New Jersey Bill of Sale Form

New Jersey bill of sale ensures that both a buyer and seller stay protected during a private transaction. The document is essential for vehicle, boat, and firearm registration.

Bill of sale forms might seem like pointless extra red tape to most people, but the truth is that they’re incredibly beneficial to buyers and sellers, as they keep you away from any legal complications from the transaction.

Here, you will find our free printable form to download and use to guarantee your bill of sale is valid in New Jersey. We’ve also prepared all the essential details, guidelines, and templates that may be relevant to your situation.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | New Jersey Vehicle Bill of Sale Form |

| Other Names | New Jersey Car Bill of Sale, New Jersey Automobile Bill of Sale |

| DMV | New Jersey Motor Vehicle Commission |

| Vehicle Registration Fee | $35.50-84 |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 59 |

New Jersey Bill of Sale Forms by Type

Based on the conditions and types of transactions, various types of bills of sale exist. When carrying out a specific transaction, you must choose and use the appropriate bill of sale and record it according to your state requirements. You will also need to check your state laws and learn how to prepare and sign the document.

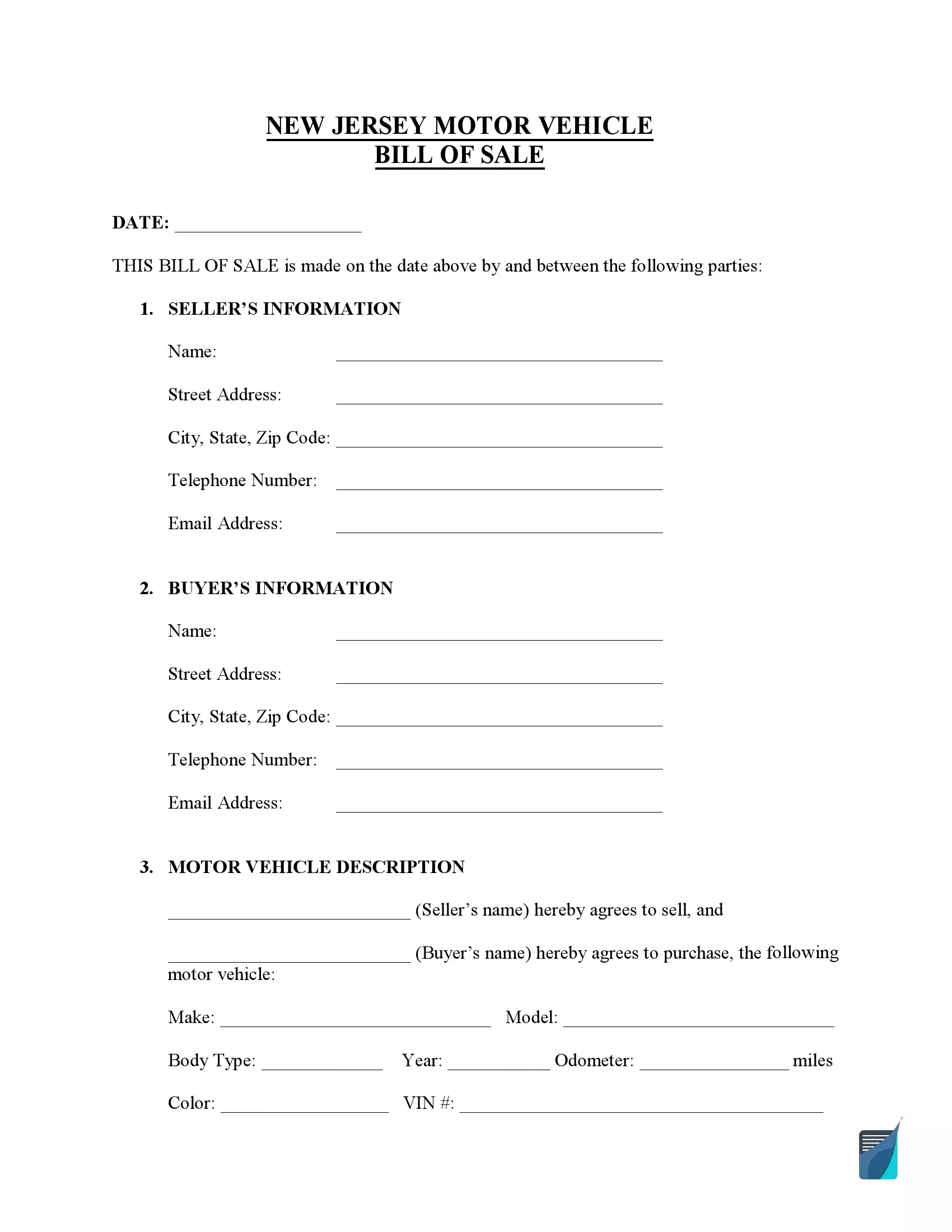

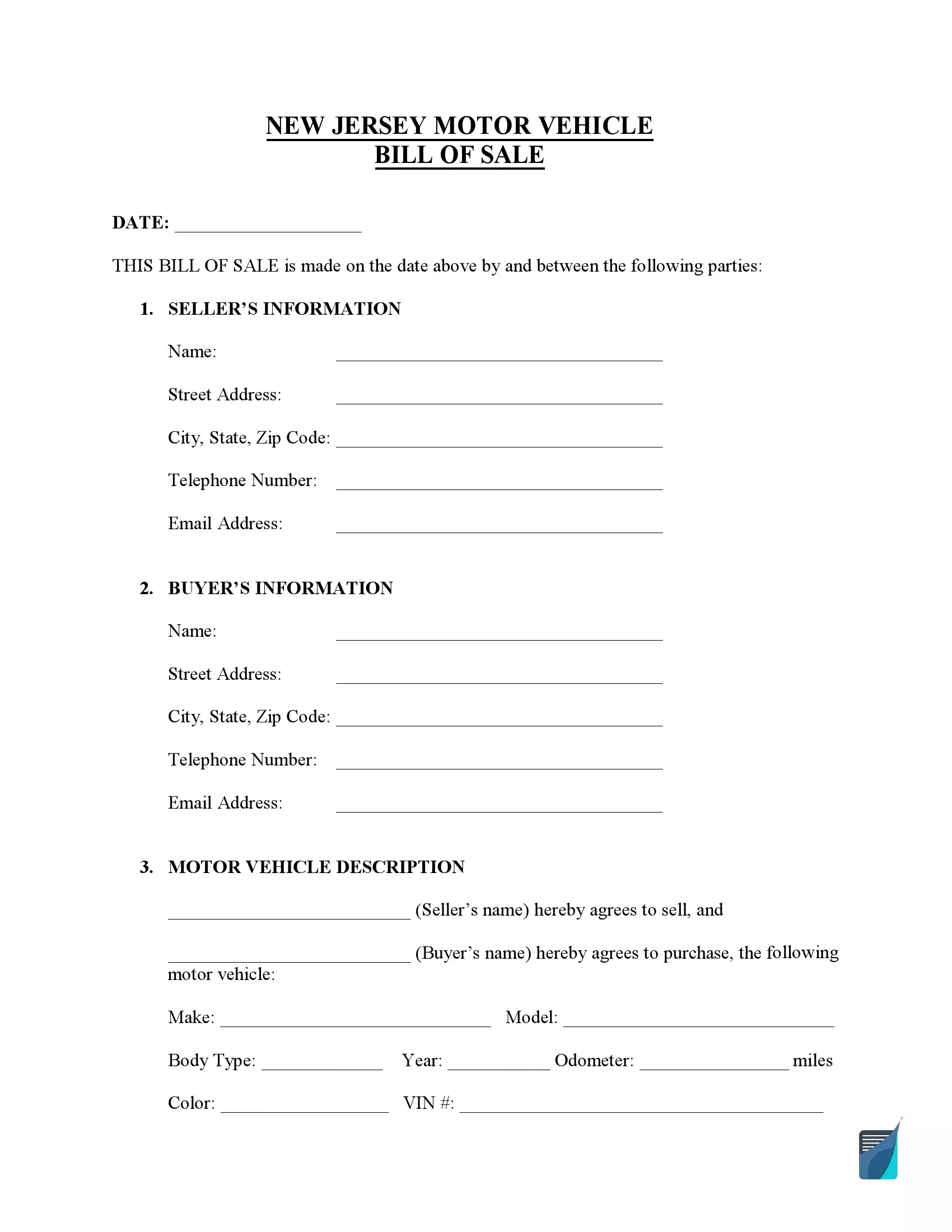

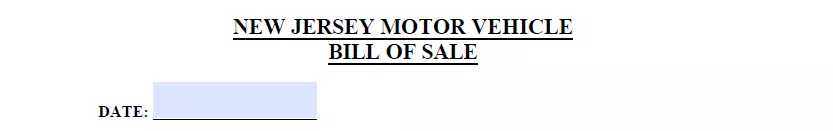

New Jersey motor vehicle bill of sale is one of the most widely-used documents to transfer ownership of a vehicle. For drafting a bill of sale for a motor vehicle, you must provide the make and model of your vehicle, its current registration plate, and mileage. To ensure that both the vendor and the buyer know the vehicle’s condition, the parties may have to examine the vehicle before completing the transaction.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

