Commercial Lease Agreement Templates

A commercial lease agreement is used to bind long-term property rental for a store, office space, or area for business use. In this type of lease, a tenant is usually registered as a company and may use the property’s address for business purposes. This commonly entails indicating the address in government registrations, marketing materials, or as an event venue. A lease for commercial property typically lasts for a few years depending on the lease term and rental fee. Because of this long-term engagement, the agreement usually contains:

- In-depth detail and emphasis on upkeep and maintenance responsibilities;

- Foresight into the company’s future needs such as alterations or subleasing;

- No restrictions on the tenant’s number of visitors; and

- A clause on the “right to first offer” should the landlord decide to eventually sell the property.

Depending on the company’s industry, both landlord and tenant may also have to revise some details of the lease agreement. However, it is always best to begin with a legally-verified agreement template before revising. If you’re looking for more guidelines, the rest of this comprehensive article can help you.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Commercial Versus Residential Lease Agreements

A commercial lease is distinctly different from a residential lease in terms of the following:

- Leased Premises – Oftentimes, commercial spaces are associated with bigger areas or prime locations. However, any location can have a commercial or a residential lease. For instance, a landlord of a suburban house can have it leased by a family under a residential lease agreement. When that commercial lease agreement ends, the same landlord may accept a company as the new tenant. In this case, a commercial lease is more applicable.

- Occupants – While residential lease agreements indicate a maximum number of occupants and visitors, commercial lease agreements may be more lenient. The reason for this is that companies employ workers or invite clients, all of whom are essential to their business.

- Lease Term – Residential lease agreements are often good for a couple of months to a year. After this, the lease agreement is typically renewed. However, in a commercial lease, contracts last for several years depending on what the company can offer. In such a case, landlords can give fixed base rent.

- Monthly Rent – Like in any lease agreement, the rental amount will depend on the location and amenities offered by the landlord. However, other factors can change the average monthly rent such as the company’s capacity to pay higher, the length of the agreement, and the cost of alterations.

- Security Deposit – By law, the deposit for a lease agreement under the residential classification is 150% of the monthly rent. However, there are no restrictions for deposits in a commercial lease.

- Guarantor – Regardless of lease property type, landlords may still require a guarantor even for a commercial lease. This is especially common for startup companies, which need to prove their ability to fund checks. Since their sales will affect their ability to pay, landlords can require personal guarantors or other proofs.

- Maintenance and Repair – Since more people use a commercial property’s common area, the wear and tear may be hastened. It’s best if both parties agree on a detailed delegation of responsibility. Most companies even prefer that they take on the majority of responsibilities since they have certain maintenance requirements for their business.

- Alterations – Tenants under a residential lease usually adjust to how the property is already set up. On the other hand, tenant companies under a commercial lease will have certain specifications for their business. Because of this, a corresponding clause may allow alteration provided that they discuss it with the landlord first.

- Relocation – For a residential lease, the landlord may have the right to relocate the tenant to another similar space with a 30-day notice. However, this may not be applicable to commercial lease agreements.

- Provisions – Lease agreement for commercial purposes must include provisions that abide by the Occupational Safety and Health Act of 1970. Therefore, the tenant company must inspect the premises for any hazardous material (like lead or asbestos), since they would be equally responsible should any problem arise.

According to the law, the labels “residential” and “commercial” are determined by the intended use. If the tenant seeks to use the property’s address privately as a home, then a residential lease agreement will do. However, a landlord and tenant must write a commercial lease agreement if the said property will be used publicly for business. When registering the address in government papers, one must make sure that their lease agreement is for a commercial lease.

Commercial Property Types

Properties used for commercial purposes have different types. Depending on the nature of the business, they may give more weight to the existing floor plan or on the location. Therefore, it would be a good idea for landlords to familiarize themselves with the following:

Office Space

Commercial properties for office use are categorized based on location and presentation of the property being rented. For instance, companies may prefer buildings rather than residential types, because this would affect their credibility. While bigger companies may opt to rent entire buildings (also called “office park”), some medium-sized companies would tend to lease a few floors. In this case, the landlord must have an administrative team to handle any concerns.

Retail Stores

Retail properties are not dependent on size. They prioritize foot traffic and location above anything else. Properties along major roads or inside of a strip mall may be considered as commercial leases. Oftentimes, shops would rent these to gain more walk-in customers. In contrast, a bigger retail property would come in the form of malls and shopping centers. These would attract more foot traffic and therefore require a higher sum for their base rent.

Industrial Properties

For manufacturing businesses that have many employees and have complex operations, a property with a huge area is a priority. Often, these would be located outside of the city and hire employees from nearby communities. The major advantage of renting a big property in rural areas are (1) lower wages, (2) bigger area, and (3) cheaper rent per square meter. However, landlords must check if their prospective tenants have complete licenses for manufacturing and environmental protection as this will greatly impact their community and the value of their property in the long run.

