Michigan Bill of Sale Form

Michigan bill of sale is a legal instrument that records the details of any private sale and purchase, from selling a motor vehicle to buying a horse. Being formally optional for private transactions, bills of sale function as additional insurance that you will receive what you give money for and that there will be no legal risks from the transaction.

Particular sales will need specific bill of sale forms, and it’s vital to learn which one is suitable for you and applicable in Michigan. You may use our lawyer-approved forms, from Michigan horse bill of sale to Michigan gun bill of sale.

Below are our freely available printable templates, ready to download and work with. We’ve also outlined all the details you may need about the bill of sale preparation.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Michigan Vehicle Bill of Sale Form |

| Other Names | Michigan Car Bill of Sale, Michigan Automobile Bill of Sale |

| DMV | Michigan Office of Secretary of State |

| Vehicle Registration Fee | Varies depending on vehicle type, model year, body style etc. |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 25 |

Michigan Bill of Sale Forms by Type

There exist a variety of bills of sale, and each of them is needed for different situations and certain types of transactions. Try and go with the correct bill of sale form and record it accordingly with the state pertaining to the type of sale you’re carrying out.

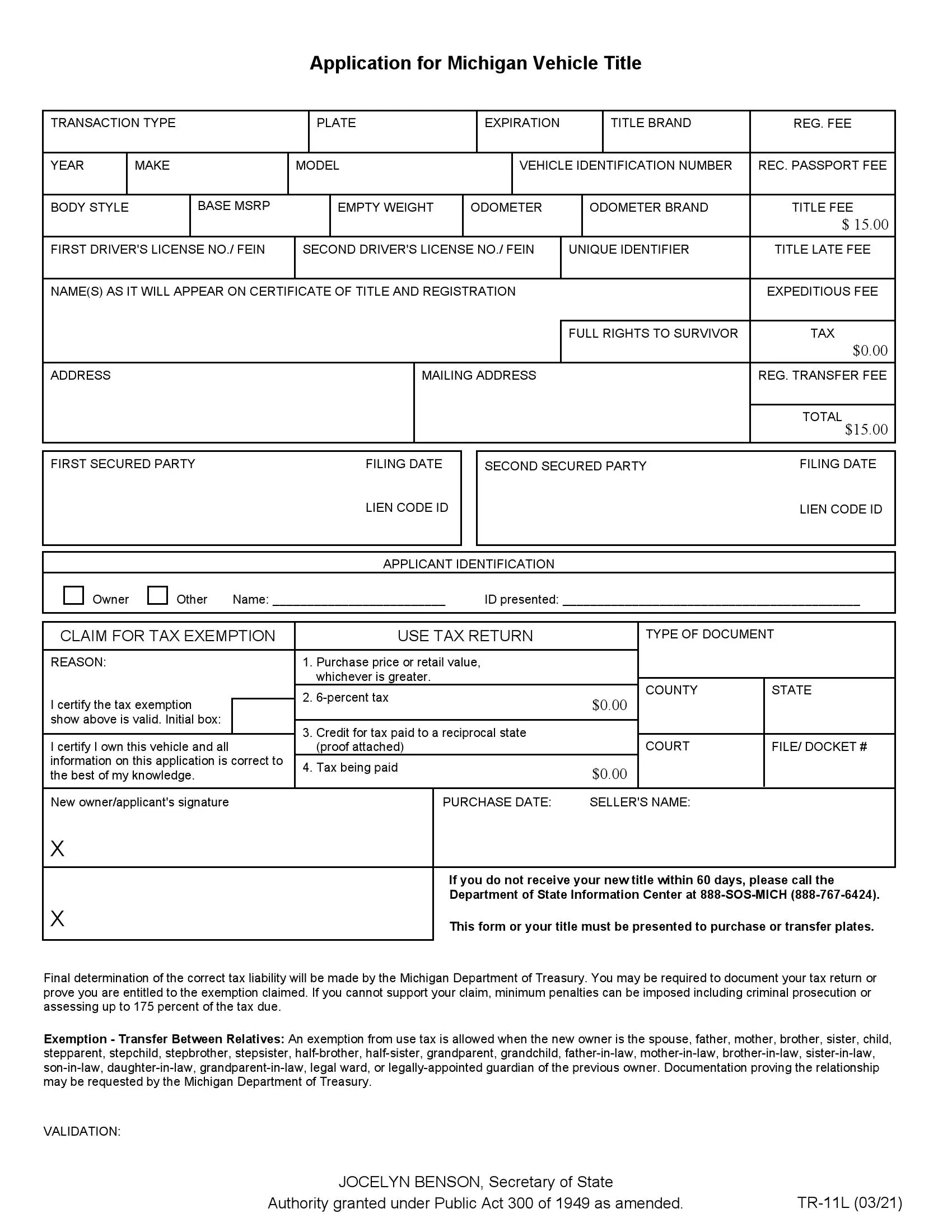

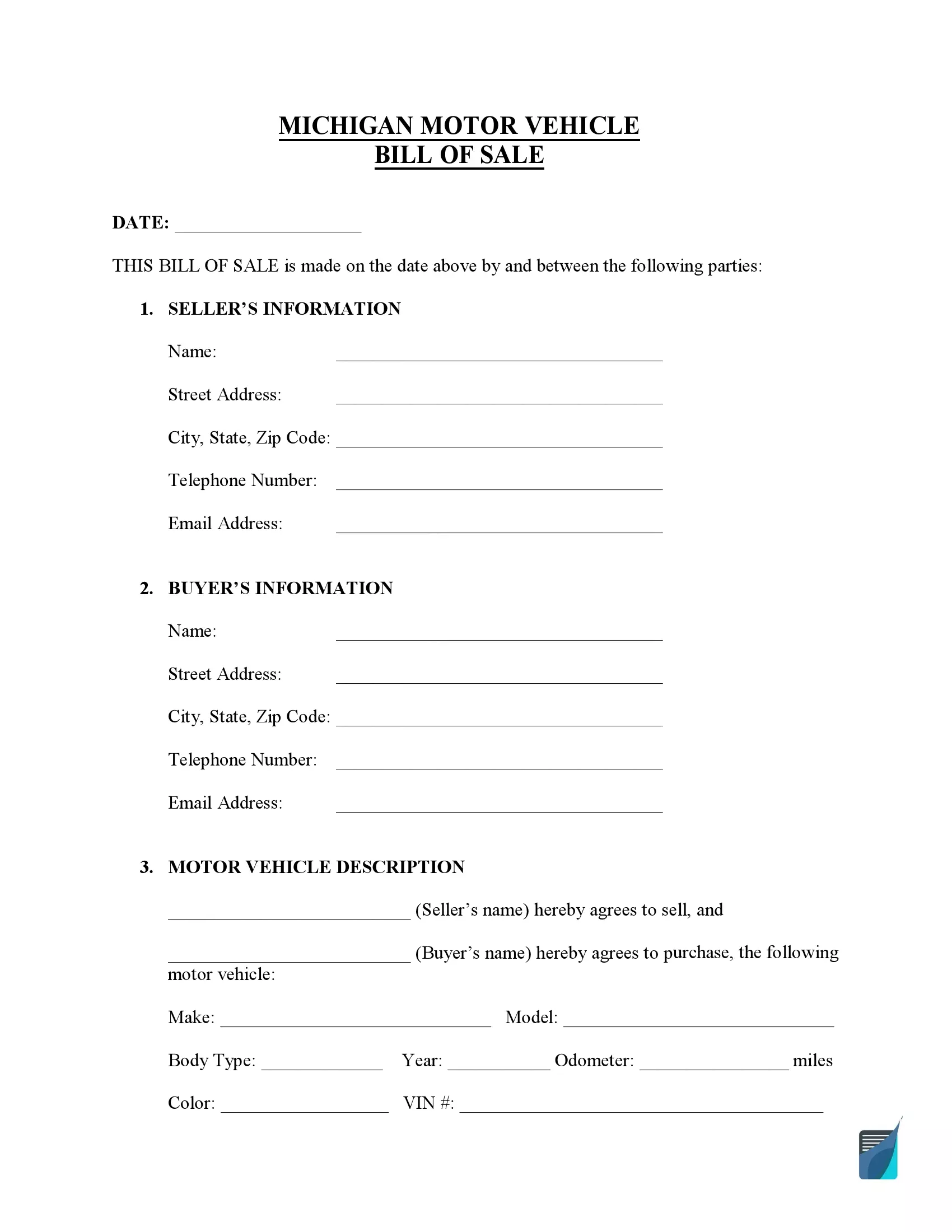

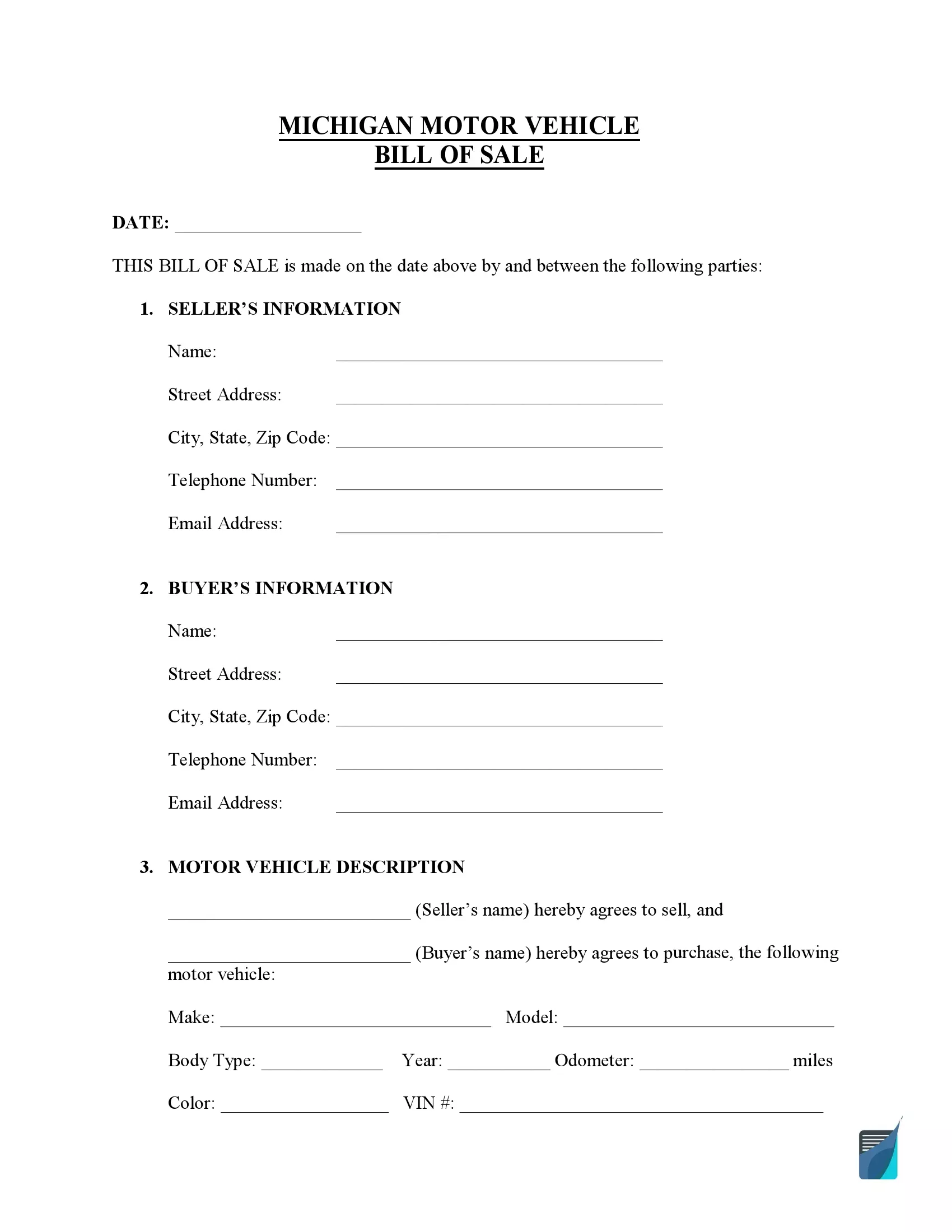

Michigan bill of sale for a motor vehicle records the transfer of vehicle ownership and is used to register a purchased motor vehicle in the local Department of Motor Vehicles (DMV). The bill of sale must contain the vehicle’s make, model, year, identification number (VIN), and latest mileage. You will have 15 days from the time of the private sale or when you transferred to Michigan to register your vehicle.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

