Louisiana Bill of Sale Form

Louisiana bill of sale is a crucial document for different private transactions. You can benefit from creating this document whenever you buy or sell a vehicle, furniture, equipment, livestock, boats, an animal, or other personal property.

Usually, a Louisiana bill of sale implies that the item is sold “as-is,” meaning that a buyer cannot claim any defects after the purchase. Sellers themselves get specific protection—a bill of sale proves that the item changes owners, and all the liability connected with the property fall on the buyer. You can read more about the benefits of the bill of sale forms in our bill of sale bill of sale guide. You will need to acquaint yourself with different types of bills of sale before you choose the right one. Also, an official bill of sale form should be used during boat sales.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Louisiana Vehicle Bill of Sale Form |

| Other Names | Louisiana Car Bill of Sale, Louisiana Automobile Bill of Sale |

| DMV | Louisiana Office of Motor Vehicles |

| Vehicle Registration Fee | At least $20 |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 15 |

Louisiana Bill of Sale Forms by Type

Louisiana bill of sale proves that one party transfers ownership of a specific personal property to another. Depending on the type of transaction, particular bill of sale forms may be more or less suitable. Here are some of the most common bills of sale that can be useful in Louisiana. Below you will also find the official bill of sale for vehicle title transfers.

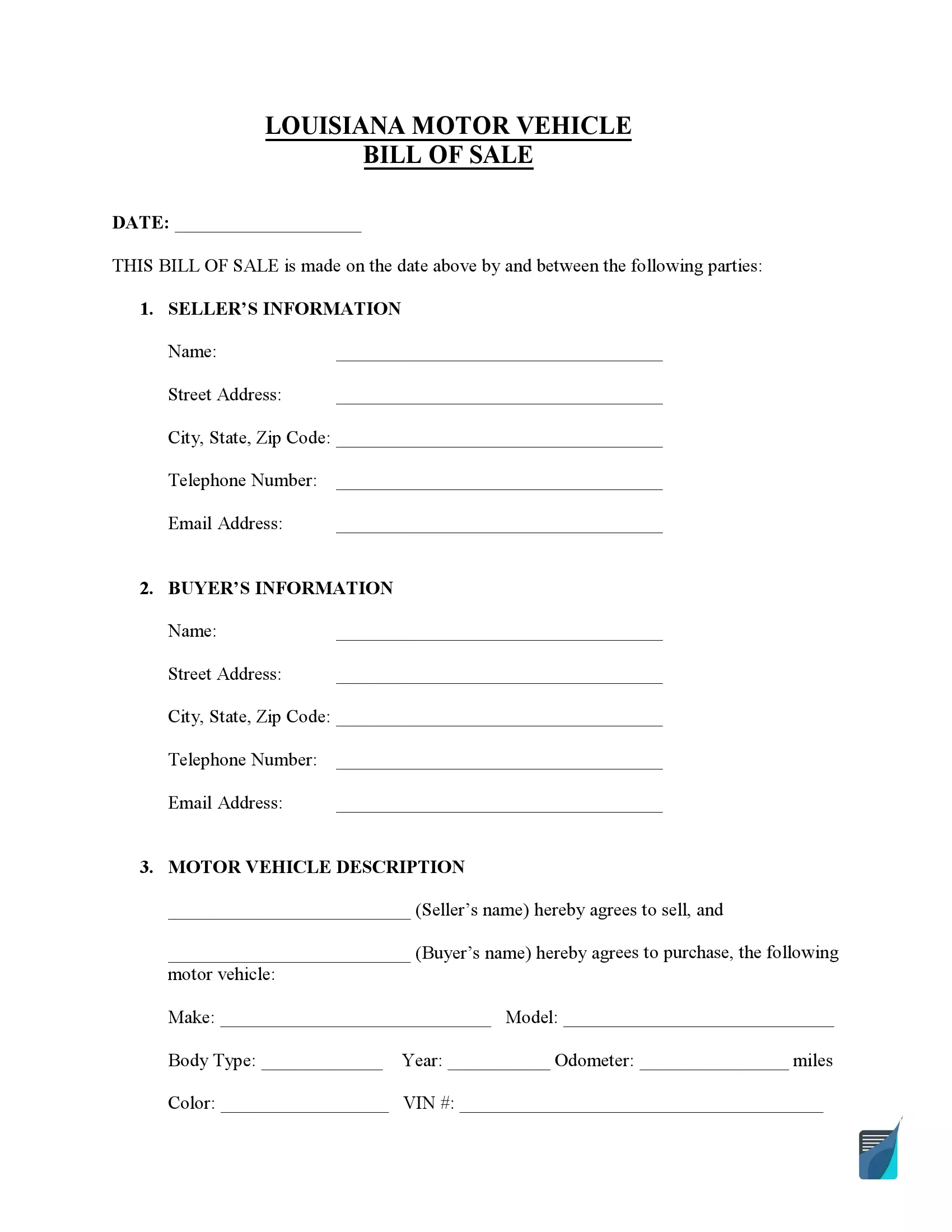

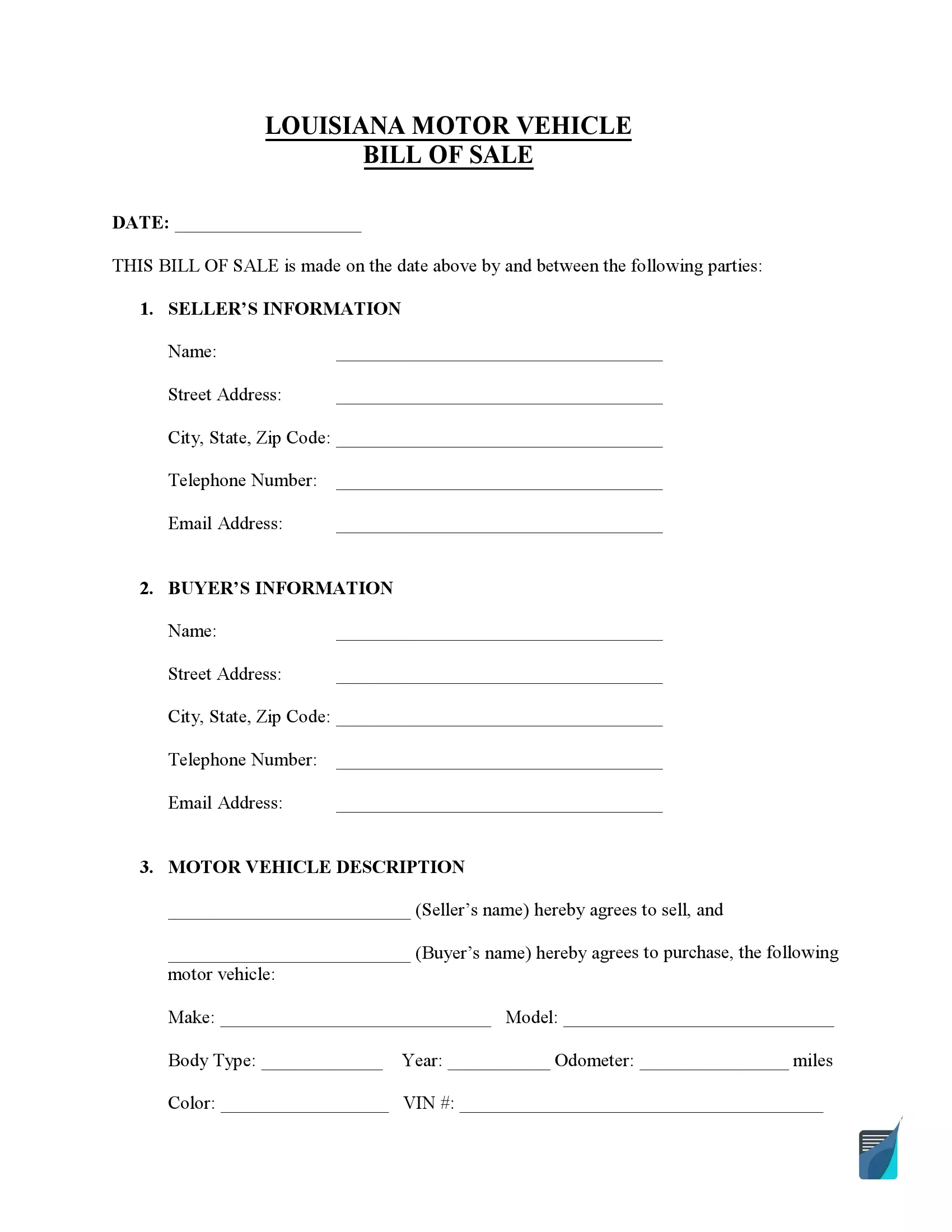

Louisiana bill of sale for a motor vehicle should contain the vehicle’s detailed description, including make, model, odometer reading, year, color, body type, and VIN. Those who buy vehicles within the state must register them within 40 days after the deal. If a motor vehicle is transferred from another state, the owner will have to register it 30 days after the change of residence. The vehicle registration should be renewed every two years.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

