Ohio Last Will and Testament Form

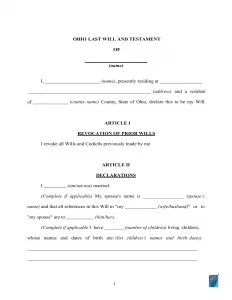

An Ohio last will and testament is a legal instrument that contains the instructions of a person creating the will (known as the testator) regarding their last wishes in case of their death, created in the format prescribed by law.

A last will allows you to name an executor (a person who oversees all aspects of probating your estate), choose where your money goes, state who should care for any minor children, and lets you provide input on your funeral arrangements. Here, you are able to get a free Ohio will template that you can fill in and print.

Other than that, down below, you will find information pertaining to the will creation process, state requirements, and answers to commonly asked questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Ohio Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Chapter 2107 – Wills | |

| Will Definition | 2107.01 Will construed | |

| Signing requirement | Two witnesses | 2107.03 Method of making will |

| Age of testator | 18 or older | 2107.02 Who may make will |

| Age of witnesses | 18 or older | 2107.06 Age requirement for witnessing will |

| Self-proving wills | Not allowed | |

| Handwritten wills | Recognized if witnessed according to the state law | 2107.03 Method of making will |

| Oral wills | Recognized if meets certain conditions | 2107.60 Oral will |

| Holographic wills | Not recognized | |

| Depositing a will | Possible with the office of the judge of the probate court in an Ohio county (The fee is $25) | 2107.07 Deposit of will |