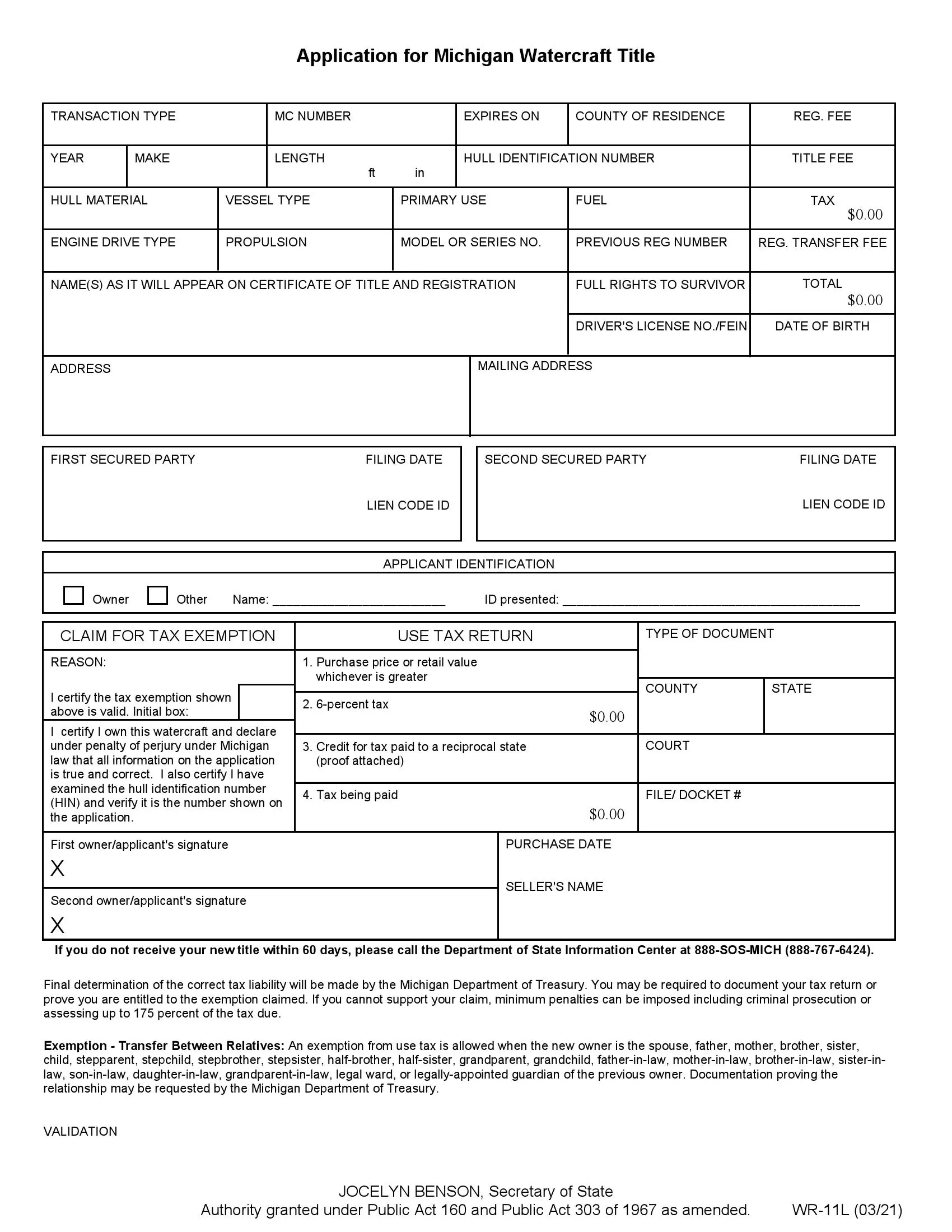

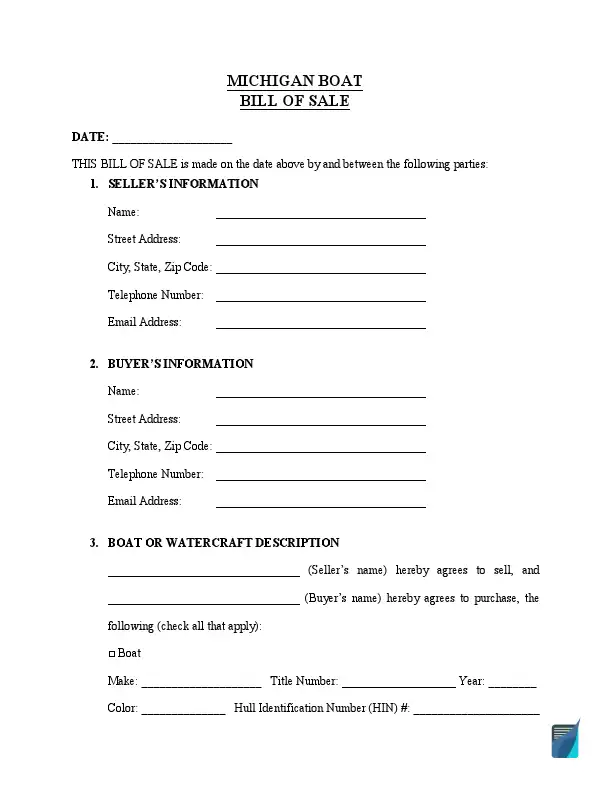

Michigan boat bill of sale proves the boat ownership transfer from a seller to a buyer. The document should include the Hull Identification Number (HIN) and other boat characteristics, such as make, model, year of manufacturing, and condition. To confirm that the identification number on the record matches the boat’s, you’ll be required to get a verification form for a serial number. Boat registrations in Michigan are generally legitimate for three years and expire on March 31 last year.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

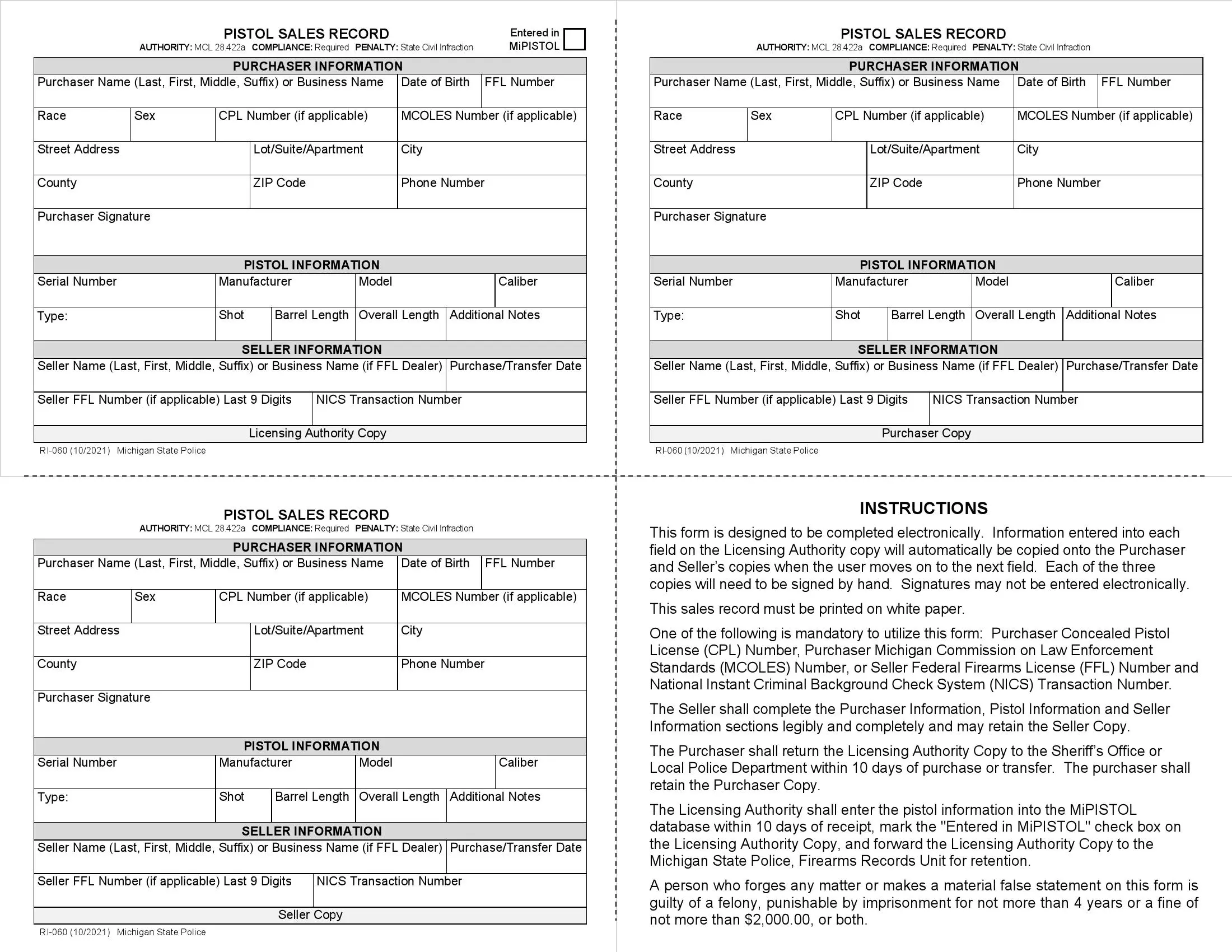

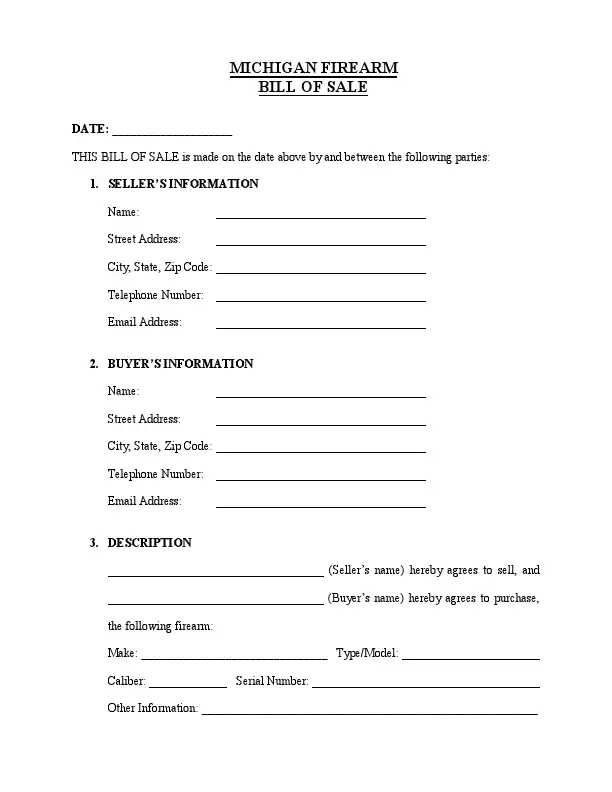

Michigan bill of sale for a firearm serves as a receipt when selling and buying a gun. The document must contain such transaction details as the firearm’s model, make, and caliber. You’ll also have to identify the serial numbers of a gun, the price, and the parties’ contact information. There isn’t a special law that demands guns to be registered, and Michigan has no firearms state registry. However, to purchase a gun, a buyer must obtain a purchase permit. A previous owner, in their turn, is required to keep records of all firearms sales and report them to law enforcement.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

