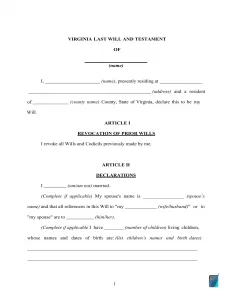

Free Virginia Last Will and Testament Form

A Virginia last will and testament is a crucial and legal instrument that represents the final wishes of a testator regarding their private property and assets and the way they’d wish them to be distributed to selected heirs.

Writing a last will and testament can be a prudent option for anybody who would like to steer clear of disagreements and misunderstandings. A thought-out and appropriately written will can be vital to the ones you love and relations upon your passing even when you do not have lots of assets.

On this page, you can download a free Virginia last will and testament form that you can fill in and print out. Also, below, you can find lots of information related to the will preparation process and common questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Virginia Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Title 64.2 – Wills, Trusts, and Fiduciaries; Chapter 4 – Wills | |

| Definitions | § 64.2-100. Definitions. | |

| Signing requirement | Two witnesses | § 64.2-403. Execution of wills; requirements |

| Age of testator | 18 or older or an emancipated minor | § 64.2-401. Who may make a will; what estate may be disposed of |

| Age of witnesses | 18 or older | § 64.2-403. Execution of wills; requirements |

| Self-proving wills | Allowed | § 64.2-452. How will may be made self-proved; affidavits of witnesses |

| Handwritten wills | Recognized if meeting certain conditions | § 64.2-403. Execution of wills; requirements |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | |

| Depositing a will | Possible with the clerk of the Virginia county circuit court A fee is $30 | § 64.2-409. Wills of living persons lodged for safekeeping with clerks of certain courts |

How to Write a Virginia Last Will

1. Consider your possible choices. Prior to beginning, you may want to decide if you’d like to use the services of a lawyer or write the entire document by yourself. In the event that you would like to prepare the will on your own, pick the type you will use: a handwritten will or maybe a free last will and testament form.