How to Make a Will in Ohio

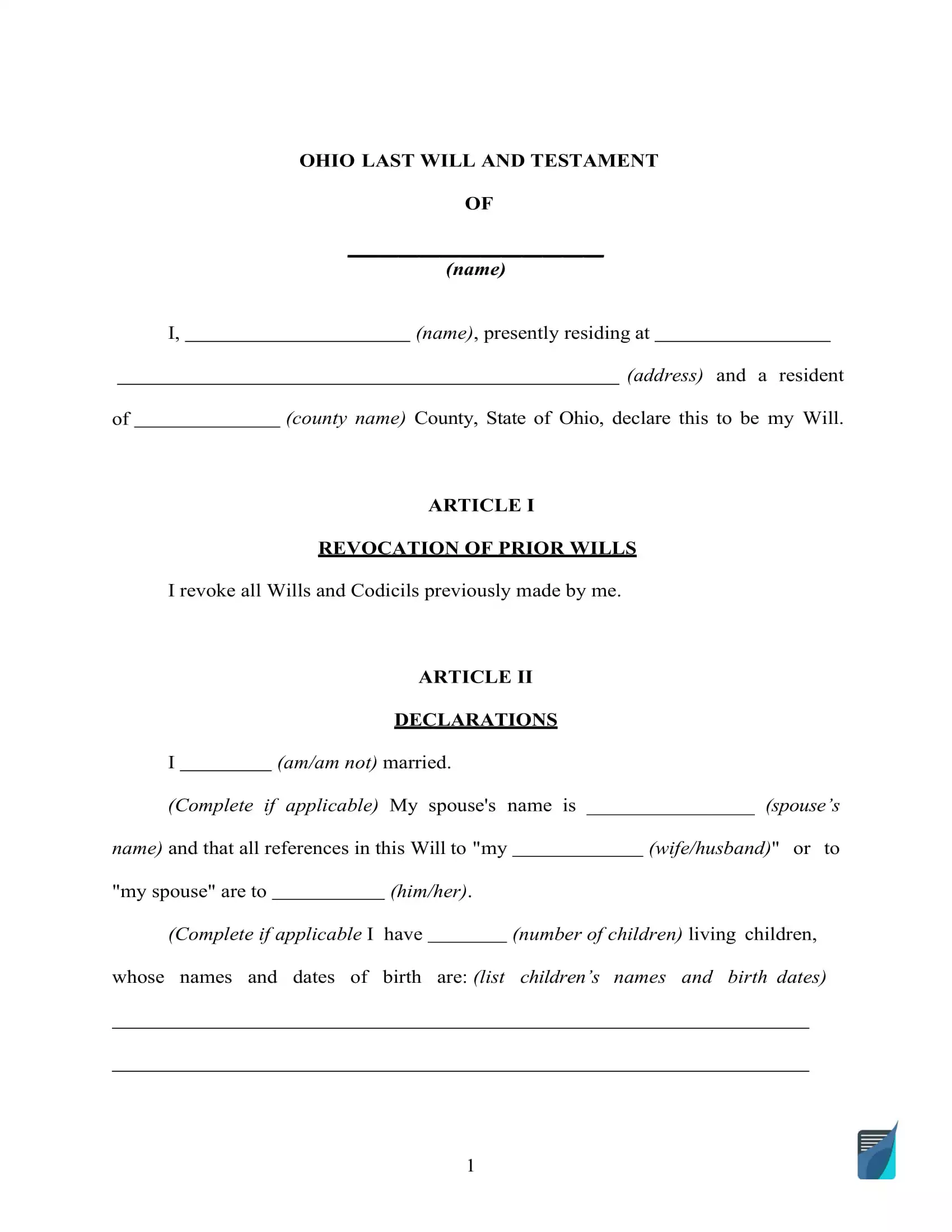

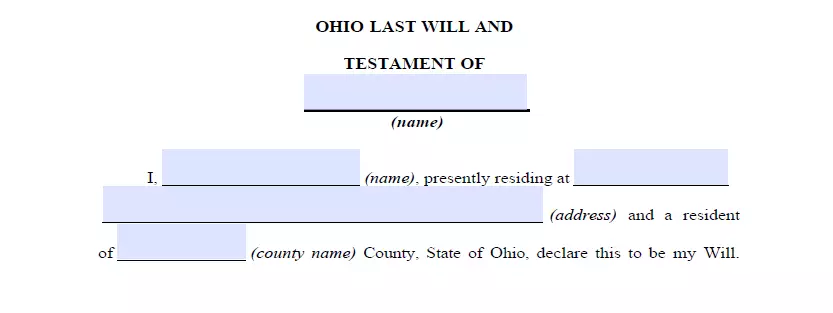

1. Specify your details (if you are the testator). Indicate your full legal name and street address (the city, county, and state of residence) to establish the testator of the will. Check the details you wrote and the rest of the passage for any mistakes.

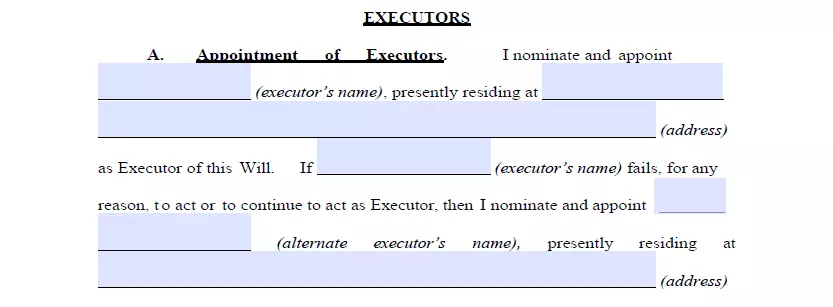

3. Appoint the executor of your will. In this part, you should determine who will execute your last will and testament by entering their full legal name, along with their city, county, and state of residence. Most states have specific restrictions regarding the out-of-state representatives and executors, which almost always suggests a lot more hassle and paperwork. A nonresident can be an executor in Ohio only if they are related to the testator by blood, marriage, or adoption, or if their home state permits nonresident executors (Section 2109.21).

As an assurance, you may appoint an alternative executor of the last will and testament. This way, you will be able to ensure that, even when the initially appointed executor is unable to carry out their duties, there is another trustworthy person you can count on.

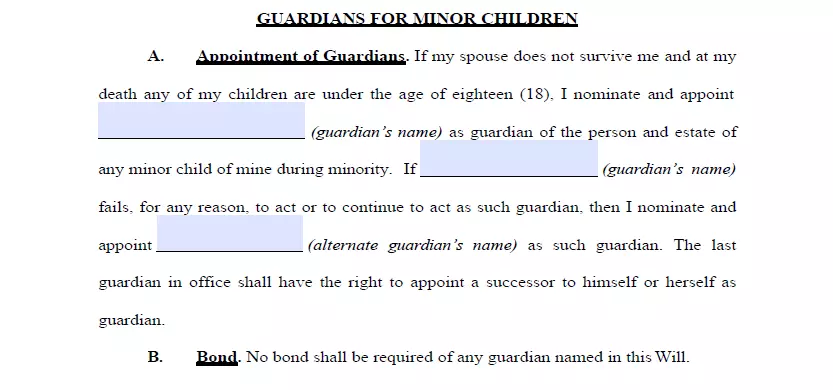

4. Establish the guardian (optional). It is possible to appoint a trusted person as a guardian in the event that you have underage or dependent children that must be looked after. If there are no directions pertaining to who should take care of your kids, the guardian will be appointed by the court.