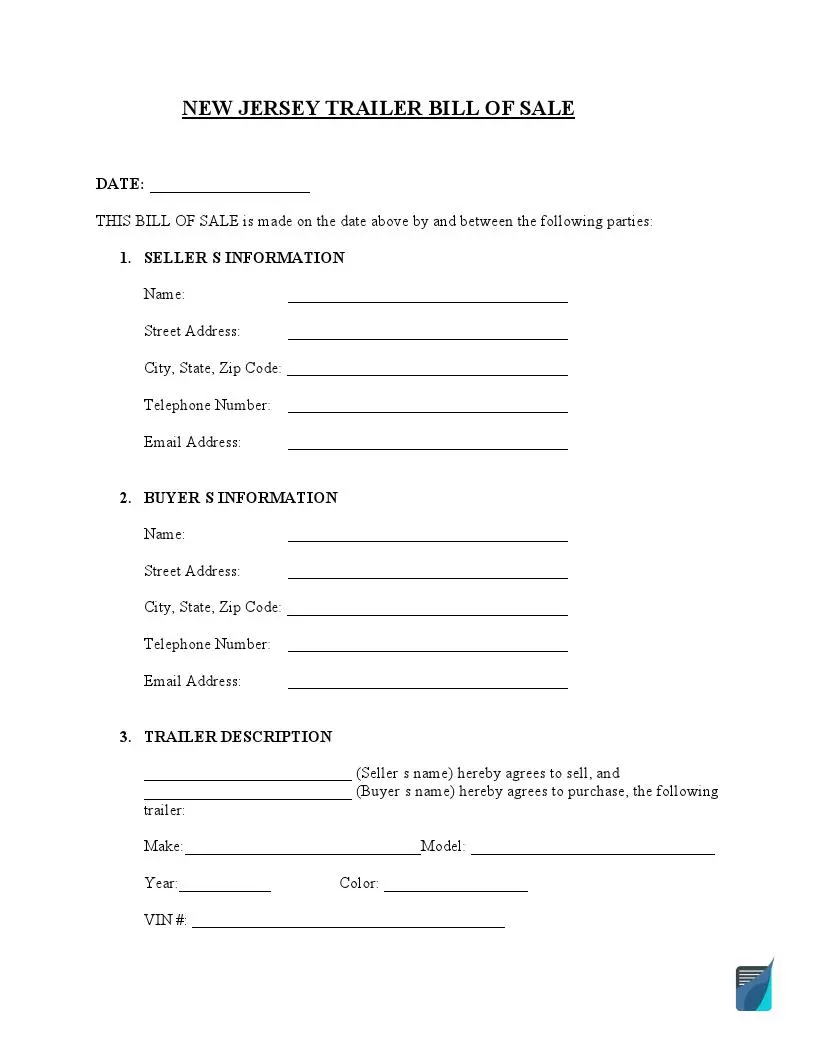

New Jersey trailer bill of sale documents the trailer ownership transfer. New Jersey law defines trailers as “other non-commercial motor vehicles” for registration purposes. Trailers that weigh 2,500 lbs. or less are only required to be registered. Trailers that exceed this weight are also required to be titled.

| Alternative Name | Utility Trailer Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

