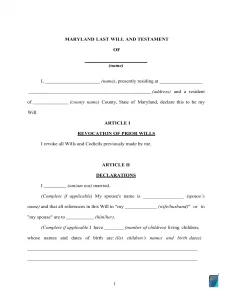

Maryland Last Will and Testament Form

A Maryland will is a document containing the last wishes of its creator (also called the testator) and ascertains how their property will be used in the event of their death. The signing requirements differ among the states, so please make sure to check the requirements table below before creating the document.

A detailed and appropriately made last will and testament can be essential to those you love after your passing, even when you do not have lots of assets to distribute.

Below, you can find a Maryland will template available for download in two formats: PDF and DOC. You can also try using our document builder to get the most our of attorney-less will creation.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Maryland Will Requirements and Laws

| Requirements | State laws | |

| Statutes | Estates and Trusts | |

| Definitions | § 4-101. Definitions | |

| Signing requirement | Two witnesses | § 4-102. Writing; signature; attestation |

| Age of testator | 18 or older | § 4-102. |

| Age of witnesses | 18 or older | No Statute |

| Self-proving wills | Redundant | A properly signed will does not require witnesses to appear in court during probate, only if contested. |

| Electronic wills | Allowed | Governor Order 20-04-10-01. See §4–102 |

| Oral wills | Not recognized | |

| Holographic wills | Recognized only under very specific conditions conditions | § 4-103. Holographic wills |