Oftentimes, businesses just lease properties rather than owning them. The type of property greatly affects what type of company it will attract. With this in mind, it is important for landlords to highlight the features of their properties, which can become advantageous for the business.

Types of Commercial Leases

According to Payment Terms

1. Gross Lease

In this type of lease, the tenant is only responsible for the base rent while the landlord pays for other expenses like utilities, insurance coverage, and property taxes. When computing the fixed base rent, the landlord may include the estimated electric and water consumption of the company plus real estate taxes. This is a good way for the company to regulate budget and unload their employees of other burdens.

2. Net Lease or Triple Net (NNN) Lease

In this type of commercial lease, the tenant is responsible for paying all expenses on top of the fixed base rent. This would include all utility bills, real estate taxes, and property insurance. On top of this, the tenant will also be responsible for regular area maintenance and repair for property damage. An NNN lease is the exact opposite of a gross lease.

Once the payment terms have been determined, the type of commercial lease is further broken down into area or set-up, which is discussed below:

According to Area Being Rented

3. Garage Rental Agreement

Most companies have vehicles but have nowhere to house them. In the case of this lease agreement, a tenant will only pay for a garage area or lot where they can park their vehicles. This type of commercial property lease is common to logistics or travel companies.

4. Facility Event Space Rental Agreement

For entertainment or marketing-related industries, event facilities are commonly rented for fixed schedules. This ensures that they will not be bumped off the calendar for their future events, which are crucial to their business.

5. Booth (Salon) Rental Agreement

In some retail businesses, only a simple booth (salon) is required. Normally, this would not take up much space, so these tenants will pay the landlord for a small portion of a shared area where they can set up their booth. Sometimes, these booths become part of a sublease agreement (a second-degree type of rental. See: “According to Set-up”).

According to Set-Up

6. Financial Lease or Capital Lease

On top of a gross lease or net lease, an agreement can be considered a “Financial” or “Capital” lease if the landlord acts as the financer of the business property or equipment. The tenant company is then responsible for paying the financer without buying or transferring ownership. This works if the value of the equipment or property will lessen over time and the company does not want to deal with other costs or headaches.

7. Operating Lease

An operating lease runs shorter than a financial or capital lease. It allows property use for a short but fixed period of time. In this way, a residual value is retained, allowing the landlord to still charge a fairly high amount to the next tenant or renter.

8. Conveyance Type Lease

Like a rent-to-own setup, a conveyance lease is long-term and aims to transfer the title to the tenant once the final payment has been made. Oftentimes, this becomes a mutually beneficial setup to a landlord who cannot find buyers and a tenant who is willing to buy but lacks initial funding.

9. Leveraged and Non-Leveraged Lease

Since most properties exceed the financial capability of growing businesses, a co-owner shares the cost of the mortgage. In this commercial lease set-up, both become the tenants and the landlords of the property. This works best for sister companies or businesses with related industries, who can maintain good relations with each other.

10. Tax-Oriented Lease or True Lease

This type of lease qualifies for some government tax benefit, therefore benefiting both landlord and tenant. Here, the landlord and tenant can file tax-cuts through a legal process. They will then be notified by a representative if the property qualifies or not.

11. Sales Aid Lease

The payment for the property or asset is directly related to the sales performance of the company. In this case, the landlord may choose to participate in the business as the marketing arm. This partnership can become mutually beneficial if the landlord has the time and capacity to take on a new role.

12. Specialized Service Lease

Businesses may also rent an asset (e.g. special equipment or construction vehicles). Since this would require a specialist to operate the said asset, the lessor or owner can add the cost of hiring to the rental fee. This may apply to Facility or Event Space commercial agreements where audio or lighting equipment usually comes as part of the package.

13. Cross-Border Lease

Commonly used by industries under logistics or international e-commerce, this lease involves a landlord and tenant from different countries. Aside from a detailed commercial lease agreement, the tenant will be required to submit government permits.

14. Sale and Leaseback

In some cases, sales and leaseback can happen when the tenant sells their asset to the lessor or landlord. Then, they would pay a rental fee for using it. This is useful if the company needs a large sum of money to finance its business activities and the lessor is willing to provide such (allowing them to earn more over time).

15. Import Lease

An import lease is a type of rental for a piece of imported equipment. The owner would be from another country, so the lessee or renter would then send the payment abroad.

16. Sublease Agreements

As previously mentioned in the Booth (Salon) agreement, the direct tenant of an area may have the right to rent out a smaller area. He or she then finds third-party tenants who would like to set up their booth or small office. In this case, they would often pay to the direct tenant instead of the landlord.

How to lease a commercial property

Commercial leases may be more complicated than a residential property. In order to navigate through complex details, here are time-tested steps that you can follow:

Step 1 – Check similar properties.

