Colorado Last Will and Testament Form

A Colorado last will is a vital legal instrument that reflects the final wishes of a testator (will’s creator) with regard to their personal property and ways they would want it to get distributed among their heirs.

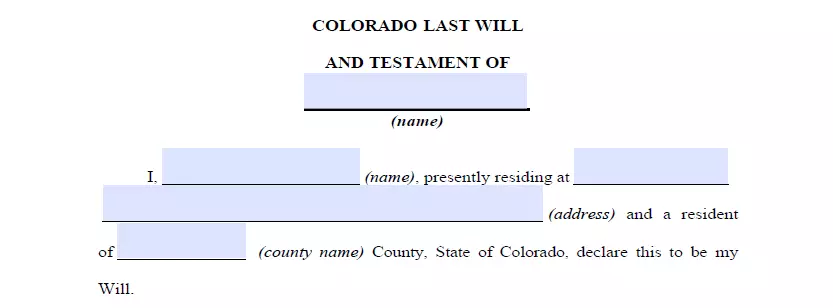

In case you are interested in downloading a printable and fillable Colorado last will and testament form, you will find such a template in PDF and DOC formats on this page, together with the recommendations regarding last will writing. You can also use our document builder for a more personalized approach.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Colorado Last Will Law and Requirements

| Requirements | State laws | |

| Statutes | Title 15 – Probate, Trusts and Fiduciaries; Article 11 – Intestate Succession and Wills | |

| Definitions | 15-10-201. General definitions | |

| Signing requirement | Two witnesses OR a notary public | 15-11-502. Execution – witnessed or notarized wills – holographic wills |

| Age of testator | 18 and older | 15-11-501. Who may make a will |

| Age of witnesses | 15-11-505. Who may witness | |

| Self-proving wills | Allowed | 15-11-504. Self-proved will |

| Handwritten wills | Recognized if meeting certain conditions | 15-11-502. Execution – witnessed or notarized wills – holographic wills |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | |

| Depositing a will | Possible with a Colorado District court A fee is $18 | 15-11-515. Deposit of will with court in testator’s lifetime , 13-32-102. Fees in probate proceedings |