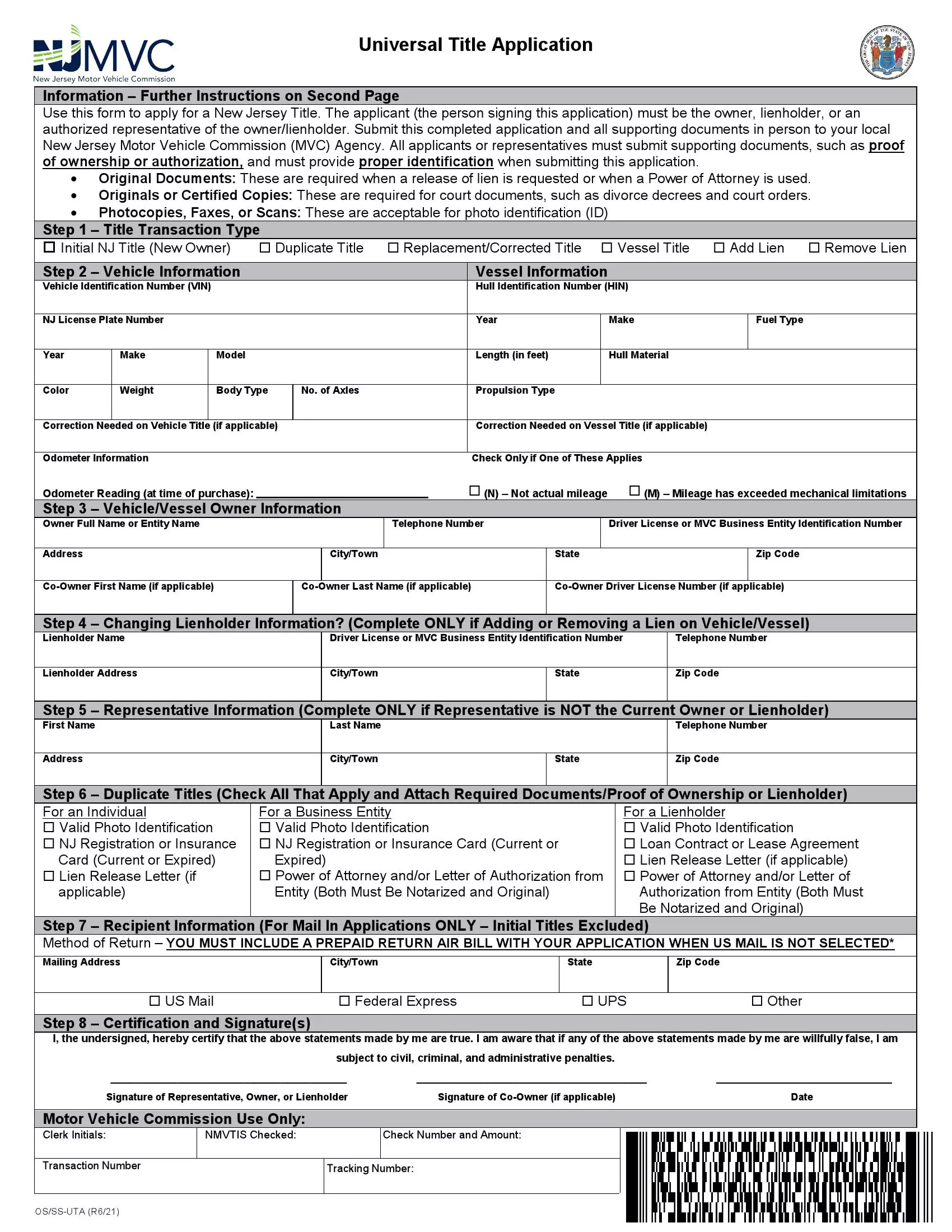

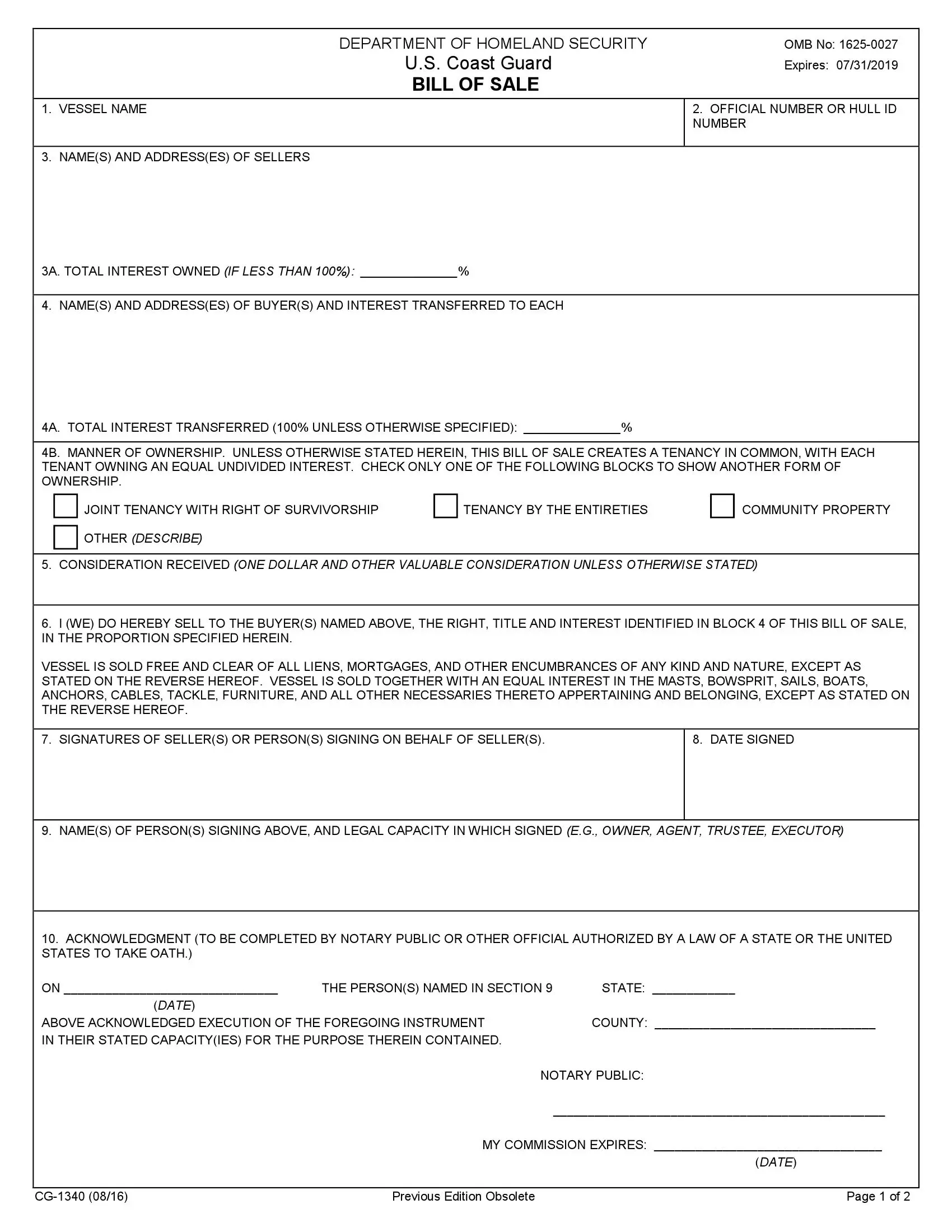

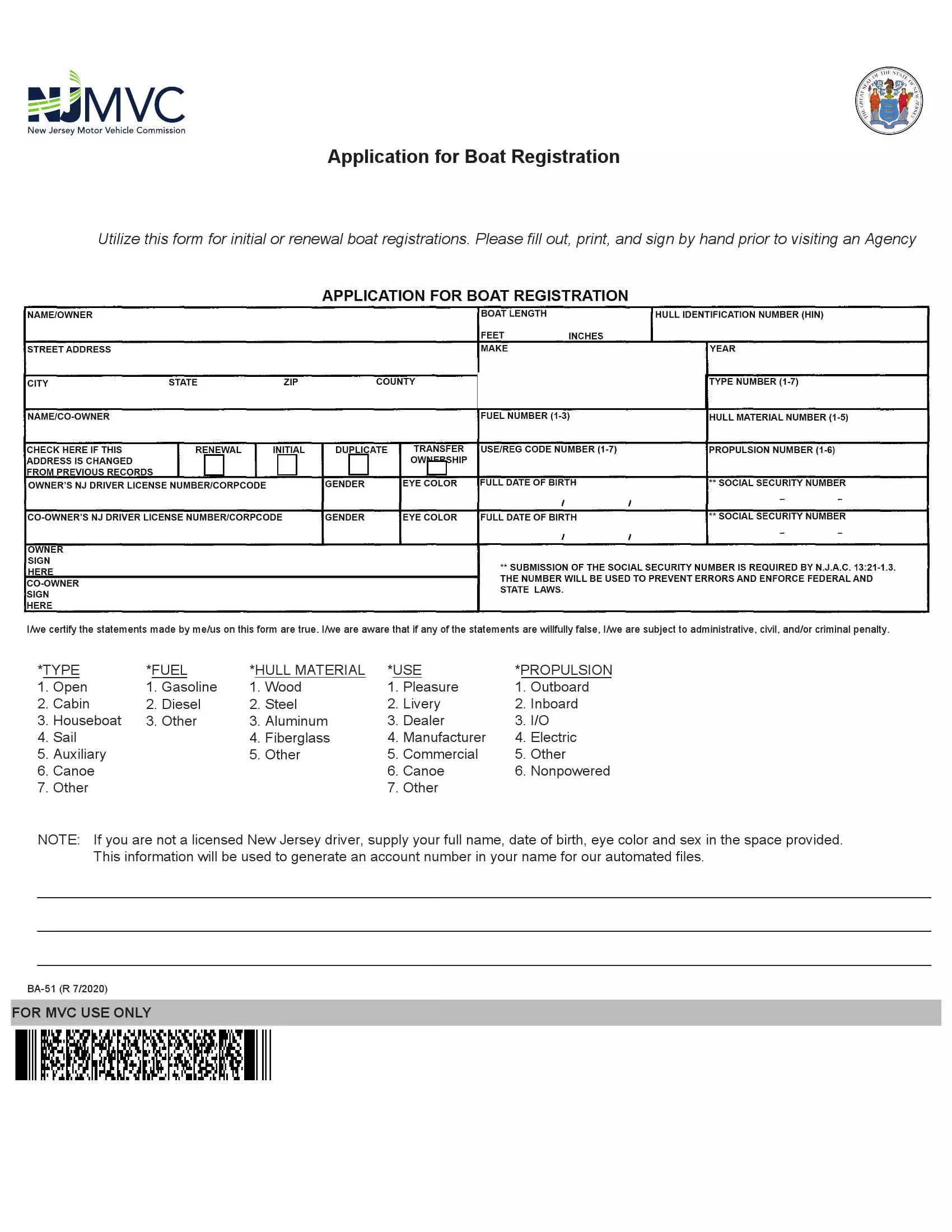

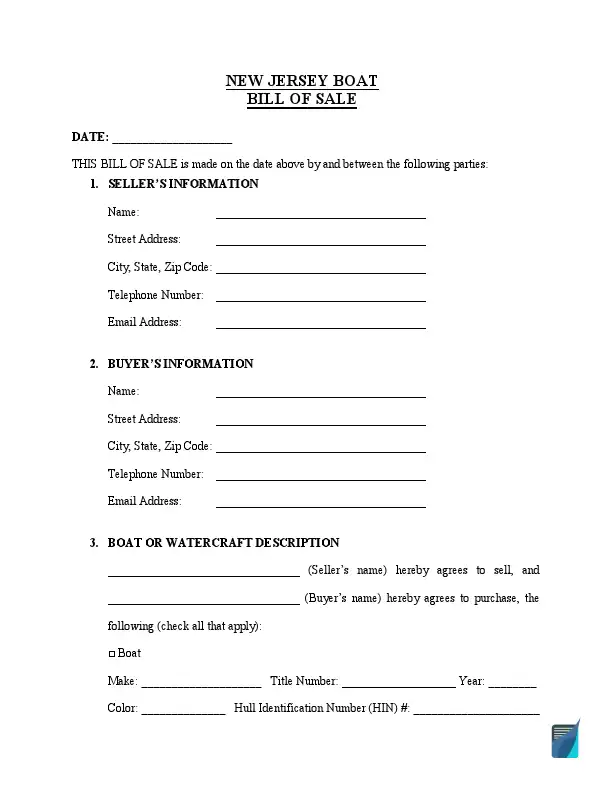

New Jersey boat bill of sale proves the boat ownership change between a seller and buyer. The documents must include all boat identification details, including the hull identification number (HIN), model, make, year of manufacture, and other essential elements associated with your boat.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Required |

