IRS Form 8801 is a U.S. tax document used to calculate the credit for prior year minimum tax for individuals, estates, and trusts. This form is particularly relevant for those subject to the alternative minimum tax (AMT) in a previous year. The AMT is a separate tax calculation intended to ensure that taxpayers with high incomes pay at least a minimum amount of tax.

Form 8801 allows taxpayers to determine if they can claim a credit on their current year’s tax return for any AMT paid in previous years. This credit ensures taxpayers are not doubly taxed on the same income over different years. It provides a mechanism to recover a portion of the AMT paid when the taxpayer’s regular tax exceeds their tentative minimum tax in a subsequent year.

How to Fill Out IRS Form 8801

If you haven’t yet got a verified 8801 template, we advise you to use our form-building software to generate the needed PDF file. Our legal forms are prepared and approved by specialists, so you won’t get an outdated document. Also, you are welcome to read the illustrated guideline on how to complete the 8801 form below.

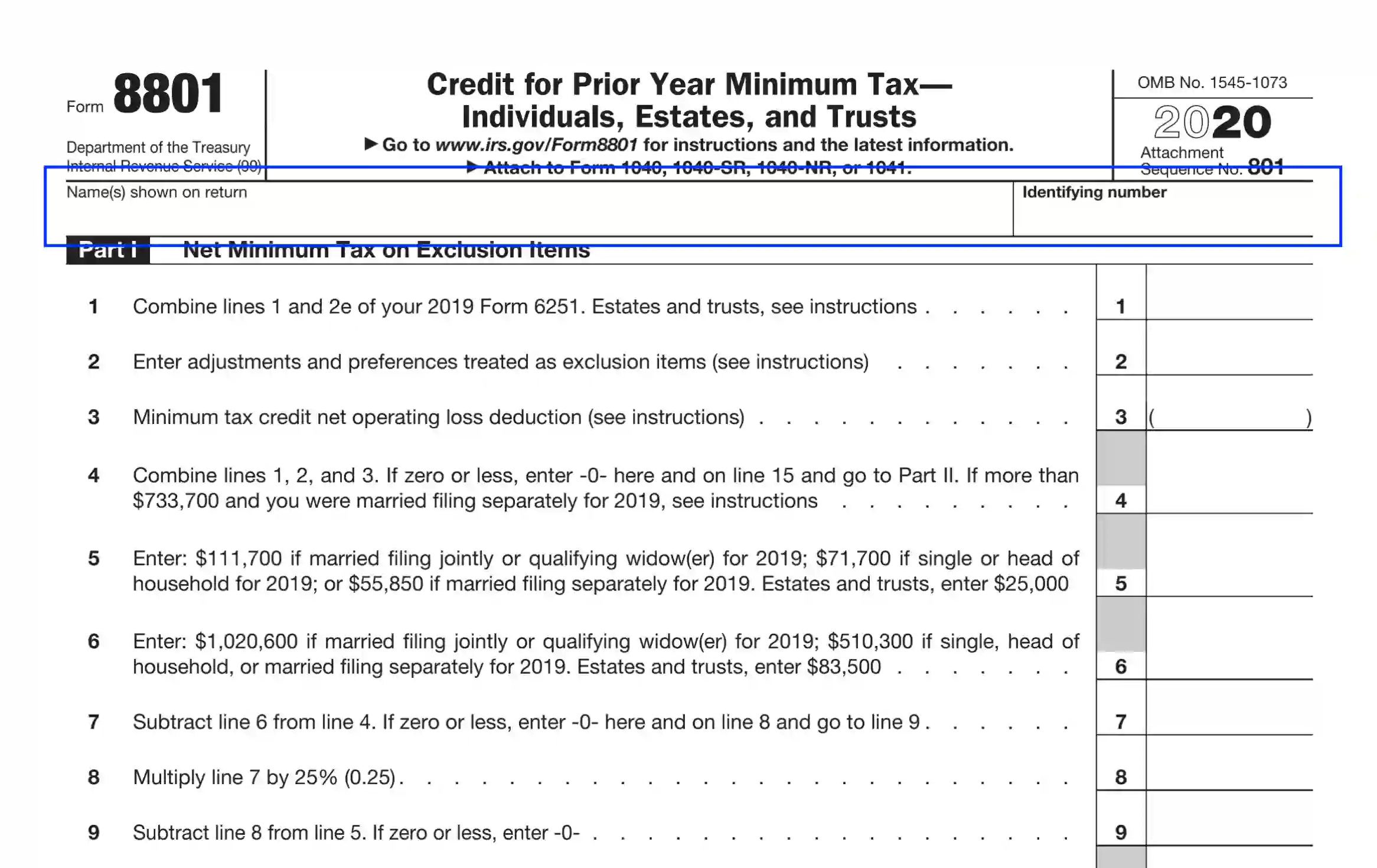

Identify the Taxpayer

Before proceeding to fill out the three sections of the 8801 template, the preparer needs to identify the taxpayer (if filing for someone else). Use the exact legal name(s) and ID number as indicated in the return report for the IRS. As a rule, Form 8801 is attached to 1040, 1040-SR, 1040-NR, and 1041 return paperwork.

