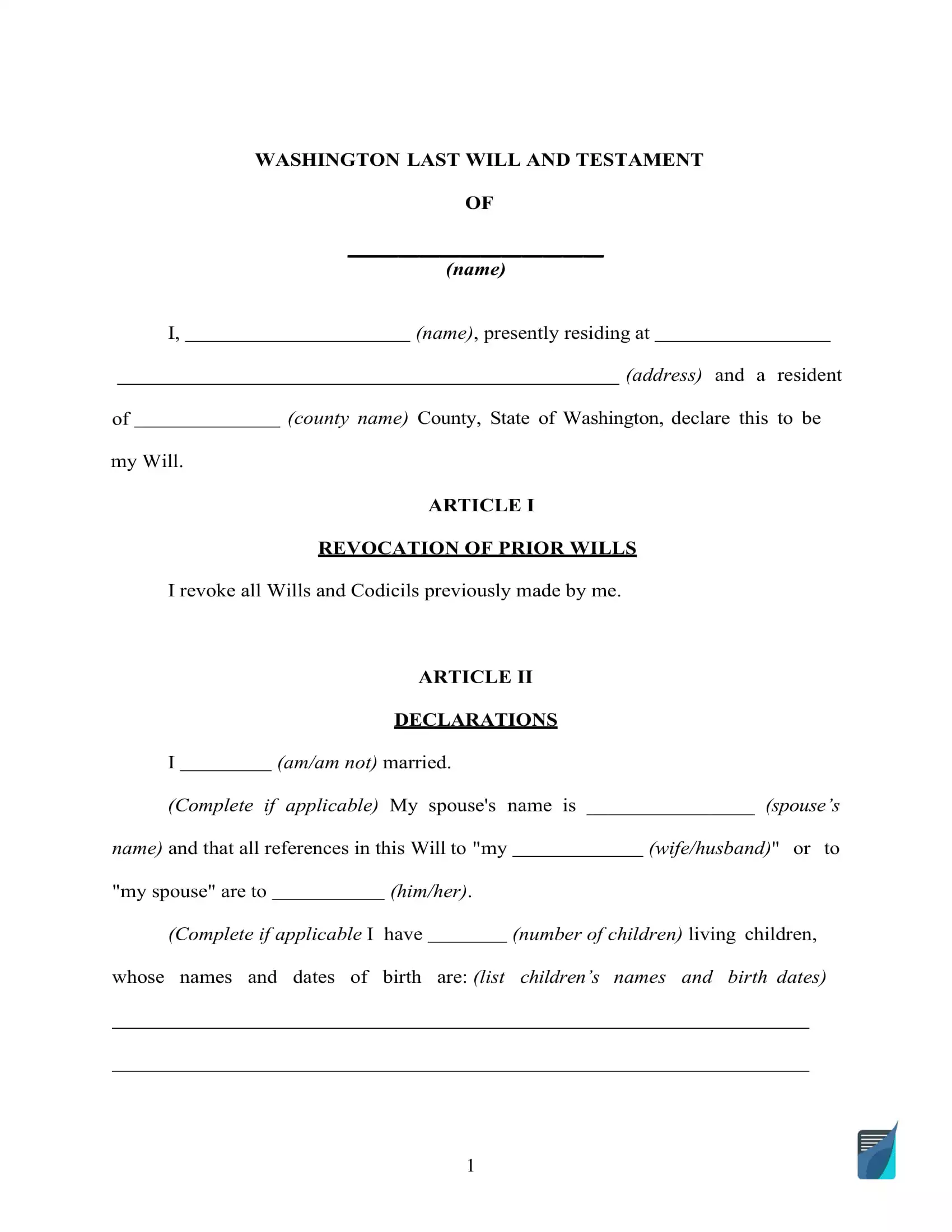

Free Washington Last Will and Testament Form

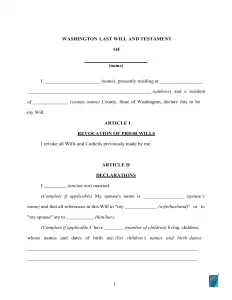

A Washington last will and testament is a legal document comprising the directions of an individual (testator) concerning their assets in the event of death, created in the form prescribed by law.

Making a last will and testament is often a good option for anyone who wants to steer clear of disagreements and confusion. An elaborate and effectively written last will can be important to your loved ones and relations after your death even when you do not have lots of property and assets.