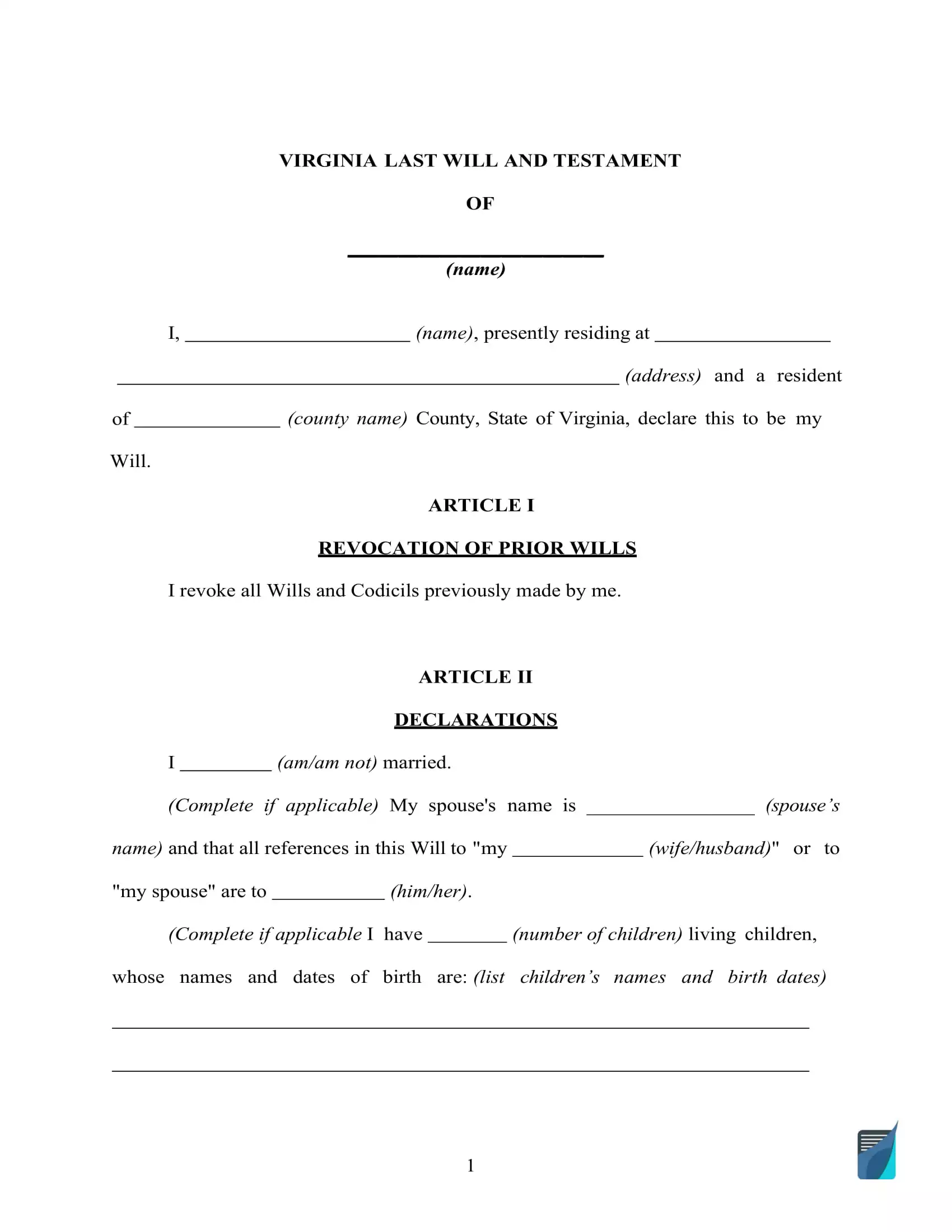

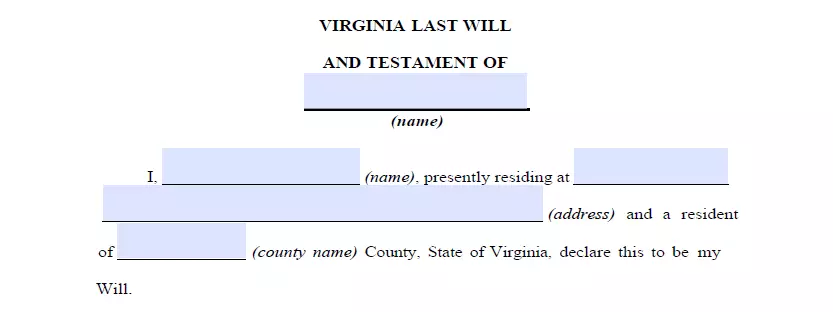

2. Indicate your details. The first step is establishing the testator by entering their full name, as well as the residential info (city, county, and state). Go over the remaining part of the passage, including the information you’ve written along with the “Expenses and Taxes” subsection.

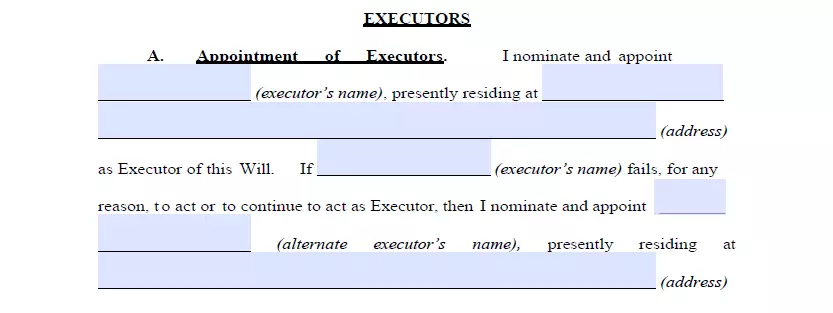

3. Indicate the executor (or executrix). The next step is to select the executor of your last will, the person responsible for ensuring all you lay out in this document is made a reality. To do this, you need to indicate the executor’s full name, as well as their residential specifics (city, county, and state). Ensure that you choose a person who resides in the same state as you do. If you don’t, there’ll be much more red tape and unnecessary hassle identified with the procedure as a consequence of various special rules every state has relating to out-of-state executors. As a safeguard, you may appoint an alternative executor of the last will and testament. That way, you will be able to make sure that even when the first appointed executor is unable to carry out their duties, there’s another trusted person you can count on.

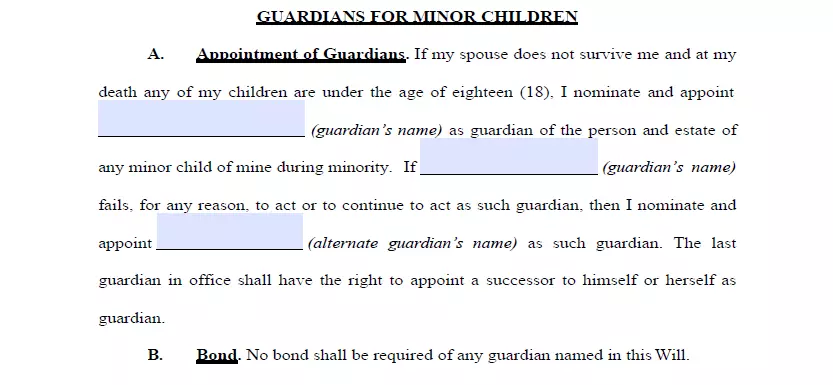

4. Establish the guardian (optional). You can choose a trusted person as a guardian in case you have minor or dependent children that must be taken care of. If there are no instructions concerning what person should take care of your children, the guardian will be chosen by the court.

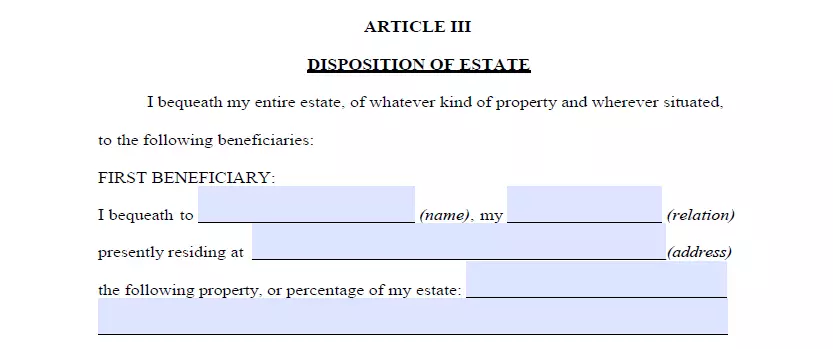

5. Specify your beneficiaries. At this point, establish individuals to whom you wish to pass your assets down, that is, your beneficiaries. Enter their full names, places of residence, and your connection to them (e.g., spouse, child, friend).