| Download | PDF Template |

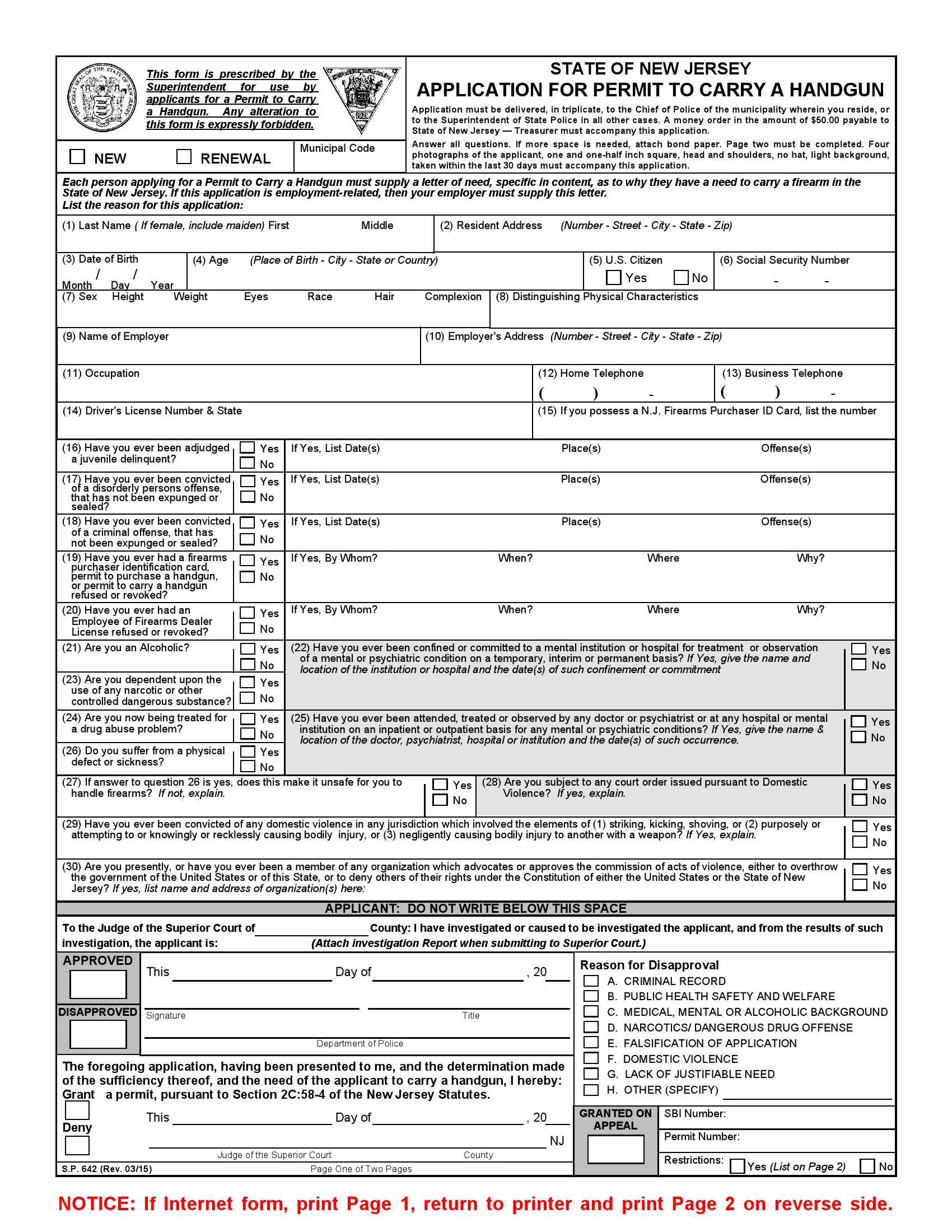

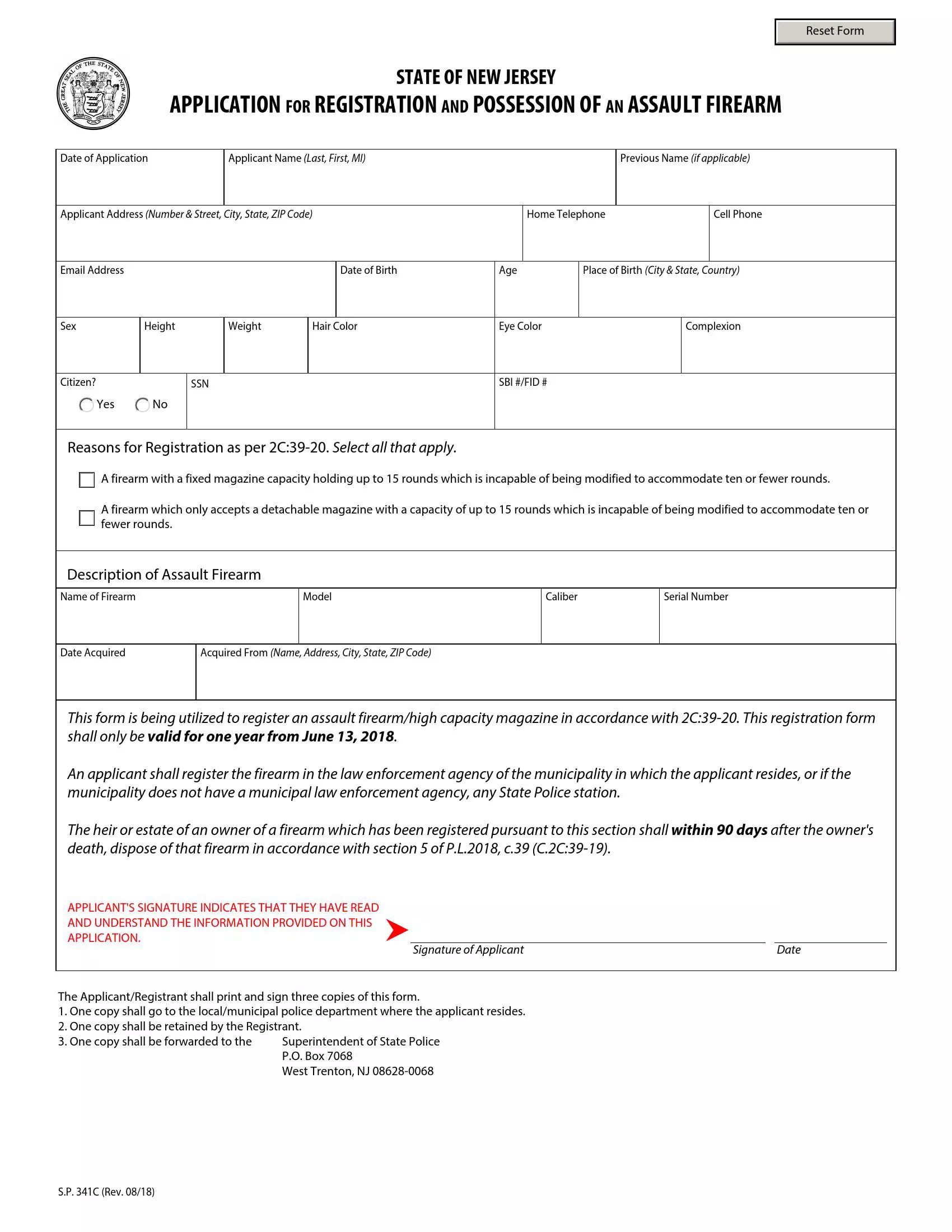

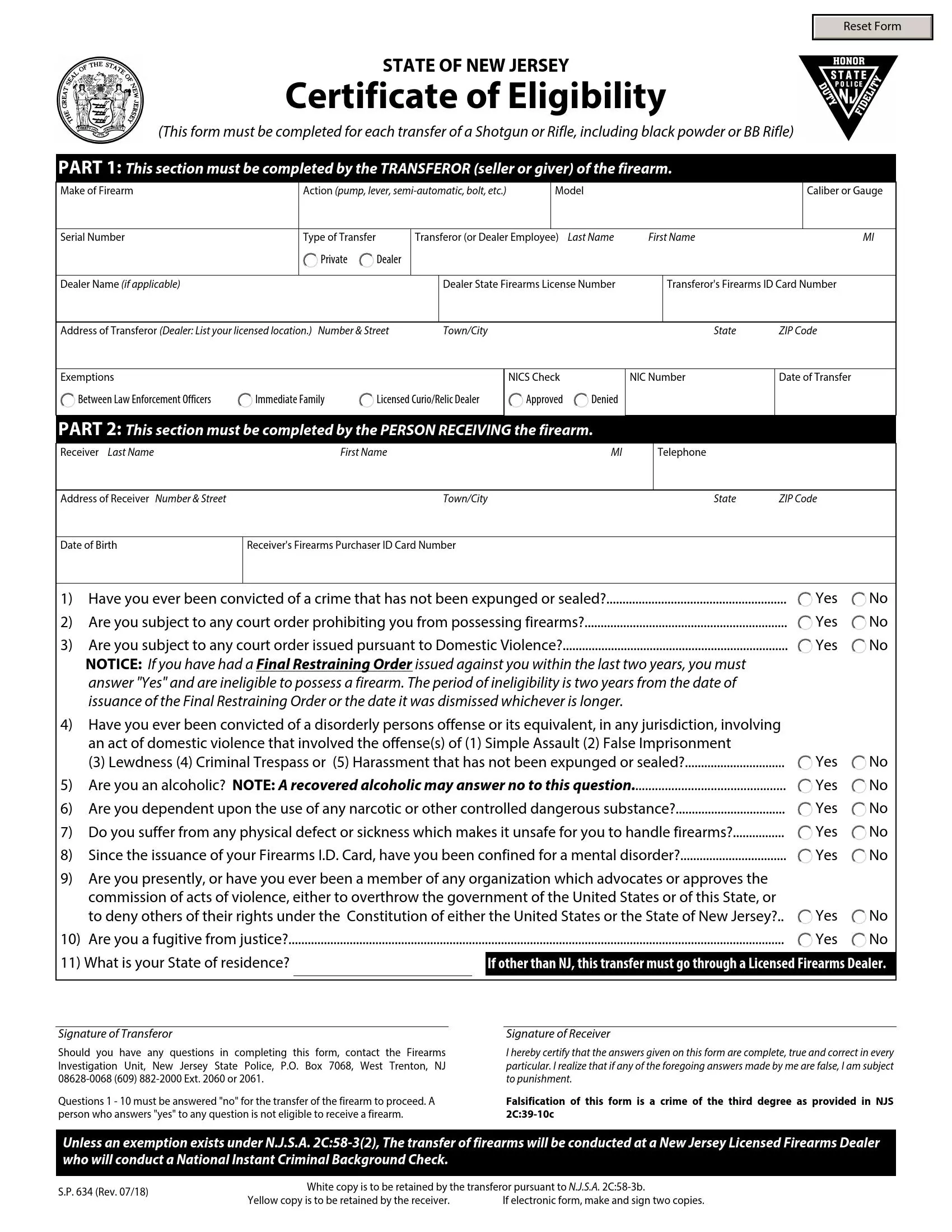

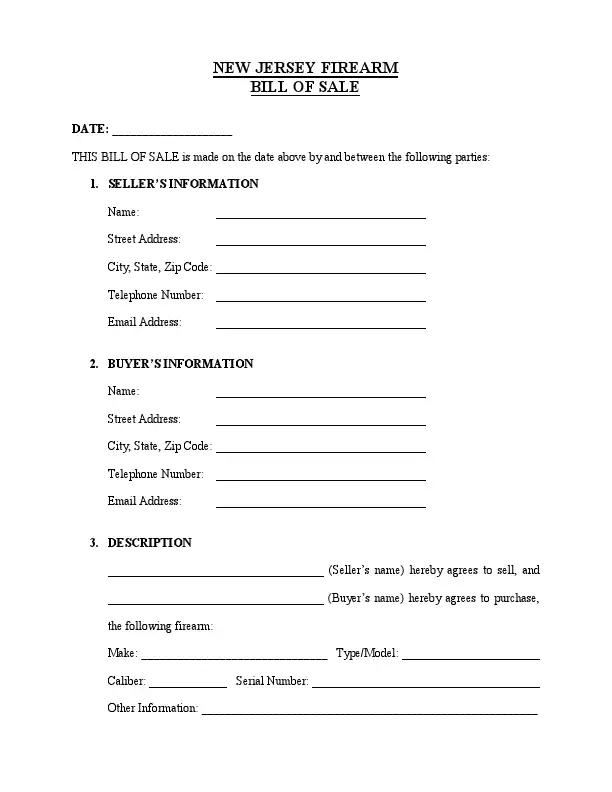

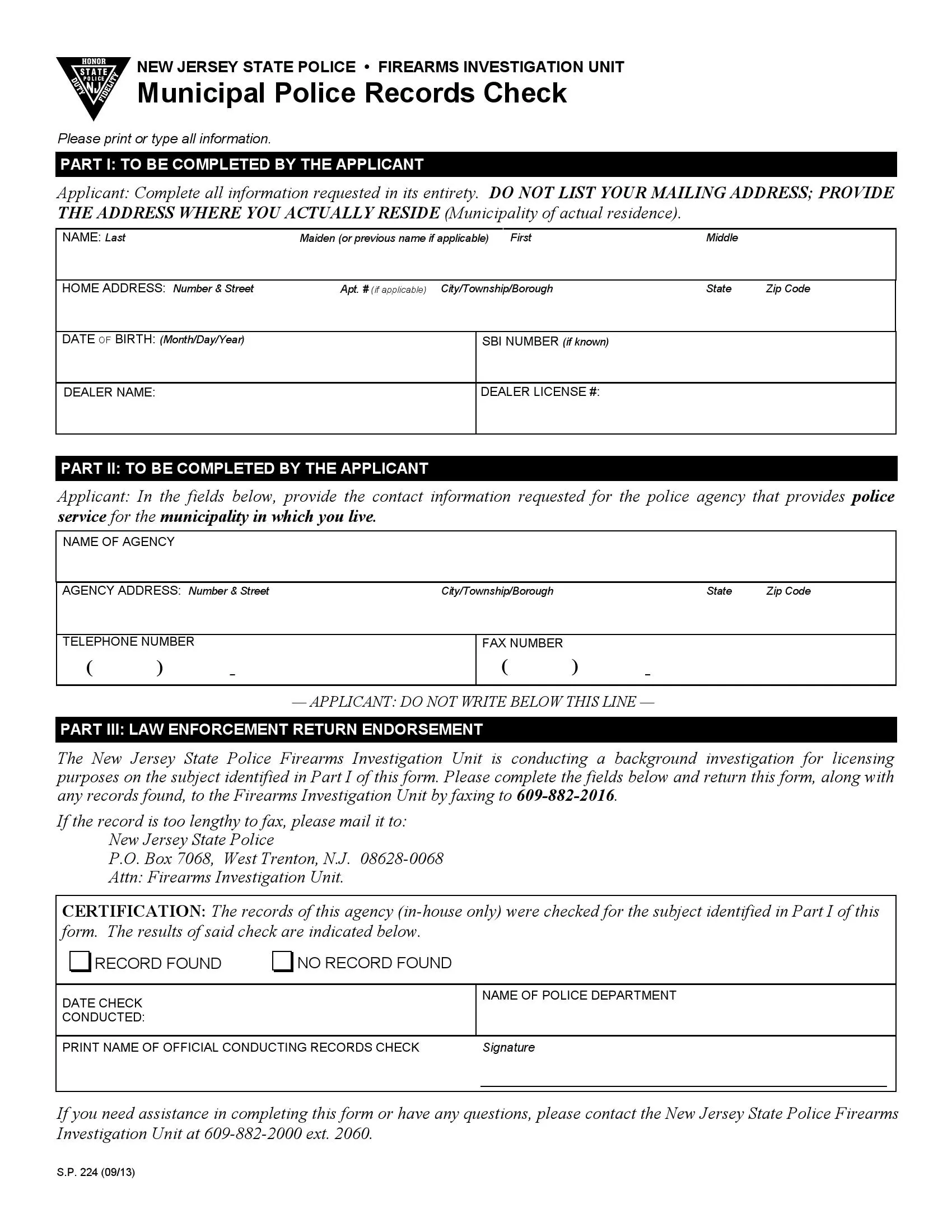

New Jersey bill of sale for a firearm is vital to indicate the terms of gun selling and purchasing. New Jersey law demands a background check to obtain a firearm purchase license. The bill of sale must specify all the essential details, such as your gun’s model, caliber, and make.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

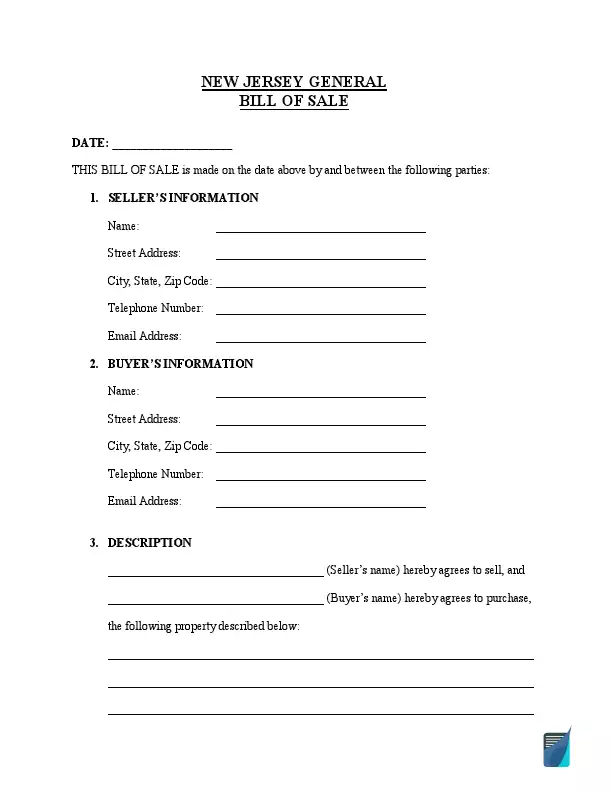

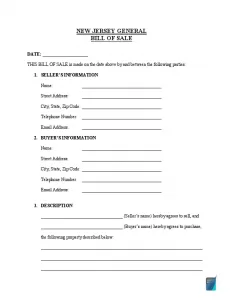

New Jersey general bill of sale provides additional protection for sellers and buyers. Considering that general bills of sale are less specific than other types of bills of sale, ensure that you are very clear in the details of the assets being for sale and the conditions of the purchase.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