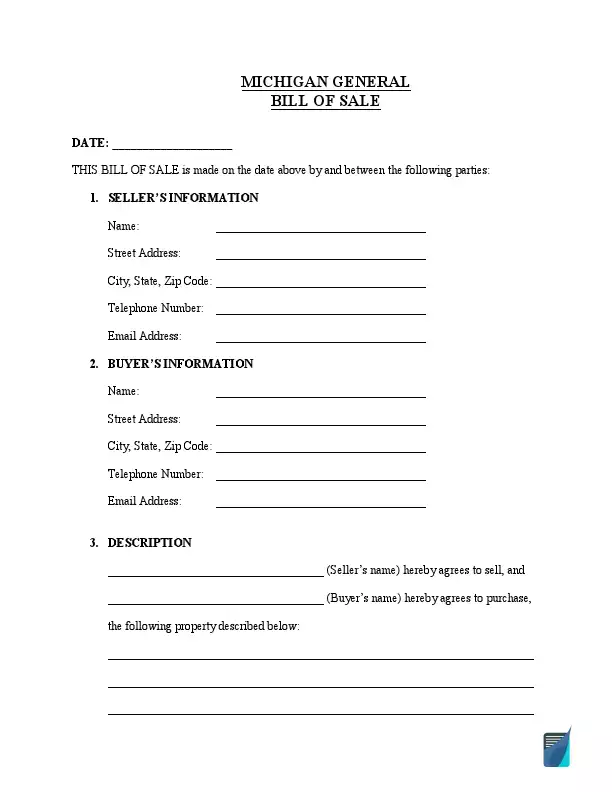

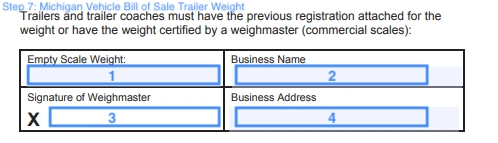

Michigan general bill of sale is designed to record any private transaction and serves as an extra security layer for sellers and buyers. As a rule, it’s used for large property transfers, including vehicle accessories, livestock track or equipment, machinery, and tools.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

How to Write a MI Vehicle Bill of Sale

A Michigan vehicle bill of sale notes a legal change of ownership and is required to complete vehicle registration. Michigan requires this document to be signed by a notary public, so both parties must hold off on signatures until a notary can make it official.

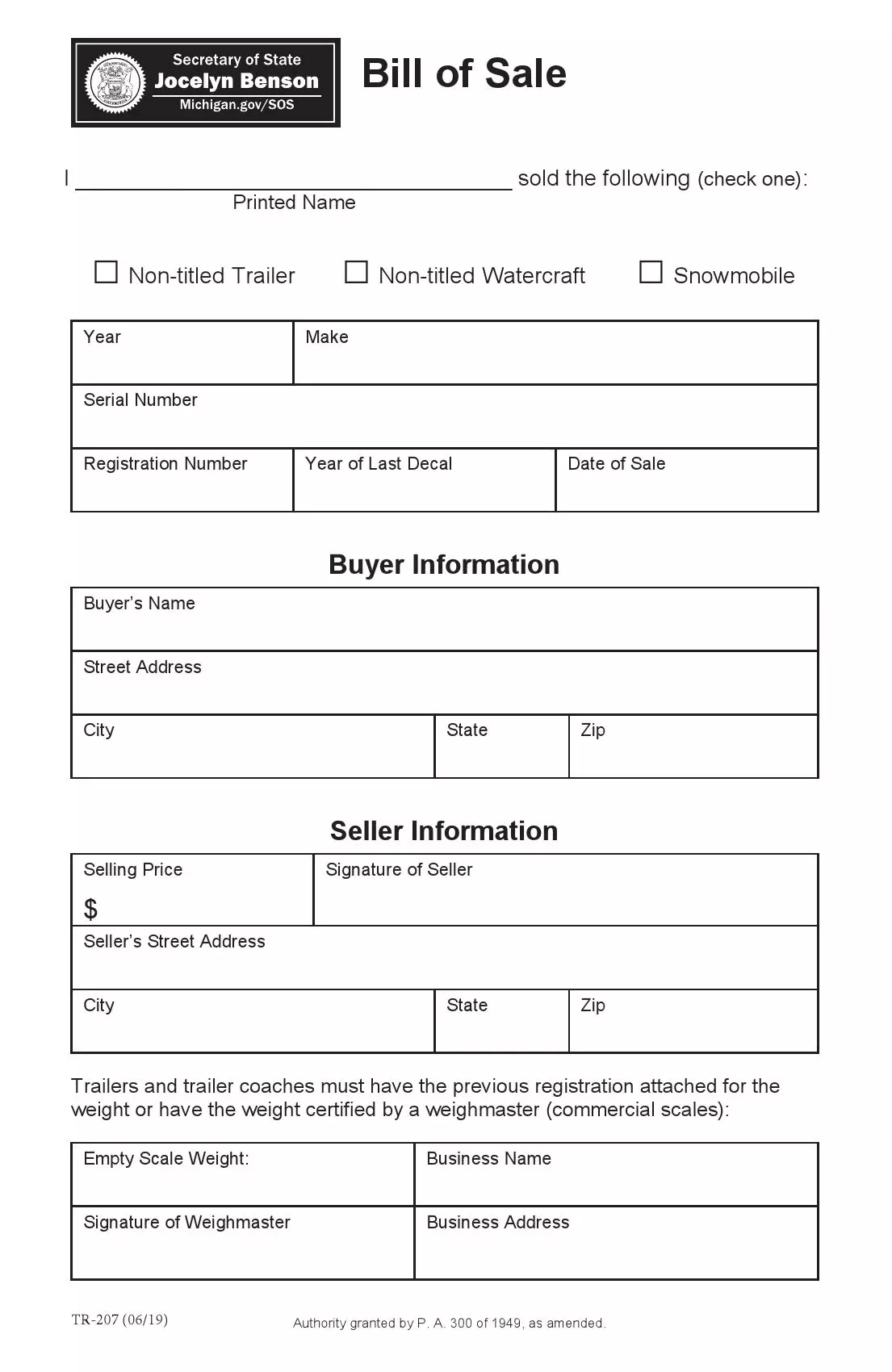

Michigan motor vehicle bill of sale recognized by the Michigan government covers all types of motor vehicles, including trailers, watercraft, and snowmobiles. This TR-207 form is needed when the seller transfers the title to the buyer in exchange for money. If you want to buy or sell a motor vehicle in Michigan, use this form. If you hesitate to fill out this form correctly, follow these easy steps.

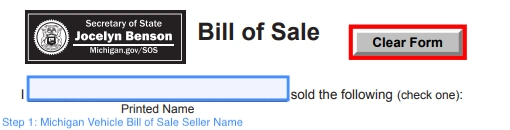

Step 1.

