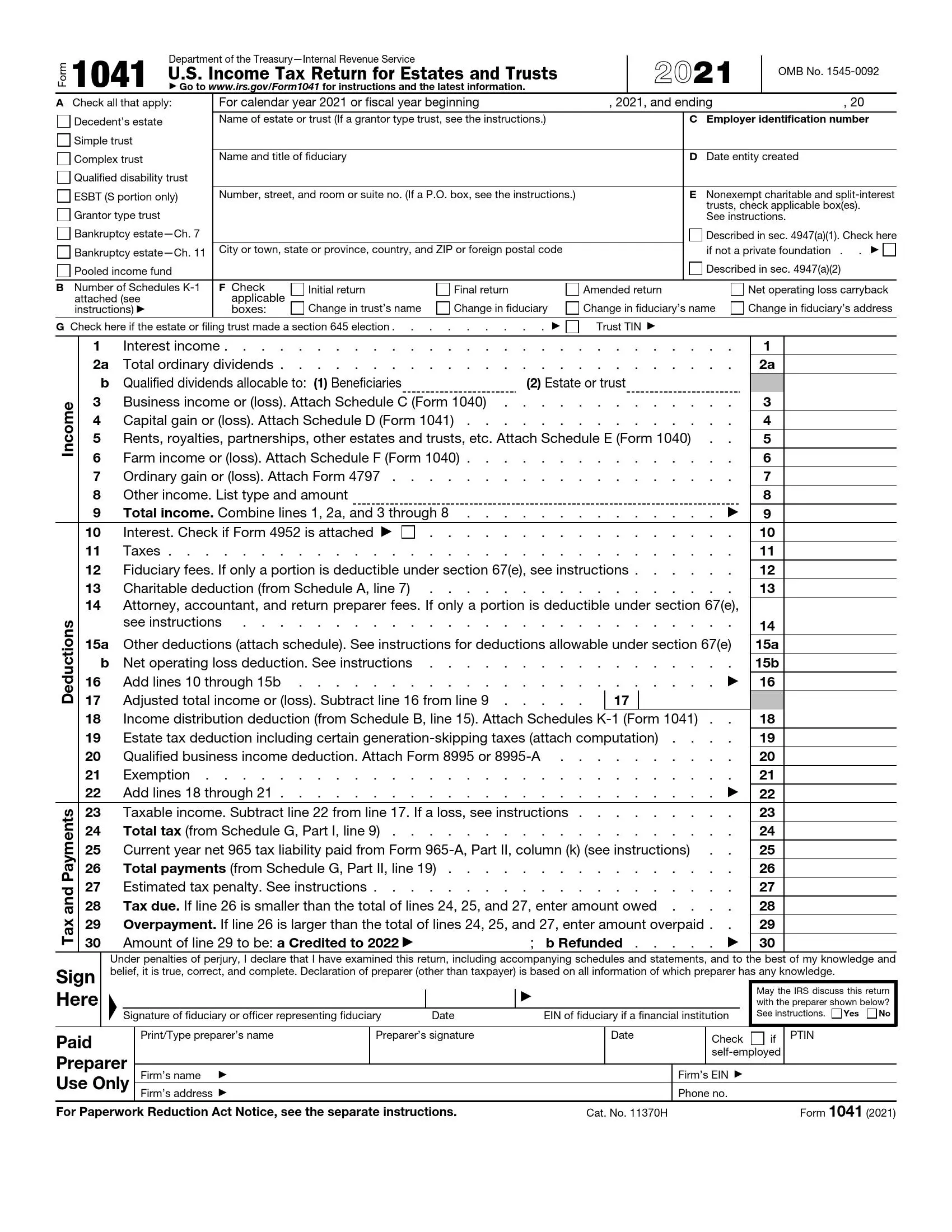

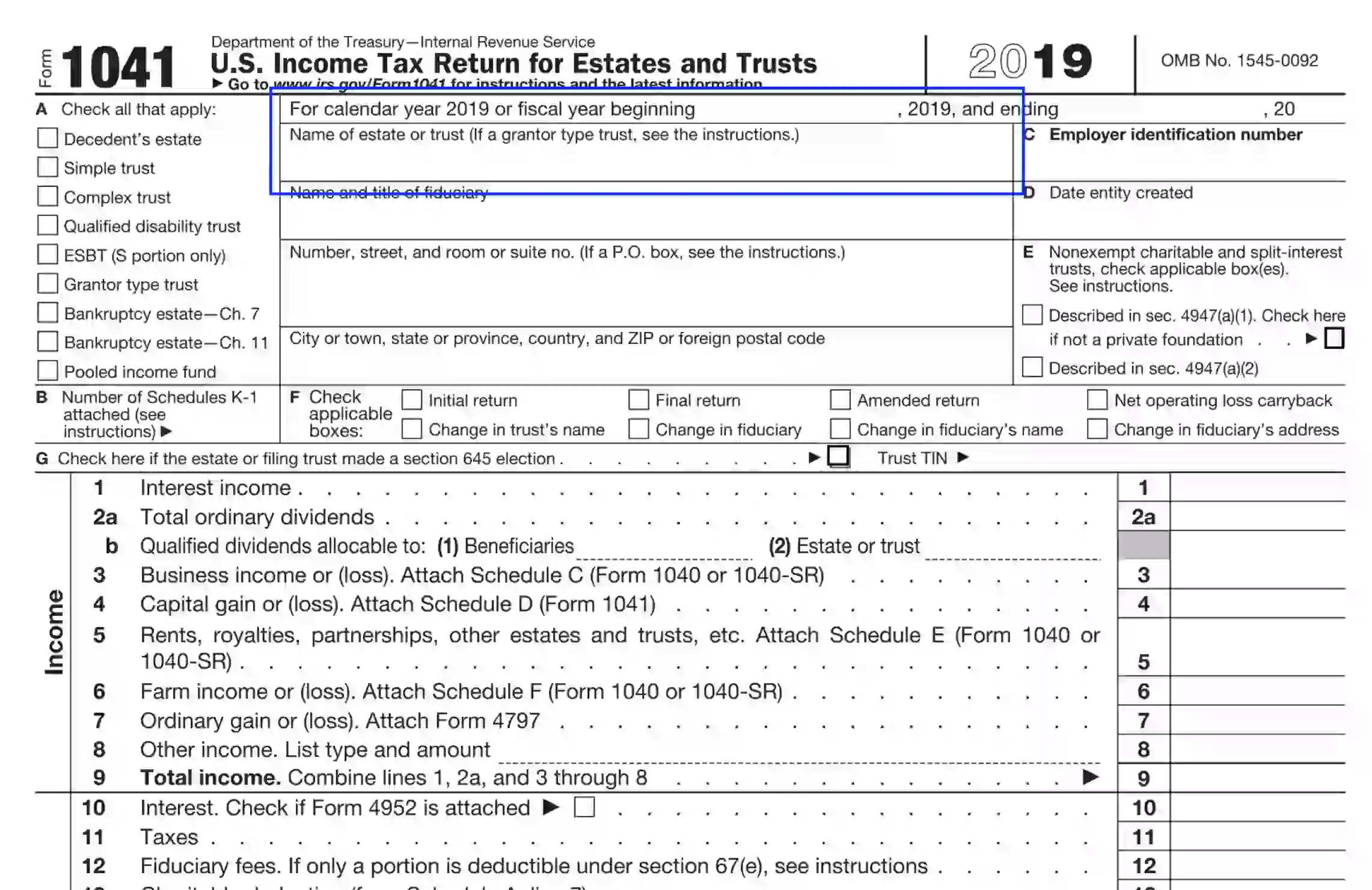

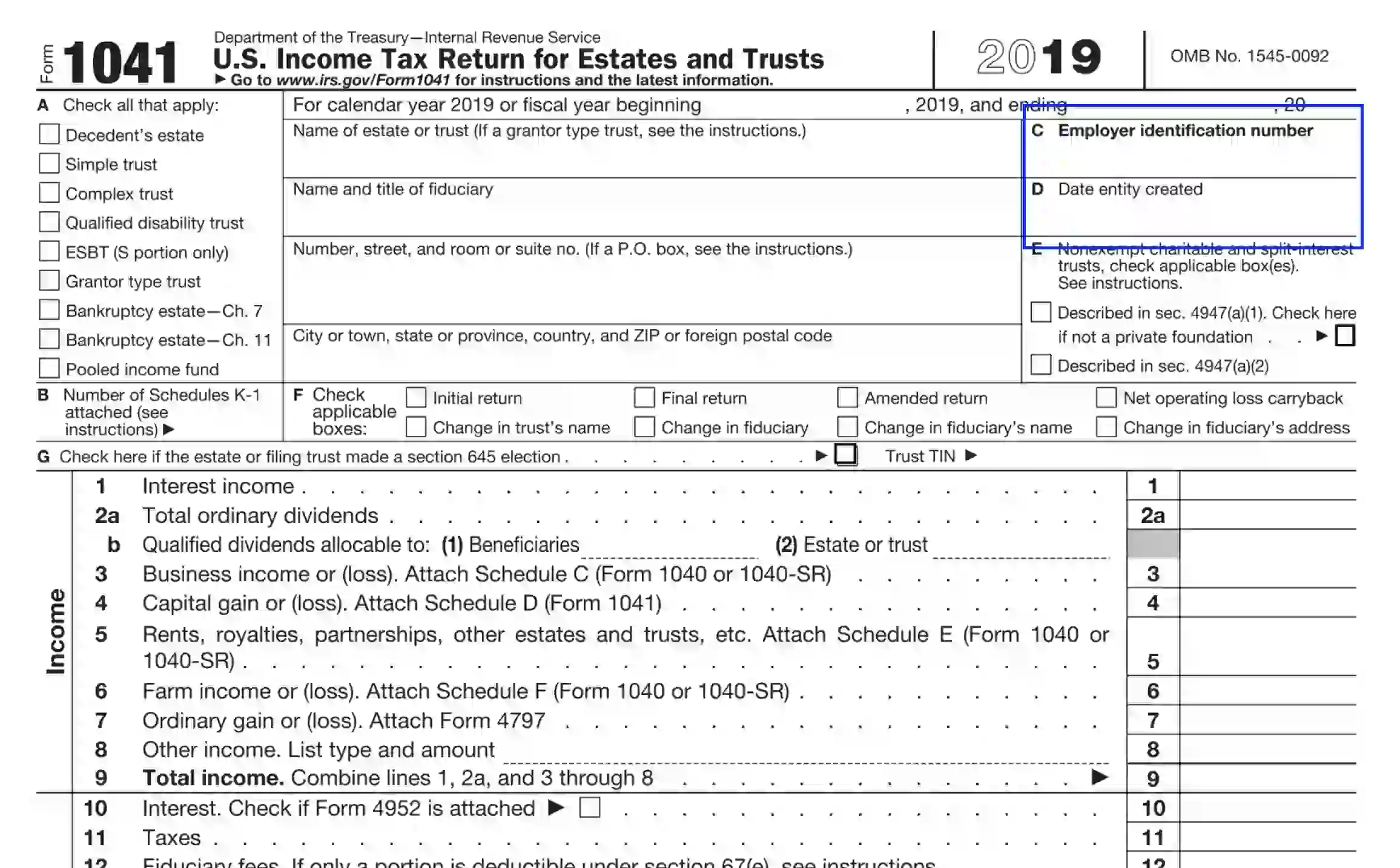

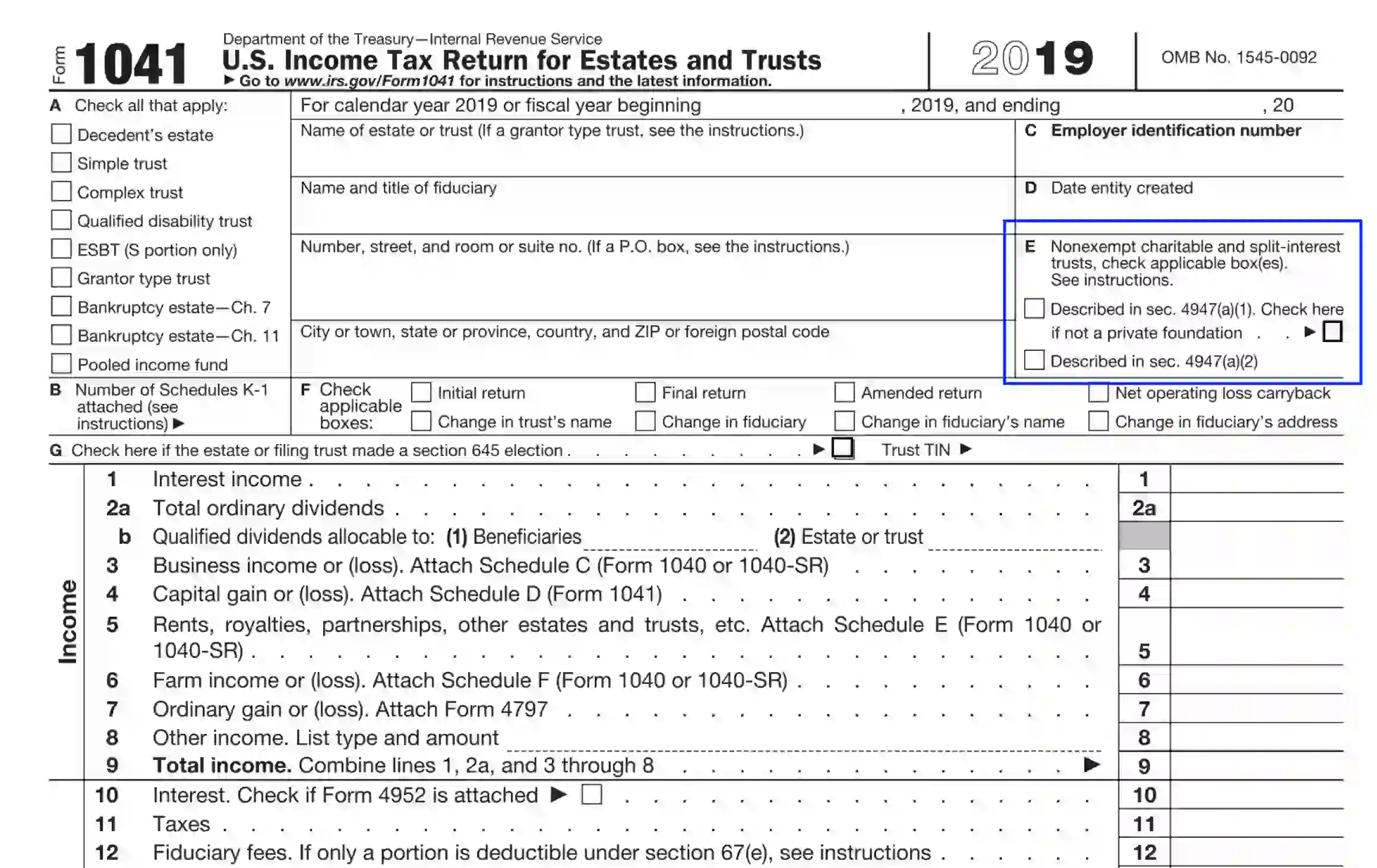

Form 1041, titled “U.S. Income Tax Return for Estates and Trusts,” is a tax form used by fiduciaries to report the income, gains, losses, deductions, and credits of estates and trusts. The form is necessary for managing the financial activities associated with these entities and is used to determine their income tax liability. It includes various schedules to detail items such as income distribution to beneficiaries and the calculation of adjusted gross income specific to estates and trusts.

