Free South Dakota Durable Power of Attorney Form

The South Dakota durable power of attorney is a legal document that allows a person (principal) to designate another (agent or attorney-in-fact) to manage their affairs, especially if they become incapacitated or unable to handle matters themselves. Unlike a general option, a durable power of attorney remains in effect even if the principal loses mental capacity.

The scope of authority granted under this form can be tailored to the principal’s specific needs. It can include the power to manage bank accounts, pay bills, collect debts, manage investments, buy or sell real estate, file taxes, and handle other financial transactions. For the durable power of attorney to be valid in South Dakota, it must be in writing and meet signing requirements.

This type of power of attorney is helpful for financial planning, allowing the principal to ensure their finances are competently managed according to their wishes. If you need other state-specific templates, check out all South Dakota POA forms.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

South Dakota Signing Requirements and Laws

In South Dakota, the legal framework for executing a durable power of attorney for finances is clearly outlined under South Dakota Codified Laws. According to Section 59-12-4, this document must be signed by the principal or another person in the principal’s presence if directed to do so by the principal. This signature must be acknowledged before a notary public or another authorized individual to ensure its validity.

The specific sections of the law, such as 59-12-3, state that the power of attorney must include certain phrases to qualify as durable. Key phrases that make a power of attorney durable include:

- “This power of attorney shall not be affected by disability of the principal,”

- “This power of attorney shall become effective upon the disability of the principal,”

- Alternate wording that signifies the principal’s desire for a power of attorney to stay valid despite any disability or incapacity of the principal.

According to Section 59-12-9, the durable power of attorney terminates under several conditions, including the principal’s death, revocation by the principal, or fulfillment of its specific purpose. Additionally, the agent’s authority may end upon the agent’s death, incapacitation, or resignation unless the document specifies a successor.

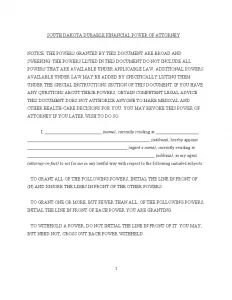

South Dakota Durable Power of Attorney Form Details

| Document Name | South Dakota Durable Power of Attorney Form |

| Other Names | South Dakota Financial Durable Power of Attorney, SD DPOA |

| Relevant Laws | South Dakota Codified Laws, Section 59-12-4 |

| Signing Requirements | Notary Public |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

Durable POA documents are used in each and every state. Take a look at other popular DPOA forms frequently filled out by Americans.

Steps to Complete the Form

These steps will ensure that the South Dakota statutory durable power of attorney form is filled out accurately and provides clear instructions and authority to your chosen agent.

1. Designate Your Agent

Enter your name in the “Name of Principal” field to confirm your decision to delegate authority. In the fields labeled “Name of Agent,” “Agent’s Address,” and “Agent’s Telephone Number,” provide the corresponding details of the person you are appointing. This individual will hold the authority to manage your financial affairs, acting in roles that could range from paying bills to managing investments.

2. Assign Successor Agents (Optional)

If desired, you can ensure continuity by appointing a successor agent and a second successor agent, who will assume responsibilities should your initial agent become unable to act. Fill out the “Name of Successor Agent,” “Successor Agent’s Address,” and “Successor Agent’s Telephone Number” fields, and if appointing a second successor, complete the fields designated for the “Name of Second Successor Agent,” “Second Successor Agent’s Address,” and “Second Successor Agent’s Telephone Number.”

3. Grant General Authority

In this section, you are asked to grant specific powers to your agent by initialing beside each category listed under the “Grant of General Authority” segment. These categories include, but are not limited to, “Real Property,” “Banks and Other Financial Institutions,” and “Taxes.” If you wish to provide your agent comprehensive authority over all listed areas, simply initial the “All Preceding Subjects” option.

4. Specify Special Instructions (Optional)

Use the “Special Instructions” area to clarify any specific directives or limitations on the power of attorney. This section is important if you have specific conditions regarding when a power of attorney should become active, such as upon your incapacitation. Fill out any additional directives or constraints pertinent to your situation that are not already covered by the standard form provisions.

5. Sign and Date the Form

Once all parts of the form are accurately completed, proceed to the “Signature and Acknowledgment” section at the end of the document. Sign your name and write the date in the designated fields. This action confirms your agreement and understanding of the powers being granted.

6. Notarization

The final step involves the notarization of your form. Present the signed form to a notary public who will verify your identity and the authenticity of your signature. The notary will complete their section by signing, dating, and affixing their official seal, which is crucial for the legal standing of the document.

Listed here are various other South Dakota documents filled out by our users. Try our step-by-step builder to customize these forms to your needs.

Download a Free South Dakota Durable Power of Attorney Form