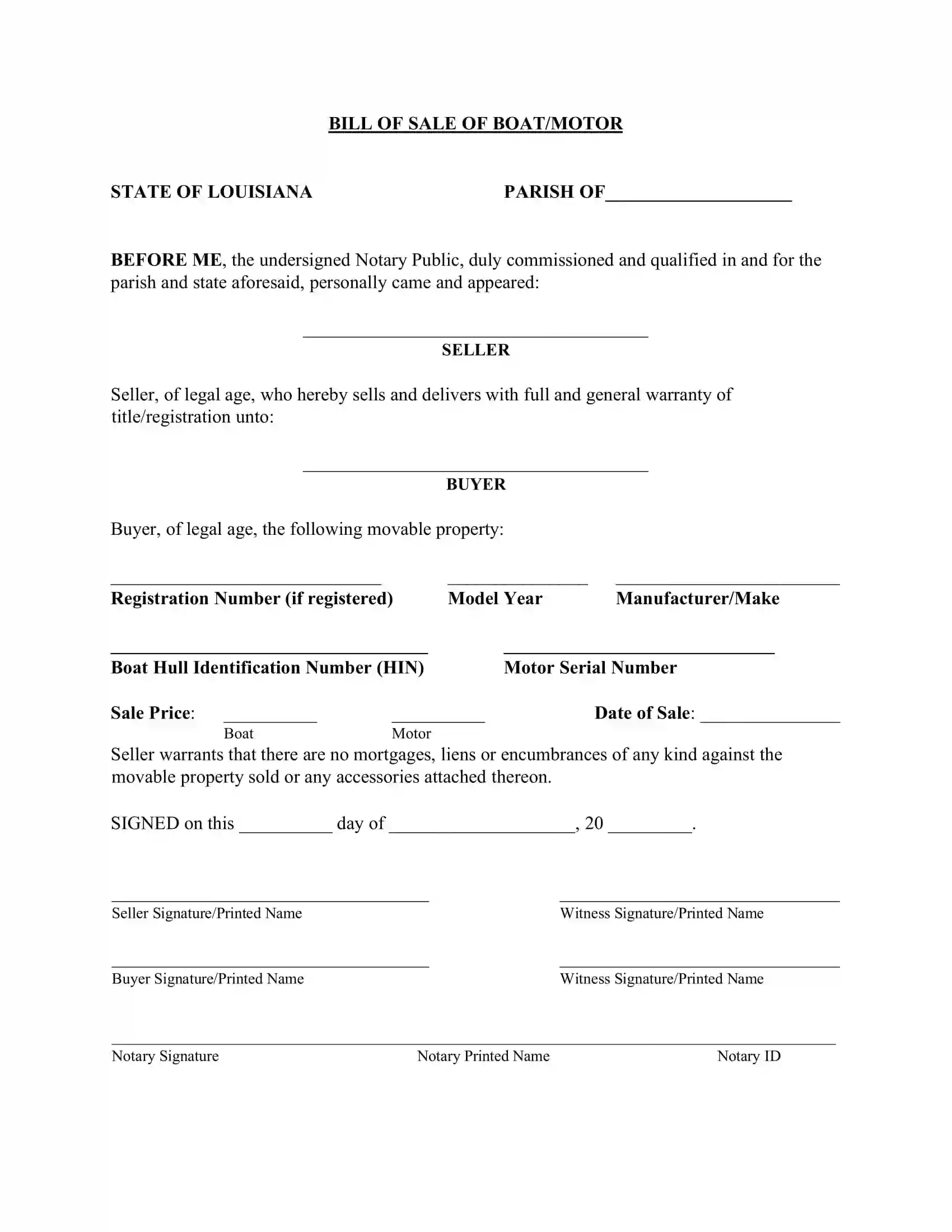

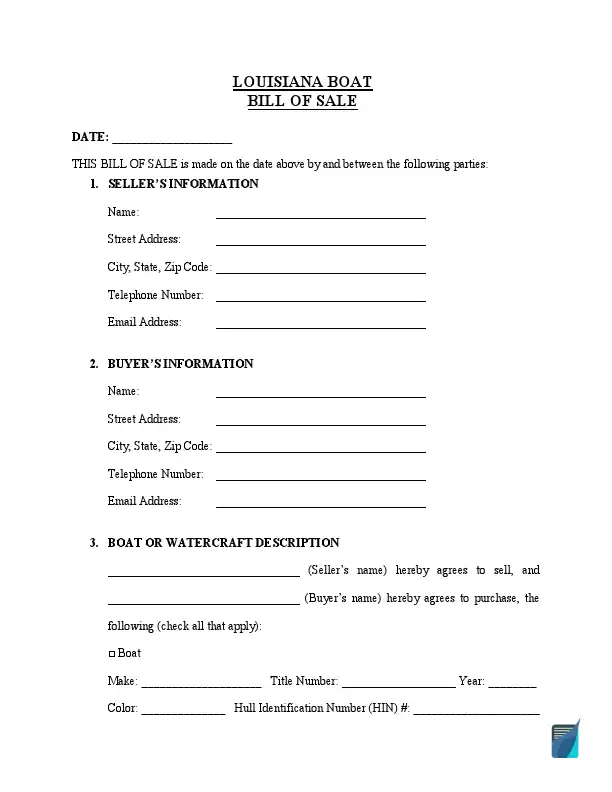

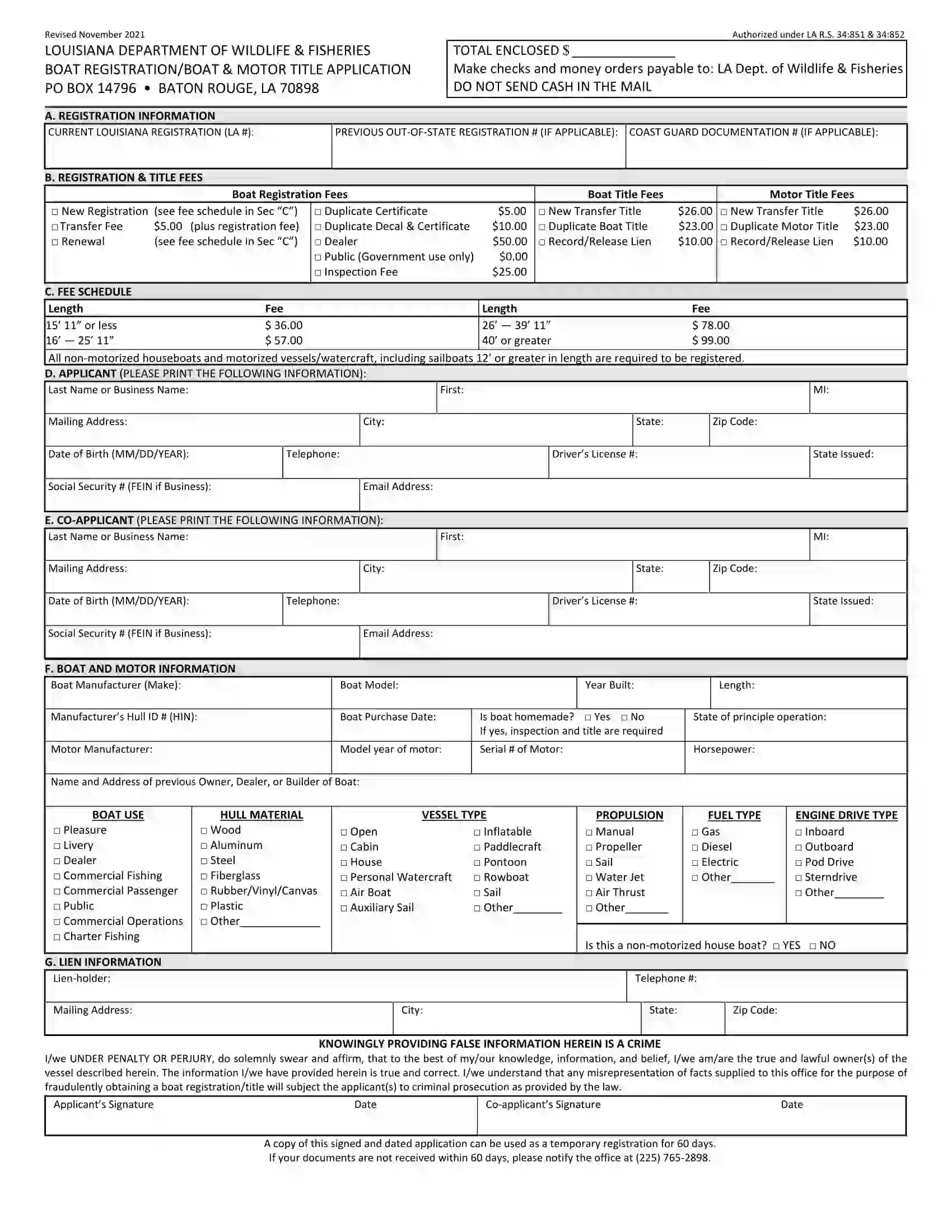

Louisiana boat bill of sale requires a person to mention HIN, make, year, motor serial number, and other information. The Louisiana Department of Wildlife and Fisheries (LDWF) requires all motorized boats, sailboats 12-feet or longer, and non-motorized houseboats to register their vessels. Once obtained, the registration lasts for three years and can be easily renewed online or via mail. If a boat changes owner, it should be reported to the LDWF within 15 days of the transfer.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Required |