To determine how to best position your commercial property, you may compare it with other similar properties in your area. Since a prospective tenant would also be doing the same depth of research, it will be to your advantage if you balance out different factors including the following:

- Foot traffic – Especially for retail companies, the number of people visiting your area is of utmost importance. Since your prospective tenant will be weighing their rental investment against their projected sales, it will be advantageous to give an estimate on the foot traffic your real estate property will receive. Indications of high-traffic areas are nearby parks, malls, schools, sports venues, bus stations, or subway stations.

- Area – An office’s priority is accessibility for its employees. Therefore, these types of prospective tenants will check the available transportation options. Aside from this, nearby restaurants or cafes are also a plus.

- Parking – Do other commercial properties have parking areas? Businesses often lose customers just because they do not have a proper parking area. So, it will be your edge if you have a designated parking space in your property. If not, you may check nearby parking spaces for rent and propose this alternative.

- Rent per square meter – Oftentimes, commercial lease agreements indicate the price per square meter. When checking others’ prices, you may get their total rent quotation and their floor space in square feet.

Step 2 – Take measurements and list details.

The floor space is one of the first pieces of information you must give prospective tenants. The following will need to be determined:

- Total square feet of the entire real estate property

- Square feet of each floor

- Square feet of outdoor areas

- Square feet of parking space or common areas

- Height from the floorboards to the ceiling (for companies with large equipment)

- Measurement of other applicable areas

However, most of them will not know how to visualize the measurements of each space. So, after the numerical details are written, you may answer the following questions:

- How many regular working desks can fit in each room or floor?

- How many cars can fit into the parking space or garage?

- How high is the head space of each floor?

Step 3 – Determine the price per square feet ($/sqft.)

Since similar properties won’t have the same space, you may determine your real estate property’s price by referring to the average ($/sqft.) of your competitors. Take their information and adjust yours depending on your property’s advantages and other factors such as property tax and cost of an insurance policy. You may refer to the formula in the next section.

Step 4 – Determine whether your lease type is a Gross Property Lease or a Triple Net Lease (NNN).

Along with the price, you must declare whether the price already includes all other expenses (gross lease) or it won’t (NNN). Different lease agreement templates are also available on FormsPal. (See Types of Commercial Leases).

Step 5 – Take pictures

Whether it’s for documentation or for marketing purposes, taking pictures of your property is essential before you rent it out. Aside from showing the pre-rental condition, high-quality electronic pictures can help you get ahead of the competition or hasten the process should you desire to hire an agent. One technique is to remove furniture or trade fixtures to open up space. Commercial renters prefer to begin with a blank slate so they can plan a setup that would be beneficial for their business operations.

Step 6 – Hire a real estate agent or advertise on online platforms

For landlords without experience leasing commercial properties, it is often a good decision to hire a real estate agent who will find good companies and take care of the negotiation process. However, a landlord with a business mindset has the capacity to handle this on his or her own provided that he or she has time.

To begin posting on online renting platforms, make sure that the platform accommodates commercial leasing. Otherwise, you might not get the right inquiries. When posting descriptions, highlight your property’s features as discussed in Steps 1 to 2. Couple this with high-quality photos that will showcase each area in an honest manner. You may also opt to show “before and after” photos with a blank area and how it would look like as an office or a shop.

Once a company shortlists your real estate property, be prepared to attend meetings. Making short visual presentation will increase your professionalism and make your property stand out. Since most companies would like to deal with professional landlords, treating the lease agreement as a business deal will assure the prospective tenant that you offer a stable, long-term engagement.

Step 7 – Schedule a viewing

If the company decides to move forward with the leasing process, you may schedule a viewing with them and tour them around the house. This will also be a good avenue to discuss how the real estate property can accommodate their desire floorplan.

Step 8 – Do a background check

Companies looking to rent will not always have complete papers. Oftentimes, their registration will depend on the real estate property’s address. This is especially common for starting companies. In this case, you may do a full background check on the business owner(s) by checking the following:

- Income Tax Records or Financial Statements

- Criminal Records

- Past landlords (Some states have a database for this)

- Sales report (either certified by an accountant or from a verified platform)

Step 9 – Revising and Finalizing the commercial lease agreement

Discuss the details of the lease with your future tenant. You may begin with a standard gross lease agreement template and integrate revisions to accommodate their special business needs. This may include special provisions for:

- Deferring payments due to the tenant’s initial cost of repair (if the property is currently in a below-average state and the company volunteers to shoulder the cost of repair)

- Allowing or prohibiting leasehold improvements (wherein tenants can make major alterations to the property for their intended use)

- Special payment arrangements (e.g. Sales Aid Lease or Conveyance Lease)

Once you have finalized all of the details, you may seek legal advice to check for any inaccuracies or loopholes, which may become problematic in the long run. Since this type of lease agreement can last for years, it is crucial to finalize your agreement with full confidence. To aid you in your lease agreement, here is a standard gross lease agreement.

