Illinois Bill of Sale Form

Illinois bill of sale form serves as a legal justification of a transaction between the two parties, the seller and the buyer, of the personal property. It is not an official state document but can be customized and accomplished by every person. The document contains information about the two parties, including names and contact details, purchase price, and the two signatures as proof of agreement.

You can download the ready bill of sale forms on our site for the transactions in Idaho. They include the most common types of bills of sale and the general one containing the general fields to be filled for every type of transaction. You can also personalize your own form, including the lines applicable to your transaction.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Illinois Vehicle Bill of Sale Form |

| Other Names | Illinois Car Bill of Sale, Illinois Automobile Bill of Sale |

| DMV | Office of the Illinois Secretary of State |

| Vehicle Registration Fee | $151 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 59 |

Illinois Bill of Sale Forms by Type

Whether you conclude a private sale agreement for a motor vehicle, a boat, or any other product, you will find different types of templates for your use. They have the needed information and can be downloaded from the site.

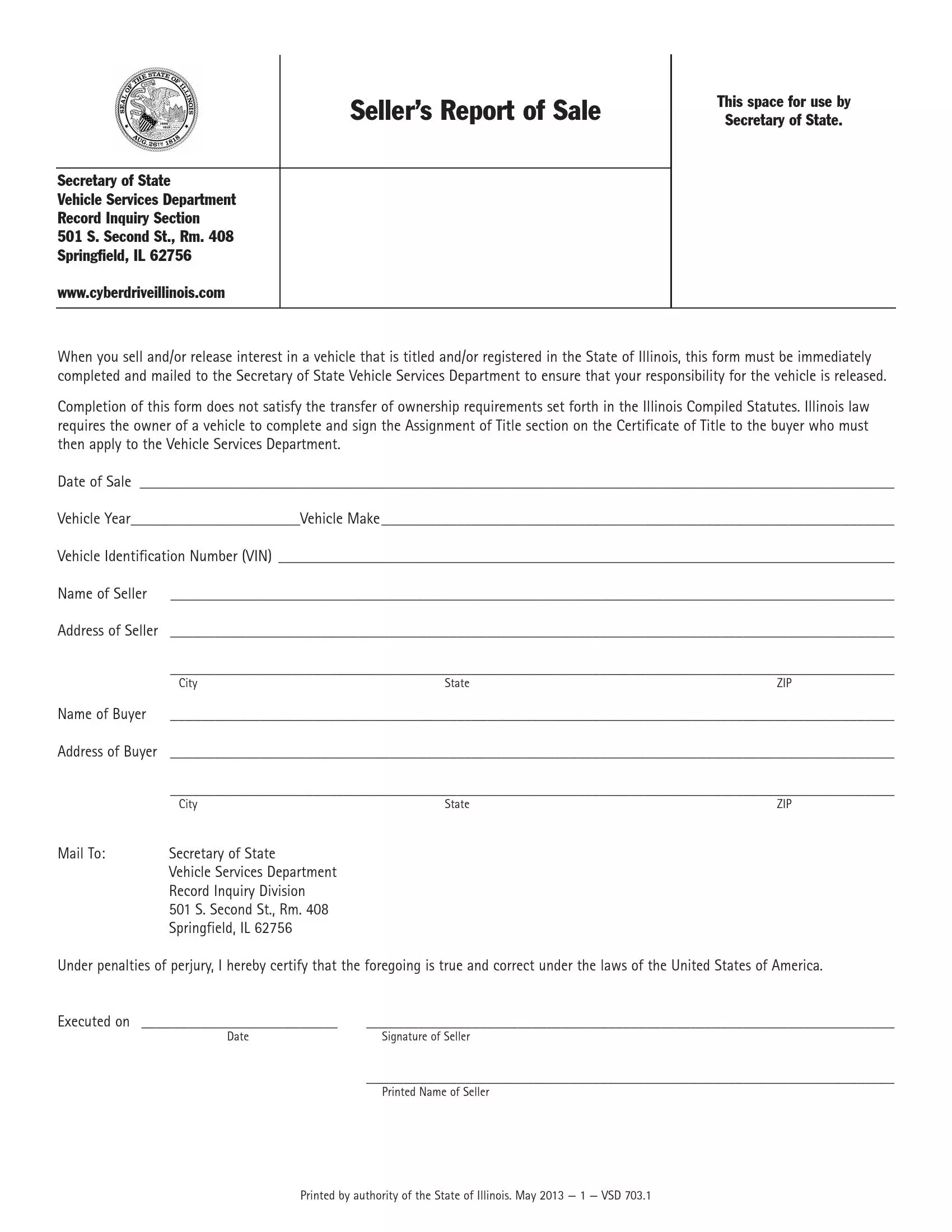

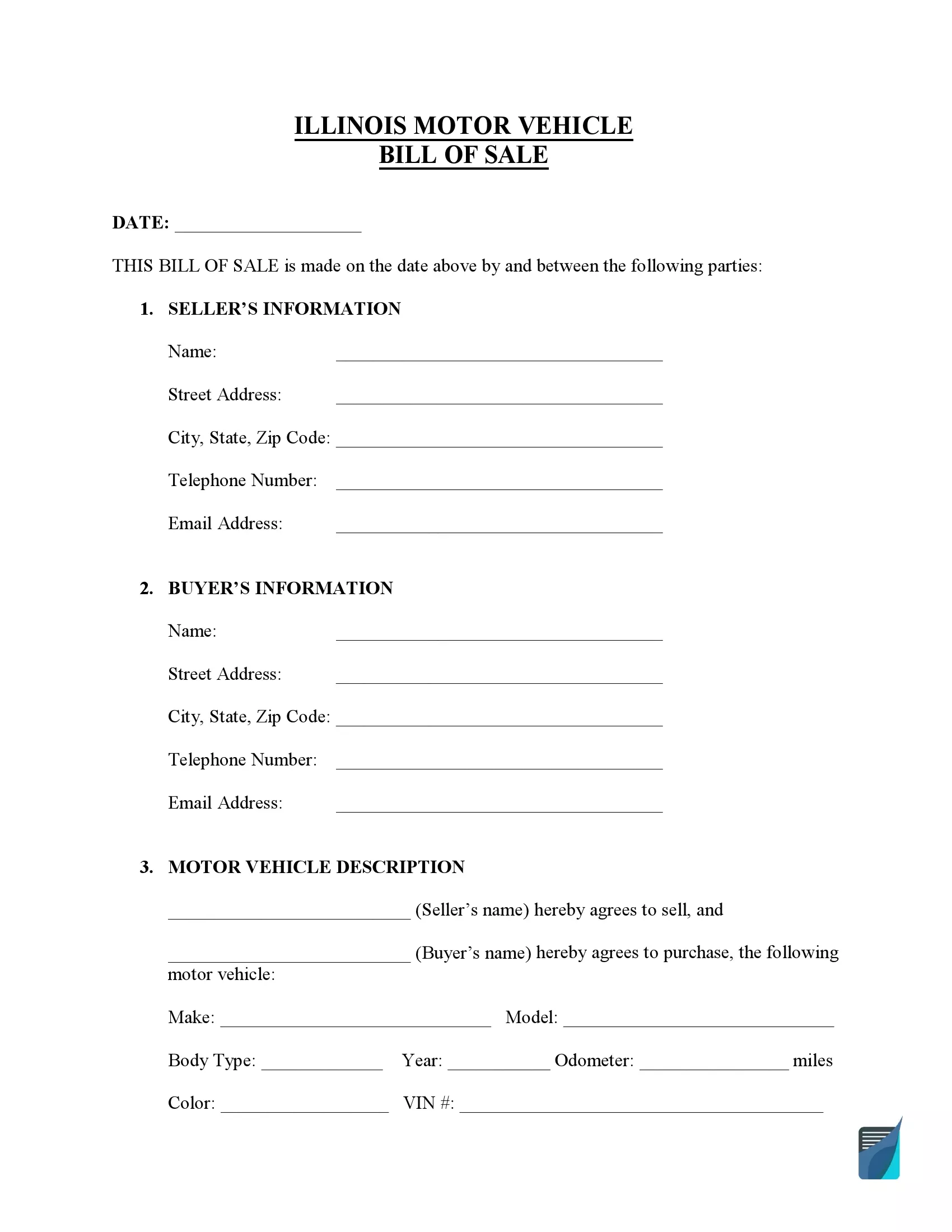

Illinois motor vehicle bill of sale is a document confirming another owner’s purchase of a new or old vehicle. It contains the needed information about the vehicle and the signature of a new owner. Illinois’s newly acquired motor vehicles should be registered with the local Secretary of State. Illinois residents have 20 days after the purchase to register the vehicle.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

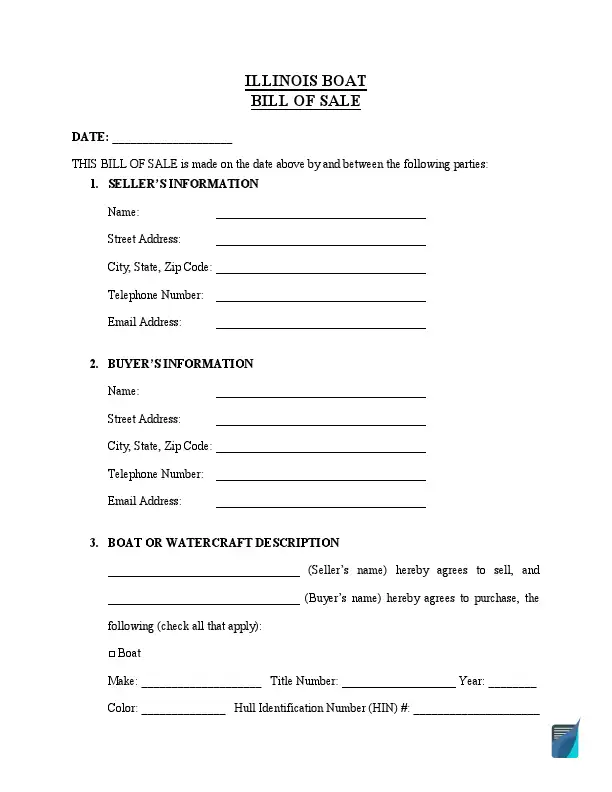

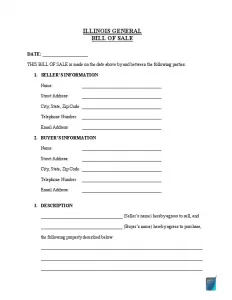

Use an Illinois boat bill of sale to sign an ownership transfer agreement between two parties. The form should be presented to the Illinois Department of Natural Resources for vessel registration. Boat registrations in Illinois expire every three years and should be renewed before the expiration date. The renewal may take up to 10 weeks, so you must have a copy of the application to continue operating a vessel.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