| Download | PDF Template |

“

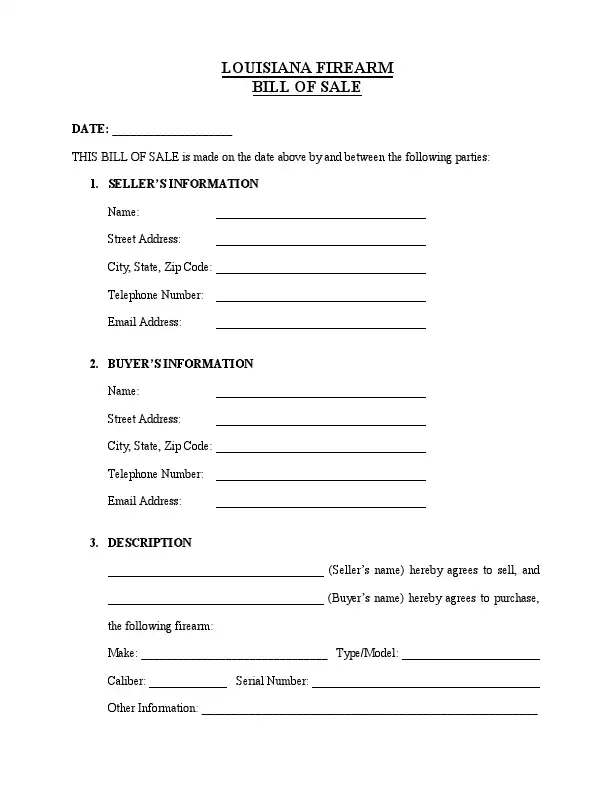

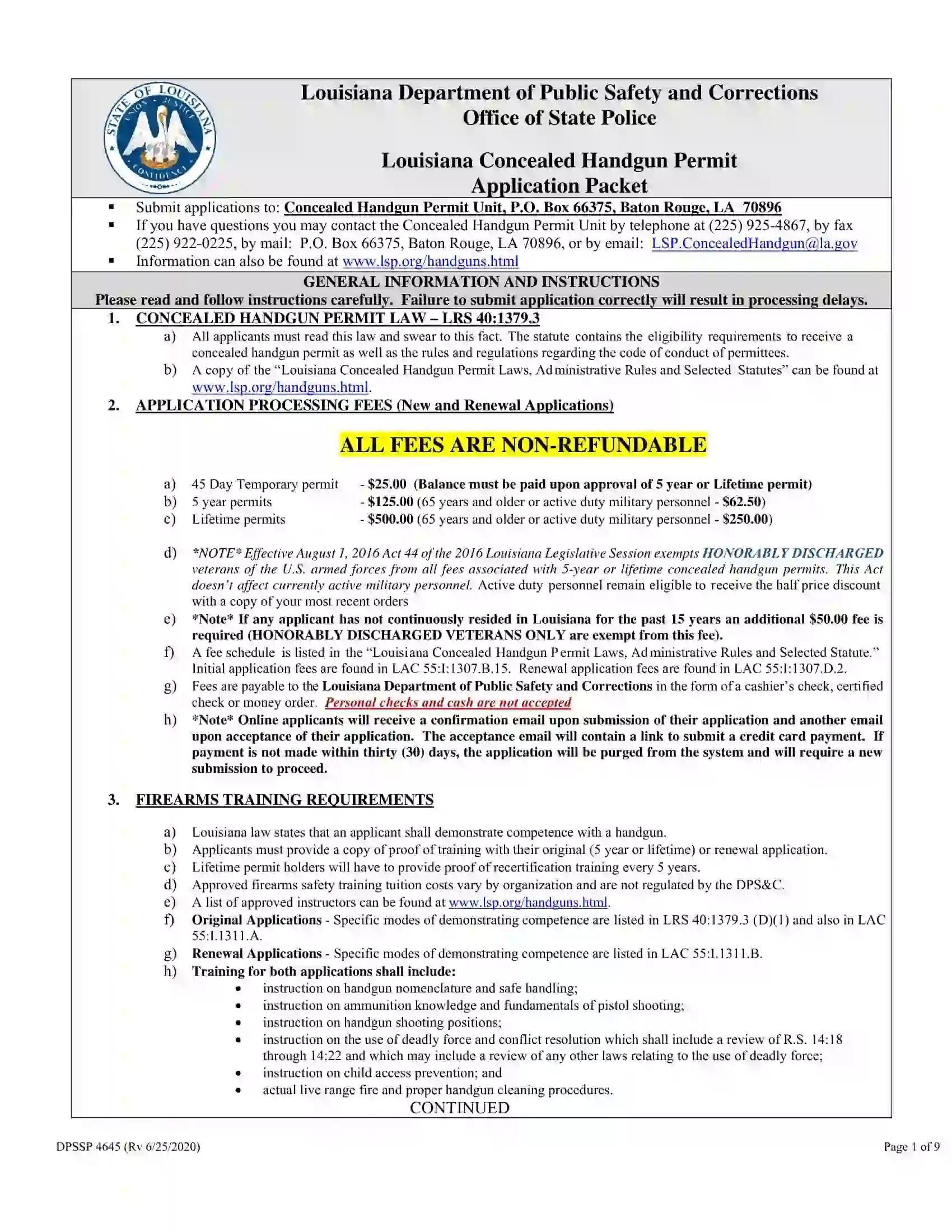

Louisiana bill of sale for a gun is a valuable document that includes identifying details about the firearm, buyer, and seller. Louisiana laws allow those who legally possess firearms to sell them privately. There is no state requirement for registering guns. Concealed carry is possible, but an individual needs a concealed handgun permit. In order to get it, a specific application form should be filled out and mailed to the Louisiana State Police. You can find the respective form below.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

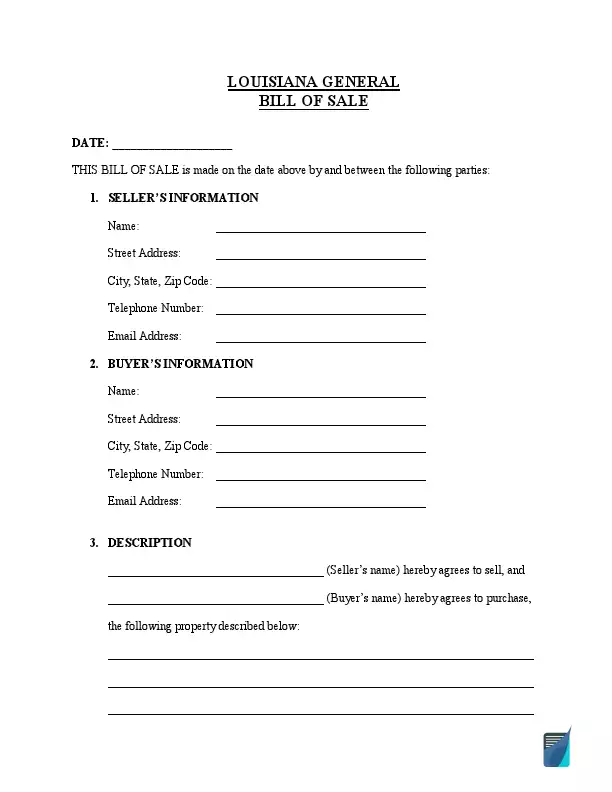

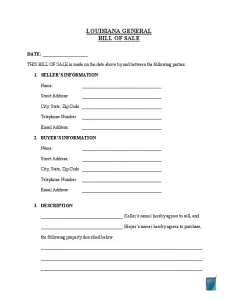

In a general bill of sale, the parties can outline the transaction details involving any personal property type. All you need to do is to fill out the sections devoted to the parties’ personal information, property description, and selling price and place the parties’ signatures.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

