Form 2210, titled “Underpayment of Estimated Tax by Individuals, Estates, and Trusts,” is a document used to determine if a taxpayer has underpaid their estimated tax and, if so, to calculate any penalty for that underpayment. This form is relevant for taxpayers who didn’t pay enough tax throughout the year through withholding or making estimated tax payments. Typically, this includes self-employed individuals, investors, retirees, and those with other sources of income not subject to automatic withholding.

Filing Form 2210 allows taxpayers to determine the penalty they owe due to underpayment of estimated tax. It also provides a space to explain any special circumstances that might waive the penalty, such as casualty, disaster, or other unusual conditions. The form includes detailed instructions to calculate the penalty based on required annual payments, actual withholding, and the dates the amounts were paid. Taxpayers can choose to have the IRS calculate the penalty for them, or they can fill out the form themselves if they want to determine the specific amounts involved or if they believe they have a case for reducing the penalty.

Filling Out the Template

The template might seem complicated because there are four sheets that you should fill out with tons of various numbers. Deliberately or not, you cannot cheat with your tax forms, so it is recommended to seek help from accountants or tax experts and ask someone to complete the template.

If you prefer to make the form on your own and fail to provide correct numbers, you may be in trouble because the IRS will probably ask you to pay fines. Do not forget that in cases of massive cheating, taxpayers may even go to prison for several years. We consider those reasons and facts enough to hire professionals who assist with the creation of multiple forms issued by the Service.

All in all, regardless of who will complete the template, you need its proper version. It can be found and downloaded on the IRS site. However, it is not necessary to leave our site: we have user-friendly form-building software with which you can easily get IRS Form 2210 (its latest version, of course). Try it right here to simplify the process. Then, see our instructions below.

Write Your Name and ID Number

The paper begins with the filer’s name and ID number. Insert both items to the relevant lines on the first page’s top.

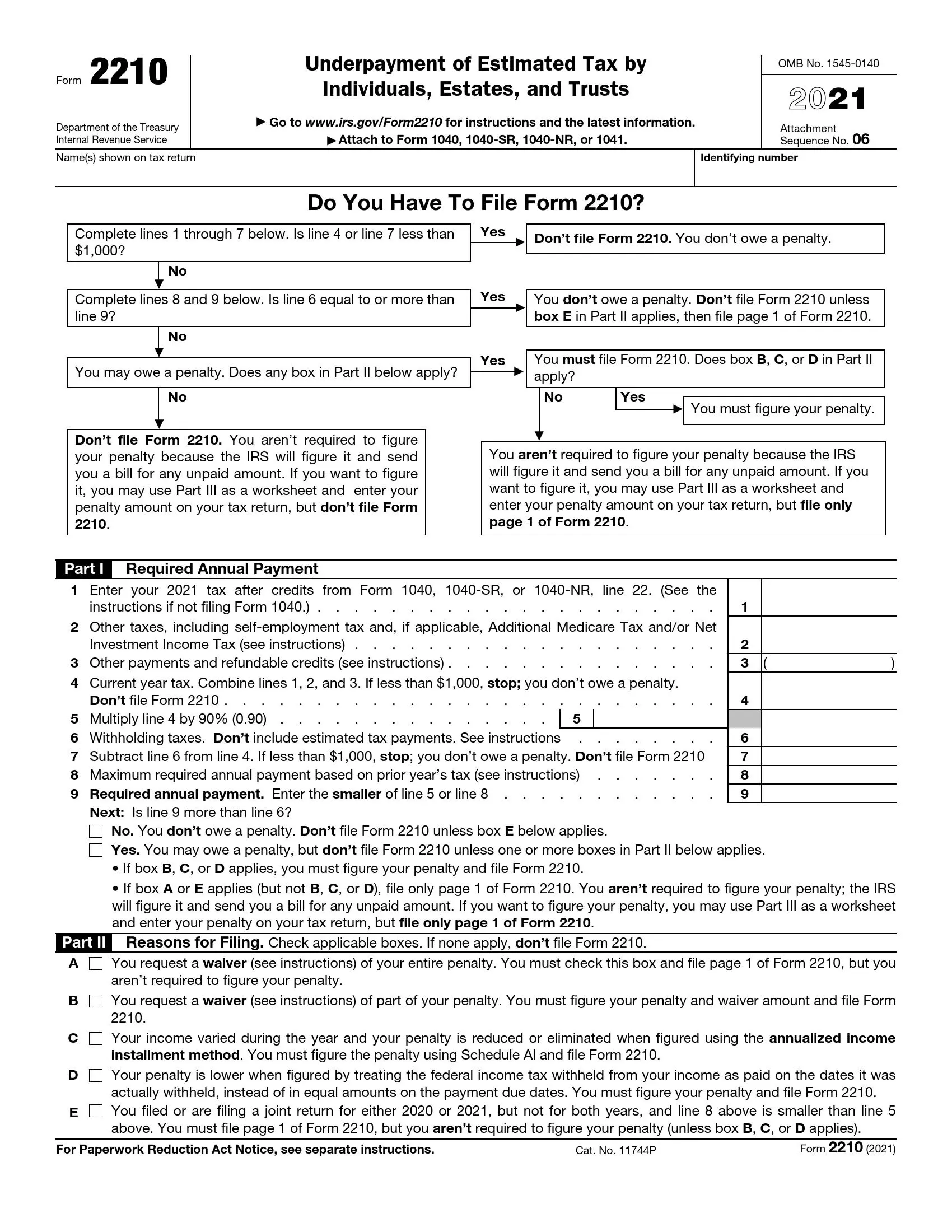

Define If You Have to File the Document or Not

Below the payer’s data, the template offers a set of questions that will help you understand if you need to send the document or not. Provide honest answers to each question to figure out if the form completion is necessary for you. If yes, scroll to the first block that you have to fill out.