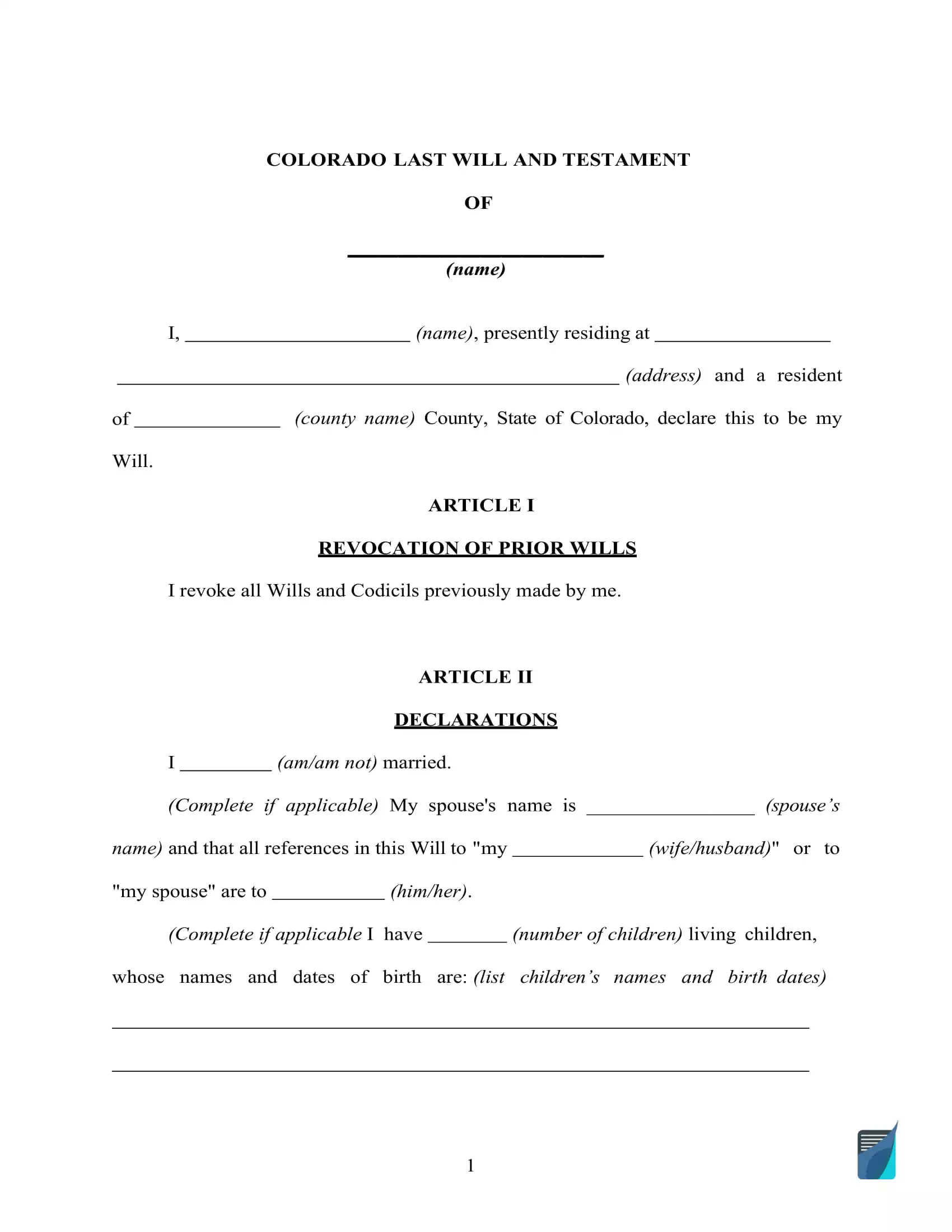

How to Write a Colorado Last Will

1. Consider your possible choices. Decide whether or not you prefer to seek the services of attorneys or write your will by yourself (either by handwriting it or using a free last will and testament form).

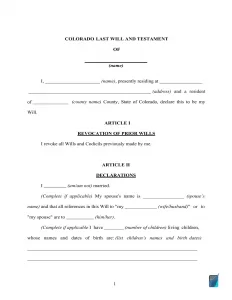

2. Specify your information. Establish the testator and their details: full name and residence (city, county, and state). Go over the remaining part of the passage, including the information you have written along with the “Expenses and Taxes” subsection.

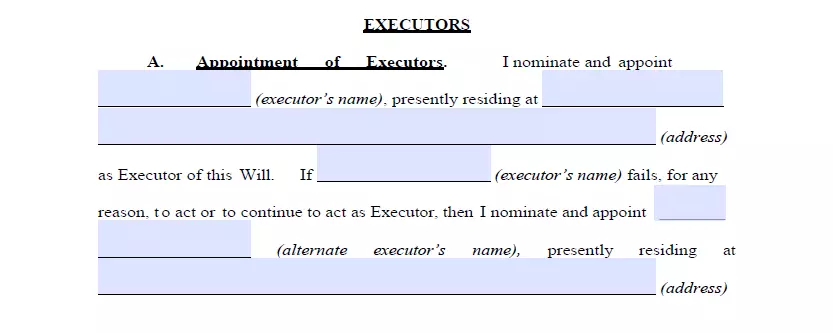

3. Establish the executor. This is the time to decide on the executor of your last will, the person liable for ensuring that all points you laid out in this document come true. To do this, you must indicate the executor’s full legal name, along with their residential details (city, county, and state). Ensure you appoint someone who lives in the same state as you do. Otherwise, there will be extra red tape and avoidable hassle connected with the process because of various special rules every state has with regards to out-of-state executors. While not required, it’s a wise idea to choose an additional person to be your executor in case the first one is unwilling or incapable of executing your will.

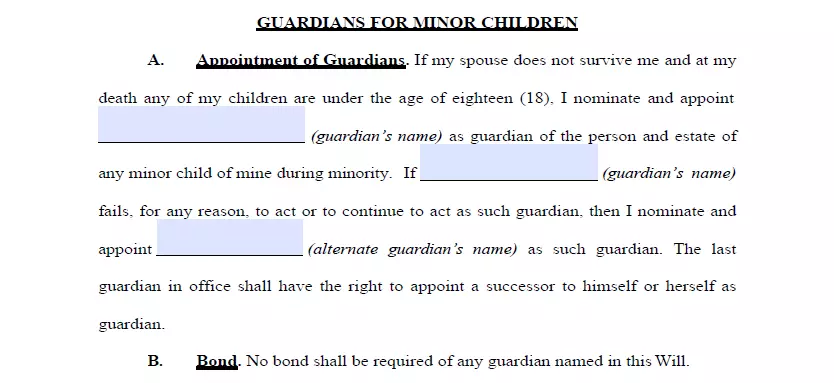

4. Determine the guardian (optional). You can choose a trusted person as a guardian in the event that you’ve got minor or dependent children that need to be taken care of. In case there are no directions pertaining to exactly who should look after your children, the guardian will be assigned by the court.