Step 10 – Properly receive payments and deposits.

Upon contract signing, secure the following:

- Company’s Security Deposits

- An advanced deposit (usually equivalent to one to three month’s rent)

- The check for the first month

- Post-dated checks for the succeeding months covered by the agreement

It is important for the tenant that you issue an official receipt or sign a receiving form stating the amount, date, and specifics of the payment.

Step 11 – Turn over the real estate property

Once the tenant’s representative verifies the completeness of the keys and real estate documents, you may need to do another walkthrough to avoid electrical and plumbing concerns in the future. For instance, make sure that the main electrical panel or box is properly labeled. For plumbing, it will also be crucial to mention if the drainage uses a straight tube, which has to be replaced by a p-trap to avoid odors. In a nutshell, turning over the property to the tenant involves managing their expectations even with the slightest detail.

How to calculate the cost per square foot

- Once you have your competitor’s real estate details, you may apply the following formula to get their price per square feet:

competitor’s rent quotation ($) / competitor’s total floor space (sqft.) = competitor’s price per square feet ($/sqft.)

- Then, when determining your own rent, you can take the average price per square feet ($/sqft) of these similar properties. Here’s an example:

(Competitor 1’s $/sqft. + Competitor 2’s $/sqft. + Competitor 3’s $/sqft.)/3 = Average $/sqft. in your area

- Based on your property’s advantages and current condition, adjust your price per square feet:

(Average $/sqft.) + or – (your adjustment) = adjusted price per square feet ($/sqft.)

- Finally, to get the price of your rental amount, multiply the adjusted price per square feet ($/sqft.) by your real estate property’s floor space, like so:

adjusted price per square feet ($/sqft.) x your property’s total square feet (sqft.) = total monthly rent for your property

How to negotiate a commercial lease agreement

When finalizing the commercial lease agreement (see step 9), your tenant may or may not agree with some provisions. Don’t worry, negotiation is always part of a balanced agreement and it’s always best to work with your tenant. Here are the common components where negotiation occurs:

- Base Rent – The tenant would always seek to lower the rental amount, so make sure you set a comfortable minimum price. If you cannot change the amount, you may explain why (e.g. it’s a newly-constructed property, or that the rent is already below the average $/sqft. in your area).

- Expenses – If the terms of expenses were not discussed previously, it is necessary to explain which structure you’ll be using (either gross or triple net). If the tenant shifts their preference to another structure, have a computation readily available.

- Leasehold Improvements – The structure and floor plan of the property can greatly affect a company’s operations. Therefore, most commercial tenants normally aim to secure permission for improvements. To be on the safer side, the commercial lease agreement can require the tenant to present a detailed plan to the landlord before alterations.

- Security Deposit – Since there is no maximum amount for commercial lease deposits, the landlord may quote a higher price and allow the tenant to negotiate. Alternatively, you may set a fixed deposit based on other commercial properties’ terms.

- Term – A business with much investment on your property may want a longer term. In such a case, you must consider the following:

- Interest Rate – (You may negotiate a steady yearly increase due to inflation)

- Projected value of the property – (Are there talks of big developments in your area, which may increase your property’s value?)

- Plans of Selling (Will you benefit more out of selling your property in the near future or will you be content with a steady long-term income?)

- Use of Property – What type of operations will be done in the property? Has the company secured proper permits for such? Let’s say you’re renting out an entire commercial space for a restaurant. Are you prepared for future issues like clogged drainage or pests?

If the tenant’s requests are within reason, it is best for the landlord to adjust. Not only will a balanced commercial lease agreement provide a bright outlook, but it will also help both parties openly communicate with each other.

Required Clauses

Americans with Disabilities Act (42 U.S. Code § 12183)

Commercial properties must be handicap-friendly (e.g. have ramps for wheelchairs) if:

- the property is intended for industries that offer “public accommodation” (e.g. a retail store, a coffee shop, or companies in office buildings) or

- it has 15 or more employees.

Who is responsible for this? Though it will be the tenant who will regulate the use of the facility, landlords bear the most responsibility according to law.

Hazard Waste (42 U.S. Code § 6901)

This clause automatically makes the tenant agree that they will follow all laws and zoning ordinances when disposing of hazardous or toxic wastes. This is not limited to industries that regularly dispose of vats of oil or chemicals. It could also be applicable to small dental clinics, hair salons, and restaurants. Should the landlord or tenant disregard this code, the insurance company may forfeit the coverage.