The document is filed on behalf of the seller. So, first of all, you need to provide the seller’s name in capital letters.

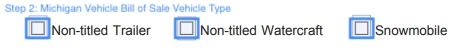

Step 2.

The next step is to clarify the type of the motor vehicle being sold. Check the box of the corresponding item you’re selling—trailer, watercraft, or snowmobile.

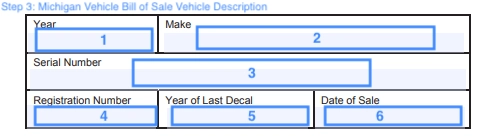

Step 3.

After that, you’re required to fill in all the pertinent information regarding the motor vehicle. The must-to-include details are:

- Year

- Make

- Serial number

- Registration number

- Year of Last Decal

- Sale Date

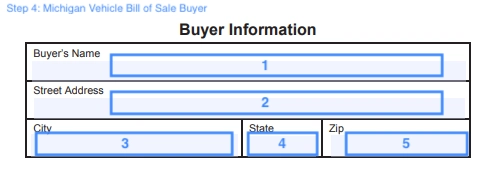

Step 4.

It’s vital to provide the actual information about the buyer. Any errors will cause issues during the vessel or vehicle registration process. Be sure to include:

- Buyer’s name

- Street Address

- City, State, and Zip Code

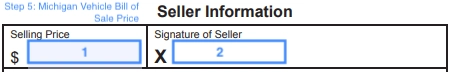

Step 5.

Clarify the selling price. It must be the total price the seller and purchaser agreed on for the vessel transaction. Also, the seller’s signature is required to affirm that the price and seller information is correct.

Step 6.

After that, the seller must provide their contact details, including street address, city, state, and zip code.

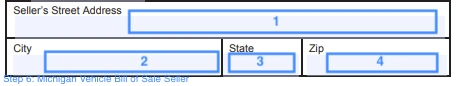

Step 7.

Lastly, for the transfer of the trailer, it is required to attach the previous registration certified by a weighmaster that indicates the scale weight of the trailer.

Registering a Vehicle in Michigan

All vehicles in Michigan must be registered for their new owners to operate them on the highways and roads of the state legally. Registration certifies that it is legally operable and insured in Michigan. Because there are details needed from both the buyer and seller, it is highly recommended that both parties present themselves at the time of registration if possible. Included in the list of documents that buyers will need to complete the purchase are:

- Motor vehicle title including signatures of all parties notarized

- A completed vehicle bill of sale template with motor vehicle-related, buyer, and seller details

- Vehicle Identification Number (VIN)

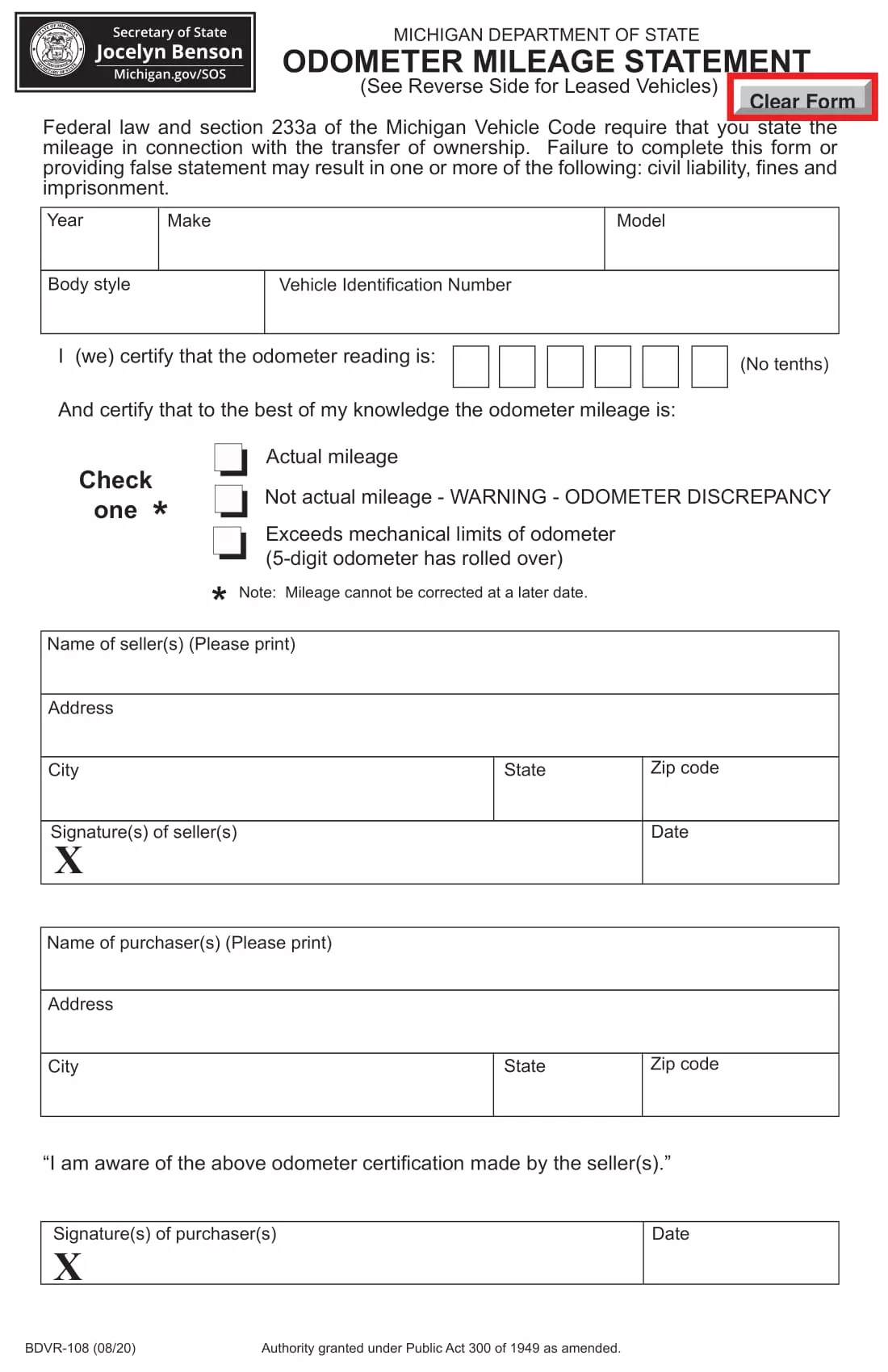

- Odometer reading and official Odometer Disclosure Statement (Form BVDR-108)

- Proof of insurance (no-fault coverage in the state of Michigan)

- Payment of all title and registration fees and taxes at the time of purchase

Motor vehicle registration fees are $8 and title fees are $15. New owners must also pay a $5 mandatory fee for a standard set of license plates. As far as recreational motor vehicles are concerned, snowmobiles come with a fee of $30 for registration, which is valid for three years, and mopeds are charged $15 for a three-year registration. Trailers and coaches that have a weight higher than 10,000 pounds cost $300 at the time of registration and are subject to renewals every year. As for taxes, Michigan has a state-wide tax of 6% on motor vehicles. This tax is calculated using the purchase price of the vehicle or the blue book value of the car at the time of purchase. The greater value is chosen for the calculation of tax deductions.