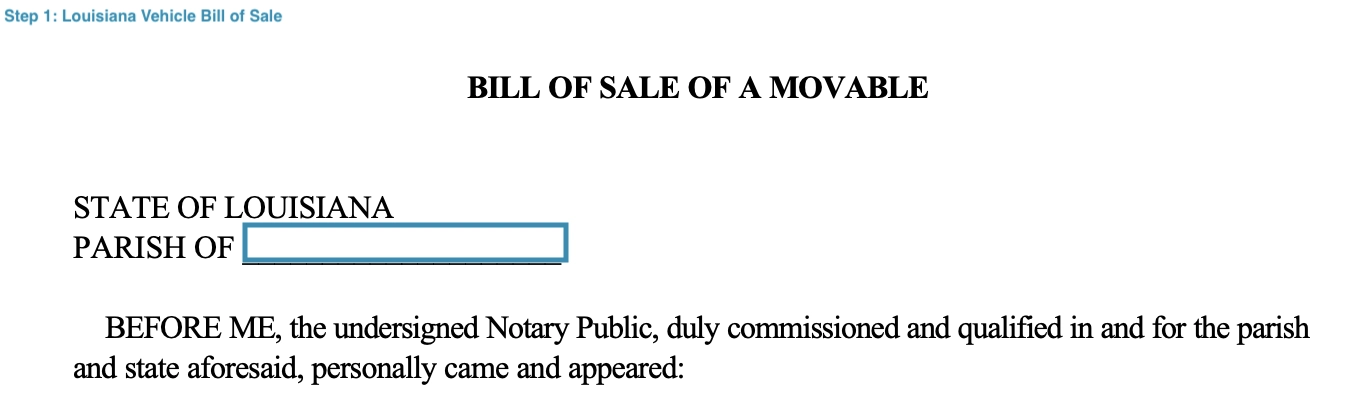

How to Write a LA Vehicle Bill of Sale

The Louisiana Office of Motor Vehicles provides drivers with the official bill of sale template they may use during the transaction. The bill of sale template must be signed and witnessed by a notary public for compliance. It’s necessary to know that all bill of sale forms notarized after August 1, 2012, must include a photo of the owner’s driver’s license, both valid and current.

The official bill of sale is used for any type of transaction of a movable vehicle between private parties. This document must be signed in the notary public’s presence at the county courthouse. Here are simple instructions to help you complete the form with no errors.

Step 1. Complete the notary public section

The official representative of the county fills the bill of sale in Louisiana. First, it is required to indicate the parish of Louisiana where the vehicle is purchased.

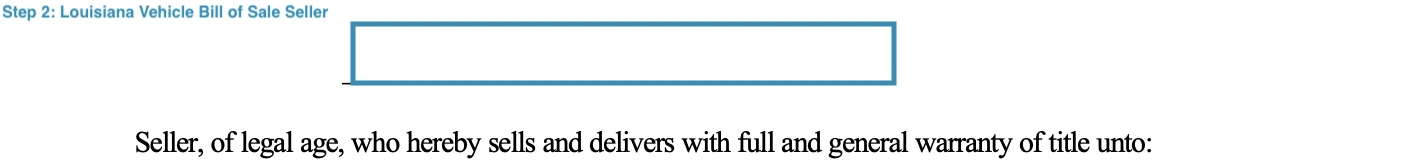

Step 2. Introduce the seller

Provide the full legal name of the owner that sells the vehicle.

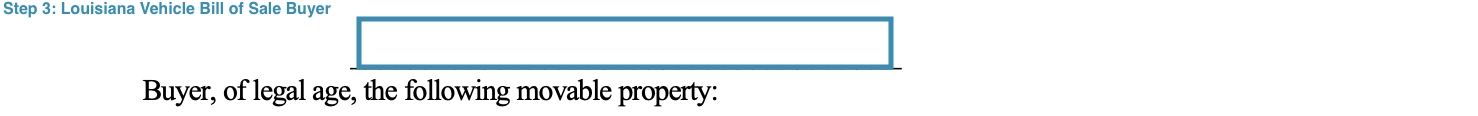

Step 3. Name the buyer

Indicate the person who purchases the motor vehicle by writing their gull name.

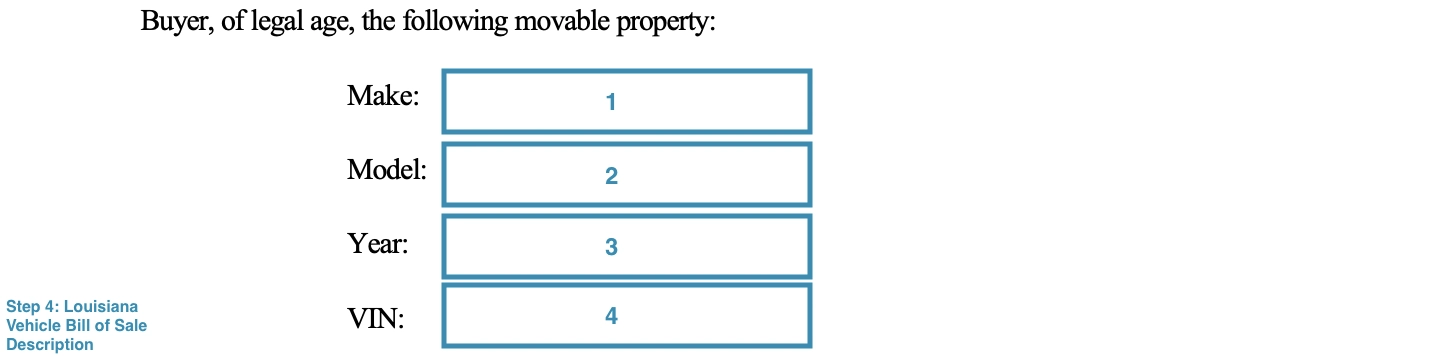

Step 4. Describe the vehicle

Clarify the details regarding the movable property that is transferred. The document must contain the following details:

- Make

- Model

- Year

- VIN

Step 5. Specify the price and date

Indicate the sale price of the motor vehicle and the date transaction has happened.