Commercial Lease Agreement Form Details

| Document Name | Commercial Lease Agreement Form |

| Other Names | Business Lease Agreement, Lease Agreement for Commercial Property |

| Avg. Time to Fill Out | 18 minutes |

| # of Fillable Fields | 114 |

| Available Formats | Adobe PDF |

How to fill out a commercial lease agreement

To ease the burden of writing your own commercial lease agreement, you may download this free commercial lease agreement template and start editing through the following steps:

Step 1 – Choose your program and download

Download the file type that is compatible with your computer’s existing programs:

- Free Commercial Lease Template (Gross) – Open Office Format (.odt)

- Free Commercial Lease Template (Gross) – Microsoft Office Format (.docx)

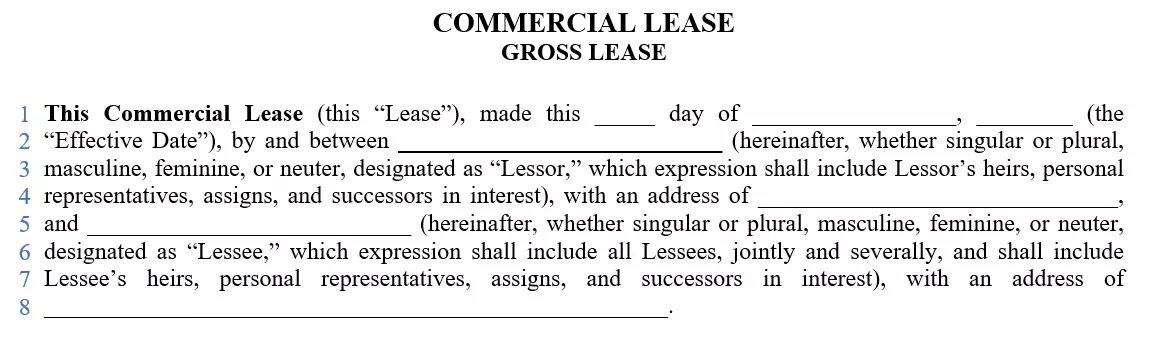

Step 2 – Fill out the opening declaration

An opening declaration states the complete details of the landlord, tenant, and information about the lease. It is the first paragraph of the commercial lease agreement.

To fill it out, input the following in sequence for each blank in the first paragraph:

- 1st line: Numerical date, month, year (e.g. “made this 2nd day of September 2020”)

- 2nd Line: Full name of the Landlord or Lessor

- 4th Line: Complete residential address of the Landlord (other than the property)

- 5th Line: Full name of the Tenant or Lessee

- 8th Line: Complete residential address of the Tenant (permanent residence)

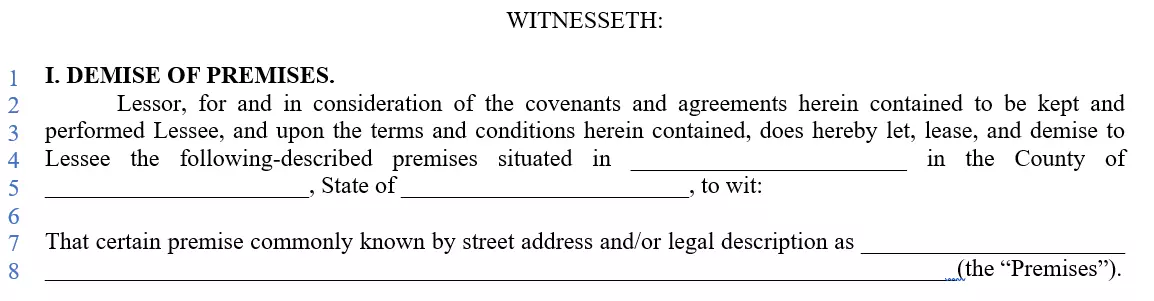

Step 3 – Describe the real estate property or area being rented

In the second paragraph or SECTION 1, input the following:

- 4th Line: Your area or city

- 5th Line: County, state (e.g. Orange County, State of California, to wit:)

- 7th to 8th lines: Complete street address (including floor, office building or house number, street, area, city, county, and state). You may also put the Zip code at the end.

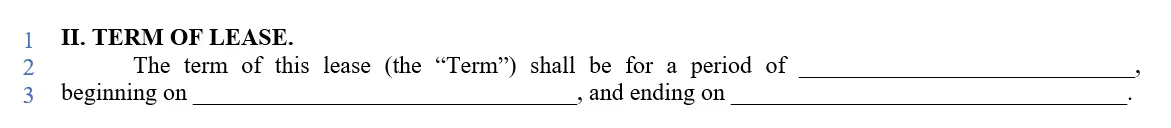

Step 4 – Indicate the lease term previously agreed upon

In the third paragraph or SECTION 2, input the following:

- 2nd Line: number of years or months

- 3rd Line: Date of the occupancy (when the tenant is allowed to move in), Date of contract expiration (when the tenant will renew or vacate the leased premises) (e.g. “beginning on September 10, 2020, and ending on September 10, 2025”).

