Utah Bill of Sale Form

Utah bill of sale is a valuable legal tool that documents the sale and purchase of a particular personal property, protecting the parties from future risks and misunderstandings. Even though the bill of sale documents may seem unnecessary, they will help keep records of all your transactions.

We offer a number of bill of sale forms applicable in Utah so that you can use the right one for each of your transactions. The state of Utah also has an official document, known as Form TC-843, used for different types of vehicles, boats, snowmobiles, and trailers.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Utah Vehicle Bill of Sale Form |

| Other Names | Utah Car Bill of Sale, Utah Automobile Bill of Sale |

| DMV | Utah Division of Motor Vehicles |

| Vehicle Registration Fee | At least $44 (electric car – $120) |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 22 |

Utah Bill of Sale Forms by Type

Before creating the form, you need to learn its different types. Each transaction requires a corresponding legal document. Depending on the personal property you plan to sell or purchase, you will need to go with the form that fits best. Bill of sale forms serve as legal evidence of the ownership transfer and protect the parties from possible disputes.

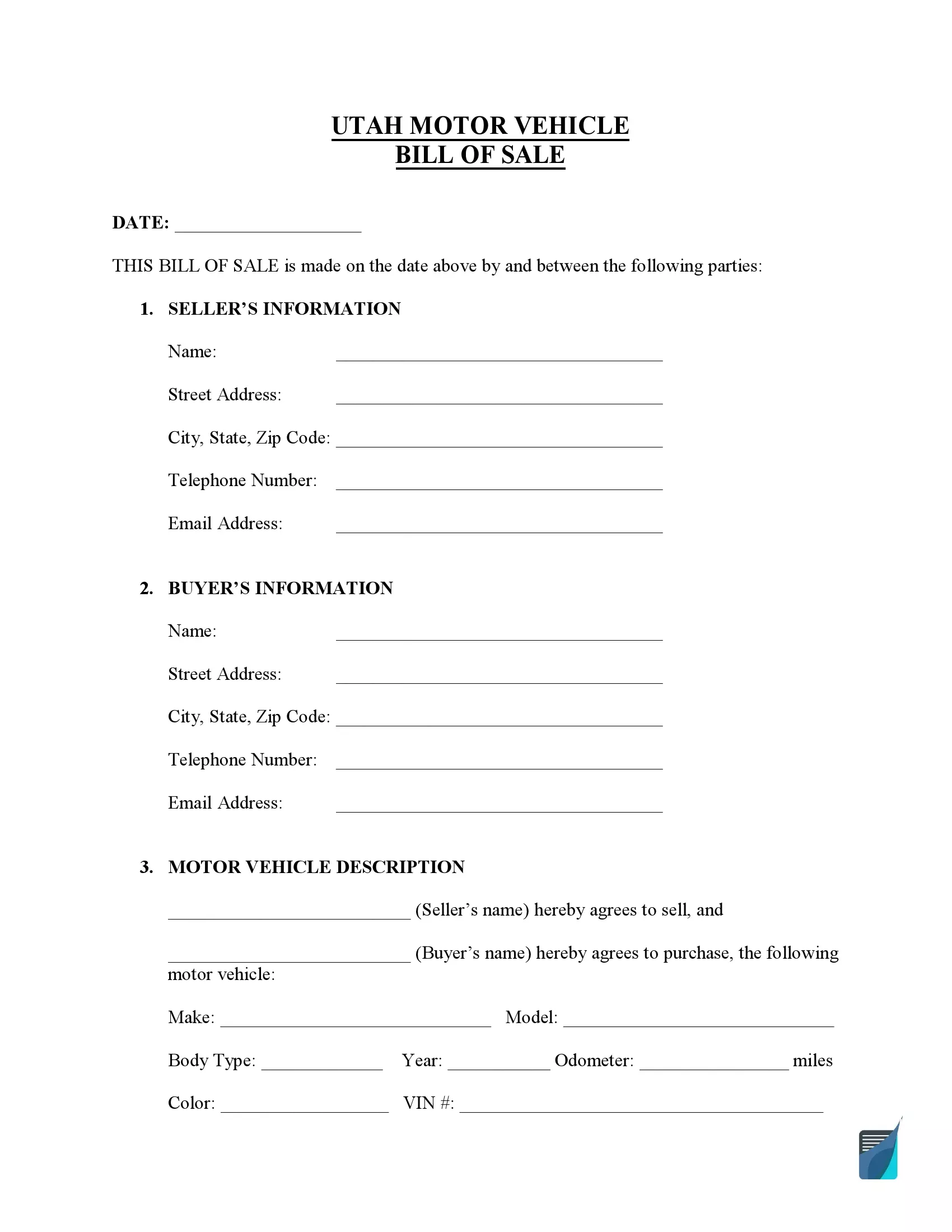

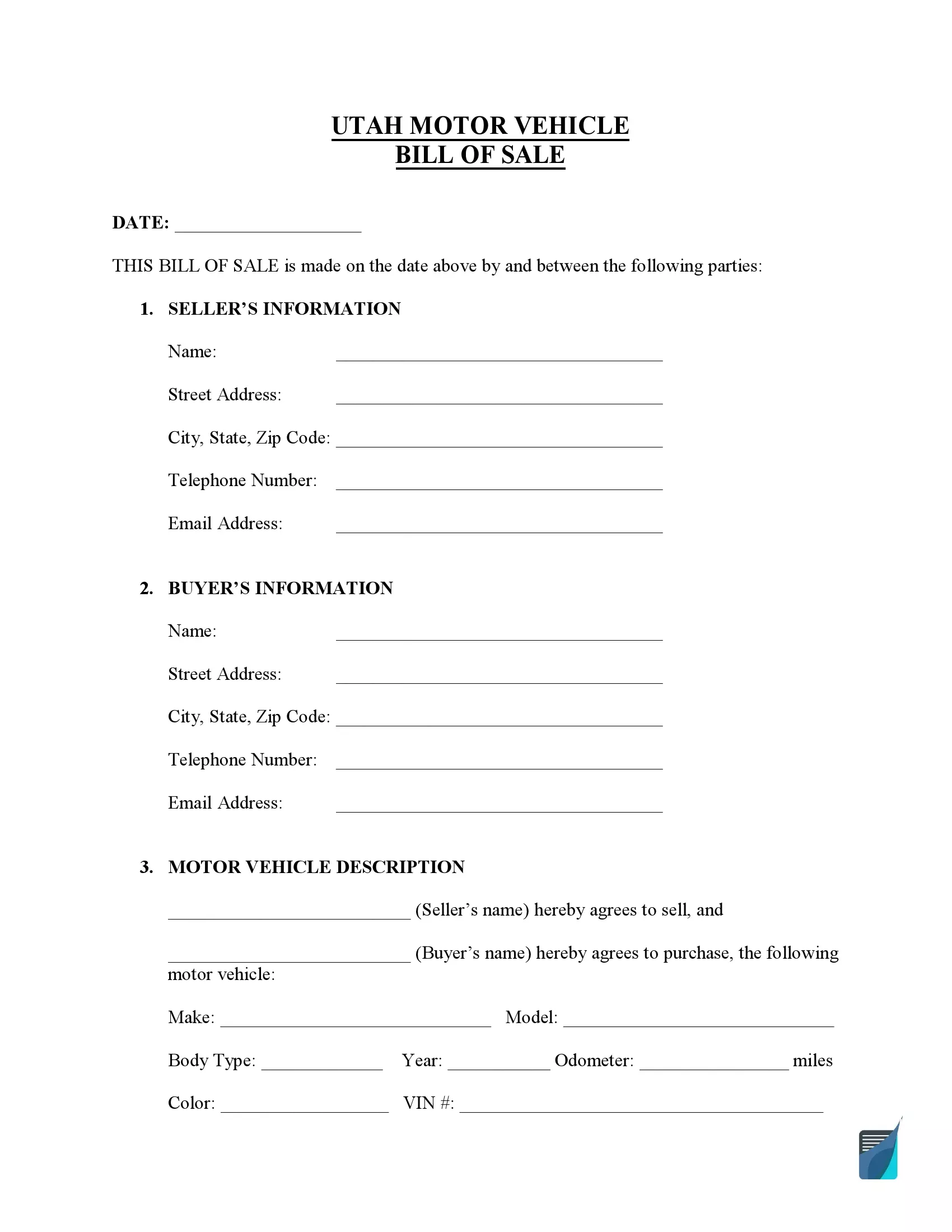

Utah motor vehicle bill of sale guarantees that the buyer will get the vehicle in the negotiated condition and protects the seller from partial liability in the event of an accident. In Utah, you will have to register your vehicle within 30 days of purchasing it or 60 days from the moment of moving to the state. Vehicle registration fees depend on the vehicle’s model and weight.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

