Free California Last Will and Testament Form

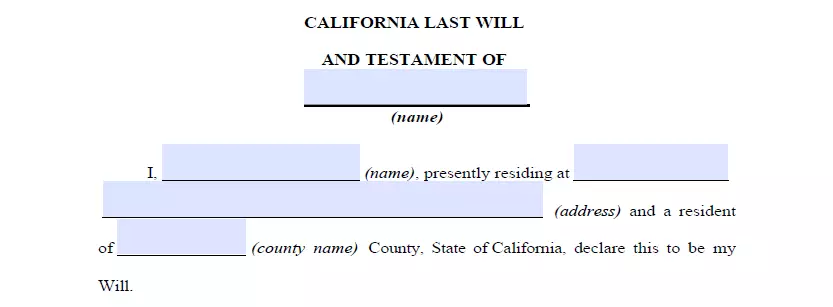

A California last will is a legal document containing the directions of a person (the testator) concerning their property and assets in case of their death, created in the manner prescribed by the state law.

As a precaution, it’s highly recommended to create a last will. Even when you don’t have a lot of assets or don’t think your time is near, a last will could help your family upon your passing.

Below, we offer a free downloadable California last will and testament form and answers to certain common doubts you could have concerning this important document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

California Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Division 6 – Wills and Intestate Succession | |

| Definitions | Division 1 – Preliminary Provisions and Definitions | |

| Signing requirement | Two witnesses | CHAPTER 2. Execution of Will. 6111 |

| Age of testator | 18 and older | CHAPTER 1. General Provisions. 6100 |

| Age of witnesses | CHAPTER 2. Execution of Wills. 6112 | |

| Self-proving wills | Allowed | ARTICLE 2. Proof of Will. 8220 |

| Handwritten wills | Recognized if meeting certain conditions | CHAPTER 2. Execution of Wills. 6111 |

| Oral wills | Not recognized | CHAPTER 2. Execution of Wills. 6111 |

| Holographic wills | Recognized if meeting certain conditions | CHAPTER 2. Execution of Will. 6111 |