| Depositing a will | Possible with a $5 fee | § 4-202. Deposit of will |

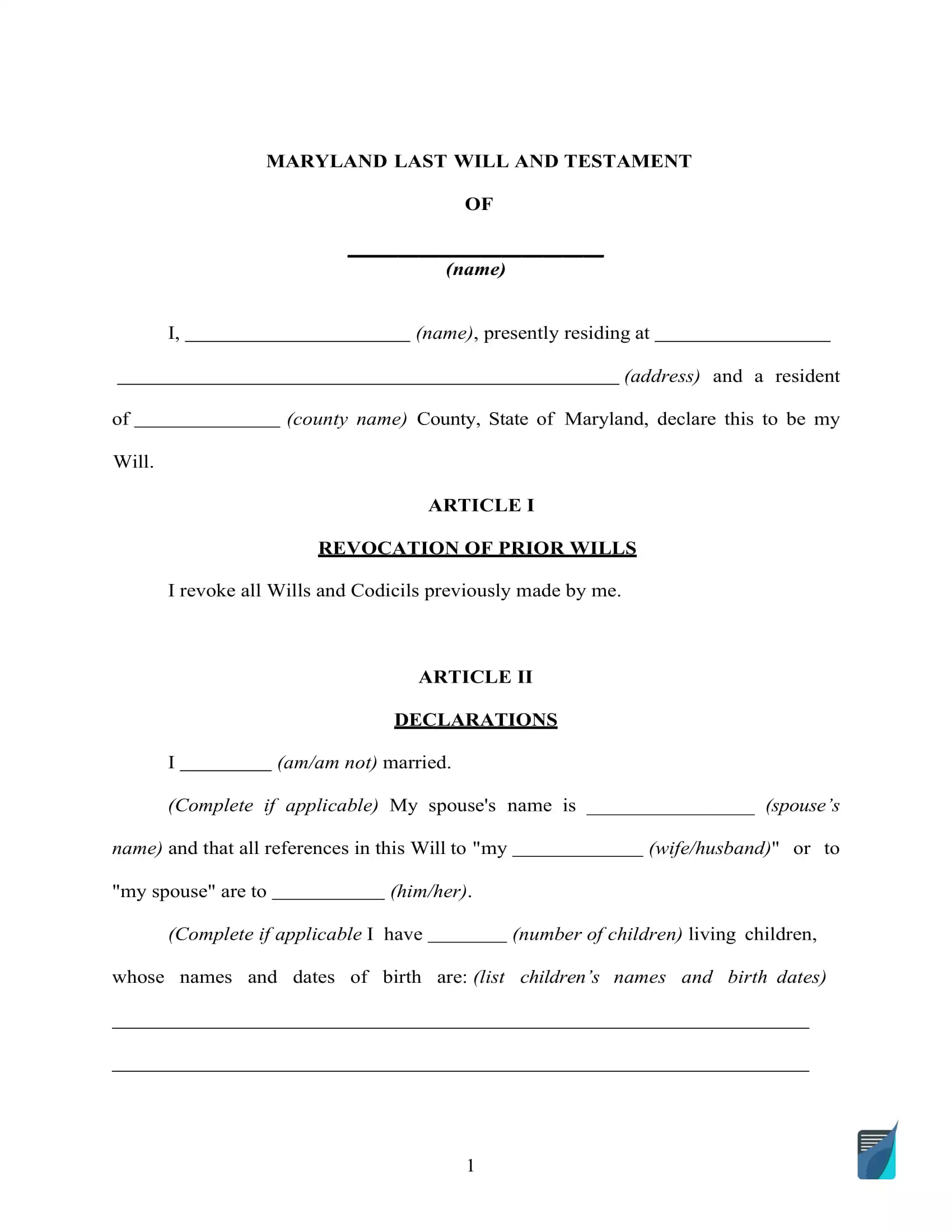

How to Write a Will in Maryland

1. Choose the format. Before beginning, you may want to decide if you want to use a fillable template or a document builder. The latter will provide you with detailed tips along the way and a more personalized experience in general.

2. Indicate your information. Fill out your full name and address (the city, county, and state of residence) to establish the testator of the will. Review the remaining portion of the section carefully, including the details you’ve entered, along with the “Expenses and Taxes” paragraph of the document.

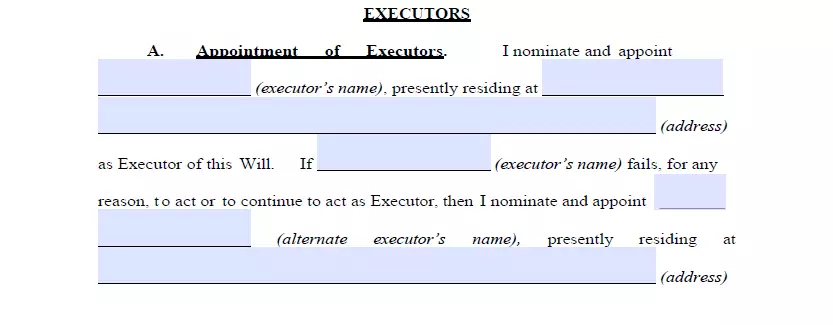

3. Determine the executor (or executrix). The next step is to decide on the executor of your will, the person responsible for making sure every little thing you write in this document gets done. Your executor’s main task is to secure your assets until all obligations and taxes are paid off and transfer what’s left to those who are entitled to it (your beneficiaries). Indicate the executor’s full name, followed by their residence specifics (city, county, and state).

A Maryland probate court will not accept a potential executor you indicated who is working as a full-time judge of any Maryland or other US state court, a clerk of court, or a register. The only exception is if this person is your surviving spouse or a relative within the third degree of kinship.

Also, be sure you appoint a person who resides in the same state as you do. Otherwise, there will be a lot more paperwork and avoidable hassle in the process because of the Maryland restrictions regarding out-of-state executors (Subtitle 5. Foreign Personal Representative)

While not required, it’s a wise idea to choose one more person to be an executor in case the first one is unwilling or not capable of executing your last will and testament.

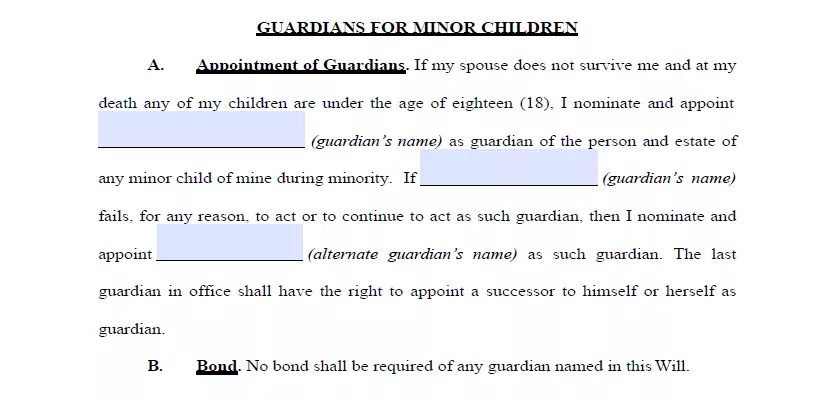

4. Indicate the guardian (optional). In the event you’ve got underage or dependent children and do not wish the court to pick a guardian for the kids when you’re no longer here, you can specify somebody you know as a guardian for your children. In some cases, witnesses may be called by the court to testify as to who would be the best guardian. If the kid is of appropriate age, the youngster may be asked who he or she would want to function as his or her guardian.