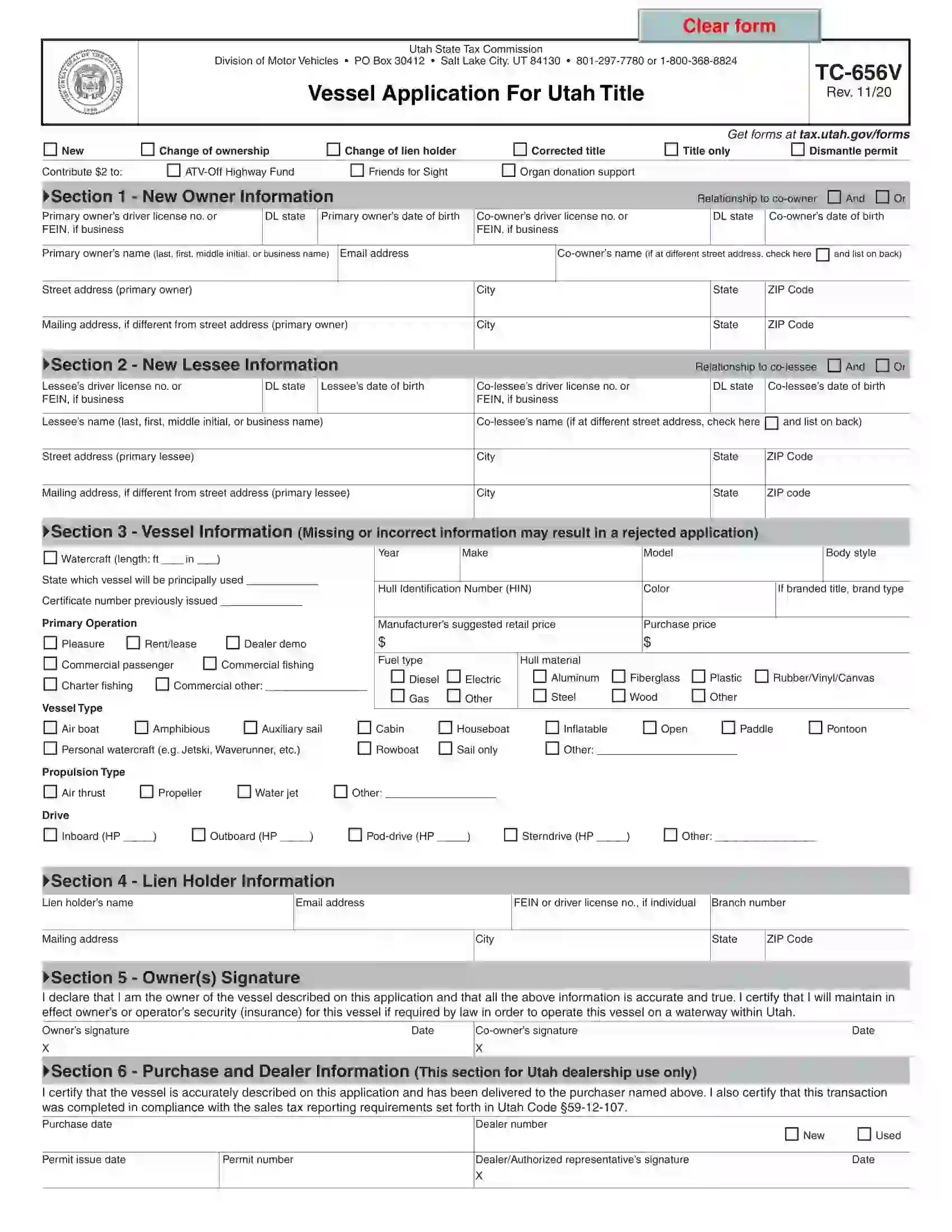

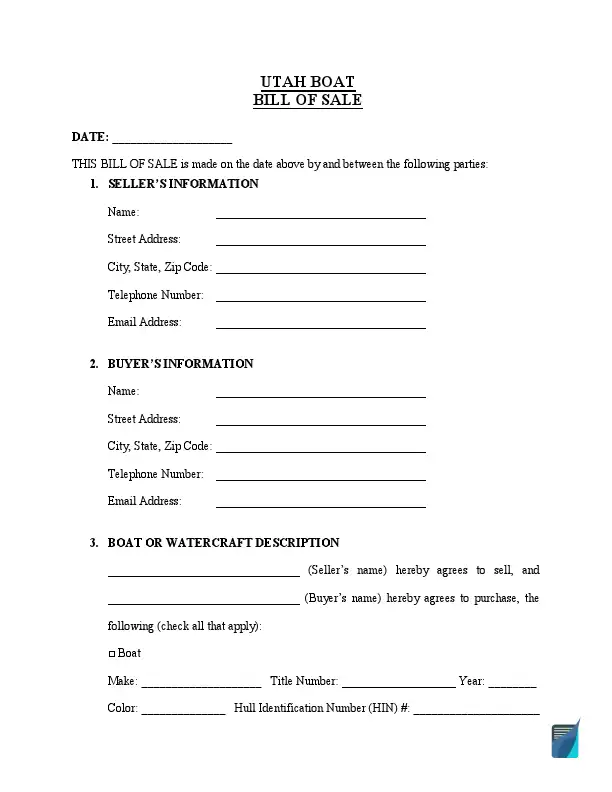

Utah bill of sale for a vessel finalizes the property transfer and records the transaction details, including all parties’ contacts and boat characteristics. If you register a boat in Utah, your registration will be in effect for 12 months. Registration is required for all motorboats and sailboats. You will need to check your local requirements and learn boat characteristics since the registration fees depend on the vessel’s length.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

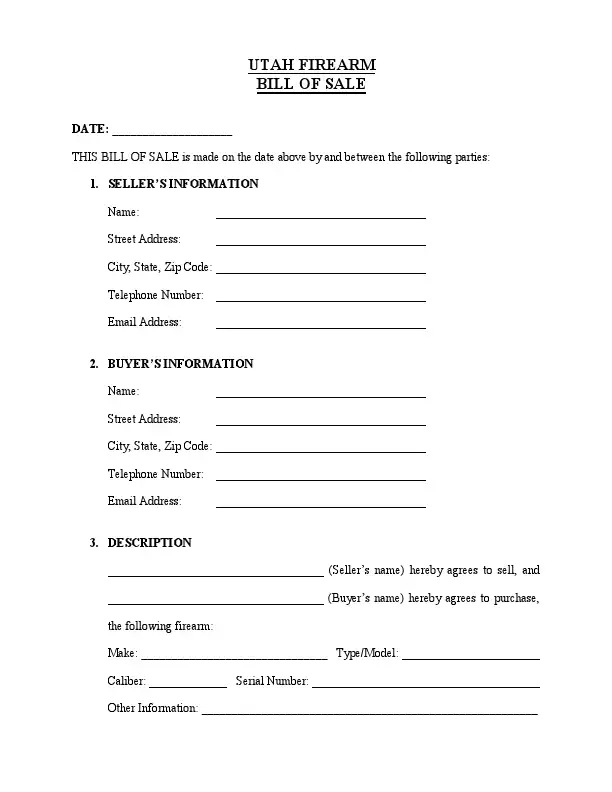

This form establishes the conditions of gun ownership transfer in Utah. The transaction doesn’t involve a criminal record check. You are not required to register your handgun in Utah. Nowadays, Utah residents are allowed to carry handguns