Relevant Official Forms

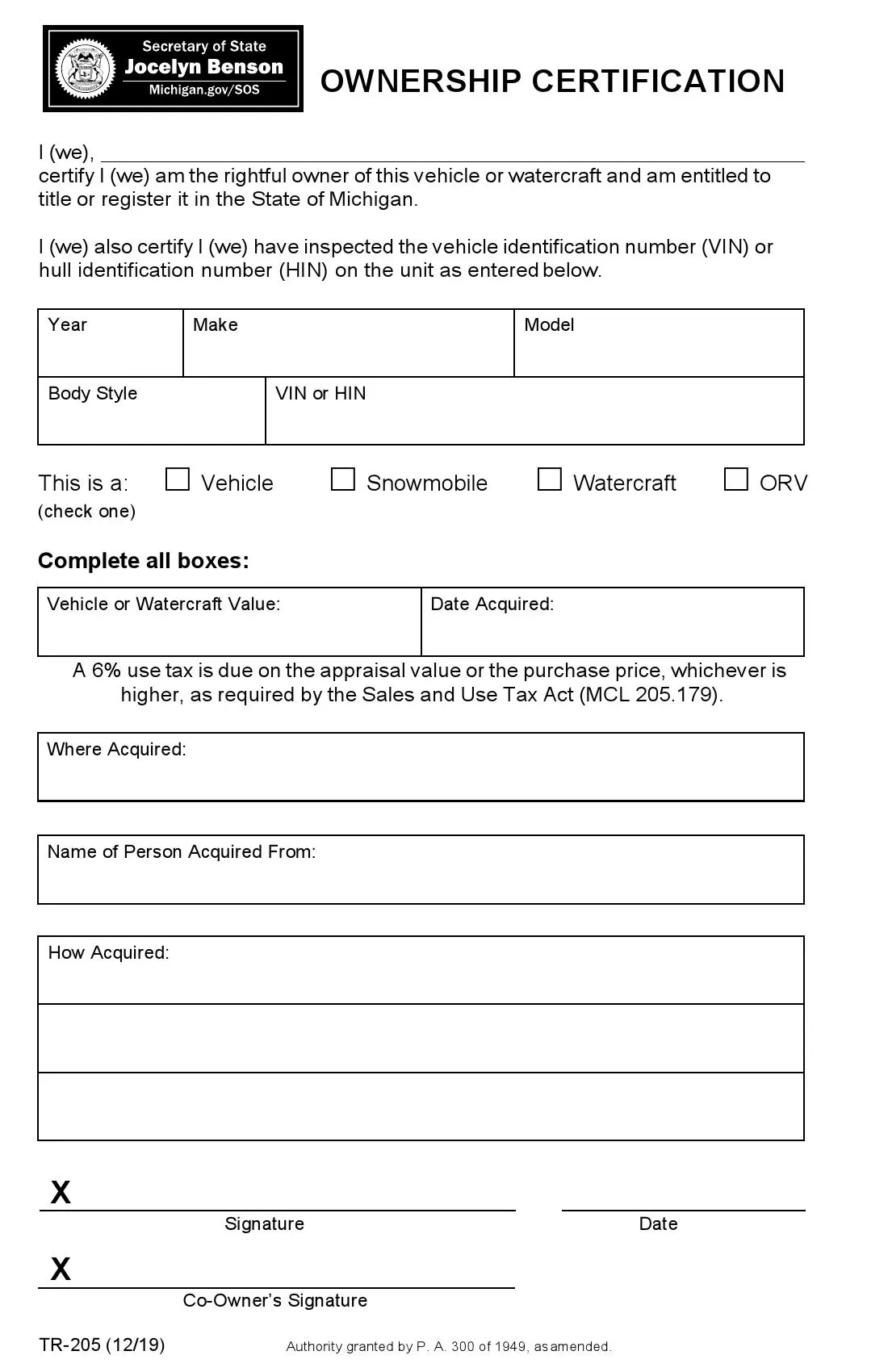

Used to prove the ownership of the vehicle or vessel when the title is lost, destroyed, or stolen.

It discloses the vehicle’s odometer reading and should be attached to your bill of sale.

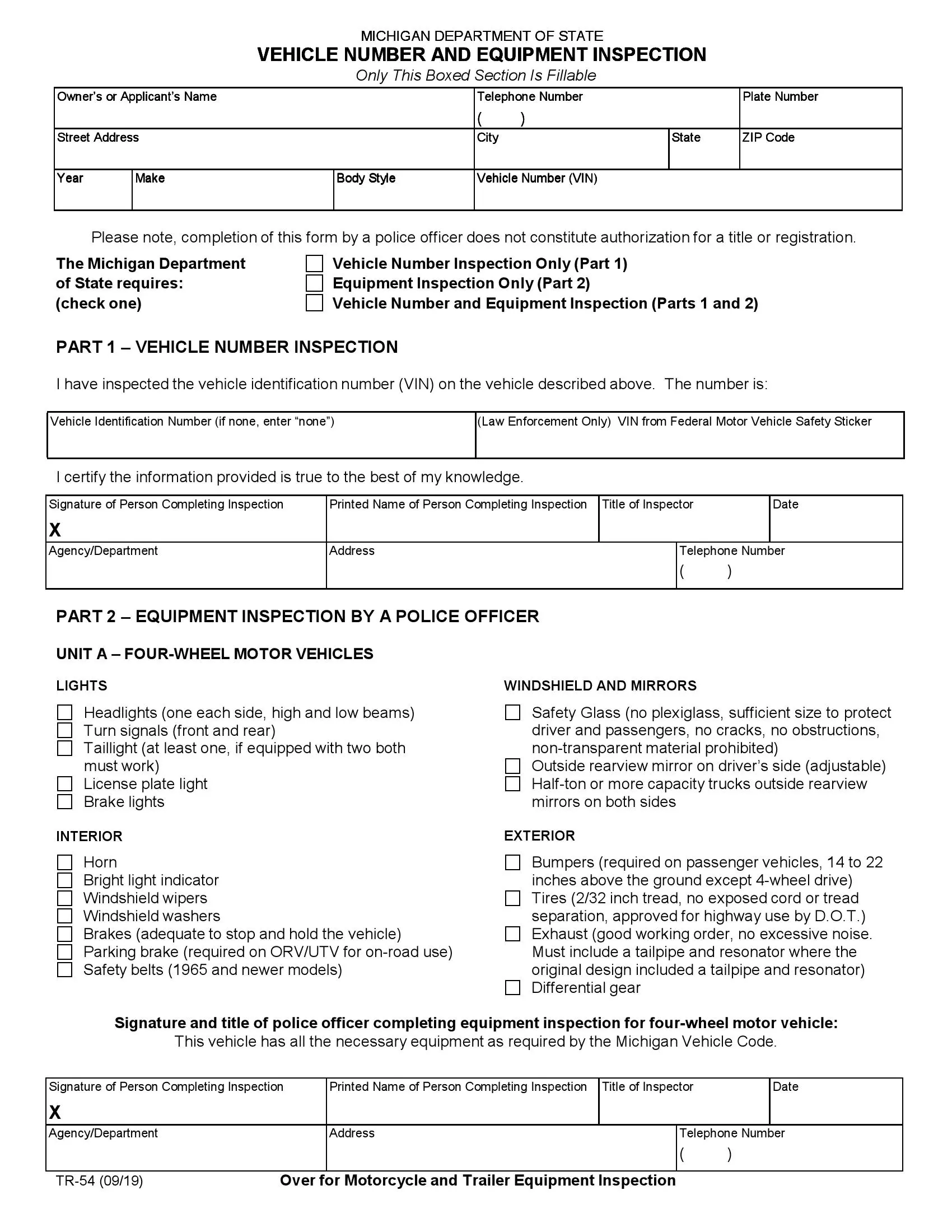

Used to inspect whether an assembled vehicle is eligible for titling.