Here, you will find a Washington last will form available in PDF and Word (DOCX) formats and the details that will eliminate your possible uncertainties in regard to estate planning, kinds of last will, and ways to create a valid document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Washington Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Chapter 11.12 – Wills | |

| Definitions | Section 11.02.005. Definitions and use of terms. | |

| Signing requirement | Two witnesses | 11.12.020 Requisites of wills—Foreign wills |

| Age of testator | 18 or older | 11.12.010 Who may make a will |

| Age of witnesses | 18 or older | 11.12.020 Requisites of wills—Foreign wills |

| Self-proving wills | Allowed | 11.20.020 Application for probate—Hearing—Order—Proof—Record of testimony—Affidavits of attesting witnesses |

| Handwritten wills | Recognized if meeting certain conditions | 11.12.020 Requisites of wills—Foreign wills |

| Oral wills | Recognized if meeting certain conditions | 11.12.025 Nuncupative wills |

| Holographic wills | Not recognized | 11.12.020 Requisites of wills—Foreign wills |

| Depositing a will | Possible with the clerk of the Washington Superior court A fee is $20 | 11.12.265 Filing of original will with court before death of testator |

How to Write a Washington Last Will and Testament

1. Consider your alternatives. Prior to beginning, it is advisable to determine if you’d like to use the assistance of a legal professional or create the entire document yourself. In the event that you wish to write the last will yourself, choose the type you will go for: a handwritten will or perhaps a free last will and testament form.

2. Indicate your details. Establish the testator and their details: full name and address (city, county, and state). Check the information you entered as well as the remainder of the passage, which includes “Expenses and Taxes.”

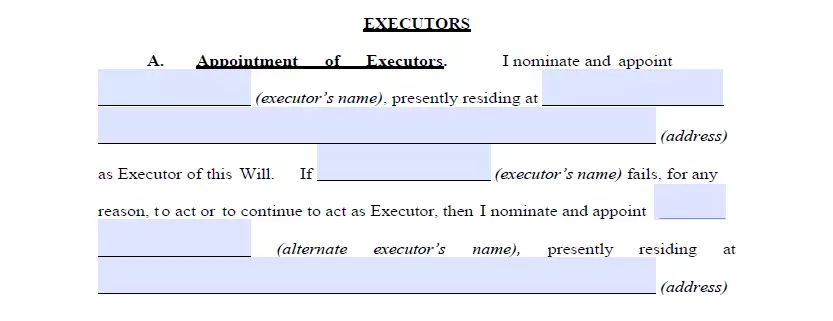

3. Specify the executor (or executrix). The next step is to select the executor of your last will and testament, the person liable for ensuring all you write in this document comes true. To achieve that, you have to indicate the executor’s full name, followed by their residential specifics (city, county, and state). Ensure you choose someone who resides in the same state as you do. If you don’t, there’ll be extra paperwork and unavoidable hassle identified with the process as a consequence of different special rules every state has in terms of out-of-state executors. It could happen that the primary representative will not be able to execute your last will due to an illness, death, unwillingness, or some other factors. In this case, the court will designate its own representative to undertake the responsibilities. To prevent that, you should select an additional executor by providing the same particulars you did for the primary one.

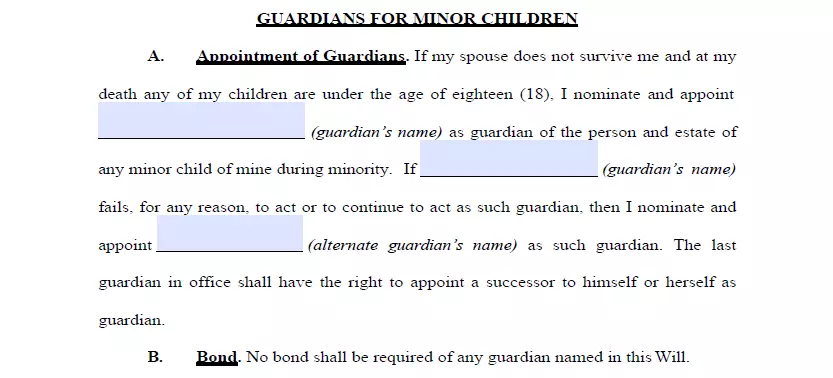

4. Appoint the guardian (optional). If you have underage or dependent children and don’t want the court to pick a guardian for them when you’re no longer here, it is possible to appoint someone you know as a guardian for your children.

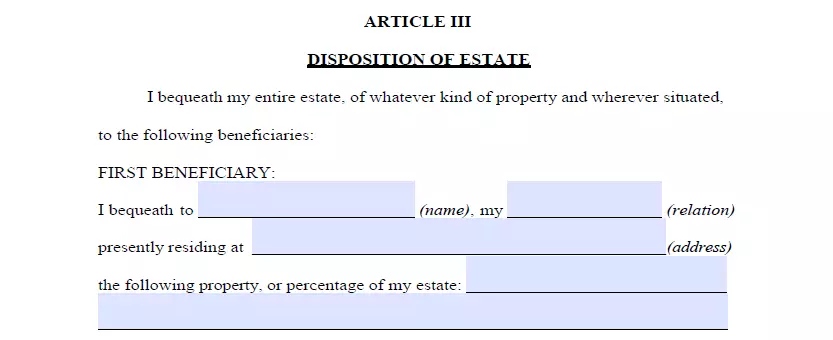

5. Indicate your beneficiaries. At this stage, you establish those who are going to receive your estate. Enter their full names, places of residence, and your relationship to them (spouse, child, friend).