How to Write a NJ Vehicle Bill of Sale

The guidelines below are related to our customizable bill of sale form. If your local authorities provide an official bill of sale, you can use their templates. Check the following steps to complete your document in minutes.

Step 1: Specify the document’s date

In the first section, you have to indicate the date when the document is signed.

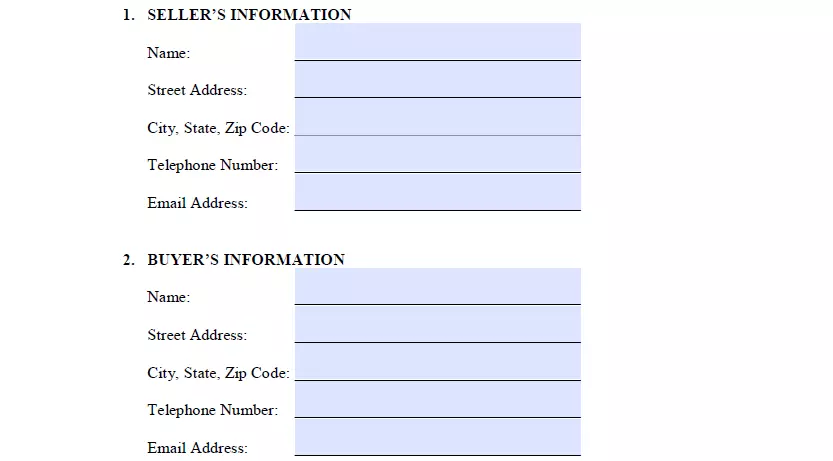

Step 2: Provide the parties’ details

The next step is to provide the specifics of each party, including the following:

- Full name

- Street address

- City

- State

- Zip code

- Phone number

- Email address

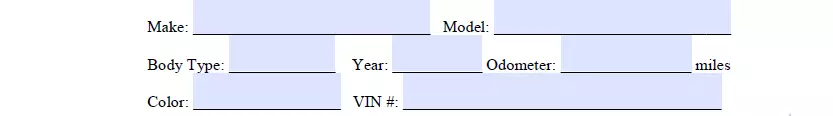

Step 3: Enter the vehicle description

Next, you will have to enter the descriptive particulars of the vehicle being sold. These particulars include:

- Manufacturer