openly. However, it must be worn in a shoulder holster or hip. In addition, a person is obliged to have a permit to possess and carry a firearm.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

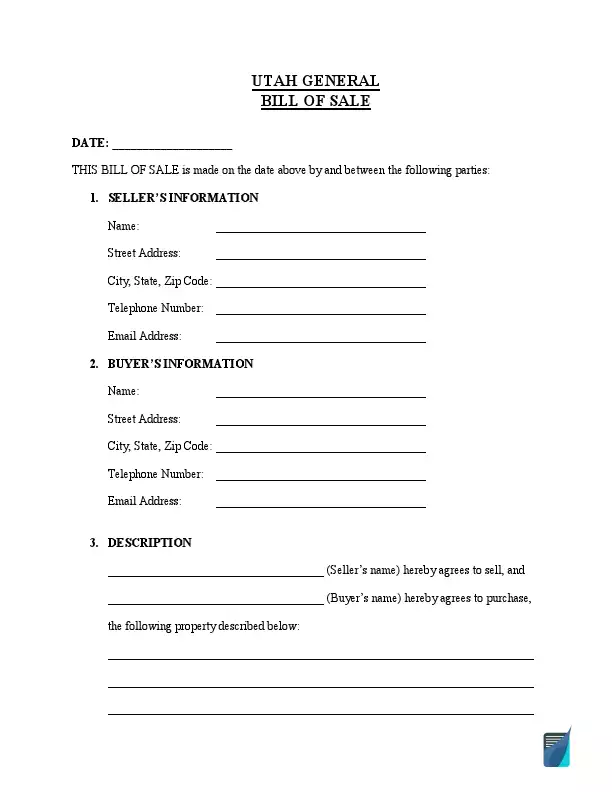

Utah general bill of sale serve multiple purposes, from selling personal property, like computers, to purchasing agricultural equipment.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write an UT Vehicle Bill of Sale

Utah vehicle bills of sale give additional security to the participants of a private vehicle sale in Utah. Utah laws do not require the parties of a private deal to complete and notarize the template. Still, it’s highly recommended to track the chain of the vehicle’s ownership, identify the vehicle’s condition and mileage at the time of sale, and determine its technical characteristics.