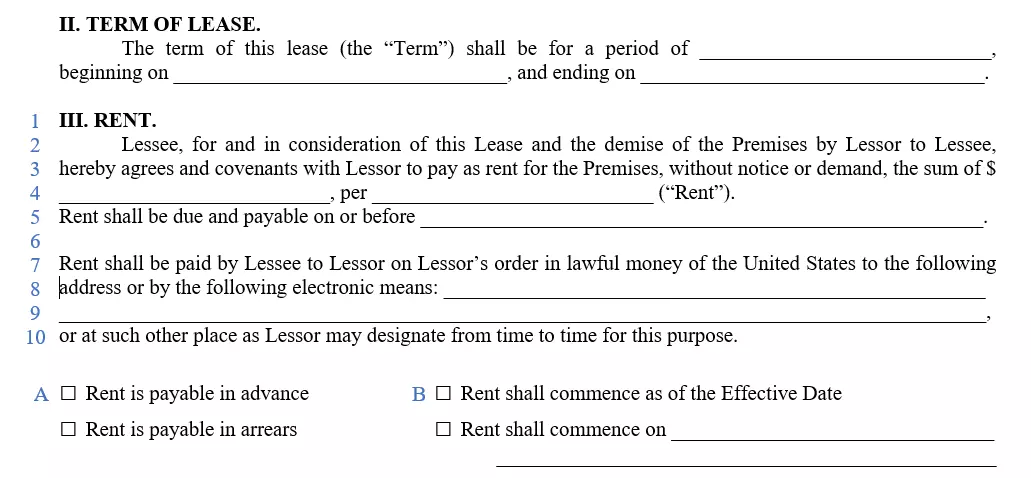

Step 4 – Indicate the duration of the lease

In the fourth paragraph or SECTION 3, input the following:

- 4th Line: Rent in U.S. dollars, month or year (e.g. “$500, per month (‘Rent’).”).

- 5th Line: Date when rent is due (e.g. “2nd of each month”).

- 8th Line: Landlord’s designated address for sending checks or Landlord’s complete bank account details.

- A: You may choose between advanced rental payment where the entire year is fully paid, or you may wait until the tenant pays the dues monthly, with the schedule indicated in the 5th line.

- B: You may choose to take the rent on the date specified in Section 2: Terms of Lease or you may allow a deferred payment depending on the situation (e.g. Payment may be applicable only after two months when all repairs have been made).

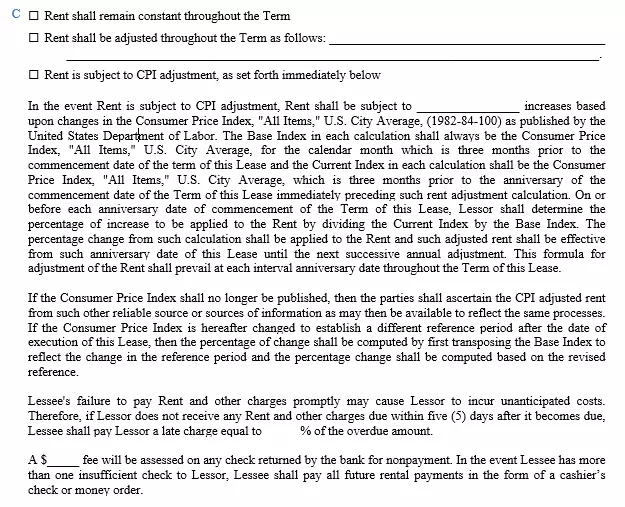

Still under Section 3: Rent, you will need to determine how much you’ll be adding to the rent after a year or so. For letter C, you may choose from the following:

- Constant – no changes throughout the entire agreement

- Adjusted based on the terms – input the percentage of increase and reoccurrence (e.g. “4% yearly”).

- CPI (Consumer Price Index) Adjustment – will be dependent on seasonal or yearly statistics. If this is your basis, you may refer to updated reports by the Bureau of Labor and Statistics. For example, in the first line and first paragraph of the CPI provision, you may add “0.6%” for July 2020. You may also use this CPI calculator for quick computation.

It is important to note that while the CPI fluctuations are based on well-researched data and give a reasonable basis of adjustments, computing this may be taxing to the landlord.

Moving past the CPI percentage, the third and fourth paragraphs of this provision will be dependent on the landlord’s computation of penalties.

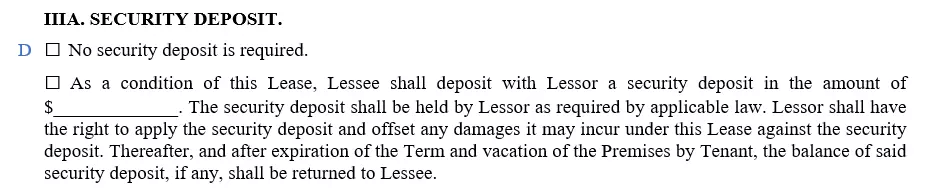

Step 5– Choose your terms for the security deposit.