- Vehicle’s model

- Body style

- Model year (MY)

- Odometer measurement

- Color

- Vehicle identification number (VIN)

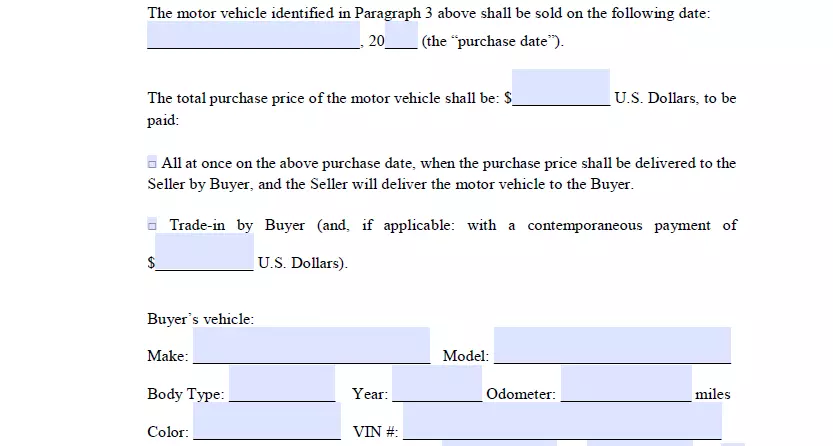

Step 4: Specify the transaction method and price

This part also requires providing the date of the purchase and the full amount approved by both sides of the transfer. As soon as that is handled, you need to specify the way of transaction:

- The entire amount straight away. The buyer gets the vehicle transported to them and pays off the whole sum within the same day.

- Trade-in. Using this option, the property owner agrees to trade their car for the buyer’s motor vehicle with an extra payment from the purchaser. The buyer’s motor vehicle details must also be in the bill of sale.

- Installment payments. With this method, you need to enter the dates when the purchaser must provide the first and the final payments, as well as their amounts.