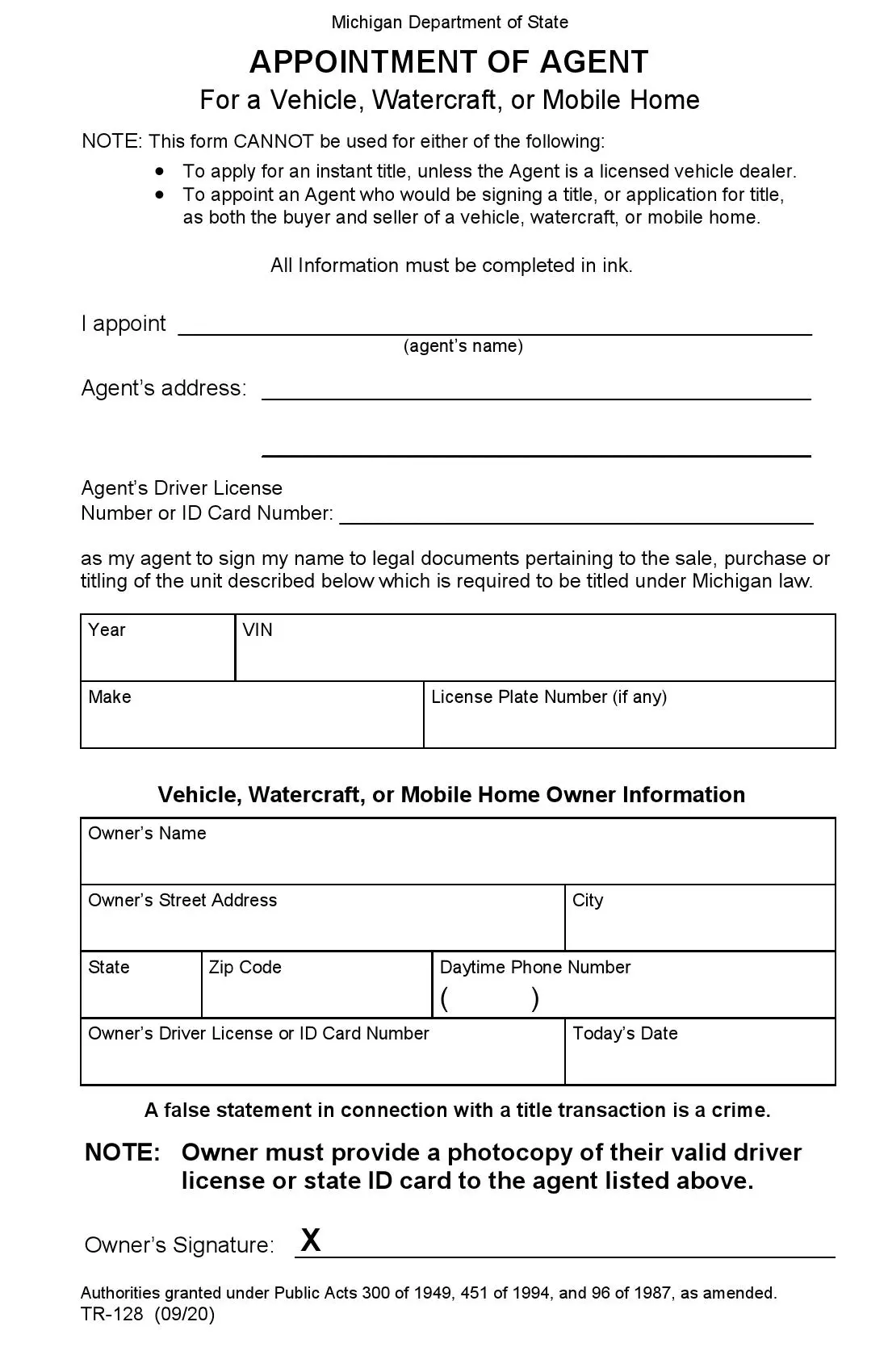

Use this form if you want to appoint another person to register your purchased vehicle.

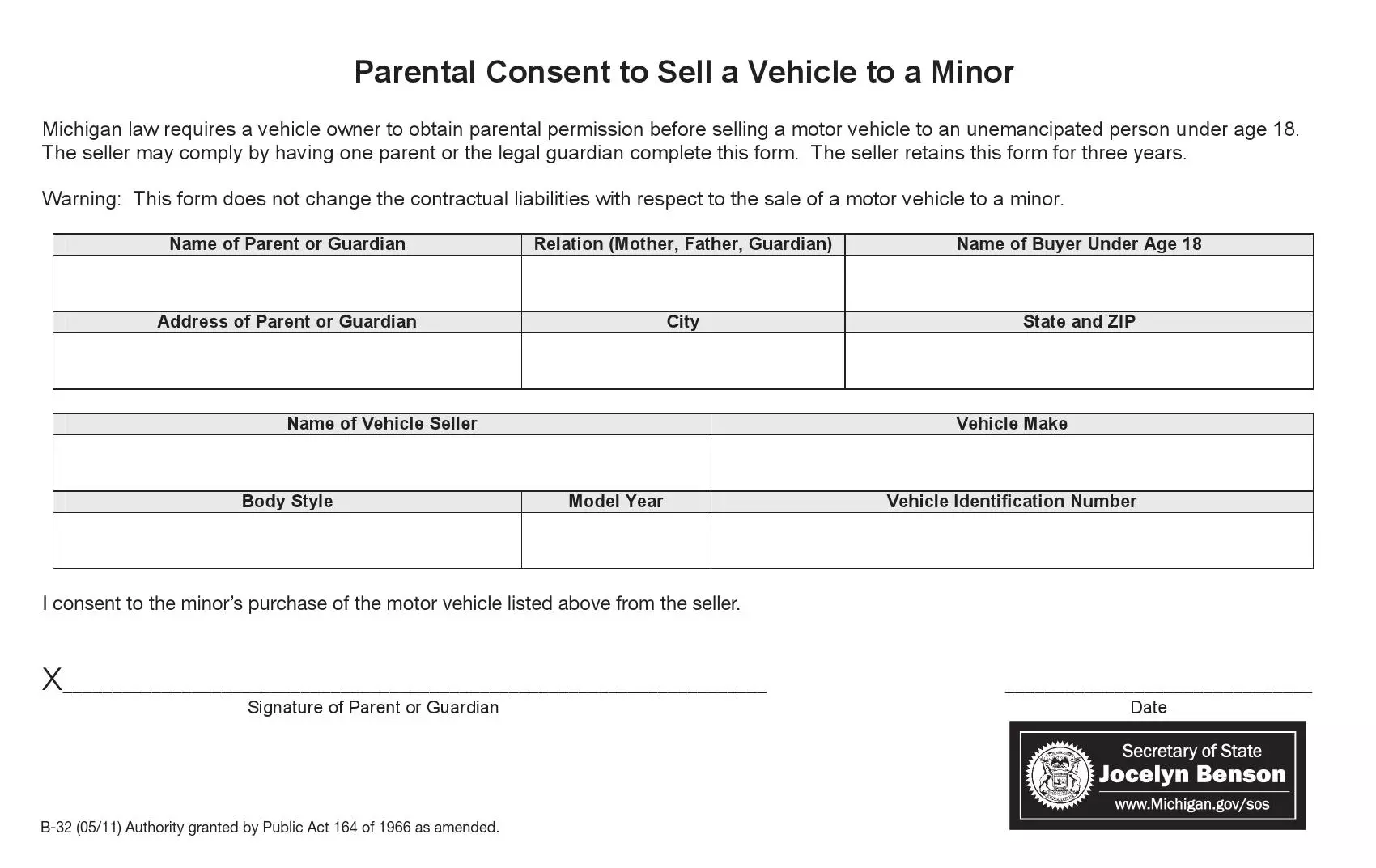

The seller must obtain parental permission to sell a vehicle to a minor.

