Free Rhode Island Durable Power of Attorney Form

The Rhode Island durable power of attorney for finances is a legal form that allows one person (referred to as the “principal”) to designate an “agent” or “attorney-in-fact” to manage their financial affairs. This arrangement can include handling tasks such as paying bills, managing investments, and buying or selling property.

The durable power of attorney remains in effect even if the principal becomes incapacitated or unable to make decisions themselves. This is particularly important for ensuring that financial matters are handled in the event of an illness or disability. In Rhode Island, like in many other states, the durable power of attorney must be written specifically and include certain phrases to ensure validity and durability. The principal has the flexibility to define the scope of the agent’s powers, which can be broad or limited to specific activities.

Unlike a health care proxy, a durable power of attorney is not intended to manage health-related decisions. For matters involving these issues, use the correct Rhode Island POA forms to ensure that they comply with state regulations.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Rhode Island Signing Requirements and Laws

In Rhode Island, the signing requirements and laws governing durable power of attorney are primarily outlined in the Rhode Island Short Form Power of Attorney Act, specifically under § 18-16. According to this statute, a power of attorney must adhere to several specific criteria to be considered valid:

- The document must be signed by the principal.

- The signature must be notarized by a notary public.

This ensures that the principal’s decision to delegate authority is made without duress and is duly verified.

Rhode Island law does not specifically define the term “durable” in relation to power of attorney. However, it allows the principal to specify the duration in the document itself (§ 18-16-2). This means the principal can state explicitly that the power of attorney is to remain effective even if they become incapacitated. If no duration is specified, it is generally understood that a power of attorney will continue until it is revoked or the principal passes away.

In Rhode Island, when a principal appoints more than one agent in a durable power of attorney, there are specific provisions regarding how these agents can exercise their granted powers. According to the state’s guidelines, unless the principal explicitly states otherwise in the statutory short form power of attorney, agents designated together must act jointly.

Rhode Island Durable Power of Attorney Form Details

| Document Name | Rhode Island Durable Power of Attorney Form |

| Other Names | Rhode Island Financial Durable Power of Attorney, RI DPOA |

| Relevant Laws | Rhode Island General Laws, Section 18-16-2 |

| Signing Requirements | Notary Public |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

Durable POA documents are used in each and every state. Take a look at other popular DPOA forms frequently filled out by Americans.

Steps to Complete the Form

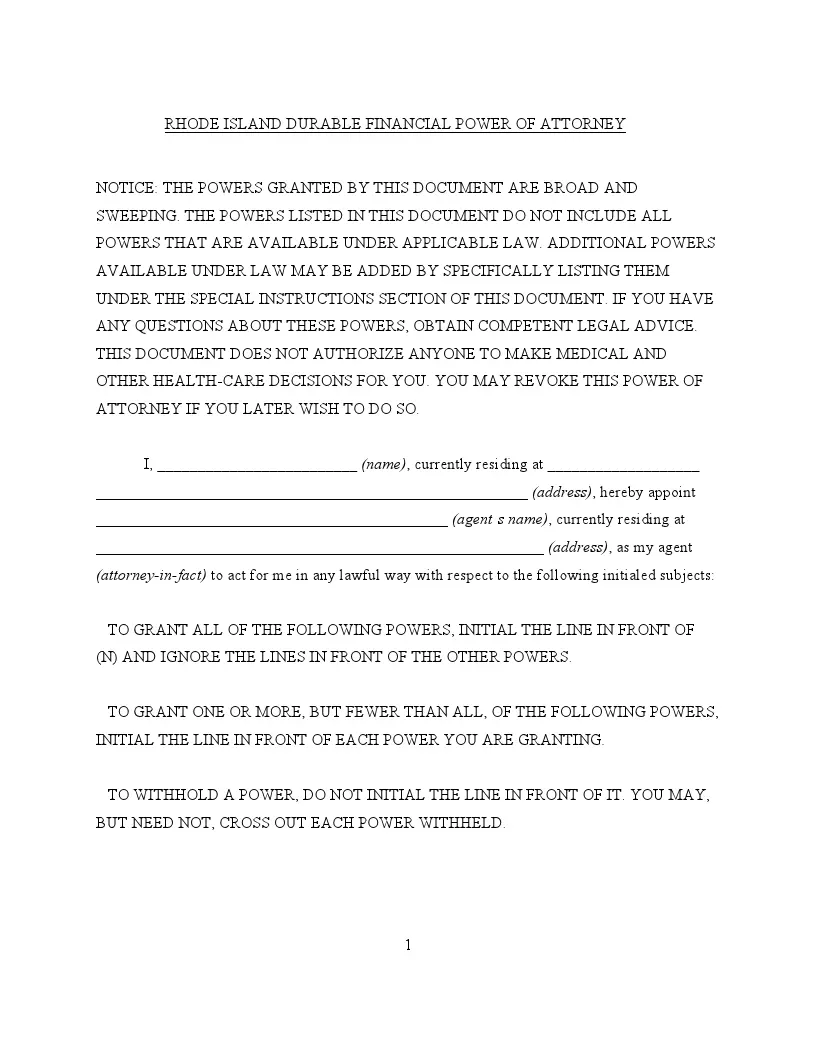

Completing the Rhode Island durable statutory power of attorney form involves a series of steps to ensure it is properly executed and legally binding.

1. Identify the Principal and Agent

Start by entering your full name and address where indicated. You will then appoint your attorney-in-fact by writing their full name and address. If appointing a second agent, include their information as well. Specify if these agents should act “severally” (independently) or “jointly” (together), depending on your preference.

2. Granting Authority

Review the list of powers from (A) to (J), which cover areas such as real estate, banking, and insurance transactions. Strike out any powers you do not wish to grant by drawing a line through the text and initialing beside each. This action customizes the extent of authority given to your agent.

3. Set the Duration

Decide on the duration of the power of attorney. Initial next to option (A) to make it indefinite, or option (B) to set a specific termination date. Fill in the termination date if you choose a finite duration.

4. Sign and Seal

Once all sections are completed to your satisfaction, sign the document in the presence of a notary. Ensure the signing process is properly witnessed and notarized as required by law.

5. Notarization

The document must be acknowledged as prescribed for acknowledging real property conveyances. Have the notary public sign and seal the document to attest to the validity of your signature and the execution of a power of attorney.

Listed here are various other Rhode Island documents filled out by our users. Try our step-by-step builder to customize these forms to your needs.

Download a Free Rhode Island Durable Power of Attorney Form