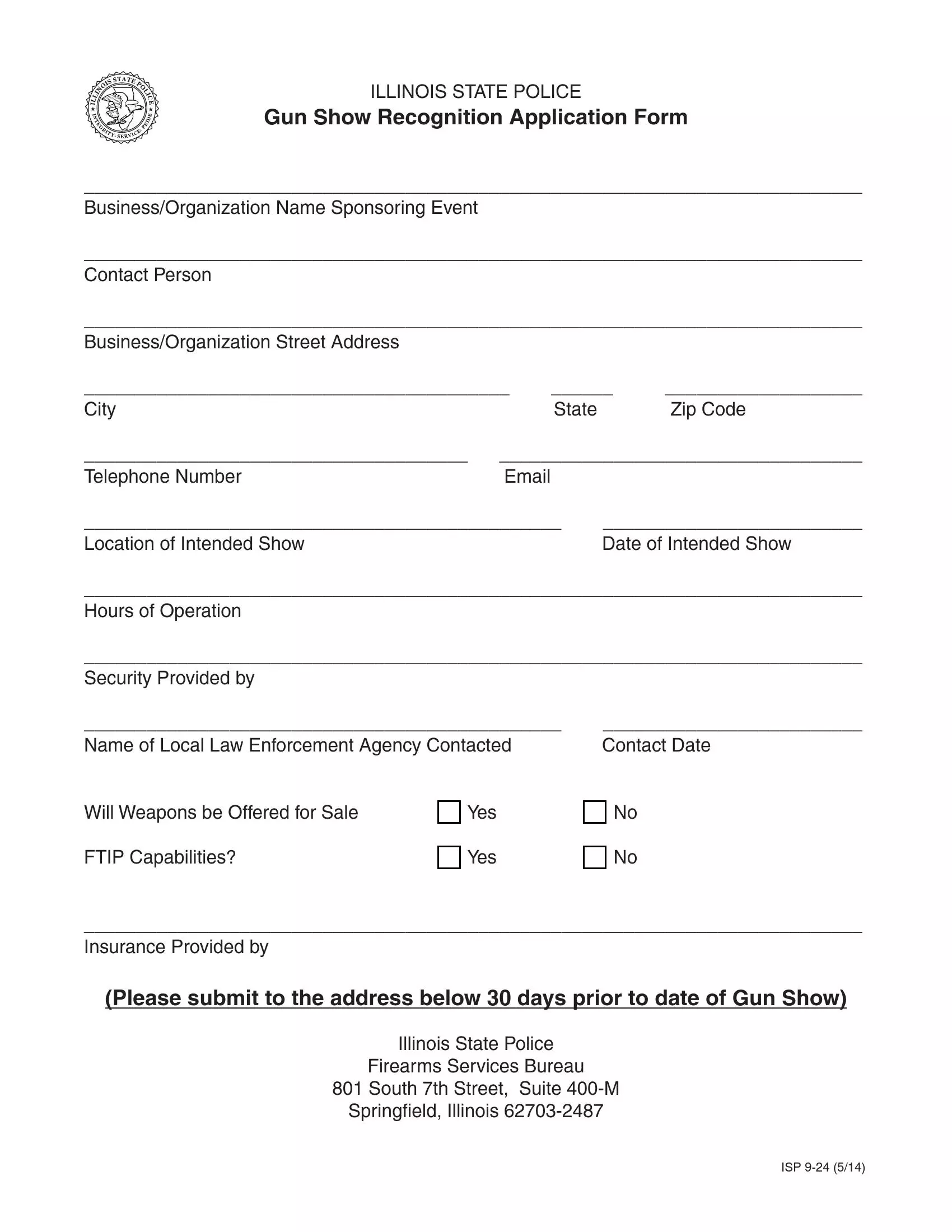

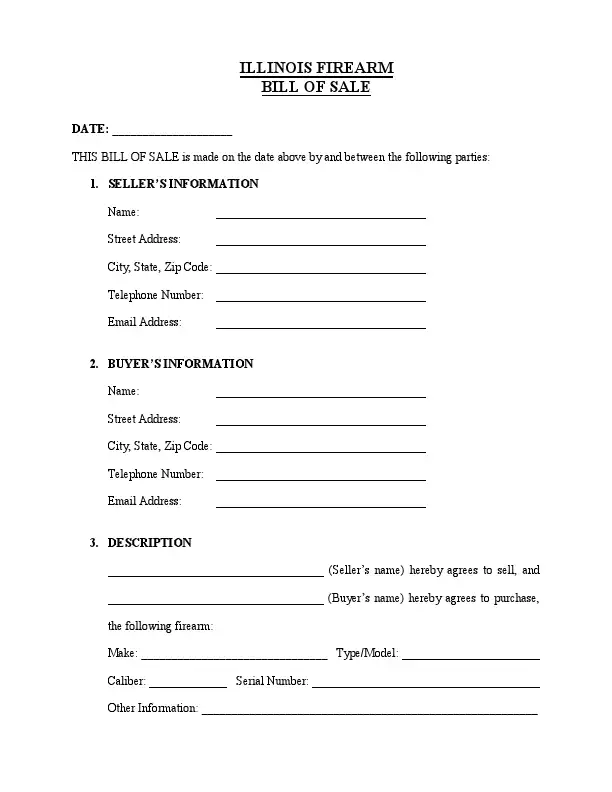

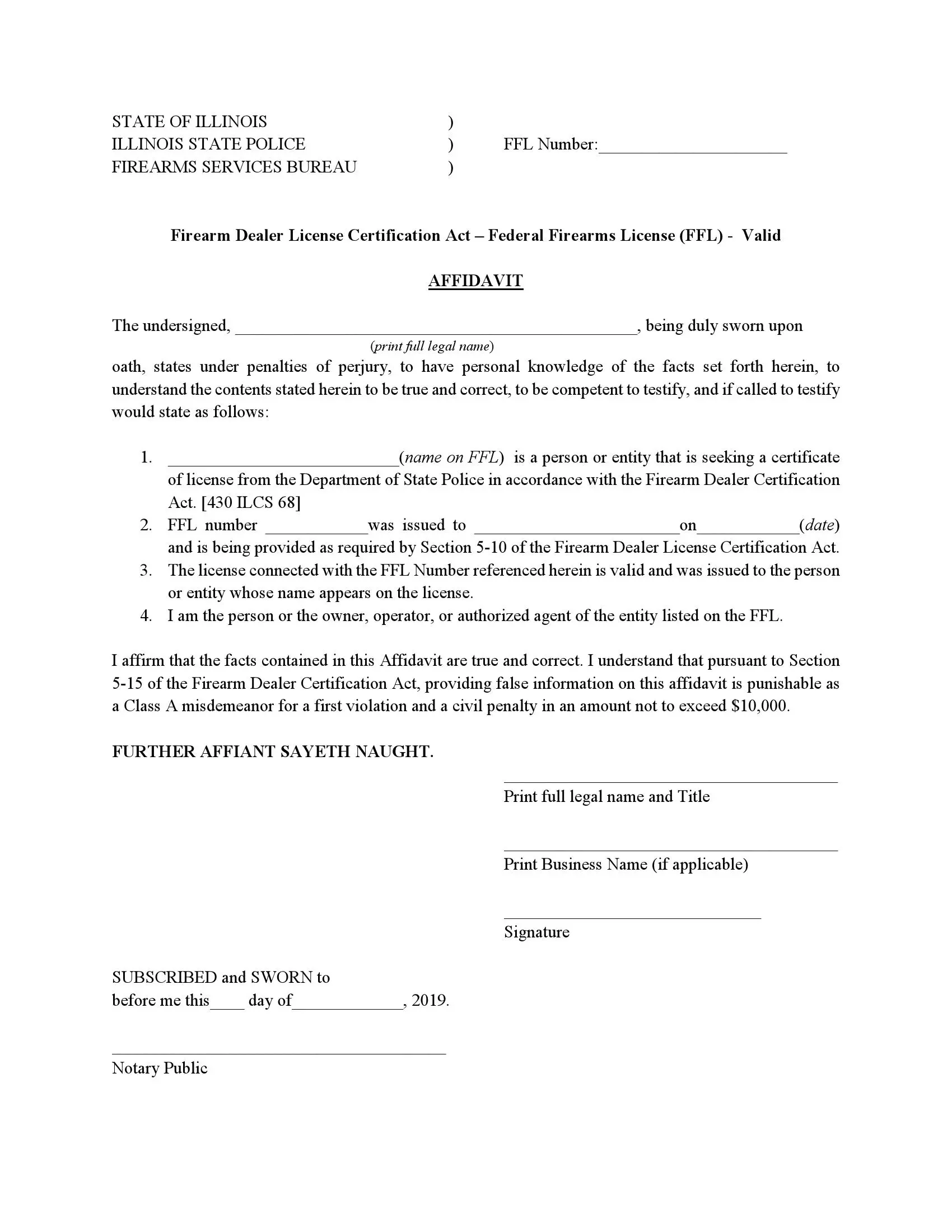

Fill in the Illinois gun bill of sale to legally prove the agreement of gun ownership transfer between the private seller and purchaser. The buyer of a firearm should have a valid Firearm Owner’s Identification to possess a gun. This card is usually valid for ten years.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

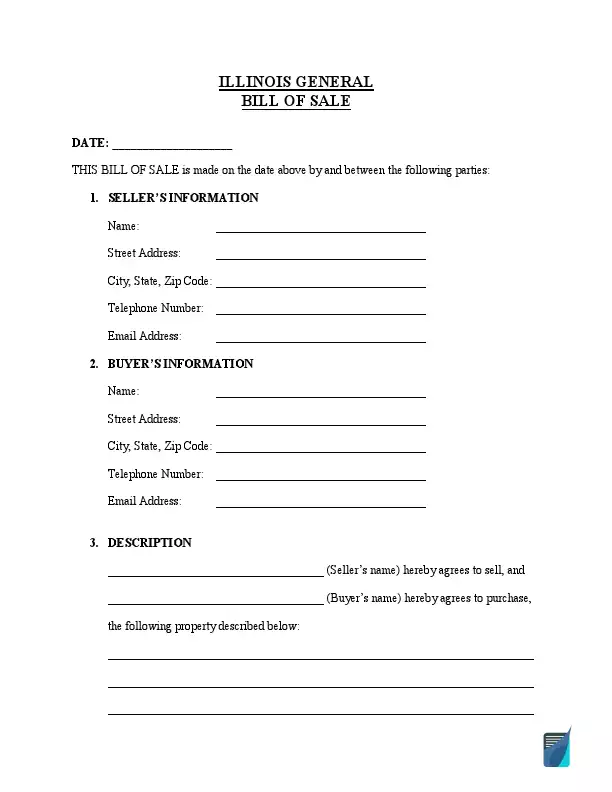

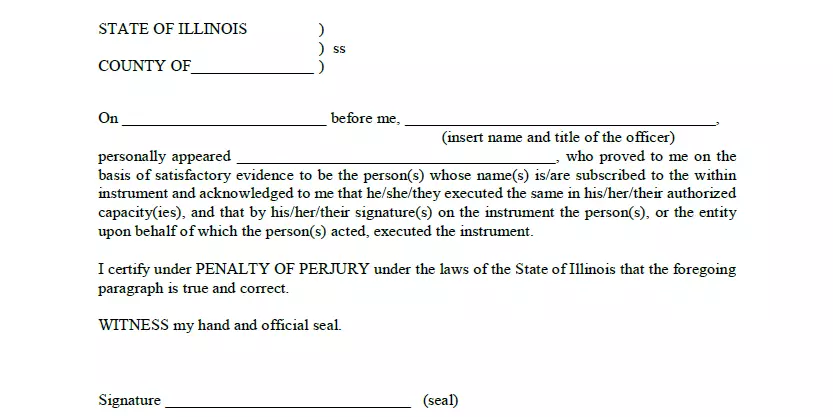

A general bill of sale is a standardized form that can be used for private transactions in Illinois state. Even though they are much more common than the specified templates, you can add and personalize the information regarding your specific transaction.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