Prepare the Exclusion Items Minimum Tax

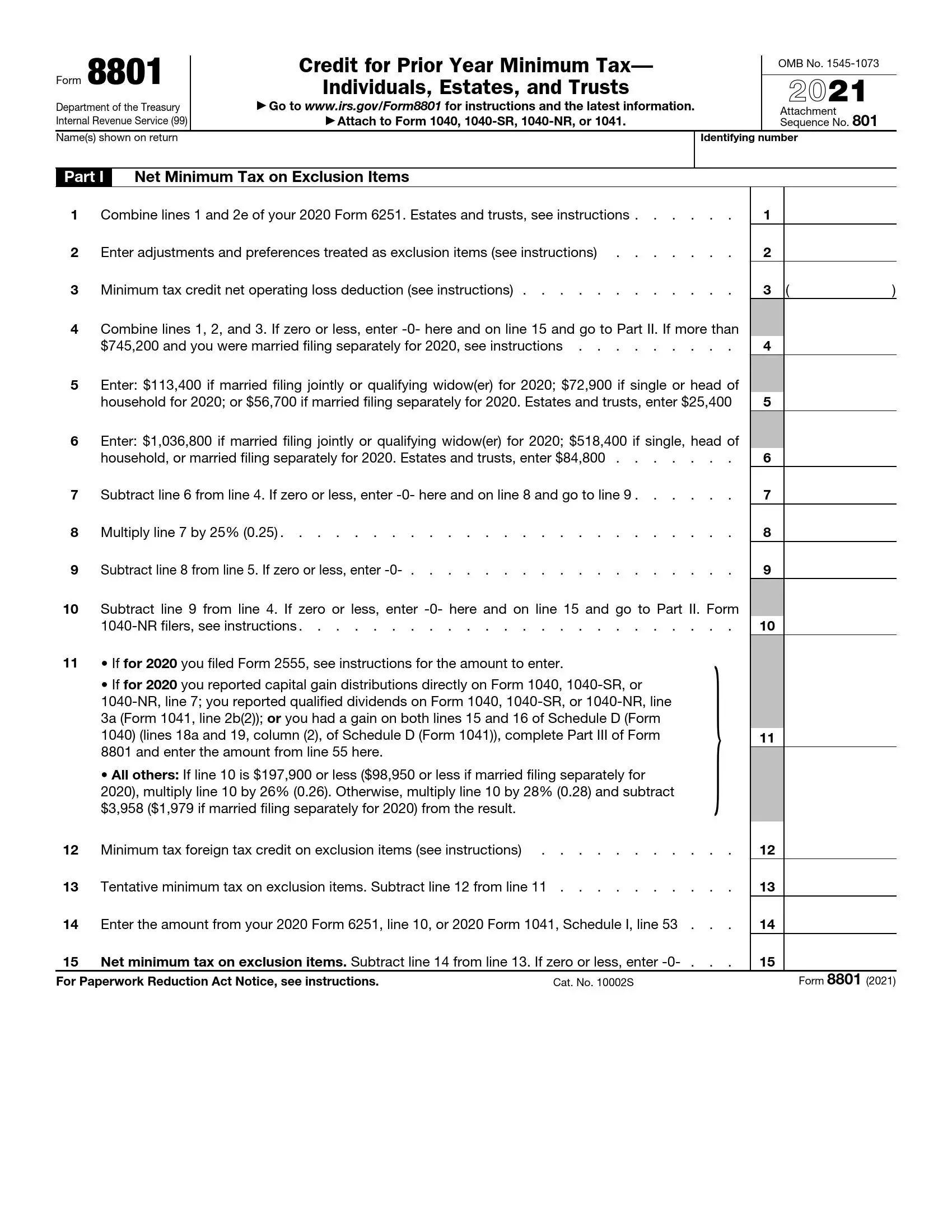

Part I should be submitted by all preparers and covers aspects regarding the exclusion items minimum taxation. Here, the taxpayer needs to answer questions 1 through 15 by entering the required amounts in the boxes to the right. Specify the following concepts regarding your tax background as inquired by the section.