The purpose of Form 1041 is to ensure that any income generated by estates and trusts is reported and taxed accordingly, separate from the personal income of the beneficiaries. This form allows for transparent financial management and tax compliance of estates and trusts, ensuring that taxes are paid on income before it is distributed to beneficiaries. It also provides a means to pass on any deductions or credits to beneficiaries who may be entitled to them. Proper filing of Form 1041 helps maintain the fiscal responsibilities of trusts and estates, aligning with legal requirements and providing a clear record of taxable activities within these entities.

Filling Out IRS Form 1041

Begin completing IRS Form 1041 by generating and downloading the required PDF file. You can find the necessary document on the IRS official website or create an up-to-date template using our latest software.

- Name the Estate

In this Unit, the declarant needs to enter the exact name of the trust or estate as specified in the Application for EIN (Employer ID). If the estate name was amended, you need to provide the updated estate (or trust) name and report the modification has happened: checkbox the corresponding slot in Unit F.

For grantor type trust, the declarant should indicate the grantor’s name, ID number, and address after you provide the trust’s name.

- Identify the Fiduciary

Specify the fiduciary’s name and title. In case the name is amended compared to one in the prior tax year, indicate the corresponding “Change in Fiduciary” box in Unit F.

After that, the declarant should provide the fiduciary’s mailing address, including the street and room number, city, state, county, and ZIP. Foreign locations must contain a relevant postal code.

If the fiduciary uses a P. O. box, make sure to provide the box number details on the referenced line.

If there are estate (trust) address amendments, the declarant should notify the IRS of all modifications after filing the document.

- Define the Entity

In Unit A of the form, the responsible party needs to indicate all types that apply to the respected entity. Check one or several boxes that are applicable.

- Submit the Entity’s Tax Data

Enter the entity’s Employer ID number in Unit C. Then, the declarant should define the date the trust was founded; use Unit D for these purposes. If the entity appears to be an estate of the deceased, insert the decedent’s death date in the provided slot.

- Complete Info Regarding Tax Status

In Unit E, the preparer needs to specify the entity’s tax status. Checkbox the slot if the entity is liable to pay taxes under Section 501 (a) of the US Code. Also, checkbox the following slot if the entity is not recognized as a private foundation defined by Section 509 of the US Code.

- Declare Schedule-K Existence (if applicable)