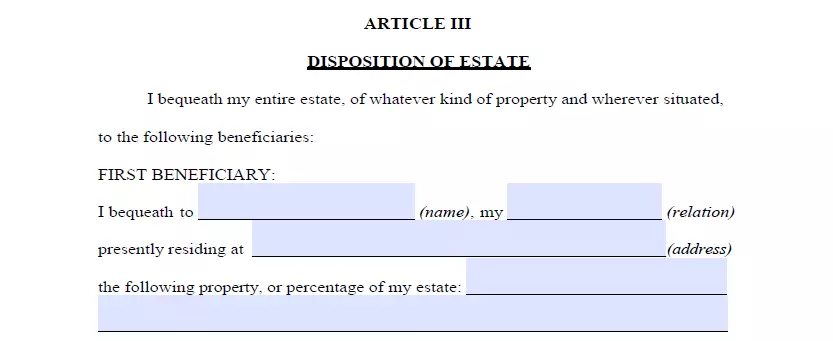

5. Specify your beneficiaries and their shares. At this point, determine those people to whom you want to bequeath your property, that is, your beneficiaries. For each beneficiary, specify these particulars: full legal name, address, and how they are related to you.

In the event that you have got an asset distribution plan that is different from even, it’s possible to describe it within this part. Property here may include cash, shares, real estate, business control, money for arrearage, as well as any physical things of commercial worth you own. The exception is shared and living trust property and assets, along with your life insurance.

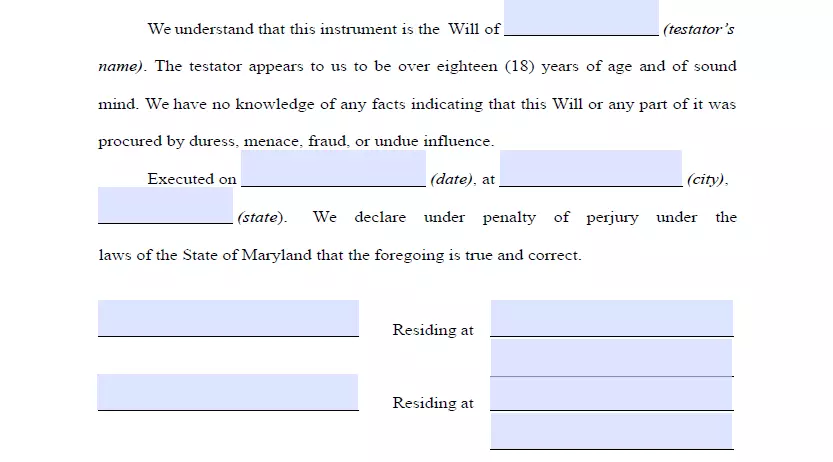

6. Ask witnesses to finalize the document. Maryland Annotated Code (§ 4-102) specifies that a minimum of two witnesses have to sign a last will so that it is regarded as legally binding. Only somebody who isn’t your beneficiary and is of 18 years or older could be chosen as a witness. Think about selecting witnesses who are younger than you to make sure that they will be around if the will is contested in court or if any other issue occurs. After a thorough review of every paragraph in your last will, all signatories (you and your two witnesses) have to fill out their full names and full addresses and sign the will.

Get a Free Maryland Last Will and Testament

Frequently Asked Questions

Must I notarize my last will in Maryland for it to be valid?

Will notarization is not required in Maryland. But, it must contain an attestation clause or have the form RW1102 attached to it.

Exactly what does it imply to be testamentary capable?

In Maryland, testators must have the testamentary capacity in order to make a valid last will and testament. An attorney can assess this mental competence after determining the testator’s mental state: their ability to recognize the property in their possession, family members and beneficiaries, and how they would like to distribute their assets after their death.

Is it allowed to disinherit your spouse?

No, you cannot disinherit your spouse in Maryland. A surviving spouse can opt for an elective share within 9 months after the testator’s death. In 2020, there were some changes to the Maryland elective share law, please read this guide for more details on this question.

Can my last will be modified without my agreement?

No, nobody but you is allowed to change your last will. A third party is only able to sign the last will if you are physically incapable f doing so.

Can a signed, typewritten last will be altered in Maryland?

Yes, it can be done. You can use a codicil for minor changes or create an entirely new will if you need to change a lot.

What will be the costs of having lost a will?

Maryland law indicates that a last will can be admitted in case it is lost or damaged. However, the personal representative of the testator can file a petition to admit a copy of the original will. In such a case, this representative must prove that the testator did not have an intention to revoke the will by destroying it. (Rule 6-153 – Admission of Copy of Executed Will)

| Related documents | When to make one |

| Codicil | There are a number of small changes you’d like to make to your last will. |

| Self-proving affidavit | You would like the probate to be quicker when it’s necessary. |

| Living will | You would like to be sure that, if you are incapacitated, you are treated exactly how you’d like to. |

| Living trust | You need extra safety and confidentiality when the time to distribute your possessions comes. |

Last Will and Testament Forms for Other States