The official Utah bill of sale template covers the transaction of all types of vehicles, including watercraft, motorcycles, and trailers. If you’re selling or purchasing any motor vehicle in Utah, use this document to secure your ownership rights. Here is how this document is filled, step-by-step.

Step 1.

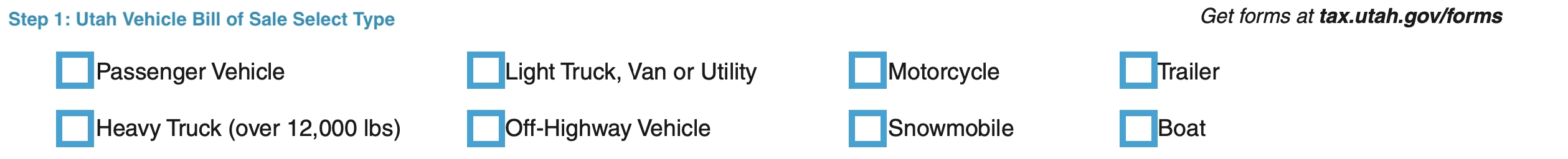

Select the type of vehicle you are selling. You may pick one of the options provided:

- Passenger vehicle

- Light truck, van, or utility

- Motorcycle

- Trailer

- Heavy truck

- Off-highway vehicle

- Snowmobile

- Boat

Step 2.

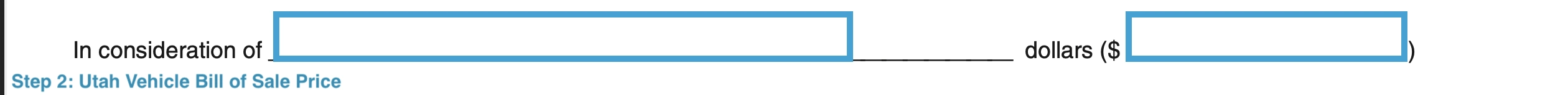

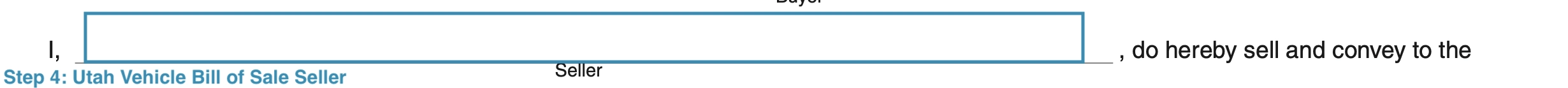

The second step is to identify the previous owner. You need to type in the name of the seller.

Step 3.

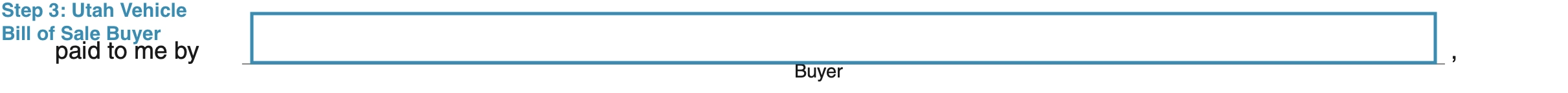

The next step is to specify the full name of the buyer.

Step 4.

This section is devoted to the vehicle purchase price. You need to indicate the total sum of money paid for the vehicle.

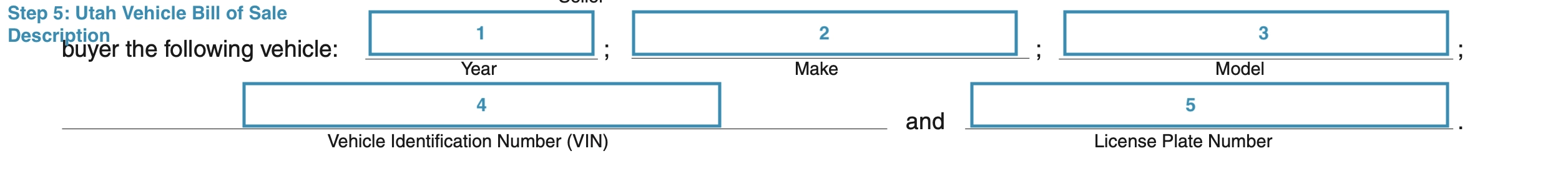

Step 5.

Here you have to provide detailed information regarding the motor vehicle:

- Year of production

- Make

- Model

- VIN

- License Plate Number

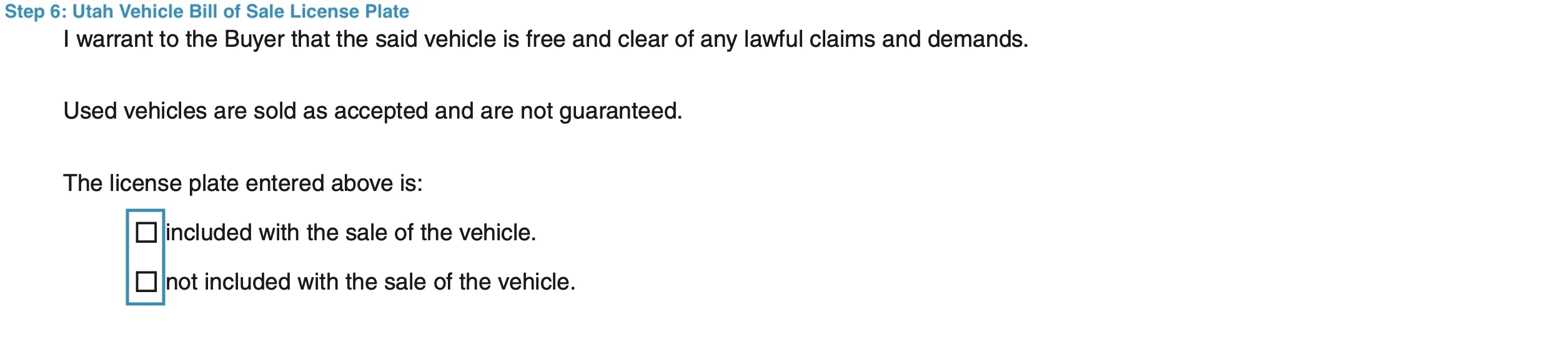

Step 6.