Official Michigan bill of sale form.

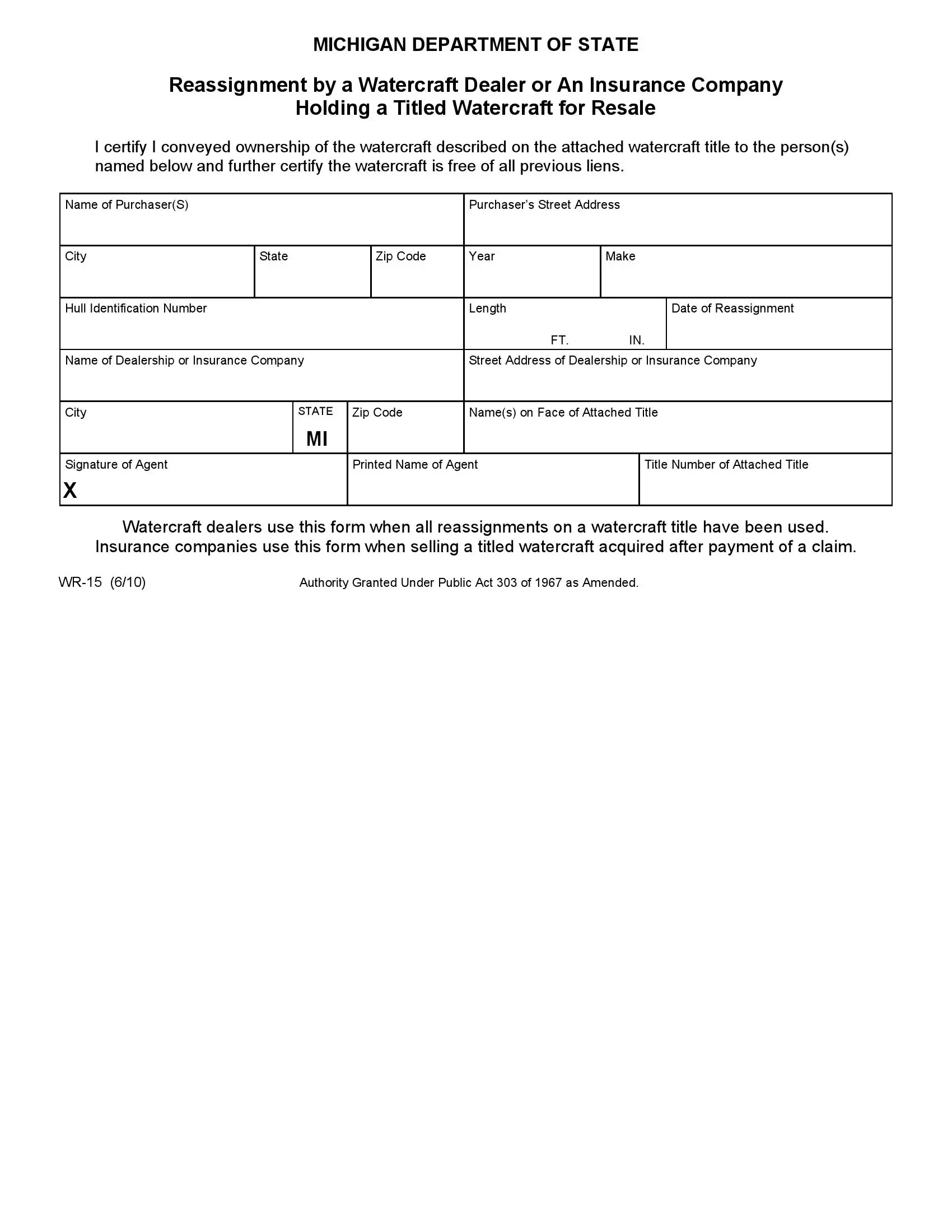

Used to certify that the watercraft ownership is transferred to the buyer and that the watercraft is free of all liens.

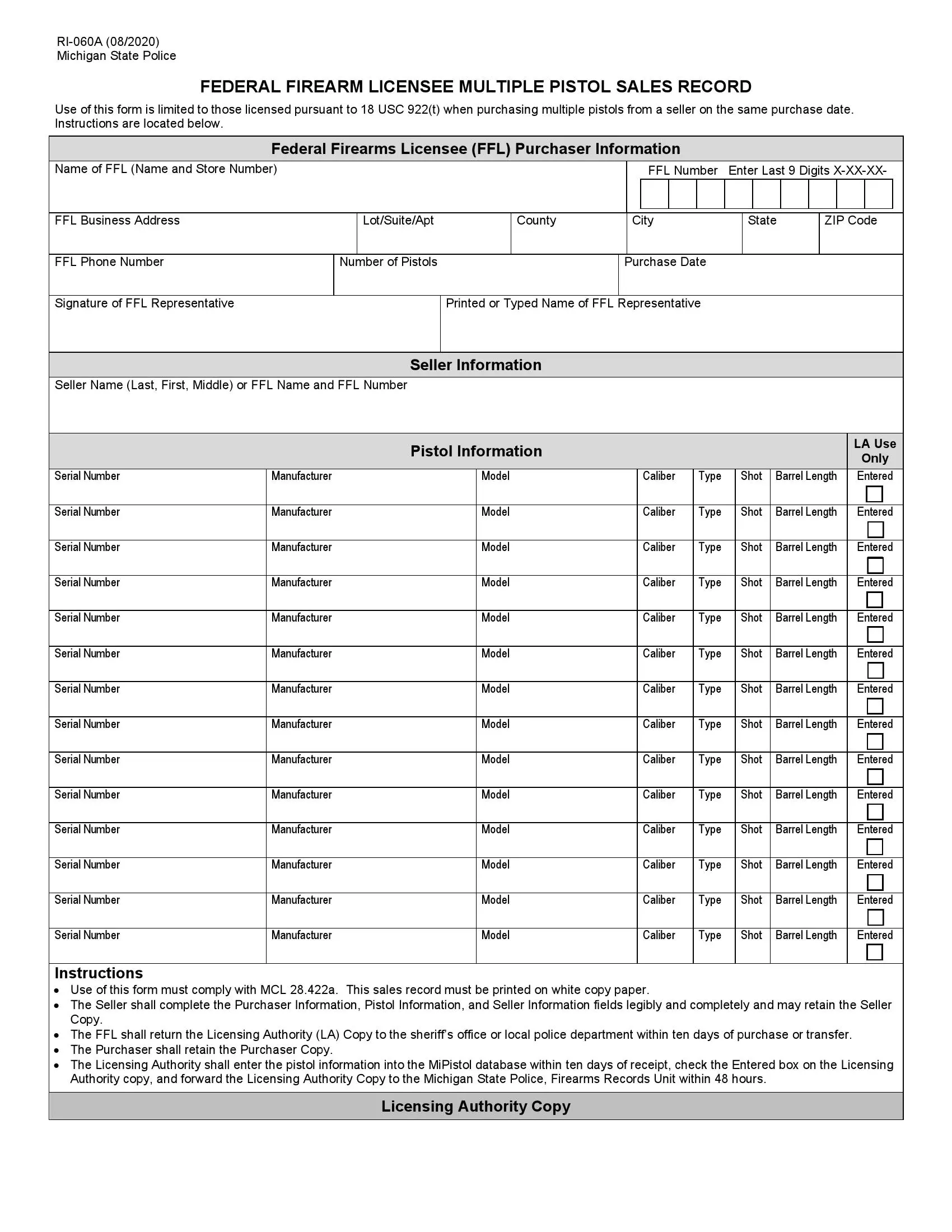

Used when one buyer purchases multiple firearms on the same purchase date.

Short Michigan Bill of Sale Video Guide

Other Bill of Sale Forms by State