Under Section 3A: Security Deposit, pick the box that works for you:

- No deposit (This usually happens when the tenant pays for the entire year)

- With deposit (In this case, you will have to indicate the amount of security deposit on the second line.) See: “How to negotiate a commercial lease agreement — Security Deposit”

Step 6– Describe the purpose of the lease.

In section 4, write the following:

- 3rd line: General purpose of the rental (e.g. Retail business).

- 4th line: Description of the purpose

Step 7– Review other sections.

The sections below are standard and usually preferred by many:

- Section 5: Condition of premises and repairs.

- Section 6: Liability of lessor.

- Section 7: Requirements of public authority.

- Section 8: Alterations, additions, and improvements.

However, should both parties agree on revising these provisions, they must seek legal advice. Otherwise, sections five to eight typically go untouched on lease agreement templates.

Step 8 – Agree which changes to the property must be made before the tenant moves in.

Section 9 above explains which alterations are allowed. Now, depending on the tenant’s decision, he or she may accept “as in condition” as written in selection point E. In some cases, the property may need repair. If this is applicable, you may tick the second box and describe the type of improvement that needs to be done.

Step 9– State conditions for subletting.

In section 10, the conditions for subletting are detailed. The landlord may decide to:

- Choose the first box, which explains that written permission from the landlord must be secured before proceeding with any subletting; or

- Choose the second box, which allows the tenant to freely sublease with a few conditions. In the blank provided, the landlord will write the lease terms of the said.

Step 10 – Indicate how you will want to pay for utilities and other incidental fees.

Section 11 has three options for utility payment, which are explained as follows:

- First box: Landlord or lessor will write which utilities he or she will cover

- Second box: All costs in the leased premises will be shouldered by the tenant or lessee

- Third box: All operating costs will be shouldered by the Tenant or lessee for the area that he or she is using (bills determined by a submeter). This is applicable to shared rooms in a building. In this case, the landlord takes the extra mile to check the submeters, bill each tenant, and take payments. To cover this extra cost, the landlord can indicate an additional fee in the last sentence of this option.

Step 11 – Read through the other standard sections.

Sections 12 to 16 have been written to balance out the responsibilities between the landlord and the tenant. You may read through them in the document provided:

- Section 12: Lessor’s right of entry and to make alterations, additions, and improvements.

- Section 13: Taxes, other assessments, and insurance.

- Section 14: Holding over.

- Section 15: Bankruptcy and condemnation.

- Section 16: Destruction.

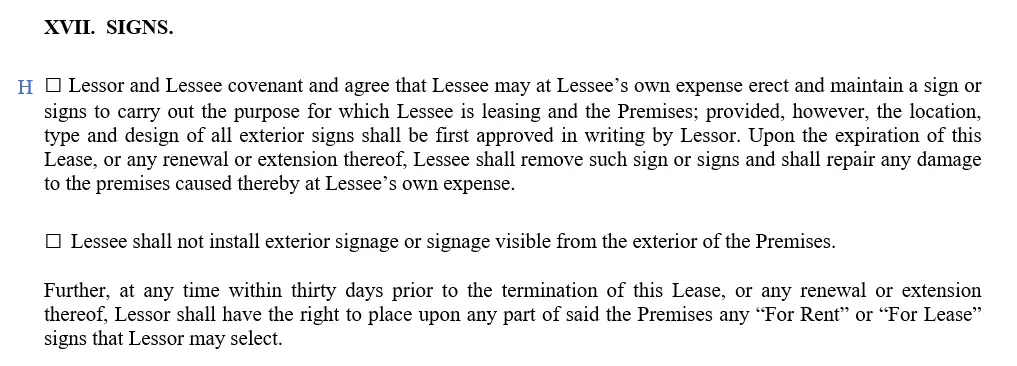

Step 12 – Decide on the guidelines for the property’s facade.

In the decision point H, you may choose to:

- Allow the tenant to put up a sign, which they have to remove at the end of the contract; or

- Prohibit the use of signage.

Step 13 – Check the following provisions:

- Section 18: Default.

- Section 19: Lessor’s remedies are cumulative.

- Section 20: Waivers.

- Section 21: Binding on heirs, personal representatives, assigns, and successors in interest.

The sections above provide legal bases and discuss what happens in a “breach of contract.” Other standard provisions are also detailed in favor of the landlord.