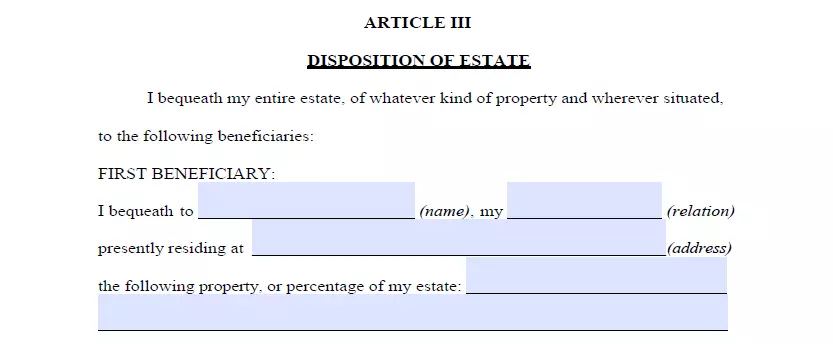

5. Specify your beneficiaries. This is where you indicate people who are going to receive your property. For every named beneficiary, enter the next particulars: full name, address, and how they are related to you.

6. Allocate property. In the event that you have an asset distribution on your mind that is not proportional, you’ll be able to explain it within this part. Assets could include money for unresolved arrears, realty, stocks, company control, cash, and any physical items of commercial worth that count among your possessions. But, joint and living will property and assets, along with your life insurance, cannot go in your will.

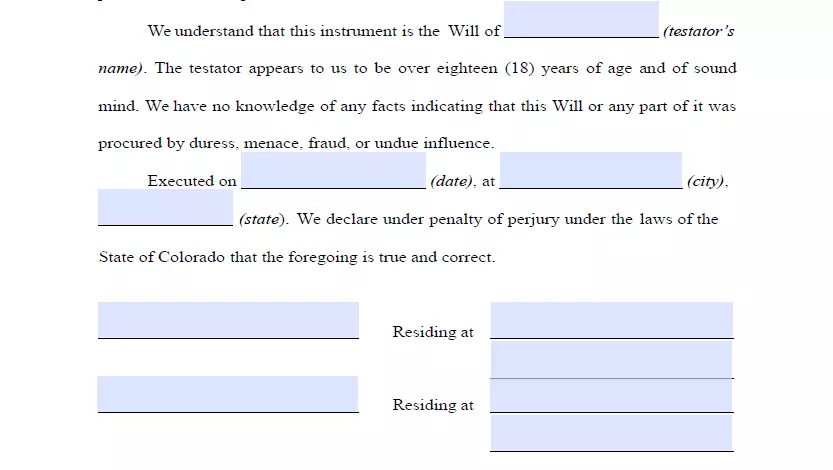

7. Ask witnesses to sign the document. Colorado Revised Statutes specify that a minimum of two witnesses have to sign a last will and testament for it to be regarded as legally binding. You can appoint another person as a witness only when they are over the age of 18 years and are uninvolved in your bequest. As a possible extra preventative measure against scenarios when your will is contested or some other problems, it makes sense to name a witness who is younger than you to make sure they will be there after you depart this life. Alternatively, the will can be acknowledged in front of a notary public. After a complete revision of each section in your last will and testament, all parties involved (you and the two witnesses) have to fill out their full names and full addresses and sign the document.

Create a Colorado Last Will and Testament

Frequently Asked Questions

Is last will notarization required by the Colorado Statute?

In Colorado, it’s not necessary to attest to your will. Nevertheless, you will need a notary public if you wish to make your will self-proving by attaching a special affidavit to the document. A self-proving last will can also make probate quicker since the court can recognize it without getting in touch with the witnesses who signed it.

Can another person change my last will?

No, it is only you (as the testator) who is permitted to modify your last will and testament. There is only one special situation when a third party is allowed to get involved. If you are physically incapable of signing your last will and testament, another person can do so in your stead yet only with your content and in your presence.

Is it possible to alter a last will after I sign it? (in Colorado)

Yes, you can modify your last will at any time.

As outlined by Colorado Law, you are allowed to adjust or annul a last will if you’re not obligated by a lawful agreement indicating the opposite.

Also, it will be a wise decision to amend your last will and testament if you undergo a significant life event such as:

- A child has been born or adopted

- You got divorced or married

- You sold or purchased real estate or major piece of property

What will happen if I have lost my last will?

In line with Colorado law, the will’s absence can be assumed as its cancellation. This means the executor must prove the last will’s legality, which in turn may become very complicated. Here’s an example of a case where the court didn’t accept a will’s copy – Estate of Perry, 33 P.3d 1235.

| Related documents | When to make it |

| Codicil | Your will needs one or a number of small adjustments. |

| Self-proving affidavit | You would like to save time and legal fees for your witnesses. |

| Living will | You would like to establish precisely what health care you want if you’re unable to communicate that yourself. |

| Living trust | You would like to avoid probate by putting your assets in a trust. |

Last Will and Testament Forms for Other States