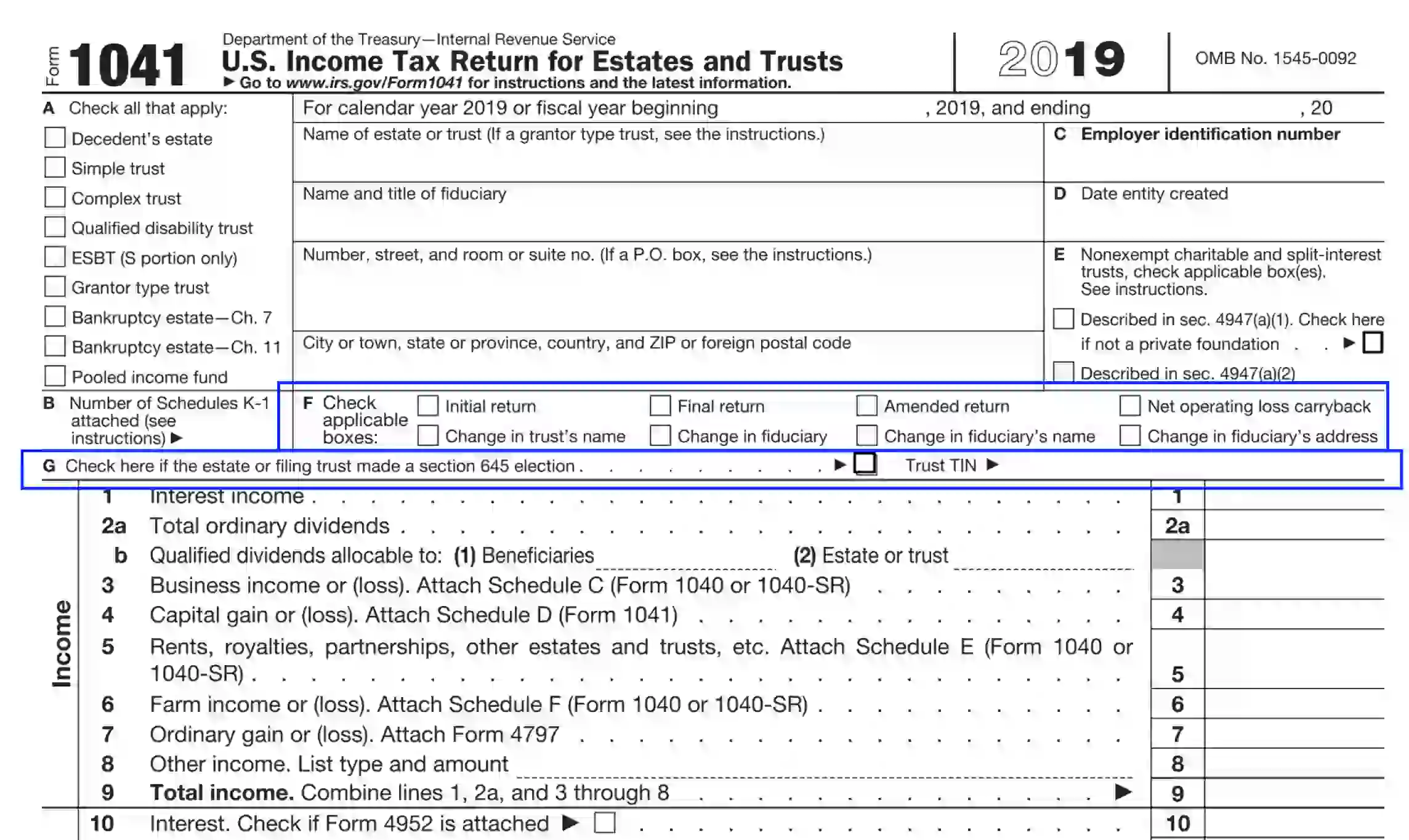

If the entity is reporting interest deductions in Unit 18, the preparer should indicate the number of attachments containing Schedule K-1 in Unit B.

- Complete Unit F

Checkbox all applicable alternatives referenced in this section. Also, complete the G section and provide the entity’s TIN in the corresponding slots.