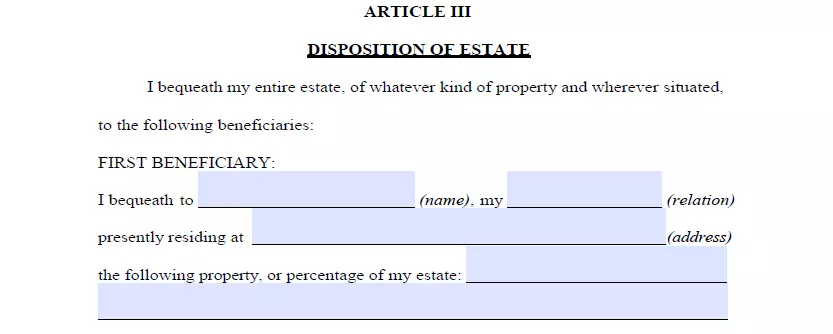

5. Establish your beneficiaries. Now establish individuals to whom you leave your property, that is, your beneficiaries. For each inheritor, fill out the following details: full name, address, and how they are related to you.

6. Allocate assets. Write down your possessions and describe exactly how you wish to distribute them amongst your inheritors if you’ve got something on your mind other than splitting the property evenly. Assets could include money for unpaid debts, realty, shares, company ownership, cash, as well as any physical things of monetary worth you own. Please notice that there are things that can’t be distributed in your last will and testament, for example, joint and living trust property and life insurance.

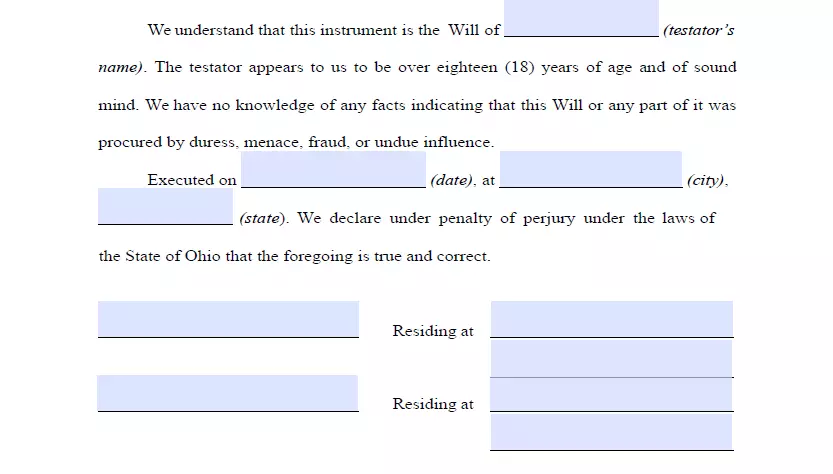

7. Ask two witnesses to sign the document after you do it yourself. Ohio laws (2107.03) stipulate that no less than two witnesses must sign a will so that it can be deemed valid. They must be over 18 years old and have absolutely no interest in your last will; thus, these people can’t be your inheritors.

Note: Think about selecting witnesses younger than you to ensure they will be present in case the will is contested in the court or if any other problem takes place. This is especially important in Ohio because you cannot make your will self-proving here.

At this point, you (as well as your two witnesses) must sign the paper after writing your full legal addresses and names. Don’t forget to look over each sentence of your will carefully before concluding the matter.

Make a Free Ohio Last Will and Testament Online with Ease

Frequently Asked Questions

Should I notarize my will in Ohio for it to be valid?

No, In Ohio, you do have to notarize your last will.

What is testamentary capacity?

You must meet testamentary capacity requirements to be able to make a will. There are generally two requirements: soundness of mind and being an adult. In the majority of states (which includes Ohio), you have to be over 18 years old in order to create a valid last will. Soundness of mind means that you are aware of your property and the beneficiaries of your possessions and fully understand the consequences of your doings.

Can I attach a self-proving affidavit to my last will and testament in Ohio?

No, you cannot. In Ohio, self-proving wills are not allowed.

Is it possible to disinherit your spouse?

No, you are not legally possible to disinherit your spouse through a will in Ohio. A surviving spouse has legal rights to claim some or all of the deceased’s estate, depending on the circumstances. It is possible for a spouse to waive this right in a legal contract, such as a prenuptial agreement.

Is it possible to amend my last will without my assent?

No, it is solely you who can amend your will. A third party is only able to sign the last will and testament in case you’re physically incapable of doing so.

Is it possible to revise a typewritten last will and testament after I sign it (in Ohio)?

Yes, this can be easily done. A person who wrote a will is permitted to adjust or revoke it anytime.

Additionally, it can be a wise decision to revise your last will and testament as you experience an important life event such as:

- Birth or adoption of a child

- You got married or divorced

- Purchasing or selling real estate

- Noticeable changes in your finances

If I am physically unable to sign my will, what do I have to do?

Under Ohio Law (ORC 147.59), someone can sign a will on the testator’s behalf if the testator clearly communicates to the notary public the intent for their designated signer to sign the document. The document must then be notarized with specific wording indicating that the signature has been affixed and includes the signatory’s name.