Specify if the license plate is included with the sale of the vehicle.

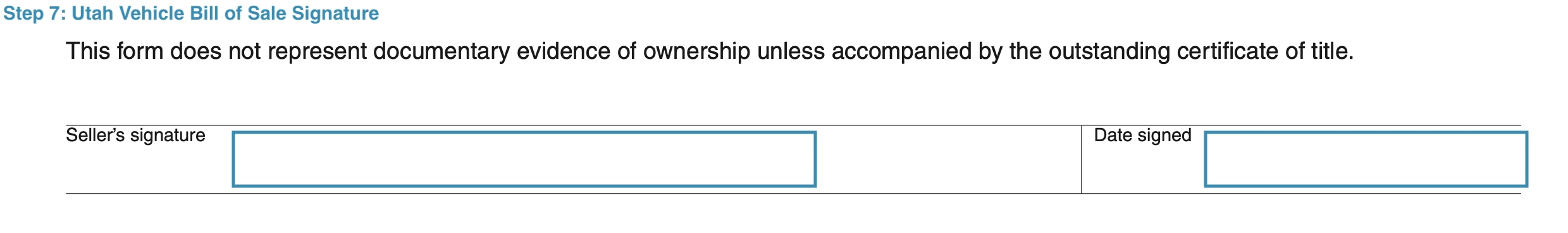

Step 7.

The seller must sign the document and indicate the date it’s concluded. After that, the deal is considered complete, and the document is legally binding.

Registering a Vehicle in Utah

Those who purchase a used vehicle in Utah need to register it to operate on Utah roads. You must visit the nearest office site with all the necessary documents and vehicle registration forms (car title, driver’s license, evidence of insurance, and inspection certificate). The registration costs are determined by the year, weight, and city of domicile of the resident.

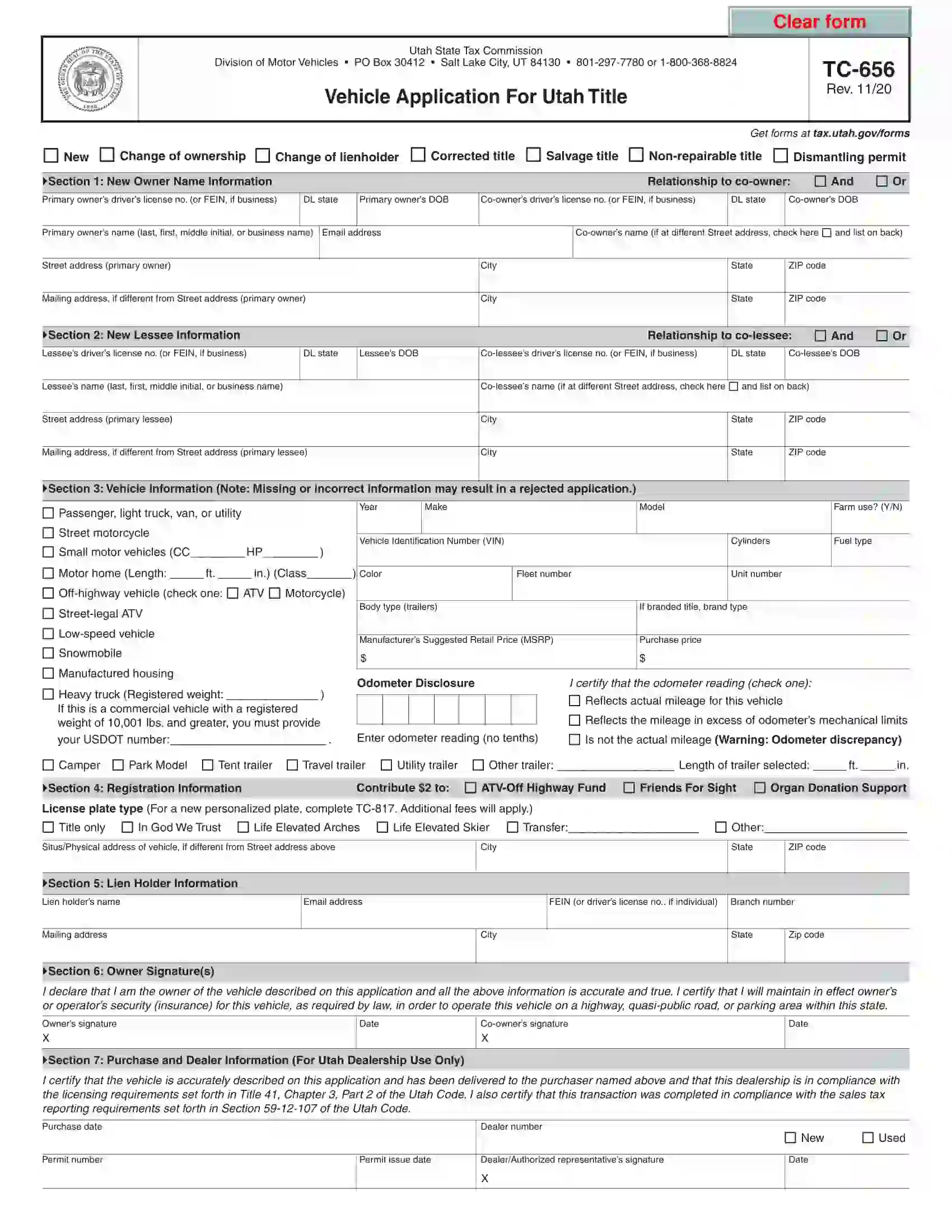

If the purchase was made at the dealer’s office, the dealer should undertake all the vehicle registration hassle. Buying a motor vehicle in a private sale requires the new owner to come to a local UT DMV office and file the vehicle registration forms as follows:

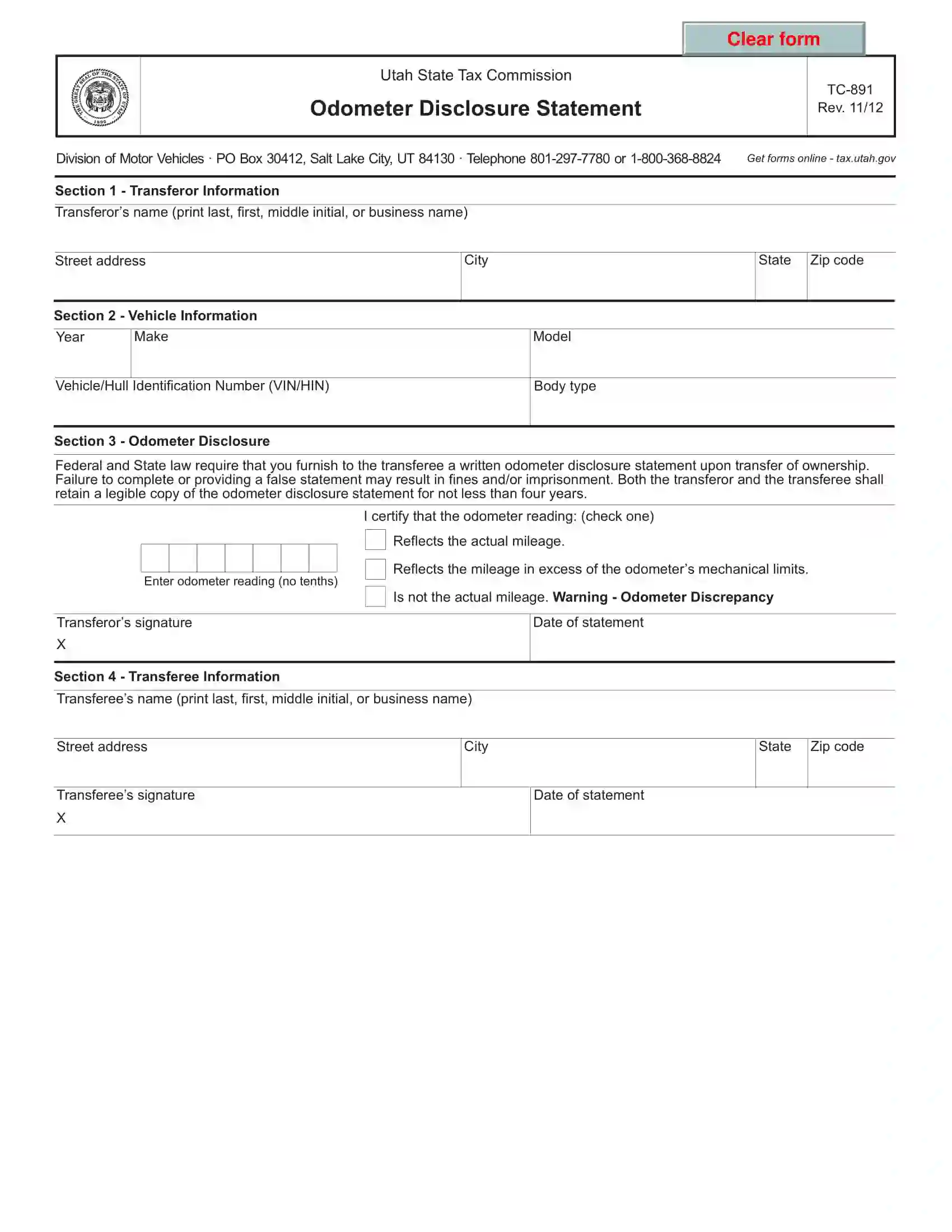

- An odometer disclosure statement (TC-891) with the indication of the actual mileage of the vehicle at the moment of sale (required for all motor vehicles)

- A certificate of title signed over by the previous owner

- A motor vehicle bill of sale

- An active driver’s license valid in Utah

- A valid Utah car insurance

- Safety or smog test results (applicable in some Utah counties)

- Receipt of the paid $6 temporary permit fee allowing to operate the vehicle until the permanent registration and certificate of title are issued

- Evidence of all fees and sales tax paid to relevant state agencies

It’s noteworthy that though the Utah DMV provides a special form for a bill of sale, it still should not be regarded as documentary evidence of ownership. The bill of sale should always be accompanied by a certificate of title. In such a case, the deal may be regarded as legally complete.

New residents have 60 days from the time they confirm their citizenship in Utah to register and title their car with the local DMV.

All new owners of vehicles in Utah should pay the 7.25% sales tax calculated based on the vehicle’s official price indicated in the bill of sale. Other fees associated with the motor vehicle’s acquisition include registration fees ($150 for cars under 3 years old, $110 for cars 3-6 years old, $90 – for vehicles 6-9 years old, $50 – for vehicles older than 9 years), a title fee ($6), and plate fees ($2.50).

You may apply for a temporary permit if you need to drive your newly acquired car while the registration is in progress. With this permit, Utah residents can lawfully drive their vehicles while their registration is being handled and can complete the necessary inspections required to pass the registration successfully. To obtain the permit, you need to address the dealership where you bought the vehicle or any Utah DMV office if you bought it from a private party.