How to Write an IL Vehicle Bill of Sale

An Illinois motor vehicle bill of sale records the transfer of vehicle ownership from a private seller to a buyer. The form provides details on changing a vehicle’s possession and any known defects. You will need this form when registering your motor vehicle.

The step-by-step guidelines below are related to the bill of sale form developed by our specialists. If your local authorities provide official bills of sale, you can use their forms instead.

Step 1: Specify the date

The first step is to specify the date when the bill of sale is created.

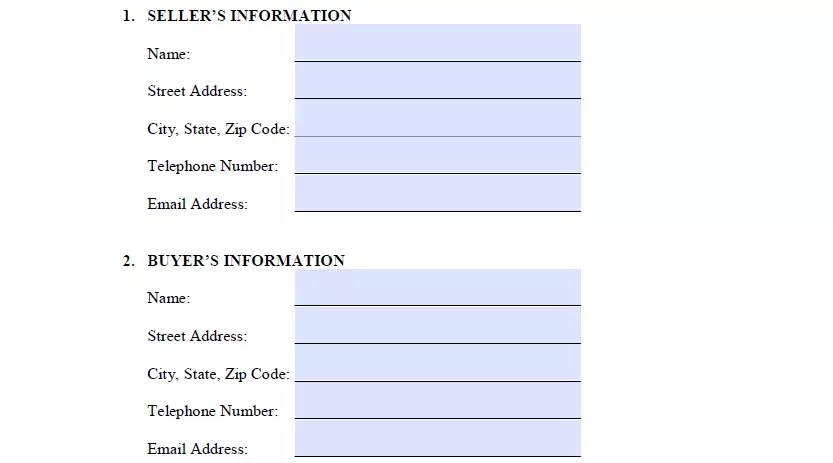

Step 2: Enter the seller’s and buyer’s details

Next, you will have to enter the relevant seller’s and buyer’s details, including for each of them:

- Full legal name

- Street address

- City of residence

- State of residence

- Area code

- Phone number

- Email address

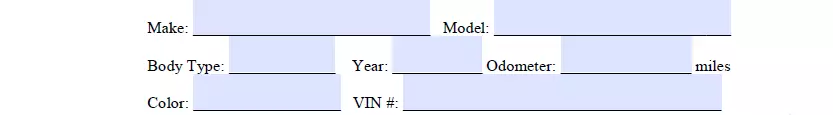

Step 3: Provide the vehicle’s description

The following step is to describe the vehicle being sold. Here, you will need to include such details as:

- Manufacturer

- Vehicle’s model

- Vehicle’s body style

- Model year (MY)

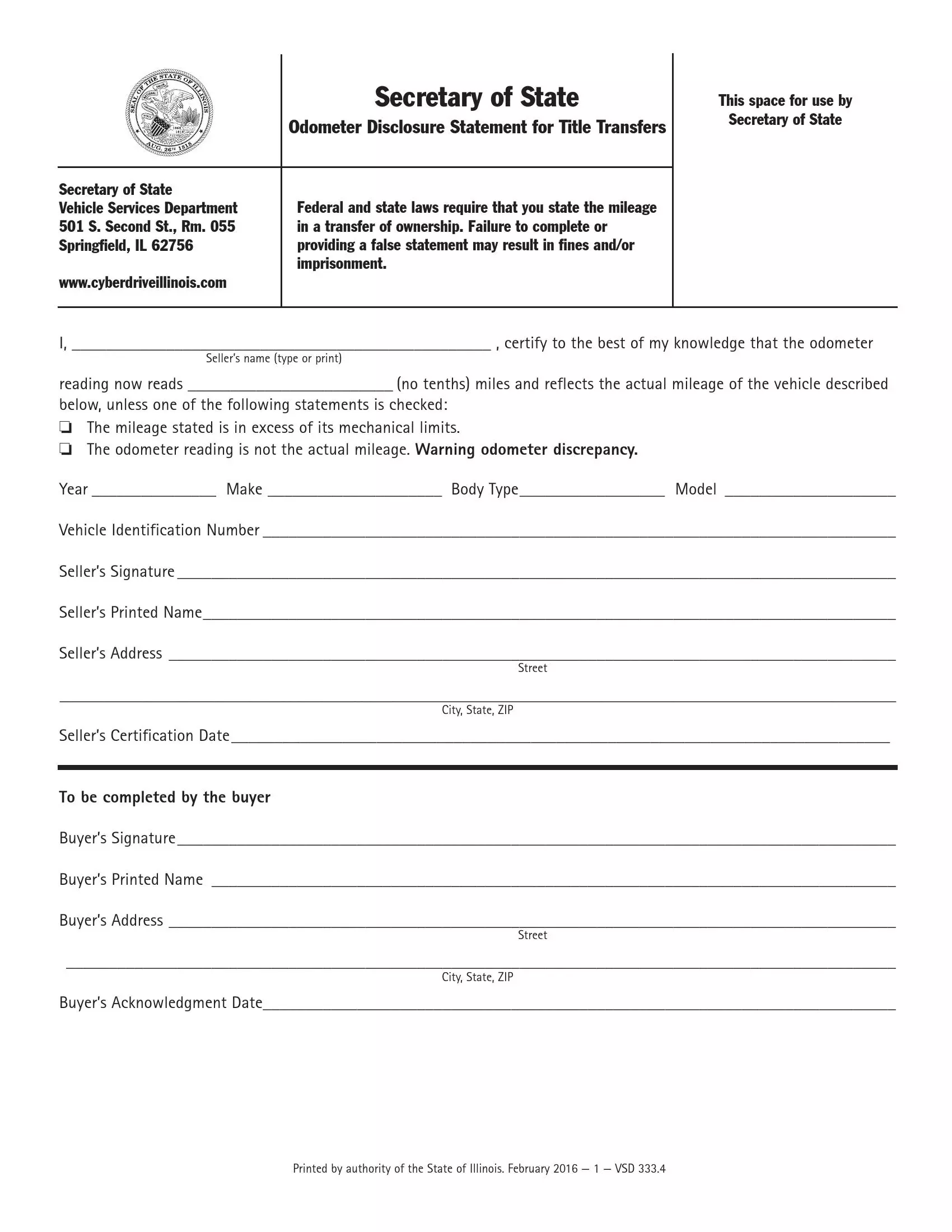

- Odometer reading

- Color

- Vehicle Identification Number (VIN)

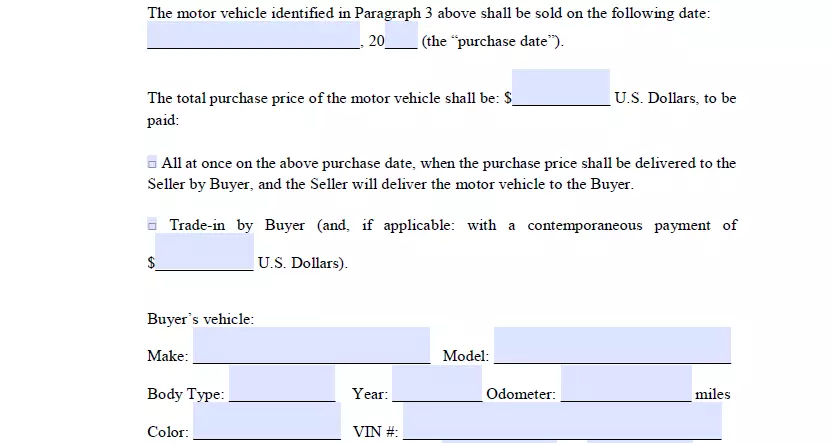

Step 4: Enter the purchase date and price

In this section, you will need to specify the purchase date and state the overall price that has to be paid for the vehicle. Then, decide on one of the sale methods:

- One-time payment. The property owner is given the entire amount of money from the purchaser in one transaction and presents the vehicle to the purchaser within the same day.

- Trade-in. If this particular option is selected, the selling party trades their motor vehicle for the vehicle offered by the buyer. If the buyer’s vehicle is cheaper, they’ll need to even that out with a supplementary payment. In this case, the document should also contain the buyer’s vehicle particulars.

- Several payments. Indicate the downpayment amount and the date it should be given, along with the date by which the entire amount has to be transferred to the property owner.