6. Designate possessions. It’s possible to indicate which of your inheritors receives this or that piece of property. If you don’t, the assets are going to be divided equally among the inheritors. Cash, stocks, real estate, company ownership, money for outstanding arrears, and any physical items of financial value you own can be brought up in your last will and testament. Nevertheless, joint and living will property, along with your life insurance, can’t be put into your last will and testament.

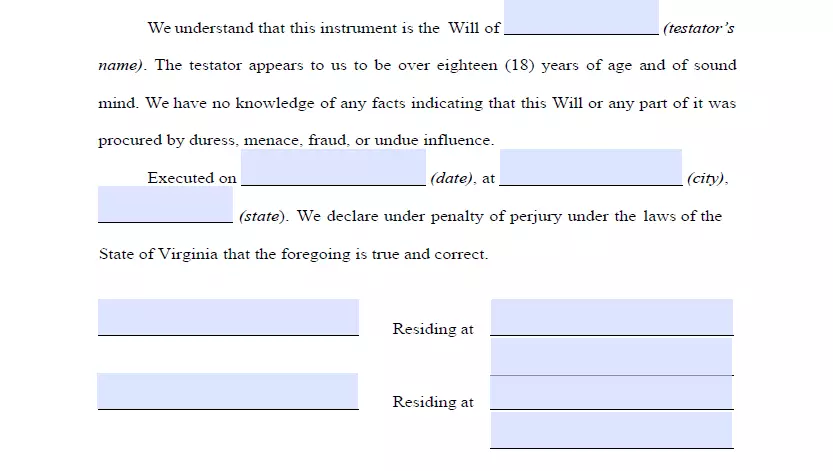

7. Proceed with the witnesses putting the signatures at the end of the document. Virginia Code stipulates that no less than two witnesses must sign a will for it to be regarded as valid. Only somebody who isn’t your beneficiary and is of 18 years or more could be picked as a witness. Think about picking witnesses who are younger than you to ensure that they’ll be around in the event the will is contested in the court or if any other problem occurs. After a thorough review of every section in your last will and testament, all signatories (you and your two witnesses) will have to write their names and full addresses and sign the document.

Get a Free Virginia Last Will Template

Frequently Asked Questions

Is a Virginia will form valid without a notary certification?

Virginia law says that a last will is valid without a notary public certifying it. However, if you want to attach a self-proving affidavit to your will, you will need to notarize it. Making your will self-proving is an excellent option since it speeds up the probate and gives another layer of certainty if your will’s credibility is doubted. You can learn more in §64.2-452 (“How will may be made self-proved; affidavits of witnesses”) of the Virginia Code.

What does it mean to be testamentary capable?

The testator has to fulfill testamentary capacity prerequisites in order to write and change their last will, which includes being of sound mind. According to the Code of Virginia (§ 64.2-401), there are two requirements to fulfill: age and soundness of mind. In the majority of states, you must be over 18 years old in order to create a will. Soundness of mind implies that you’re conscious of your property and the beneficiaries of your assets and understand the aftereffects of your doings fully.

Is it allowed to disinherit your child or spouse?

In Virginia, there’s no such term as community or marital property. Thus, it is not required that all belongings gathered or improved in the marriage have to be equally devolved to each of the spouses. In Virginia, you’ll be able to disinherit your marriage partner, but the latter will have the right to own some minimum number of your possessions—Virginia law protects surviving spouses by permitting them to claim an elective share of the decedent’s estate.

Besides your spouse, Virginia law permits you to disinherit any other member of the family. With the addition of particular disinheritance paragraphs to your last will and testament, you can cut off your children (those of 18 years and above) or other family members from receiving any of the possessions.

If I am physically unable to sign my last will, what to do?

In accordance with Virginia Estate Code (§64.2-403), it’s possible for an individual to sign a last will and testament provided that it is their (as a testator) instruction and with their present. You can give a special instruction in several ways that include oral communication, a positive response to a query, or gestures.

A notary is allowed to sign the testator’s name if the latter isn’t able to do it due to a physical disability. The notary must be instructed to perform so in the presence of a witness. It is worth mentioning that these witnesses are not allowed to have an interest (equitable or legal) in any properties and assets being the focus or impacted by this document (the will).

| Related documents | Cases when you may need to create one |

| Codicil | There are some slight modifications you’d like to make to your will. |

| Self-proving affidavit | You would like to avoid possible difficulties in the probate court. |

| Living will | You would like to declare your wishes about the end-of-life medical treatment and life-prolonging procedures. |

| Living trust | You want to consider an alternative to a will. |

Last Will and Testament Forms for Other States