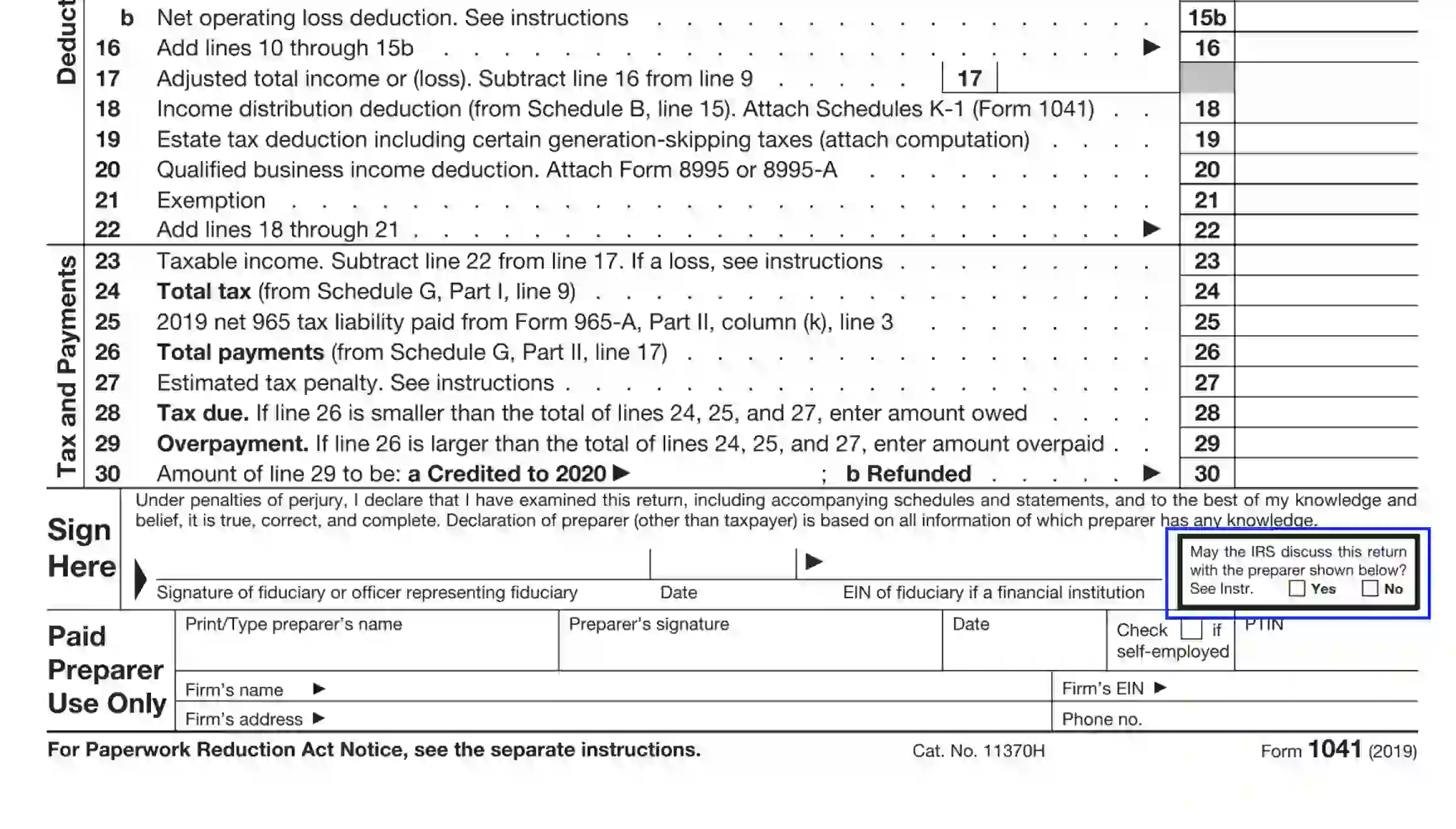

- Answer the Questionnaire in Units 1-30

Every trust’s or estate’s income includes the compilation of gains, interests, income deductions, and taxation supported by the US laws. In this extensive part, the preparer needs to submit all related issues dividing them into three aspects:

- Income

- Deductions

- Tax payments

Follow the questionnaire and provide accurate data next to each line.

Some of the questions demand information provided in Schedules A, B, and G, referenced on the second page of IRS Form 1041. You can find the general instructions to completing each section on the IRS official website.