Following that, select one payment method:

- Cash

- Cheque

- Cashier’s cheque

- Money order

The very last thing to complete within this part is to determine if all applicable taxes are included in the final cost.

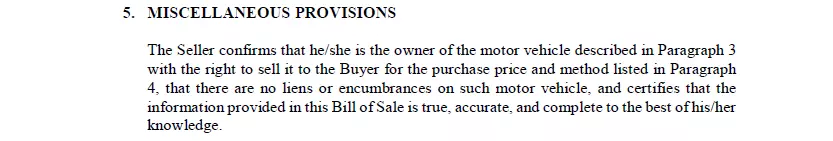

Step 5: Go over the standard terms

Read the standard terms and ensure that both sides are familiar with them. They generally say that the buyer obtains the property in “as-is” condition and is liable for it once the purchase is completed.

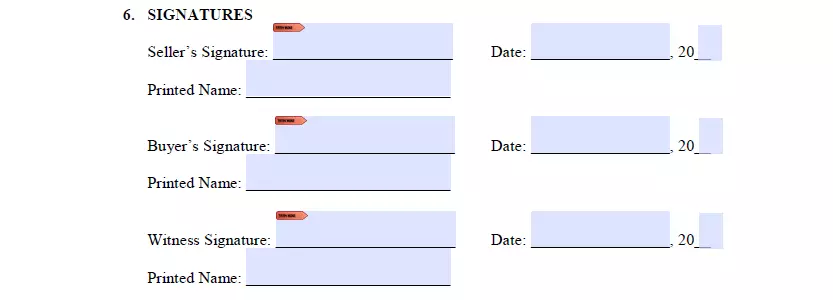

Step 6: Sign the bill of sale

The purchaser is generally not requested to sign the form. However, it is recommended to have the form signed by all parties. You could also have one or a number of witnesses confirm the transaction.

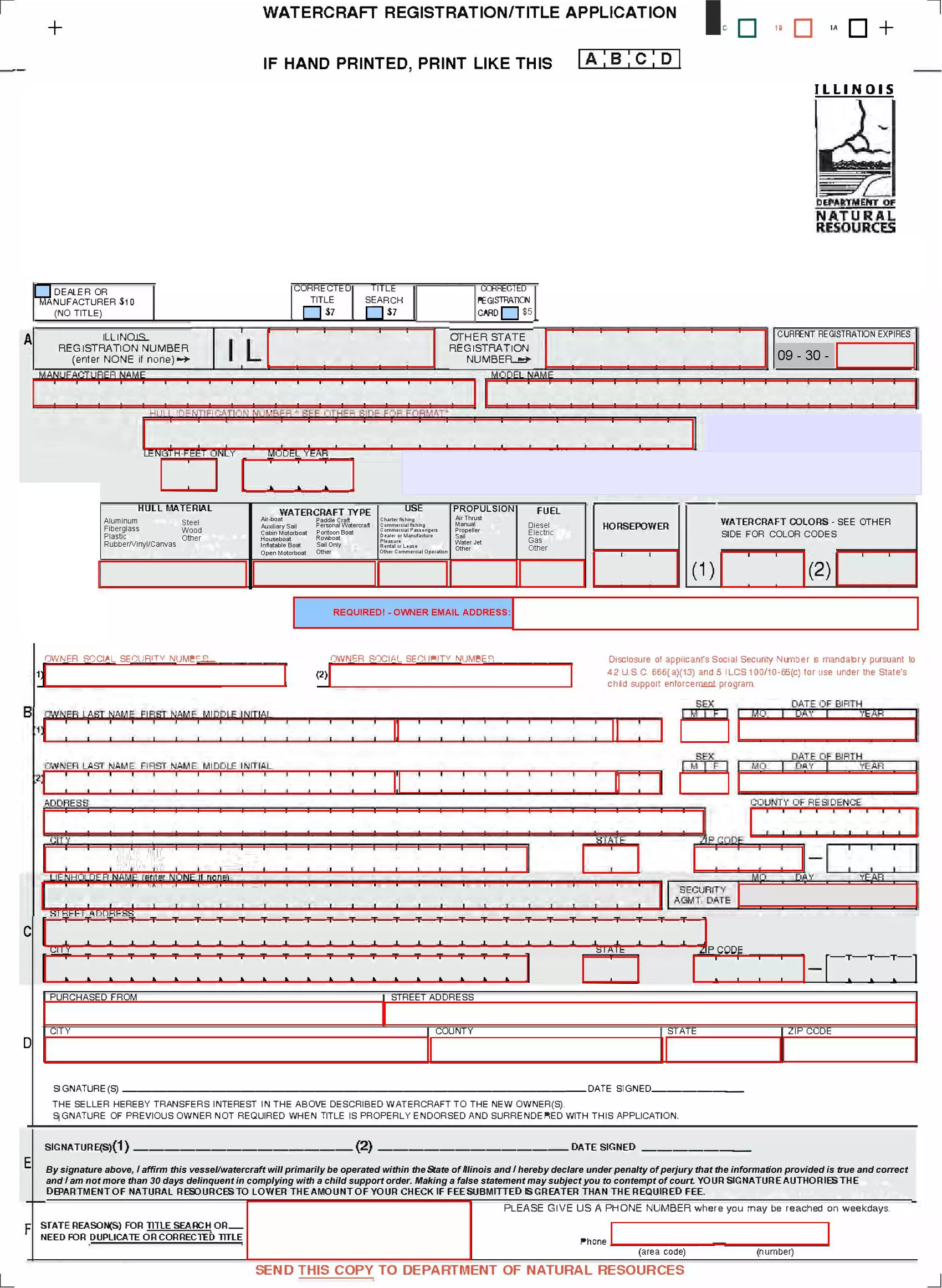

Step 7: Certify the document

Even though notarization is rarely necessary, it functions as yet another way to guard against legal difficulties.

The purchaser should get the original bill of sale because it is frequently necessary during the title change. As a seller, you can either get a copy and store it or have a pair of identical documents signed and completed by both sides.

