Free Connecticut Durable Power of Attorney Form

The Connecticut durable power of attorney is a legal form allowing you to appoint someone you trust, often referred to as an “agent” or “attorney-in-fact,” to manage your financial affairs if you become incapacitated or are unable to handle them yourself. This form grants the agent broad powers to handle banking, real estate transactions, personal property management, and other financial decisions.

The “durable” in this power of attorney means that the agent’s authority continues even after you are incapacitated. Moreover, the principal can specify whether the durable power of attorney should take effect immediately or only upon the occurrence of a future event, typically the incapacity, as verified by a medical professional.

The form is an essential tool for estate planning, ensuring that the principal’s financial matters are handled according to their wishes, even if they are unable to manage them personally. Note that a durable power of attorney deals only with managing your finances and property, not your health. It becomes effective when you cannot handle these matters due to physical incapacity. To designate an agent for end-of-life care, consider other Connecticut POA forms.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Connecticut Signing Requirements and Laws

In Connecticut, the signing requirements and laws governing durable POA are delineated under the Connecticut Revised Statutes, specifically sections that govern powers of attorney and their execution.

When creating a Durable Financial Power of Attorney, the principal (the person granting the power) must be mentally competent when signing. This means they understand the nature and scope of the powers they are granting to their agent. The document must be written clearly to prevent misunderstandings about the extent of authority given. The main signing requirements include:

- The principal’s signature on a durable financial power of attorney must be notarized. This formal step confirms the principal’s identity and signature.

- At least two adults who are not named as agents in the document should witness the principal’s signature. These witnesses must not have any vested interest in the principal’s estate.

- The signing must be done voluntarily, without any coercion or undue influence.

The termination of a power of attorney or an agent’s authority is governed by Section 1-350i of the Connecticut Revised Statutes. The principal can revoke the power of attorney at any time as long as they are mentally competent.

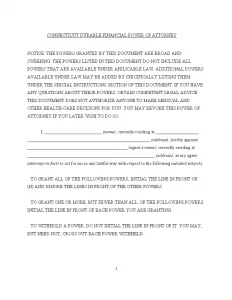

Connecticut Durable Power of Attorney Form Details

| Document Name | Connecticut Durable Power of Attorney Form |

| Other Names | Connecticut Financial Durable Power of Attorney, CT DPOA |

| Relevant Laws | Connecticut Revised Statutes, Chapter 15c, Section 1-350d |

| Signing Requirements | Notary Public and Two Witnesses |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

Durable POA documents are used in each and every state. Take a look at other popular DPOA forms frequently filled out by Americans.

Steps to Complete the Form

When filling out the Connecticut durable power of attorney form, you must ensure all sections are completed correctly to grant your chosen agent the authority to manage your financial matters.

1. Add Principal’s Information

Start by entering your full legal name and address in the section provided. This identifies you as the principal who is granting the power of attorney.

2. Appoint Your Agent

Fill in the name and address of the person you wish to appoint as your attorney-in-fact (agent). This person will have the authority to act on your behalf in financial matters.

3. Specify Powers to Grant

The form lists various financial powers from which you can grant authority to your agent. These include handling real property, managing tangible personal property, dealing with stocks and bonds, and more. If you wish to withhold any specific power, strike through the corresponding subparagraph and initial in the box opposite to indicate your decision.

4. Add Special Instructions and Limitations

If you wish to set specific limitations or special instructions for your agent, write these directives in the provided space. This section allows you to customize the powers granted, including any restrictions on using your property to benefit the agent.

5. Designate Successor Agents

Optionally, you can designate successor agents who will take over if your primary agent is unable or unwilling to act. Provide the names and addresses of these successors in the spaces provided.

6. Choose a Conservator of Estate

If you want to designate someone to serve as a conservator of your estate, specify this individual’s name. You can also appoint an alternate if your first choice is unable to serve.

7. Set the Effective Date

Determine when a power of attorney will become effective. If it’s to be effective immediately, no further specification is needed. If it’s to be effective upon a certain condition, such as your incapacitation, specify this in the special instructions.

8. Sign and Date the Form

After completing all sections, sign and date the form at the end. This must be done in the presence of a notary public and two witnesses who will also sign and print their names to validate the form.

9. Notarization

Ensure a Commissioner of the Superior Court or a Notary Public acknowledges your signature. The notary will confirm your identity and that you are signing the form voluntarily and of your own free will.

After completing the above steps, review the document to ensure all information is correct and reflects your wishes regarding delegating your financial powers. This final check is essential to prevent issues or disputes regarding the document’s validity.

Listed here are various other Connecticut documents filled out by our users. Try our step-by-step builder to customize these forms to your needs.

Download a Free Connecticut Durable Power of Attorney Form