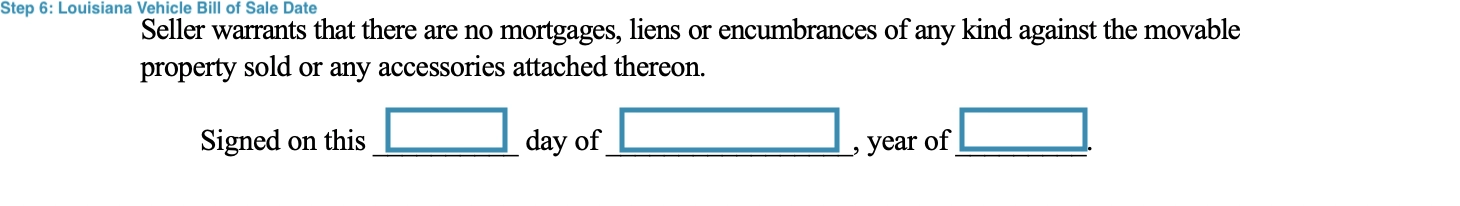

Step 6. Indicate the date of signatures

Highlight the date when the document is completed and signed.

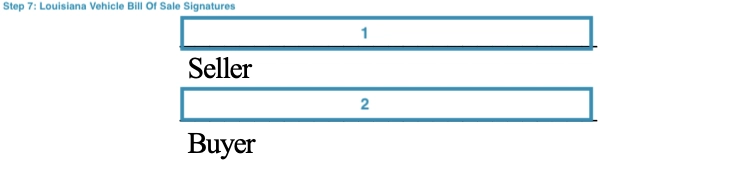

Step 7. Sign the document

The bill of sale must have the signatures of both parties, the seller and the buyer, to be valid.

Step 8. Notarize the docuemnt

The bill of sale must be signed by the official notary representative of the county.

Registering a Vehicle in Louisiana

If you buy a car from a private seller in Louisiana, you must present a bill of sale to register it. The Louisiana bill of sale acts as both a receipt for the transaction and formal documentation of possession of the different kinds of cars. Registrations require presence at the closest Office of Motor Vehicles (OMV) and presentation of required documents. These include:

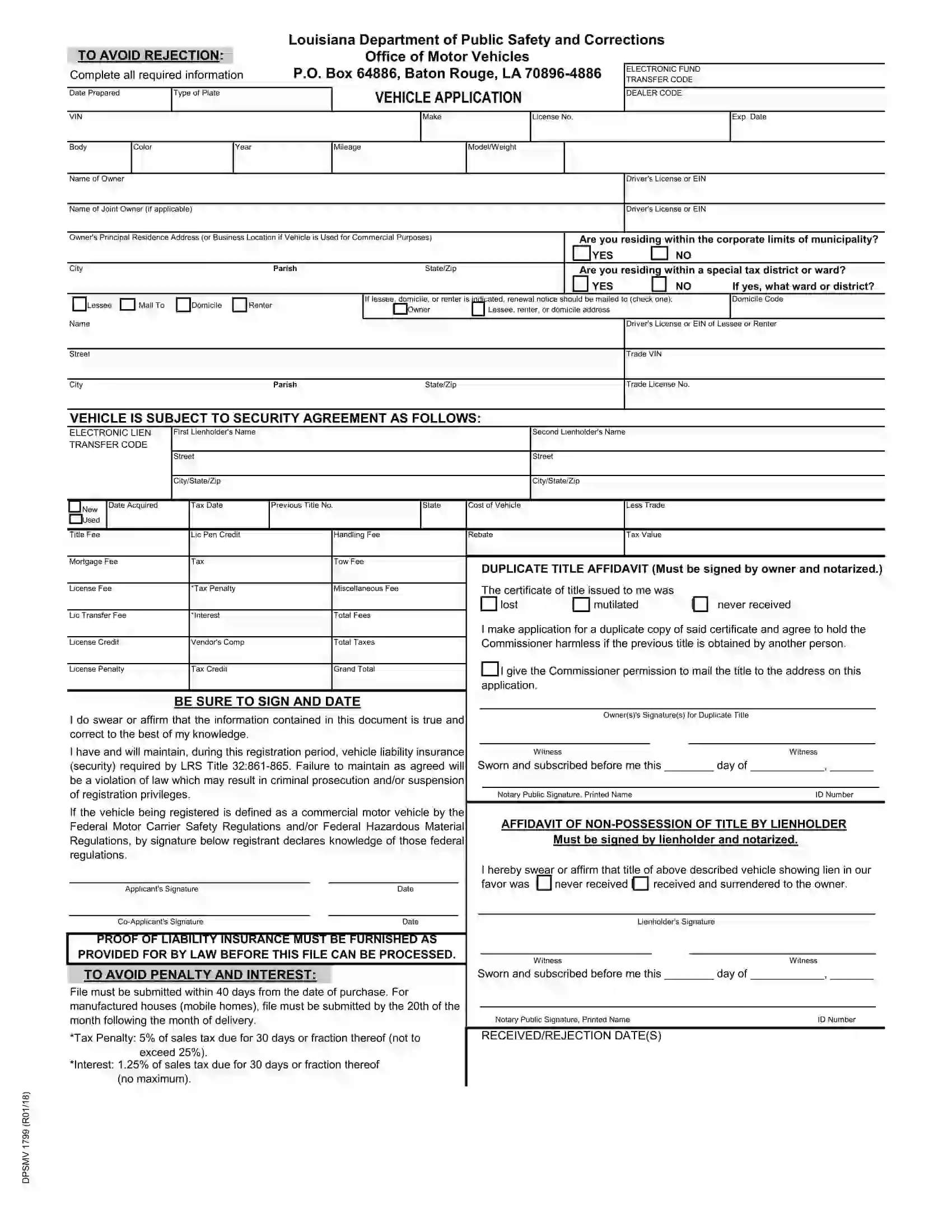

- A completed motor vehicle application form (DPSMV 1799)

- Valid driver’s license

- Proof of liability insurance coverage

- Proof of inspection

- Completed motor vehicle bill of sale form (with signatures of both parties, VIN, and odometer reading)

- Notarized and signed vehicle title

- Registration and titling fees (see details below)