Relevant Official Forms

Official Utah Bill of Sale for a Vehicle, Boat, Trailer, Snowmobile, and Motorcycle

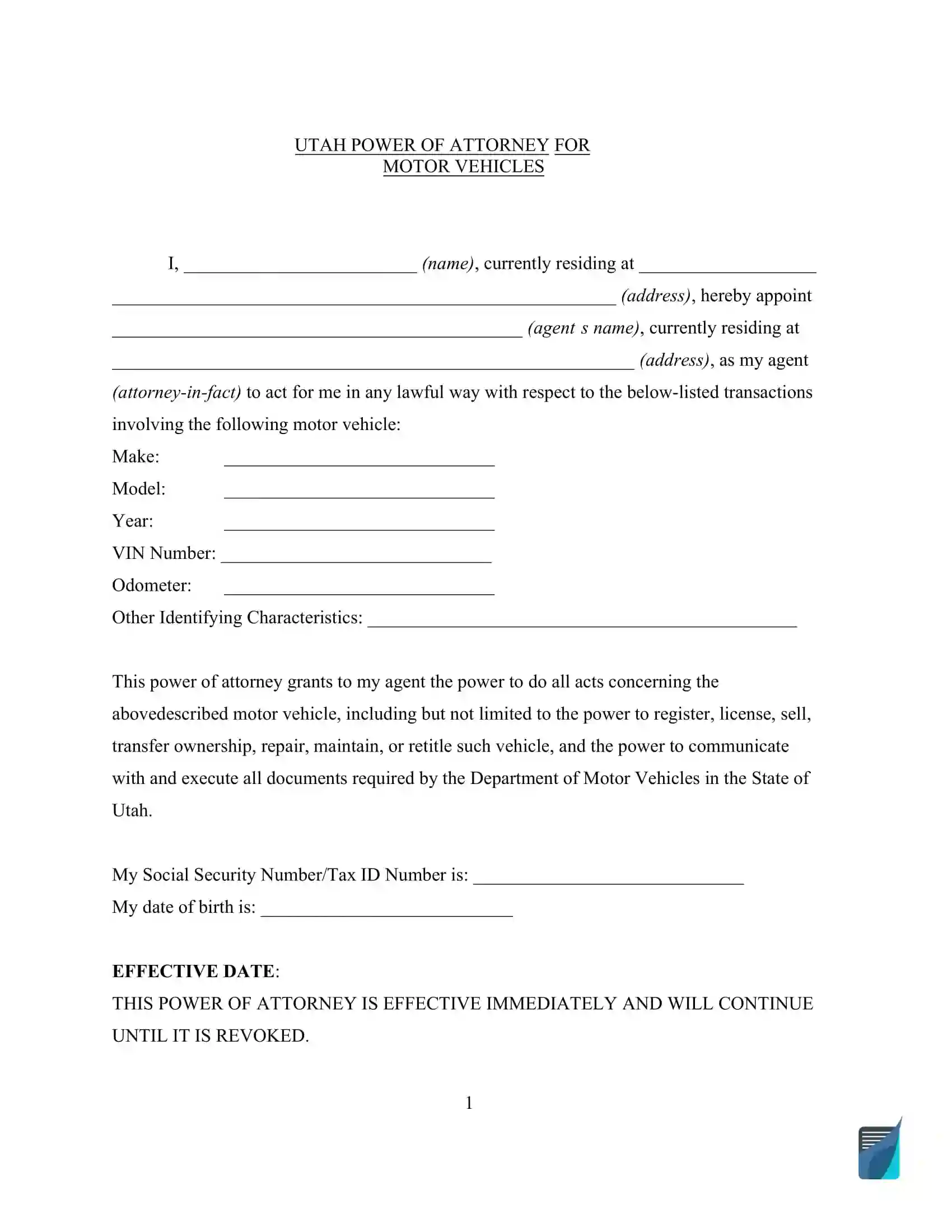

Power of attorney for motor vehicles appoints a personal representative to act on behalf of the principal in affairs related to the vehicle.