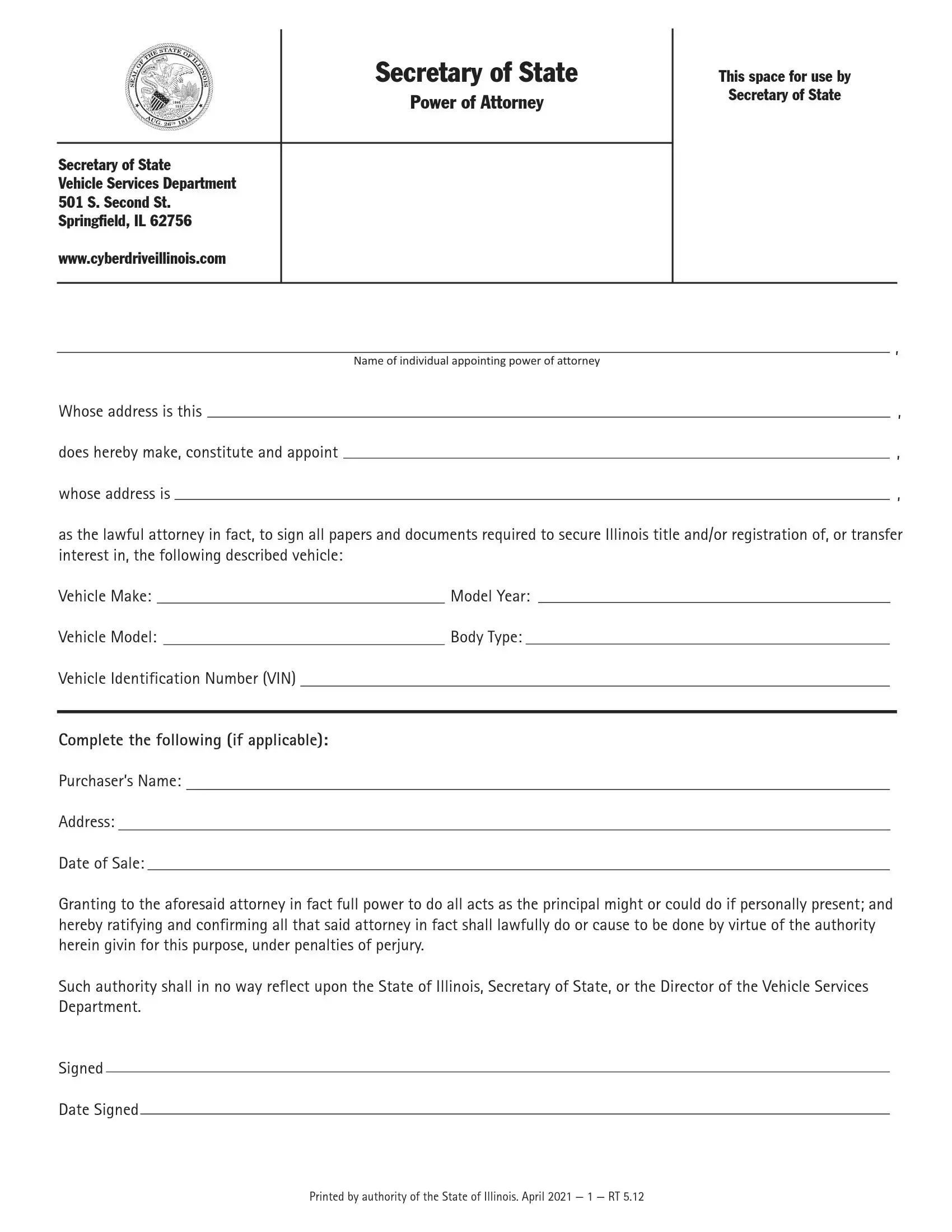

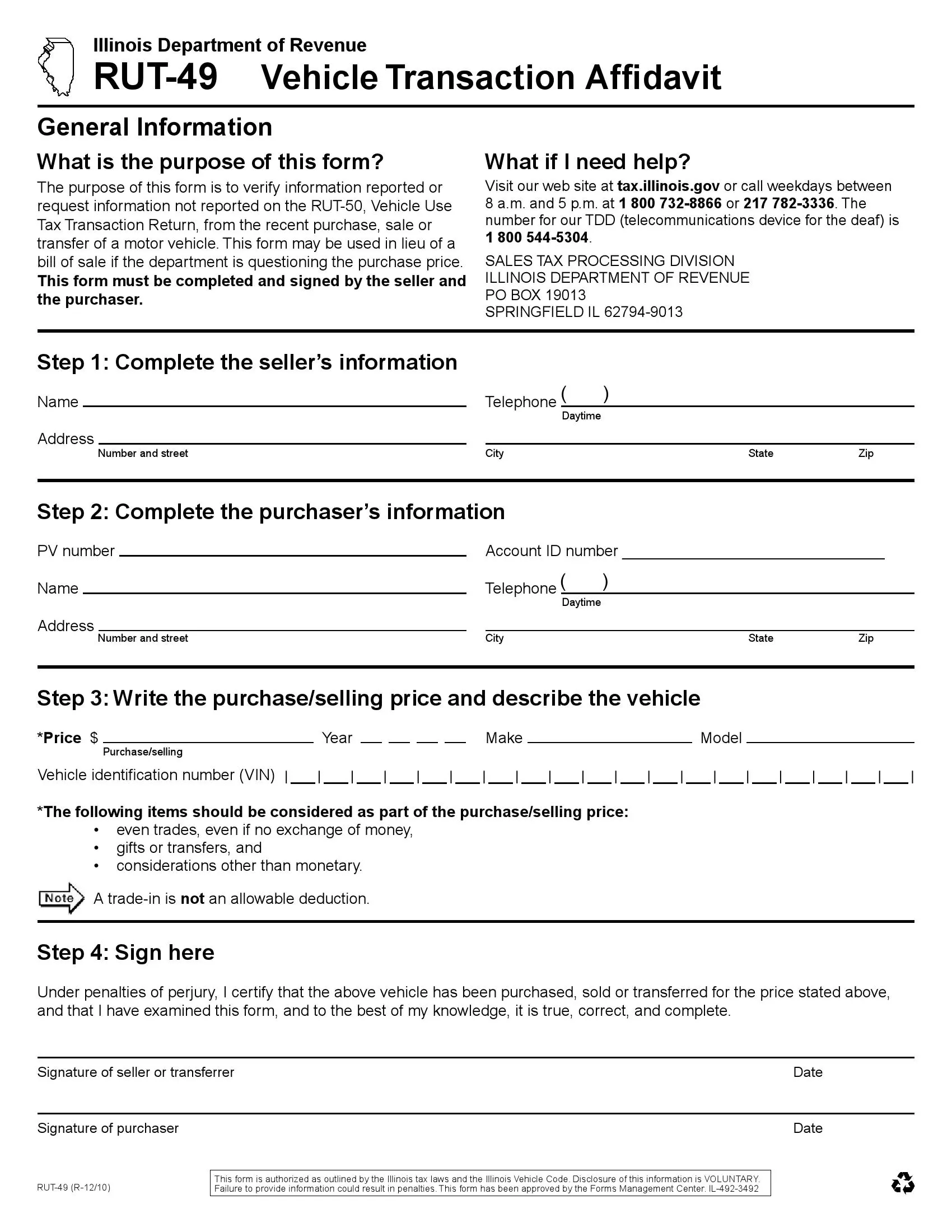

Registering a Vehicle in Illinois

All new motor vehicle owners in Illinois should register their vehicles after the vehicle transaction or on other occasions. For instance, the same vehicle registration applies whether you buy the car, inherit it, or receive it as a gift. The local law demands that you register it within 20 days of receiving the automobile to avoid legal trouble.

The registration procedure can occur in the nearest vehicle department office across the state. If you buy your motor vehicle from a dealer within the state, the dealer should complete the registration process for you. However, if you purchase a vehicle from an individual, you must register it yourself. You must complete all necessary paperwork and present it to the nearest local Illinois Secretary of State’s Office.

Illinois’s vehicle registration laws allow car owners to file the process online by filling out a digital form from its official web portal. However, printing out your completed form and handing over other necessary documents at your nearest local SOS office is necessary. It’s necessary to supply the following documents to complete your motor vehicle registration:

- Illinois vehicle bill of sale

- A title that the vehicle’s last owner signed

- Proof of current motor vehicle insurance from the state

- A driver’s license or state ID to prove one’s identity

Also, you should disclose if the vehicle has any lien; if it has, you should name the lienholder and their address. In addition, you have to be ready to pay all vehicle registration fees: $101, title: $95, and the applicable sales tax.

Relevant Official Forms

Watercraft registration or title application required for boaters who want to operate in Illinois.

Firearm Dealer License Certification Act is submitted by a person who want to retail, collect or manufacture the firearm.

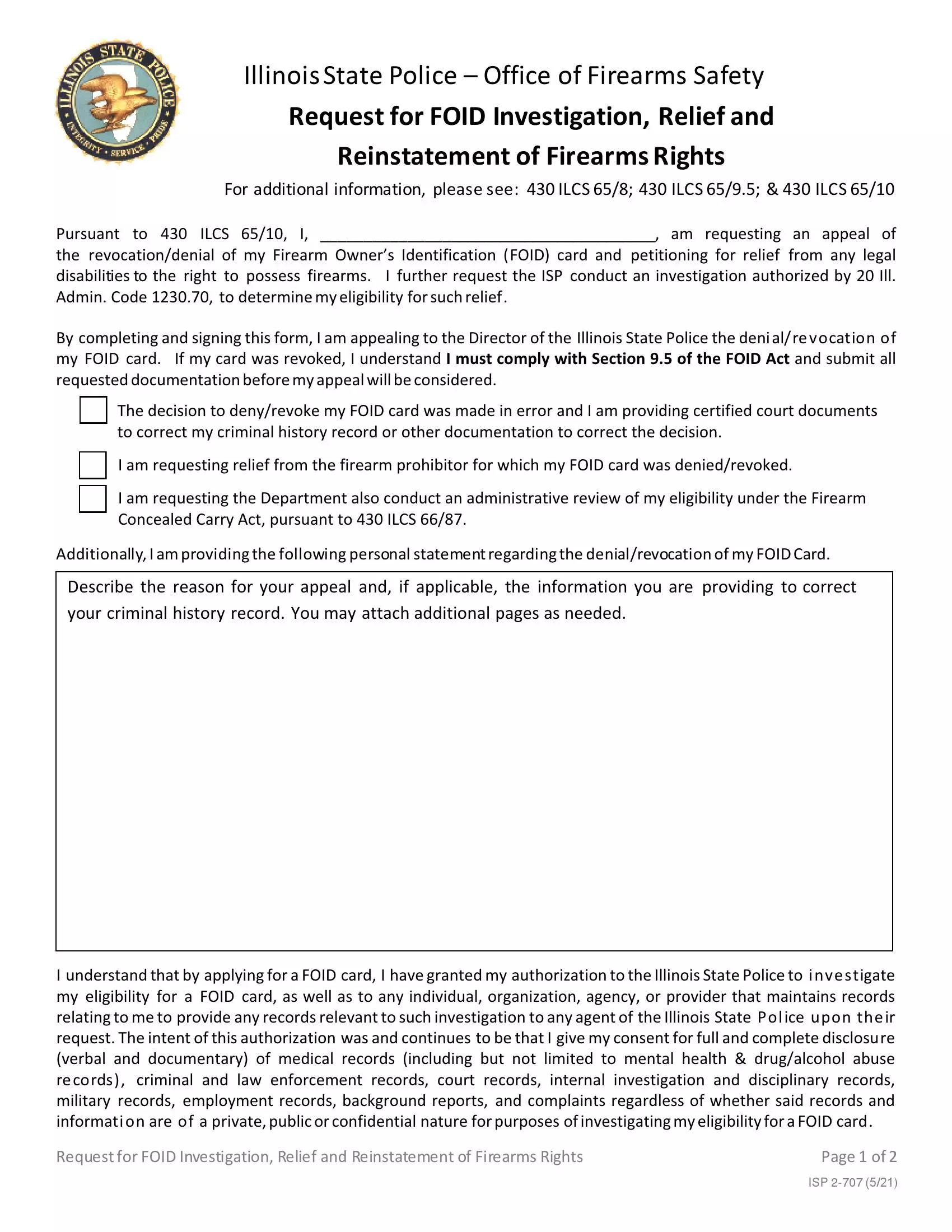

FOID Investigation Relief Reinstatement Firearms Rights Form is submitted when the resident wants to appeal the denial of their FOID (Firearm Owner’s Identification) card.

Short Illinois Bill of Sale Video Guide