Free Maine Durable Power of Attorney Form

The Maine durable power of attorney is a legal form that allows an individual (the principal) to designate another person (the agent or attorney-in-fact) to manage their financial affairs. This document remains effective even if the principal becomes incapacitated, distinguishing it from a non-durable power of attorney.

The scope of authority granted to the agent can be broad or specific, depending on the principal’s preferences. Examples include handling banking, real estate, investments, and tax matters, among other financial responsibilities.

The agent must act in the principal’s best interests, maintain accurate records of transactions, and avoid conflicts of interest. They are also accountable to the principal and may be required to report their actions if requested. At the same time, the principal can revoke the durable POA at any time as long as they are mentally competent.

A properly completed Maine POA form provides peace of mind, ensuring that all important matters are handled smoothly during the principal’s incapacity.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Maine Signing Requirements and Laws

In Maine, the signing requirements and laws governing a durable POA are outlined in the Maine Probate Code, specifically under Title 18-C, Part 9: Maine Uniform Power of Attorney Act. This legislation ensures that a power of attorney is executed correctly, even if the principal becomes incapacitated:

- Under Section 5-904, a power of attorney is considered durable unless it expressly provides that the principal’s incapacity terminates it. The document remains in effect even if the principal becomes incapacitated, allowing the designated agent to continue managing all affairs without interruption.

- According to Section 5-905, a power of attorney must be signed by the principal or by another person in the principal’s conscious presence and at their direction. The document must be acknowledged before a notary public or another individual authorized by law to take acknowledgments.

- As per Section 5-110, the principal retains the right to revoke the power of attorney at any time, provided they are competent. The document also terminates automatically upon the principal’s death.

The agent is legally bound to act in the principal’s best interest, manage the principal’s affairs prudently, avoid conflicts of interest, and comply with the principal’s expectations.

Maine Durable Power of Attorney Form Details

| Document Name | Maine Durable Power of Attorney Form |

| Other Names | Maine Financial Durable Power of Attorney, ME DPOA |

| Relevant Laws | Maine Revised Statutes, Title 18-C, Section 5-905 |

| Signing Requirements | Notary Public or Witnesses |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

DPOA docs are among the most commonly used ones within the USA. Here are some of the most requested durable power of attorney papers.

Steps to Complete the Form

Following these steps ensures that your Maine durable financial power of attorney is correctly filled out and ready to be used as needed.

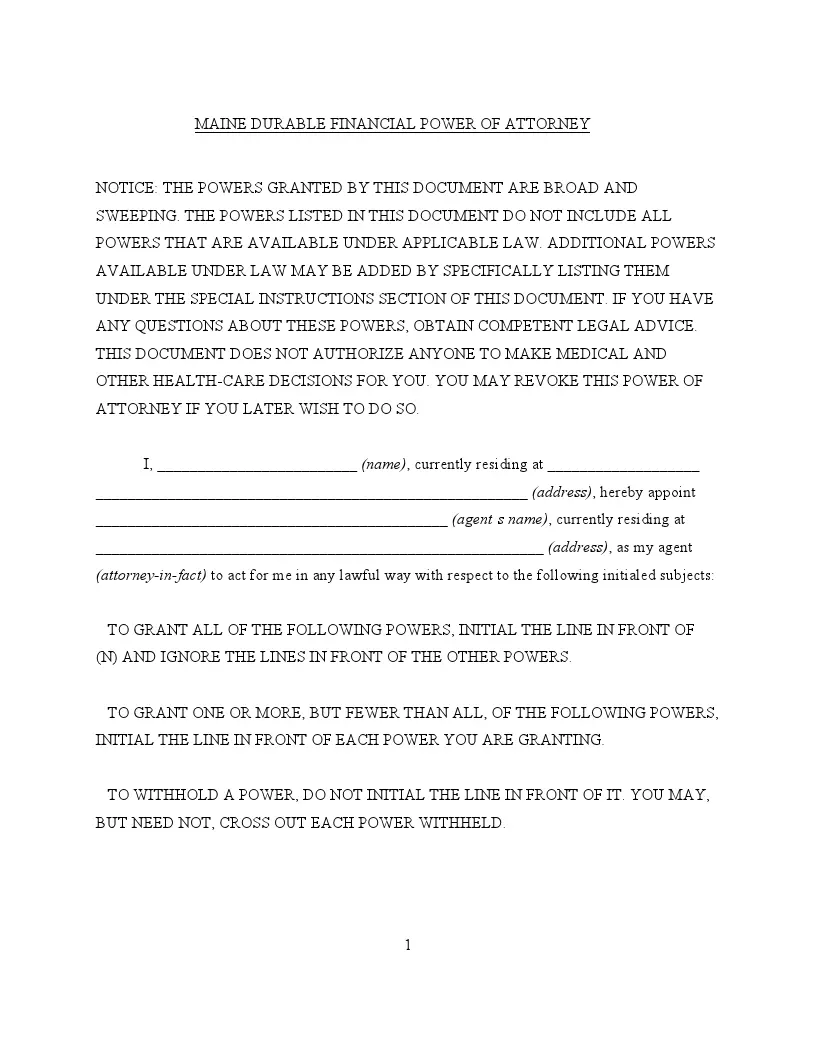

1. Enter Your Information

Begin by providing your full name and current residential address in the spaces provided at the beginning of the document. This first field identifies you as the principal granting the power of attorney.

2. Appoint Your Agent

Enter the full name and residential address of the person you appoint as your agent or attorney-in-fact. This individual will be able to manage your financial affairs according to the powers you grant.

3. Specify Granted Powers

You must initial next to each power you wish to grant to your agent. These powers range from real property transactions to tax matters. If you prefer to grant all listed powers, simply initial it next to the option (N), which includes all powers, and ignore the other lines.

4. Add Special Instructions

If the powers granted have specific conditions or limitations, detail these in the “Special Instructions” section. It can include additional powers not listed or specific directives on handling certain matters.

5. Determine Effectiveness

Decide when the power of attorney will become effective. You can choose for it to be effective immediately, from a specified future date, or only upon your incapacitation. Initial next to your choice to confirm.

6. Appoint a Successor Agent

If desired, you can appoint a successor agent who will take over if your primary agent is unable or unwilling to serve. Provide the name and address of the successor agent in the designated section.

7. Sign and Date the Document

At the end of the form, sign and print your name. Record the date you execute the document to formalize the power of attorney.

8. Notarization

The document must be notarized to be legally binding. Take the completed form to a notary public. The notary will verify your identity and understanding of the document’s implications, witness your signature, and seal the form.

Listed here are various other Maine documents filled out by our users. Try our step-by-step builder to customize these forms to your needs.

Download a Free Maine Durable Power of Attorney Form