After that, you will need to choose one transaction method:

- Cash

- Check

- Cashier’s cheque

- Money order

Lastly, check if the purchase amount contains all applicable taxes.

Step 5: Read the miscellaneous provisions

The “as-is” provision states that the seller gives no warranties and is not liable for maintenance after the transaction.

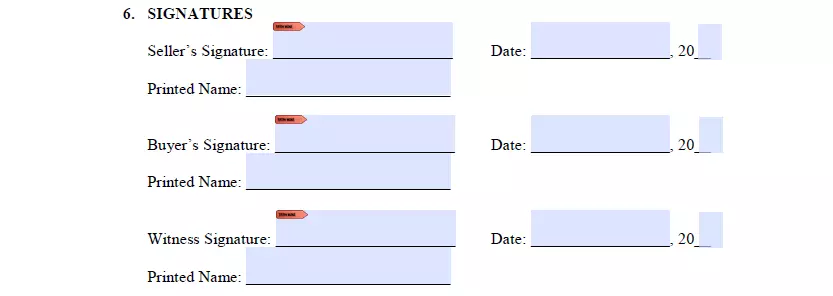

Step 6: Sign the document

The buyer’s signature is generally not required. Yet, you’re more protected from legal problems if both parties sign the form. To be safe, the parties could choose a person who will witness the deal and sign the bill of sale.

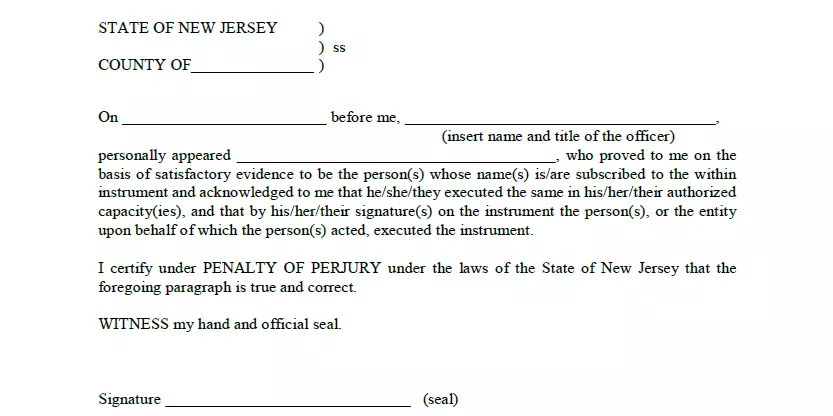

Step 7: Notarize the bill of sale

With this, you will have more legal protection. However, this step is usually optional.

The original document copy must be given to the buyer since they’ll require it to get a title to their newly bought car. As a seller, you can either get a copy and store it or have a pair of identical documents signed and filled out by both parties.