Determine the Demanded Annual Payment

In the first block, you will understand the required payment in the current year. Line by line, enter certain numbers: tax credits from the past year, other taxes, current year tax, and all other figures required by the template. Do the math as stated in the lines.

After you have counted everything, answer a question below the lines and figure out your following steps (whether you should file the paper or not and exact papers you should send).

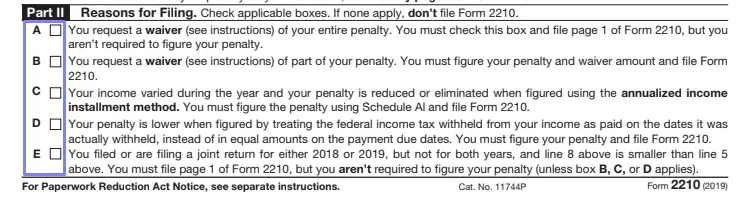

Choose the Reasons to Submit the Form

In Part II, you will see a list of reasons that oblige you to file this form. Read all of them carefully and mark all reasons that fit your case. If you have nothing to mark, you do not have to file this paper. Stop working on it right here.

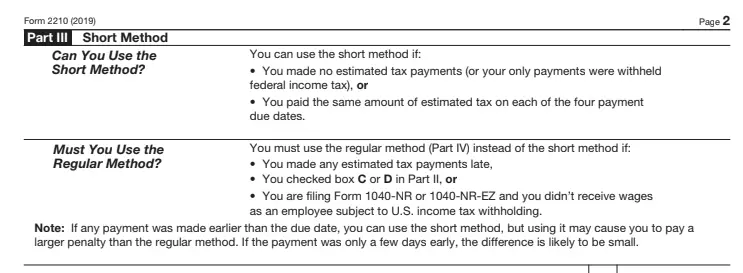

Pick the Calculation Method

You can use either the short or the regular method to calculate your underpayment. The whole Part III is about using the short method, and it begins with a set of conditions explaining if you can use this option or not. Read all conditions and choose the relevant method. If it is possible to use the short one, complete Part III. For the regular one, proceed directly to Part IV.

Fill out each line with the numbers required in the template. You will have to use figures from previous parts and calculate them. This is how you will understand your underpayment and penalties. The short method allows payers to determine these items much easier than it would be if they used the regular method.

Use the Regular Method (If Needed)

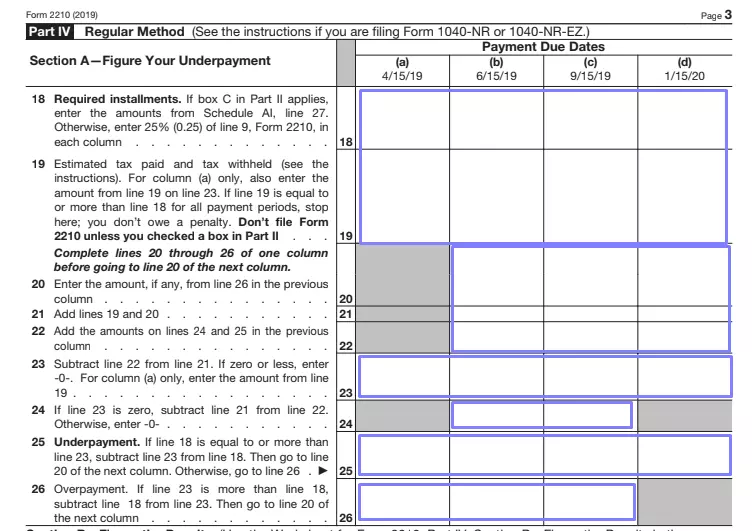

If previously you figured out that you need to use another method, go to Part IV and complete the chart offered there. It is more complex than the lines in Part III. Follow the instructions you see in the chart’s fields (Section A) to do the math correctly and enter correct sums.

In Section B, calculate your penalties as prescribed. Duplicate the total in your tax return.

Complete Schedule AI (If Applicable)

In some cases, you will also need to complete the add-on to the form — Schedule AI. Check the Service’s guide about the form to understand if you have to fill out this part or not. If yes, complete the given chart with demanded calculations.

When and How to Submit the Form

Your IRS Form 2210 must be submitted together with your tax return: 1040, 1040-NR, 1040-NZ, 1041, or 1040-NR-EZ. For all those forms, the deadline slightly differs every year. The last day to deliver the documents in 2021 is April 15.

You are allowed to send your tax return and all related papers via two methods: either regular mail (you have to visit the post office convenient for you and send an envelope with all the forms to the address the Service offers) or the special electronic system proposed by the Service (online, via your browser). The second option is usually recommended because it is easier — you can file everything without leaving your home or office — and your documents will be checked quicker.