 should attach the 8582 PAL specifications to explain the gain and loss balances from passive activities for the tax period at issue.