Registering a Vehicle in New Jersey

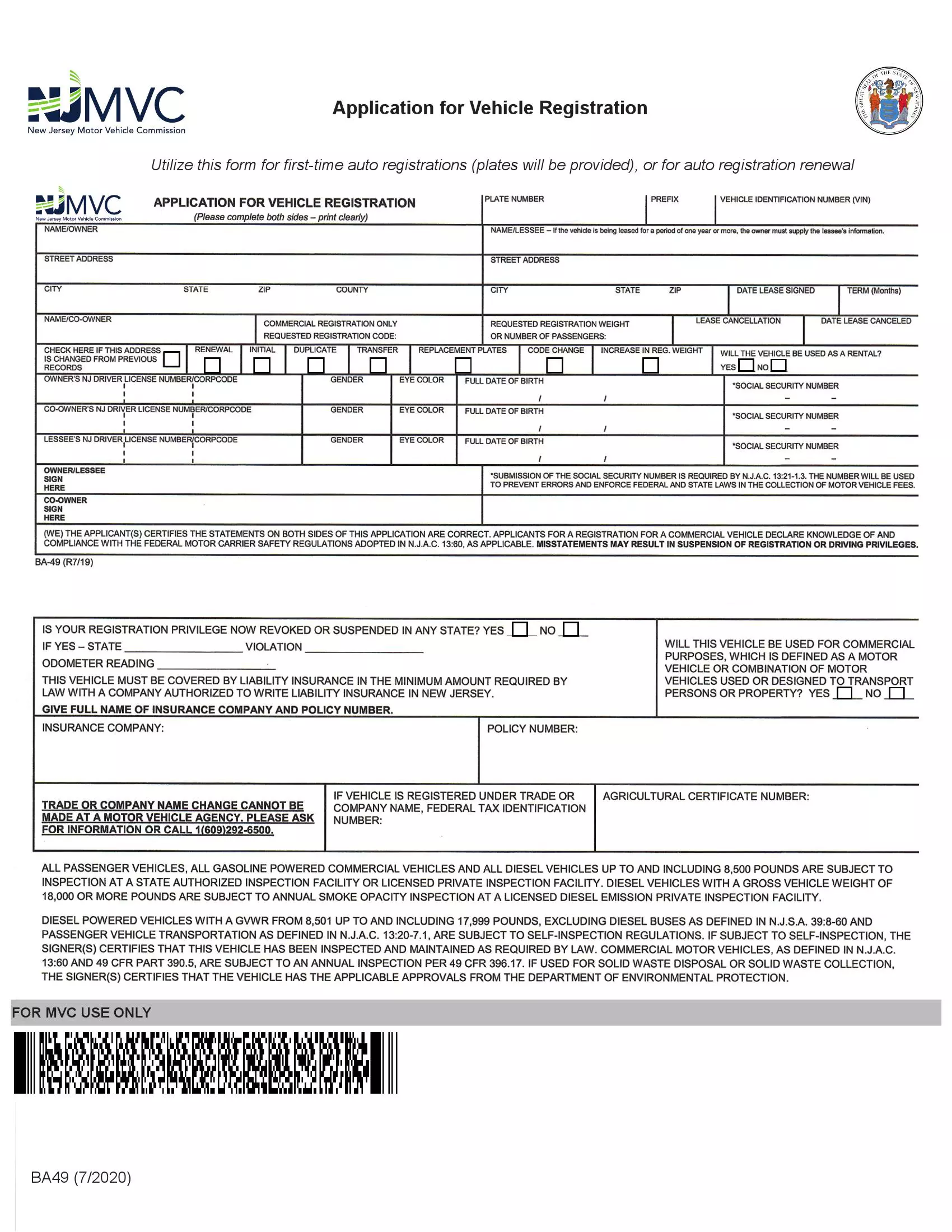

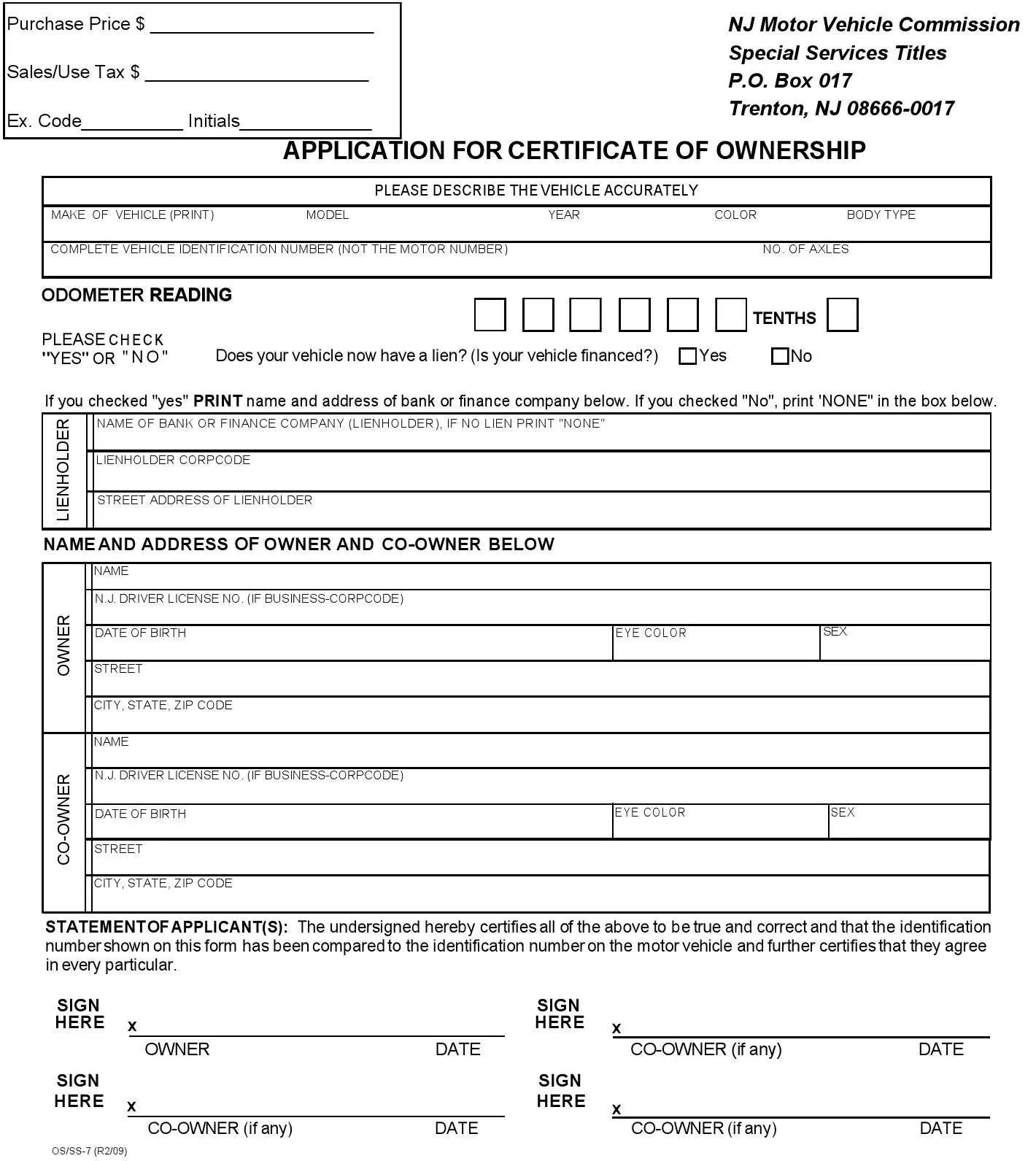

There is no requirement to complete a New Jersey motor vehicle bill of sale in private deals with vehicles. The only mandatory requirement is the transfer of ownership title and the signature on the reverse side of the title about the change of ownership. The bill of sale form is required when the Certificate of Ownership is absent (when the purchase is made in states not requiring the title).

Upon completing the private deal, the seller must remove their plates from the motor vehicle and submit them to the New Jersey Motor Vehicle Commission office (in case they don’t transfer the plates to another vehicle). The seller should also sign the title of ownership document and provide it to the new owner with a completed bill of sale template–both serving as proof of the new owner’s right to the motor vehicle.

The new owner’s motor vehicle registration cannot be done by mail. The buyer is required to visit a local motor vehicle agency of the New Jersey Motor Vehicle Commission to present the following documents:

- The title of ownership signed by the buyer and seller (on its reverse side)

- An Odometer Disclosure Statement (form OS/SS-2 in New Jersey) signed by the seller

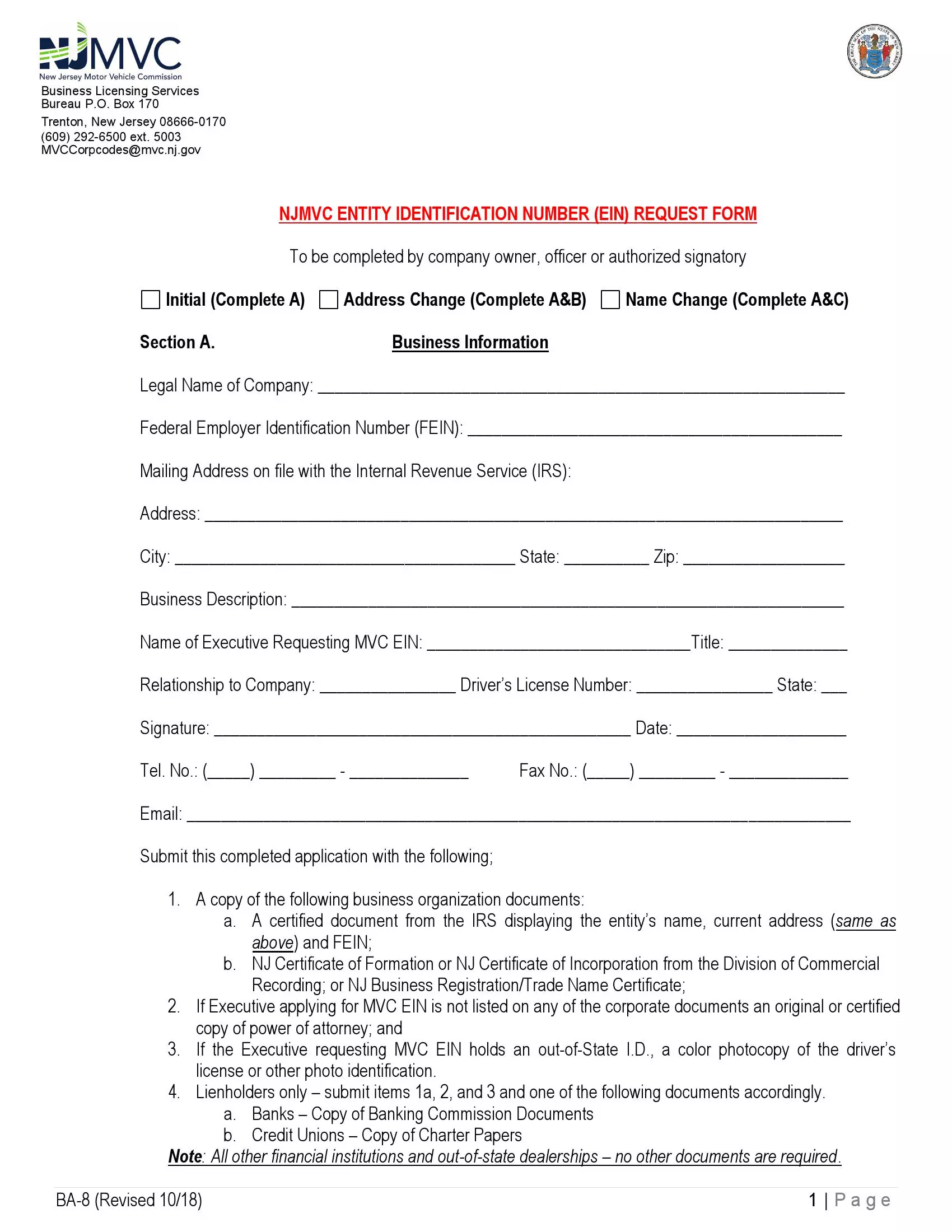

- The original driver’s license or Entity Identification Number (EIN), formerly known as Corpocode

- A complete Vehicle Registration Application (form BA-49)

- Receipts of all taxes and fees paid to the state

- An active insurance card issued by a New Jersey provider

- ID and proof of residence

- A completed and signed bill of sale

The registration process should be completed within ten days after the sale date. Otherwise, the new owner will have to pay a $25 fine for the delay in registration.

If a person different from the purchaser signs the documents for the deal, registering a motor vehicle with the new owner is possible only by providing the Power of Attorney (POA) document.

Fees and taxes for the sale of a motor vehicle and its registration with the new owner include the titling fee (fixed at $60 for standard cases, $85 for financed vehicles with one lien, and $110 for financed motor vehicles with two liens), the registration fee (calculated depending on the vehicle’s category), and the sales tax fee calculated based on the vehicle’s estimated value.

Relevant Official Forms

Used to certify the ownership of the vehicle transferred from another state.

Application for an entity identification number (EIN) to register a commercial vehicle.

Used to check whether there are police records on a person who wants to buy a firearm.

Short New Jersey Bill of Sale Video Guide