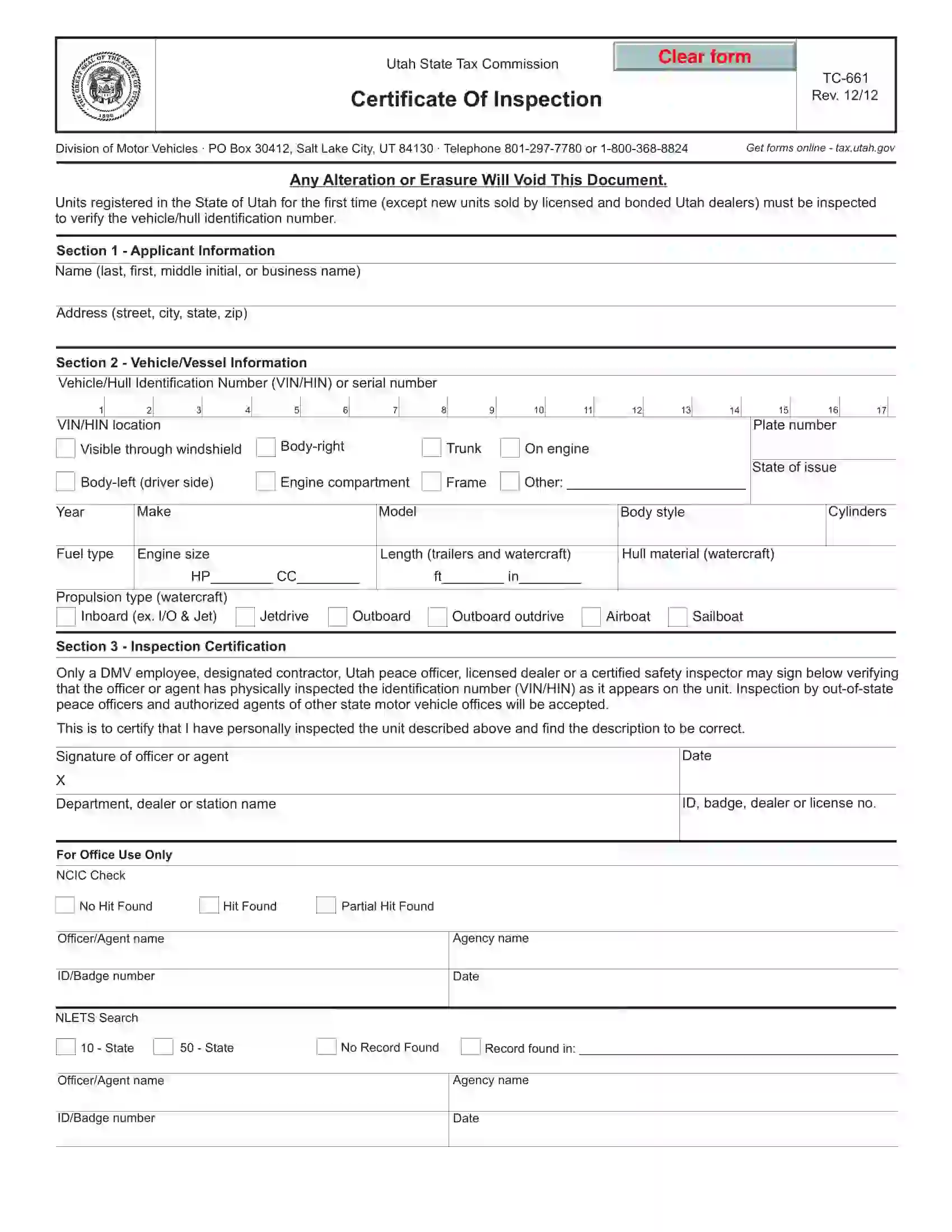

Certificate of Inspection (Form TC-661) is used to verify the VIN when the vehicle is registered in Utah for the first time.

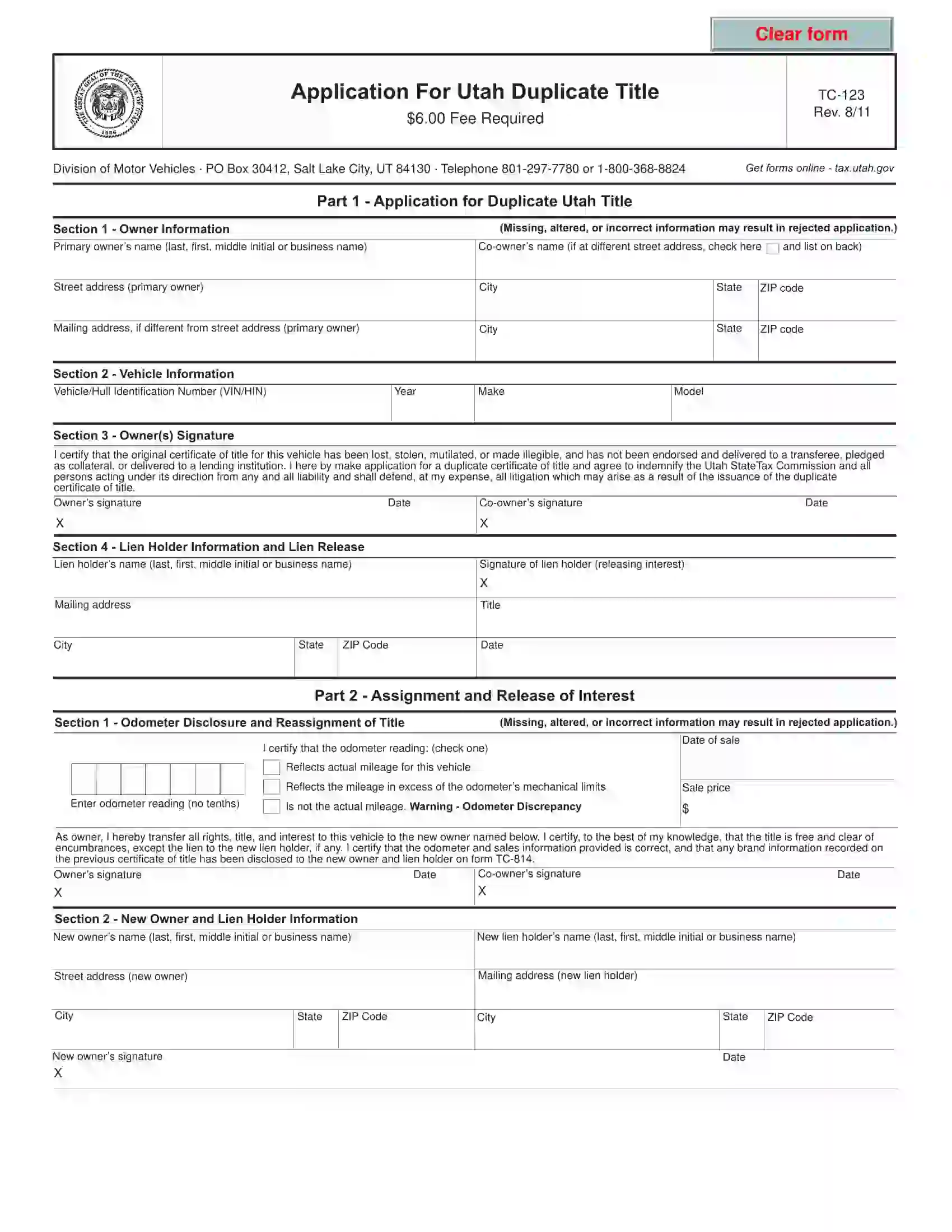

Form TC-123 or Application for Utah Duplicate Title is used if the previous title is unavailable due to some reasons.

Application for Concealed Firearm Permit is designed to apply for a regular or provisional concealed firearm permit.

Application to Switch the Permit helps switch from a provisional to a regular concealed firearm permit.

Concealed Firearm Permit Replacement Form allows a person to replace the concealed firearm permit in case they lose it.

Short Utah Bill of Sale Video Guide