Make sure to pay special attention to Unit 11, as this line determines whether the preparer should fill out Part III of the respected 8801 paperwork.

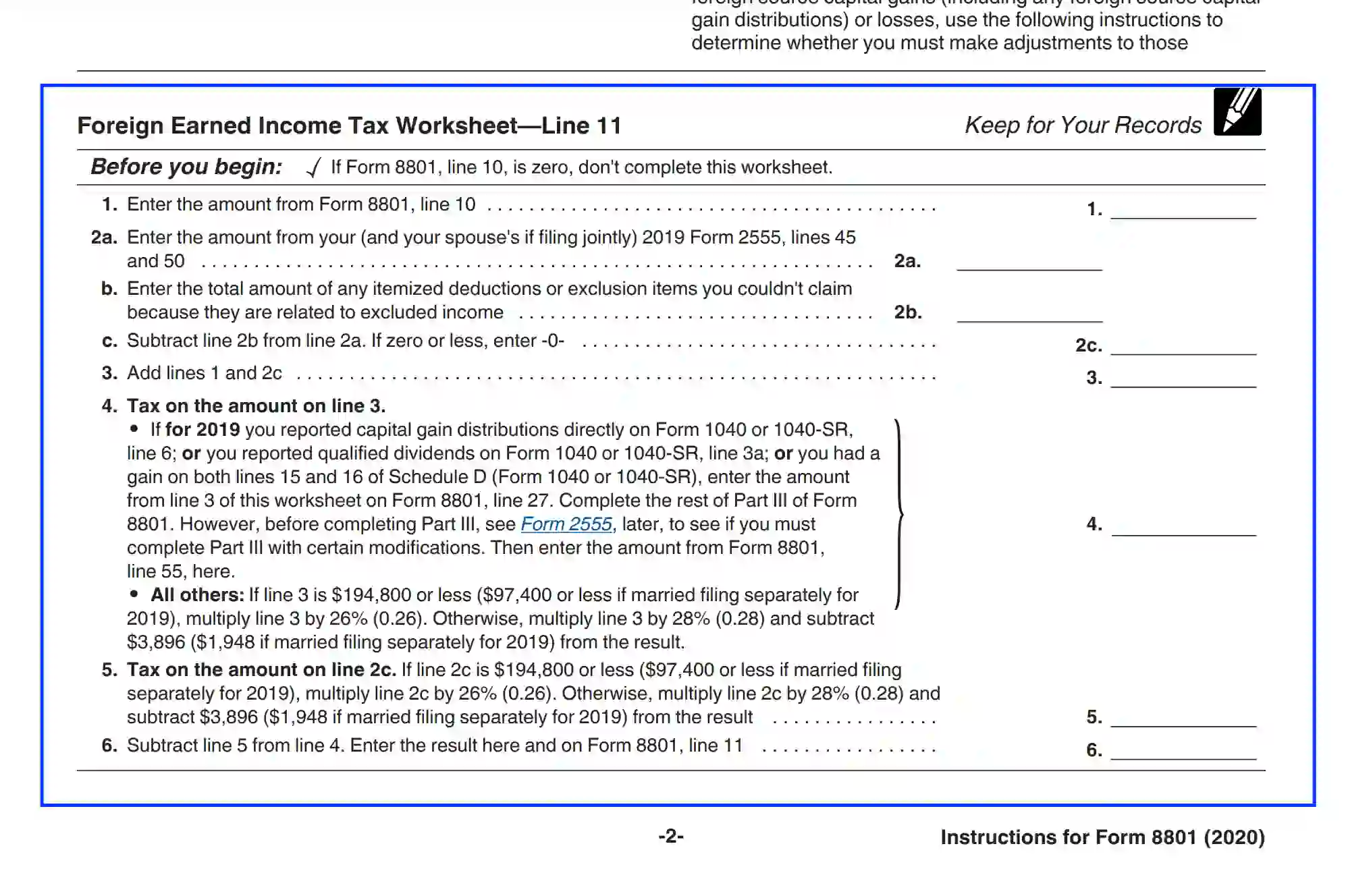

Submit Worksheet Attachment to Clarify Line 11

If the taxpayer has completed Form 2555 to request the foreign earned revenue exclusions and deductions, including the housing ones, they should fill out Line 11 Worksheet (Foreign Earned Income Tax) to compute the amounts and enter the result in Unit 11 of Form 8801. The worksheet is included in the 8801 Instructions located at the IRS web portal.

Use the worksheet only to calculate the needed parameters and keep the info for your personal records.