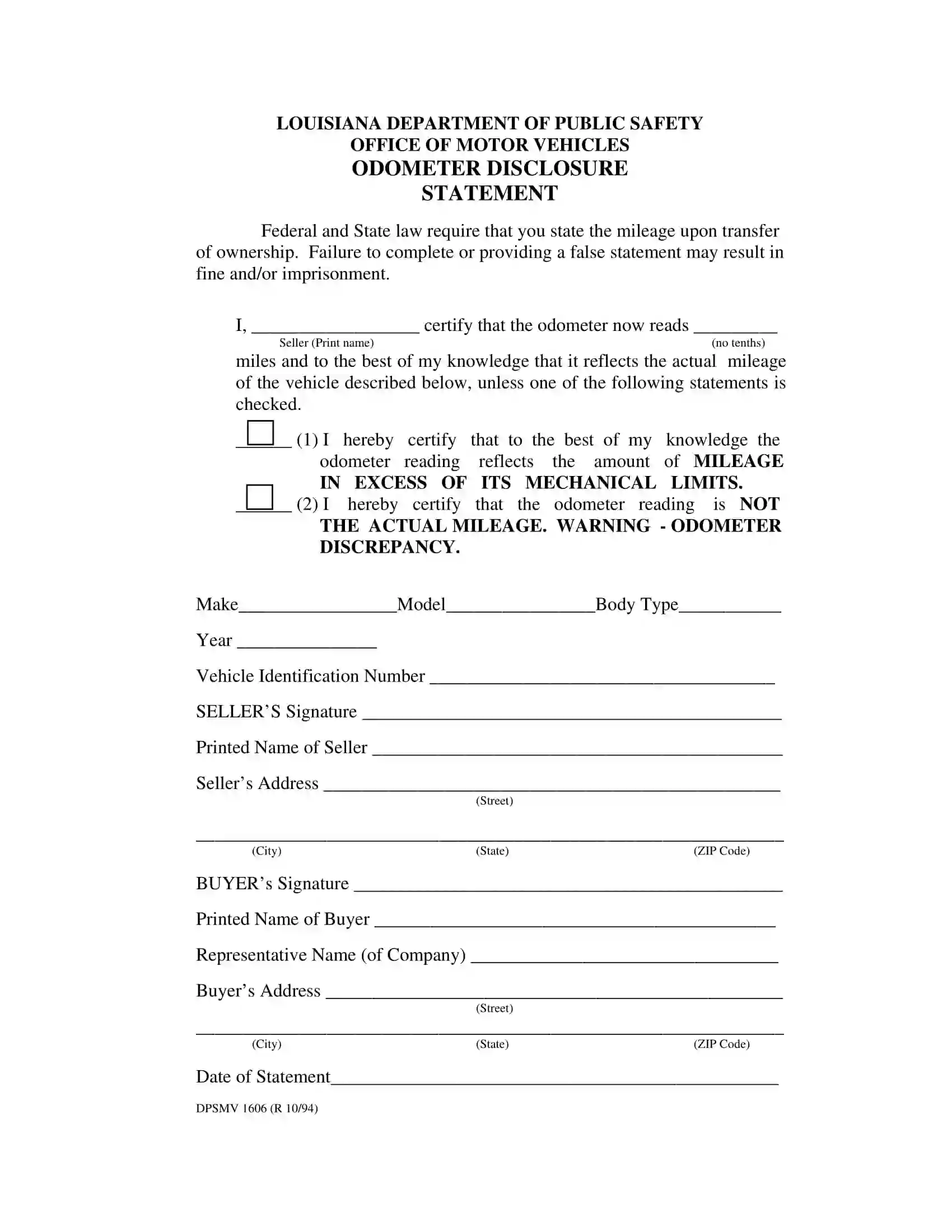

- Odometer statement (on vehicles ten years old and under)

At the time of registration, new owners should be prepared to pay between 4% and 9.5% of taxes on the value of the motor vehicle. Registration and title fees vary by county but do not exceed $8. Depending on the county of the new owner, they may be subject to additional taxes as per local requirements. Both active military and those who paid out of state taxes are exempt from motor vehicle taxes. Military members must show proof of taxes paid at the time of purchase and a copy of either military ID or military orders to qualify.