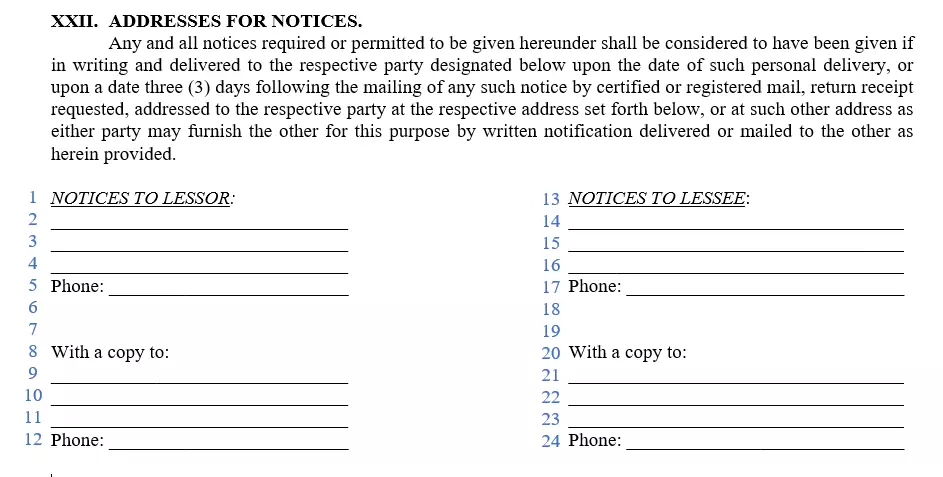

Step 14 – Indicate addresses for correspondence.

- Lines 2 to 4: Landlord’s residential or office address

- Line 5: Landline and Mobile Numbers of Landlord

- Lines 9 to 11: Residential or office address of the Landlord’s representative

- Line 12: Landline and Mobile Numbers of the Landlord’s representative

- Lines 14 to 16: Tenant Company’s residential or office address (usually the property’s address)

- Line 5: Landline and Mobile Numbers of the Company

- Lines 9 to 11: Residential or office address of the Tenant’s representative (can be a residential address)

- Line 12: Landline and Mobile Numbers of the Tenant’s representative

Step 15– Make no changes to other sections

- Section 23: Declaration of contractual liability.

- Section 24: Grammatical usage.

- Section 25: covenant to execute additional instruments.

- Section 26: Captions.

- Section 27: Governing law.

- Section 28: Amendments.

- Section 29: Compliance with environmental laws.

- Section 34: Miscellaneous

The above sections are standard and help bind the entire agreement together. However, feel free to review the details discussed in FormsPal’s lease agreement templates.

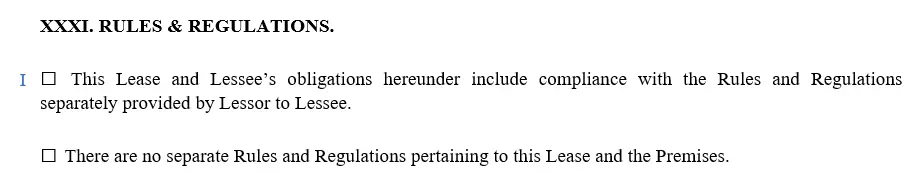

Step 16 – Indicate whether or not there is a separate list of lease terms.

- Tick the first box if there are separate “tenant covenants,” which you may attach as riders to the agreement.

- Tick the second box if everything is discussed within the agreement and there are no other reference files.

Step 17– Give more details about the broker.

For decision point J, you may simply:

- Tick the first box if there is no broker; or

- Otherwise, tick the second box then add the full name of the broker as well as the amount of their commission in dollars (e.g. $ 30 dollars per month). This is usually 4 to 6% of the rent.

Step 18– Choose what happens when the lease contract ends.

- Choose the first box if the agreement must be renewed on a monthly basis after the initial long-term agreement; or

- Choose the second box if you do not want to renew the agreement or may allow automatic renewal with a higher monthly rate.

The landlord and the tenant can also write a new agreement once the old one has expired.

Step 19– Indicate the complete details of both parties.

Finally, wrap it up by writing the following details:

- Line 1: Landlord’s full name or Company Name

- Line 2: Landlord’s Signature

- Line 3: Landlord’s position (if under a group or company)

- Line 4: Landlord’s full name

- Line 5: Company Name of Tenant

- Line 6: Tenant’s Signature

- Line 7: Position of tenant’s designated representative (usually the president or CEO)

- Line 8: Full name of tenant’s designated representative

Step 20– Print and Review

Once done, print the document on a clean, legal-sized bond paper. Send it to the Tenant for review.

Step 21– Finalize and Sign

Upon finalizing the agreement, it is best if both sign it face-to-face with other witnesses. The tenant and the landlord must sign at the bottom of each page. Witnesses may also put their signature.

Step 22– Notarize

Finally, you may send this to a notary public or an attorney for documentation. By doing so, you automatically seal the agreement and provide legal enforceability.

Writing a lease agreement can be daunting, but with FormsPal’s lease agreement templates and in-depth guide will help you carry out this task with no problem.