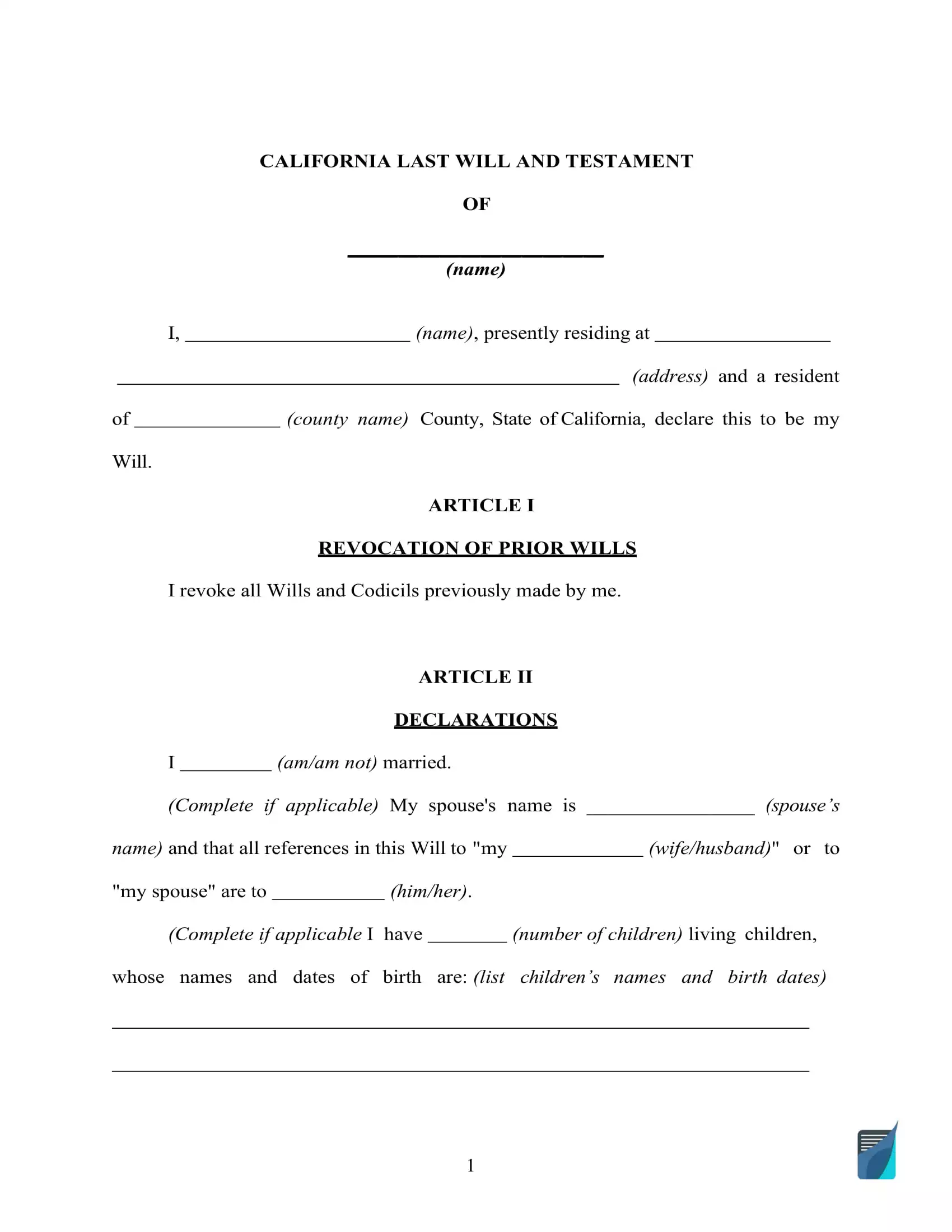

How to Write a California Last Will

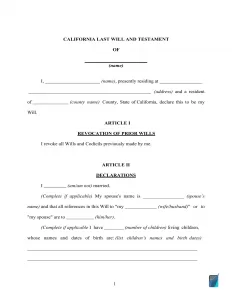

1. Think about your possibilities. Prior to beginning, it is advisable to decide if you’d like to use the help of a lawyer or prepare the whole document on your own. If you want to prepare the last will by yourself, select the type you’ll use: a solely handwritten, holographic will, or maybe a free last will and testament form.

2. Indicate your information. Establish the testator and their particulars: full legal name and address (city, county, and state). Go over the remaining part of the section, including the details you’ve written along with the “Expenses and Taxes” subsection.

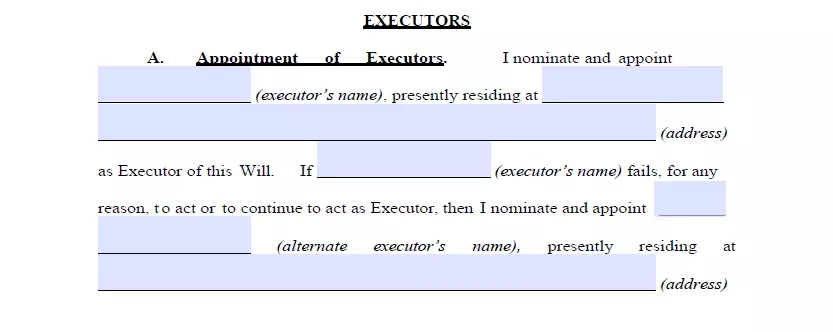

3. Establish the executor (or executrix). The next step is to choose the executor of your last will and testament, the person liable for ensuring every little thing you write in this document comes true. To achieve that, you have to enter the executor’s full legal name, along with their residential information (city, county, and state). Make sure you appoint somebody who lives in the same state as you do. If you don’t, there will be more red tape and avoidable hassle involved in the procedure because of different special regulations every state has relating to out-of-state executors. Although it is not required, it might be wise to choose an additional person to act as an executor in the event the first one is unwilling or incapable of executing your last will and testament.

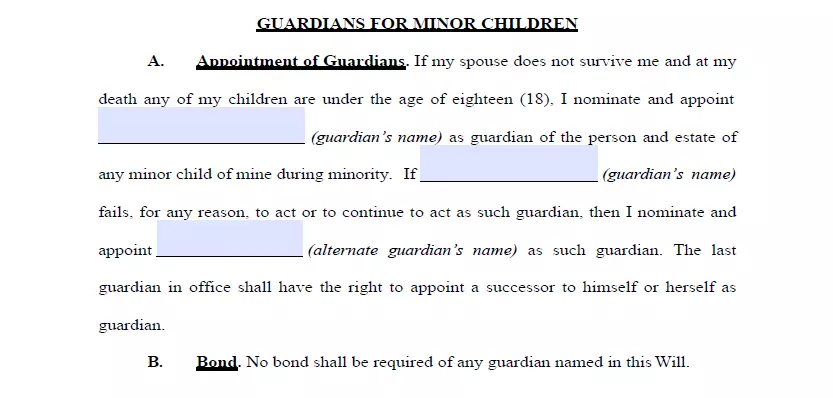

4. Determine the guardian (optional). It is possible to choose a trusted person as a guardian in case you have underage or dependent children that need to be taken care of. If there are no directions regarding what person should take care of your kids, the guardian will be chosen by the court.