6. Allocate assets. List your assets and describe how you want to distribute them amongst your inheritors if you have something on your mind other than splitting the estate equally. Property could include cash, stocks, real estate, company control, money for unpaid arrears, and any physical items of monetary value in your possession. Please be aware that there are things that cannot be distributed in the last will and testament, for example, life insurance and shared and living will property.

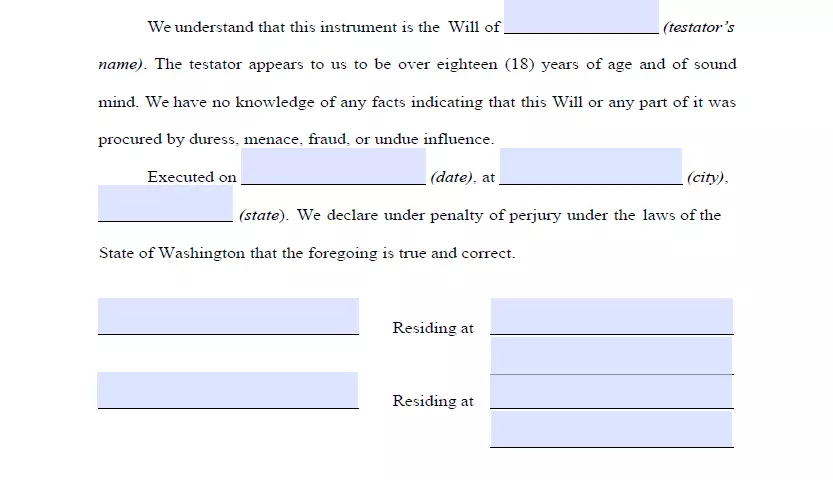

7. Proceed with the witnesses putting the signatures on the document. In accordance with Washington Revised Code, for any will to be legitimate, it has to be signed by two witnesses. They must be over 18 years of age and have no interest in your estate, which means that they cannot be inheritors. Consider picking witnesses younger than you so that they’ll be around if the will is contested in court or if some other problem arises. After a careful revision of every passage in your last will, all parties involved (you and the two witnesses) have to fill out their full names and full addresses and sign the document.

Get a Free Washington Last Will Template

Frequently Asked Questions

Is last will notarization necessary by Washington law?

In Washington, it’s not necessary to notarize your last will. But in case you would like to attach a self-proving affidavit to the last will, you must notarize it. If you make your will self-proving, the court won’t need to speak to the witnesses to ascertain the validity of the document, which will expedite the probate.

What exactly is testamentary capacity?

The testator must fulfill testamentary capacity requirements in order to write and change their last will, including being of sound mind. There are generally two requirements to fulfill: soundness of mind and age. In most states, you’ve got to be over 18 years in order to make a will. Soundness of mind means that you are conscious of your estate as well as the heirs of your possessions and thoroughly understand the aftereffects of your actions.

In Washington, will I need a self-proving affidavit?

Under Washington law, you do not need to attach a self-proving affidavit to your last will and testament. Nevertheless, it will serve you well to add this document. In the course of probate, it will act as an alternative for the witness testimony in court and facilitate the process.

Can you leave out your children or spouse from a last will and testament?

If you would like to disinherit your marriage partner, it will most likely be impossible. Washington is a community property state (sometimes called marital property). It is a type of interest documentation provided by the law. It declares that half of all assets (along with arrears) of one marriage partner is owned by the other and stays such on divorce.

In Washington, it’s possible to disinherit your spouse only with regard to your part of the property. Before getting married to someone, you can conclude a prenuptial agreement with that individual. It’ll help you to modify the way in which the marital property ought to be allocated on divorce or your passing. This is perhaps the only way to disinherit your marriage partner or limit her or his share.

For the others, it’s legal in Washington to disinherit family members in your will. Your adult children or other members of the family can be lawfully disinherited totally in your last will and testament. For doing that, include certain sections to your last will and testament.

Can a signed last will be modified in Washington?

Yes, it’s possible to change it. In Washington, in case you haven’t engaged in a contract mentioning otherwise, you can repeal or alter your last will at any moment. Moreover, it will be a good idea to revise your last will and testament at the time you go through a major life event such as:

- Child birth or adoption

- Marriage or divorce

- Real estate or a large piece of property has been bought or sold

- Significant changes in your financial position

What happens if I lose my last will?

In case the last will is lost or damaged, as indicated by Washington law, the court will admit it. However, the probate court can be unlikely to take anything except for the original of the last will to probate.

As outlined by Washington law, the absence of the will is assumed as its revocation. That suggests that the trustee must provide proof of the last will and testament’s validity, which in turn might be found to be quite complicated.

| Related documents | Times when you may need to make one |

| Codicil | You would like to make a single or several minor alterations to your last will. |

| Self-proving affidavit | You would like the probate to be easier in due time. |

| Living will | You want to be sure that, if you’re incapacitated, you are treated how you’d wish to. |

| Living trust | You need extra safety and privacy when the time to distribute your property comes. |