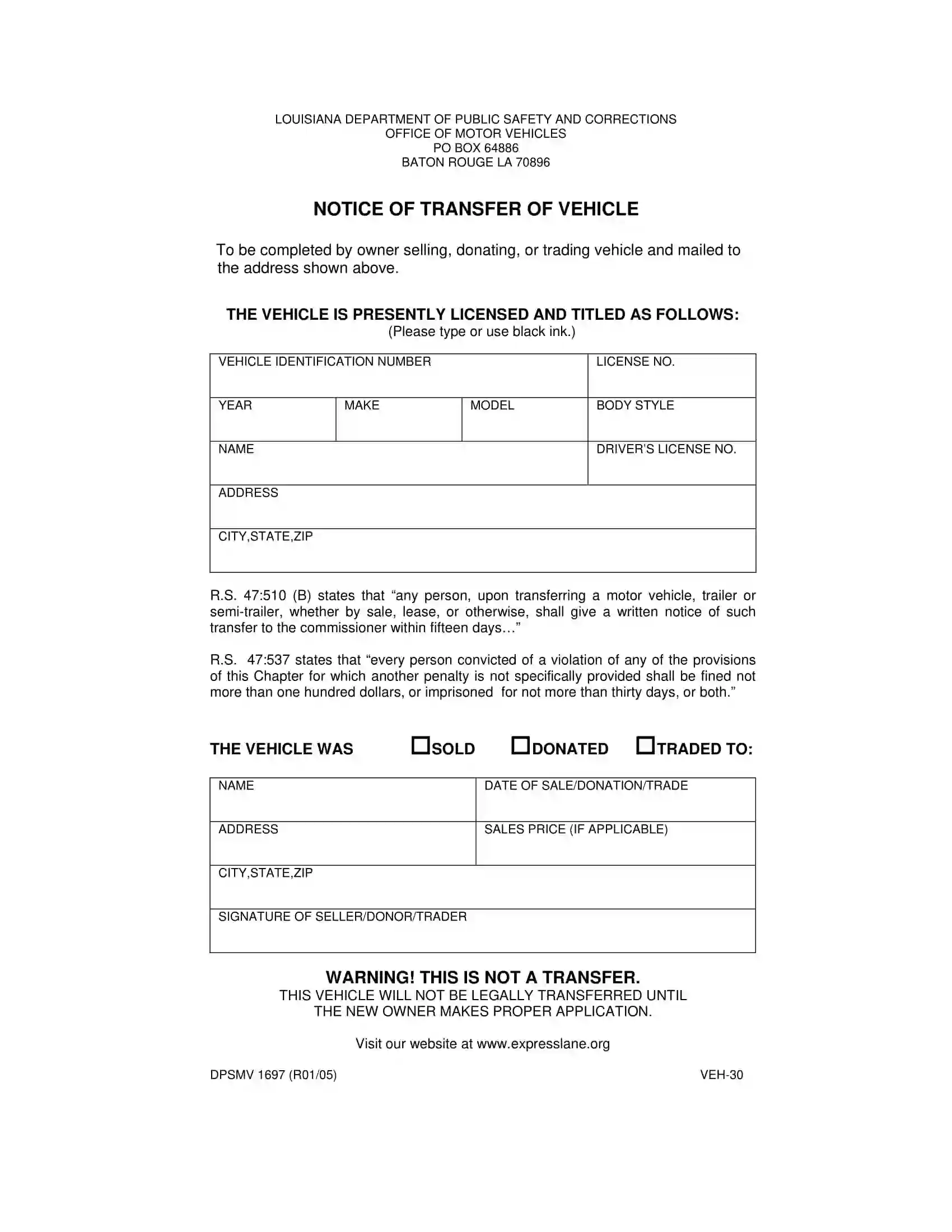

In Louisiana, the previous owner must complete out sections on the bottom of the document to sign the vehicle title over to the new proprietor. Within five days of the transaction, sellers must submit a Notice of Vehicle Transfer online or using Form DPSMV 1697.

Specific requirements vary by county, some of which require an additional smog inspection. The vehicle must comply with the safety and emissions regulations put forth by the state of Louisiana. In the state of Louisiana, license plates are not transferable. Therefore, a set of standard license plates is included with registration unless otherwise specified. Specialty plates come with a minimum $25 fee added to all registration costs.

Relevant Official Forms

Form DPSMV 1799, known as a Vehicle Application Form, is used if the original certification of title is lost.

Form DPSMV 1606 or Odometer Disclosure Statement must be attached to a bill of sale when recording the transfer of ownership.

Notice of Vehicle Transfer (Form DPSMV 1697) is required to be submitted by the owners who sell, donate, or trade their vehicles.

This Application should be used by the owners who want to register their boats at the Louisiana Department of Wildlife and Fisheries.

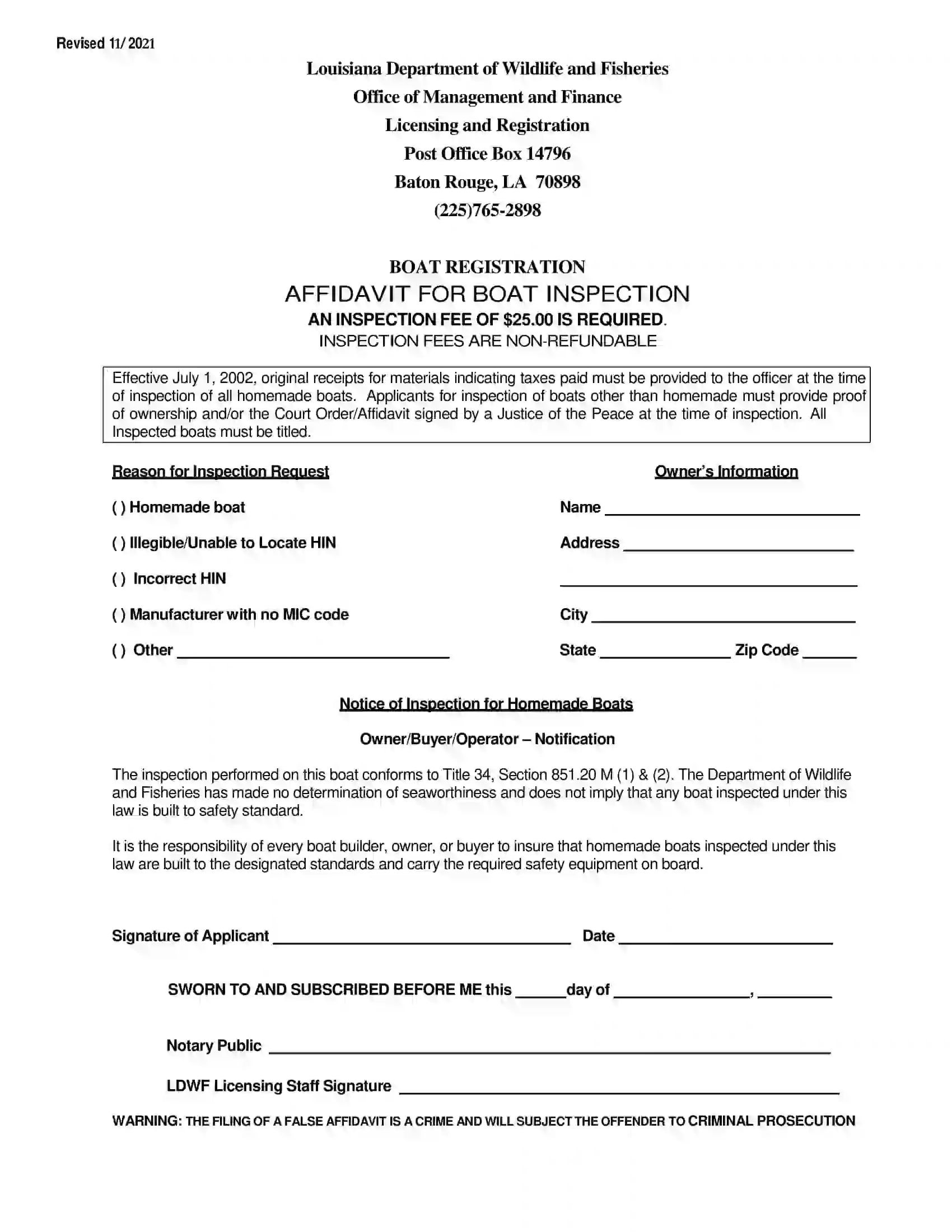

Affidavit for Boat Inspection is used if you have a homemade boat or the identification number of the boat is incorrect or hard to read.

Form DPSSP 4645 or Concealed Handgun Permit Application is used if a person wants to obtain a permit to carry a firearm in Louisiana.

Short Louisiana Bill of Sale Video Guide

Other Bill of Sale Forms by State