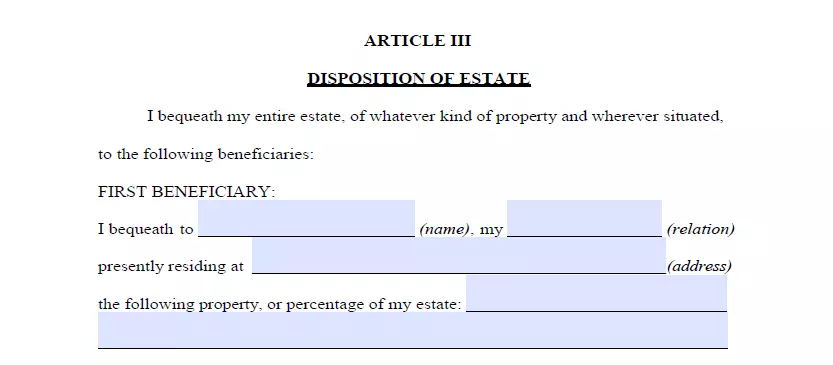

5. Specify your beneficiaries. Now you establish those who will inherit your property. Write their full names, places of residence, and your relationship to them (spouse, child, friend).

6. Allocate possessions. If you’ve got an asset allocation in mind that is not even, you’ll be able to describe it within this section. Assets might include cash, stocks, realty, company control, money for arrearage, as well as any material items of financial value you own. Please notice that there are things that cannot be distributed in your last will and testament, for instance, life insurance and joint and living will assets.

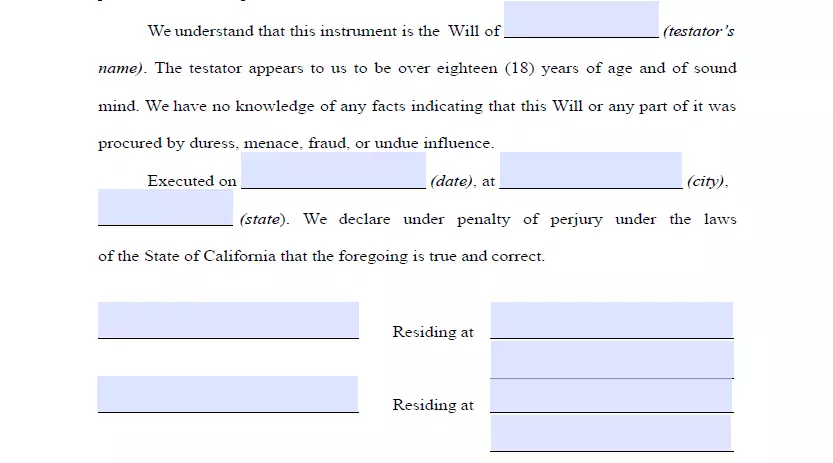

7. Ask witnesses to sign the document. According to California law, for a last will and testament to be considered valid, it needs to be signed by two witnesses. Only someone who isn’t your beneficiary and is of 18 years or more could be selected as a witness. Consider choosing witnesses who are younger than you so that they’ll be around in the event the will is contested in court or if any other issue occurs. At this point, you (as well as your two witnesses) have to sign the will after filling in your full legal addresses and names. Do not forget to examine every section carefully prior to concluding the matter.

Create a Free California Last Will

Frequently Asked Questions

Is will notarization required by California Law?

A will in California is valid without a notary certification. Neither will you need a notary public to make your last will self-proving.

Exactly what does it mean to be testamentary capable?

To be able to create your last will and modify it (to be testamentary capable), you must match specific requirements relating to your legal and mental capabilities first.

In the majority of states, to draft a valid last will and testament, you must be of sound mind and no less than 18 years of age. “Sound mind” means that you don’t have any kind of mental illness (dementia, senility, insanity, etc.) that doesn’t allow you to have an understanding of the aftermaths of your actions.

Is the child or spouse disinheritance possible?

In California, there is such a thing as community or marital property. It implies that all of the properties and assets collected or increased while in the marriage ought to be evenly shared between the two spouses, and this makes it almost implausible to disinherit your marriage partner.

Possibly, this is one of the reasons we have the following statistics. As per Census.gov, in 2018 in California, the divorce rate was 6.7 per 1,000 women over 15 years old. It is lower than the US nationwide rate during the same period.

Just the possessions you control (your personal property) are subject to will disinheritance when it comes to your spouse.

The only way for you to disinherit your marriage partner will be to enter into a prenuptial contract with him or her prior to marriage.

It’s legal in California to disinherit any other members of the family in the will. That concerns your children and other relatives; simply add disinheritance provisions to your last will and testament.

Can a signed last will be modified later on in California?

Yes, a person who wrote a will is permitted to alter or cancel it at any time. The only case that might disallow you to do it is when it is forbidden under a contract you concluded.

What to do in case a person is physically unable to sign their will?

Solely per your instruction and with you present can another person sign your last will and testament (See Point 3). It’s possible to give a special directive through a number of methods, which include speaking, a positive answer to a query, or body gestures.

| Related documents | Instances when you could need to have one |

| Codicil | You would like to slightly change your last will without making a new document from scratch. |

| Self-proving affidavit | You want to save time and money for your witnesses. |

| Living will | You would like to make certain your end-of-life treatment is carried out in line with your wishes. |

| Living trust | You want to skip probate by placing your property in a trust. |

Last Will and Testament Forms for Other States