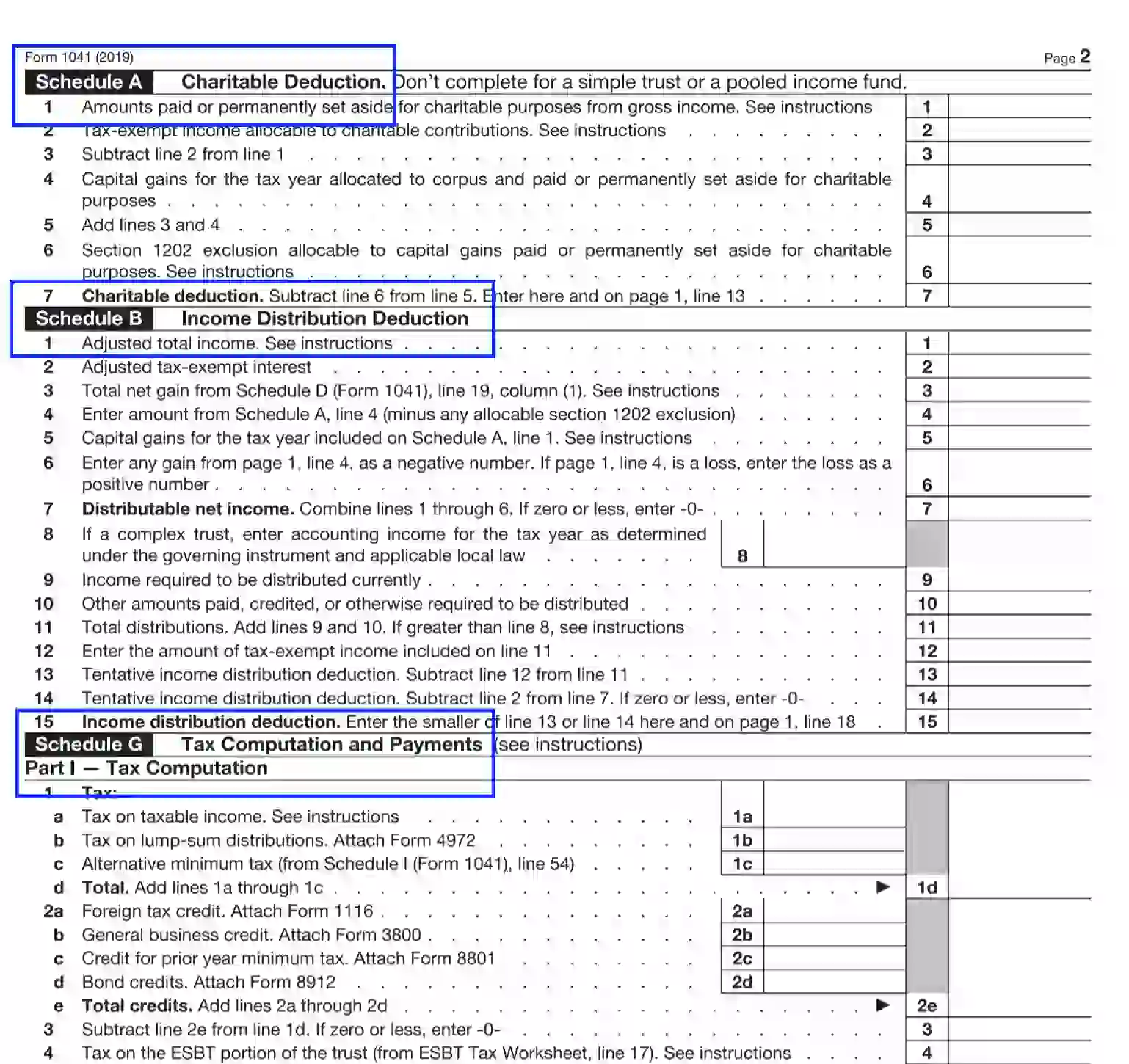

Schedule A

This section covers aspects connected with charitable deductions and is governed by Section 170(c) of the US Code.

Schedule B

This section is recognized as Income Distribution Deduction. It should be completed if the estate or trust under discussion has been distributed the profit to beneficiaries during the reporting tax period.

Schedule G

This section consists of two parts — Tax Computation and Payments.

Other Information

Complete the poll on page three of the form, providing valid answers to each question.

- Authorize the Paperwork

Once the preparer has entered the required information and completed the needed schedules, they need to acknowledge the document by appending the fiduciary’s signature. Also, the responsible party needs to place the current calendar date.

In case the fiduciary or their official representative is a financial entity, they need to submit their Employer ID number.

- Introduce the Paid Preparer (If Applicable)

If the responsible representative hires a third party to prepare the return, ensure to complete the referenced section at the bottom of the first page. The Unit must contain the following data:

- Paid preparer’s name in a type or print manner

- Paid preparer’s signature

- Current calendar date

- Employment status

If the hired party is self-employed, the preparer should checkbox the corresponding slot. If the preparer is employed with another entity, they need to provide the firm’s name, address, EIN, and contact phone number.

- Preparer’s Tax ID Number (PTIN)

Everyone who assists in arranging federal tax returns should submit their PTIN to support the eligibility.

- Authorize the Preparer to Negotiate the Document with IRS

If the responsible party authorizes the appointed preparer to discuss the data released in the document, you need to indicate the “Yes” box at the very bottom of the form.