When providing info for Unit 4 of the worksheet, consider the requirements to completing Part III of report 8801. The section is mandatory to be clarified if the below-listed parameters are present:

- The taxpayer submitted capital income distributions on line 6 of 1040 or 1040-SR for the prior tax year.

- Qualified dividends were submitted on line 3a of either 1040-SR or 1040.

- Both lines 15-16 of Schedule D attached to 1040 and 1040-SR contain earnings amounts.

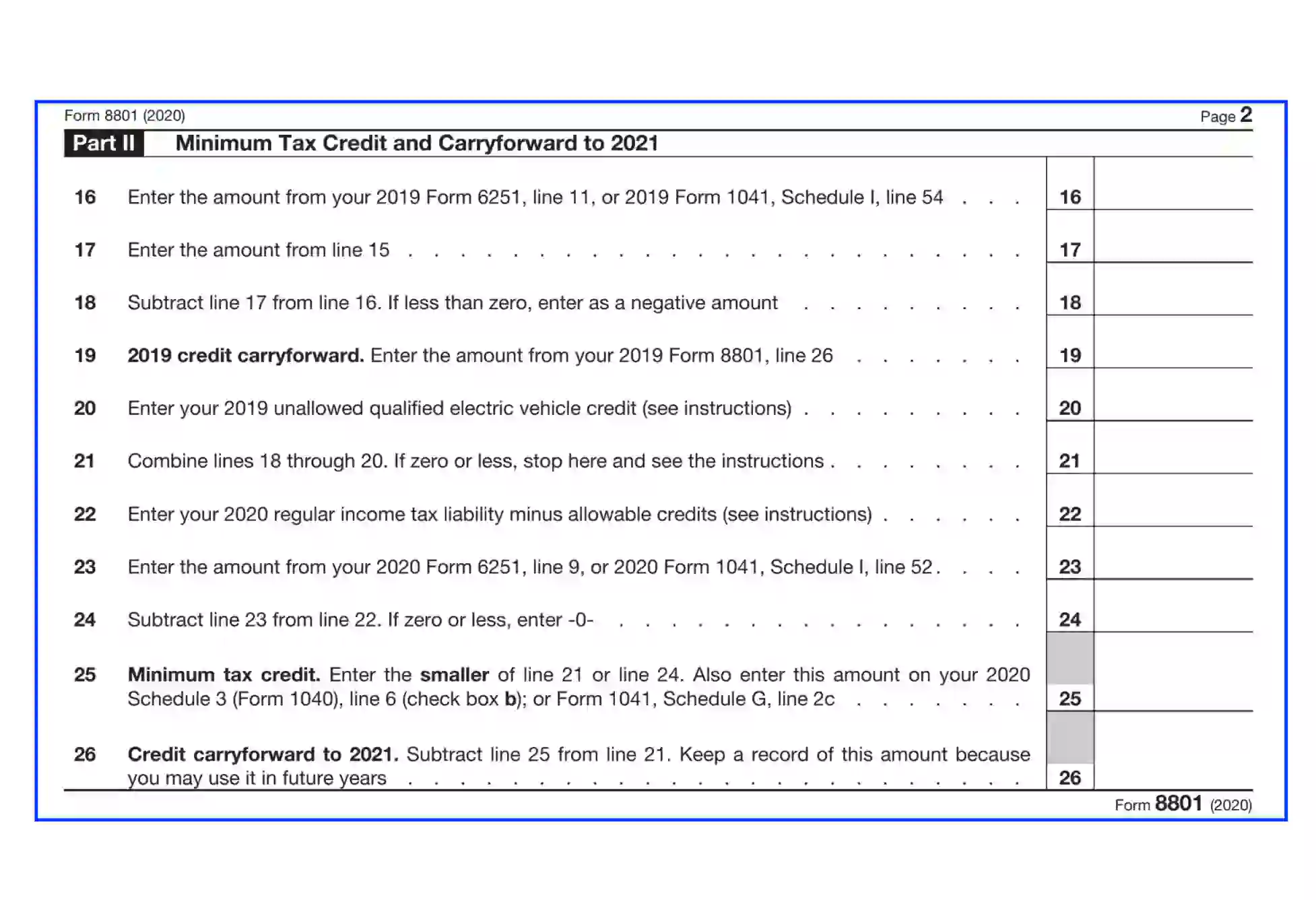

Compute the Minimum Tax and Credit Amounts to Use During Further Periods

Use Units 16 through 26 to figure the needed amounts and enter the parameters as required by each line. You will need additional forms and schedules to provide the requested data.

Submit the 8801 Document

As the 8801 paperwork doesn’t need any signature and date details, attach it to either 1040, 1040-SR, or 1041 and follow the requirement of the main report to file the disclosure.