Free Connecticut Last Will and Testament Form

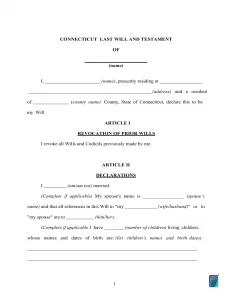

A Connecticut last will and testament is a legal document comprising the official directions of a person (testator) relating to their property and assets usage in the event of death.

If you’re in need of a printable and fillable CT last will form, you’ll find one on this page, together with the tips on last will preparation and laws and answers to commonly asked questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Connecticut Last Will Laws and Requirements

| Requirements | State laws | |

| Definitions | Sec. 45a-233. (Formerly Sec. 45-100d) (a) Definitions | |

| Statutes | Chapter 802a – Wills: Execution and Construction | |

| Signing requirement | Two witnesses | Sec. 45a-251. Making and execution of wills |

| Age of testator | 18 and older | Sec. 45a-250. Who may make a will |

| Age of witnesses | Sec. 45a-251. Making and execution of wills | |

| Self-proving wills | Allowed | Sec. 45a-285. Proof of will out of court |

| Handwritten wills | Might be recognized if witnessed according to state law | Sec. 45a-251. Making and execution of wills |

| Oral wills | Not recognized | |

| Holographic wills | Not recognized | |

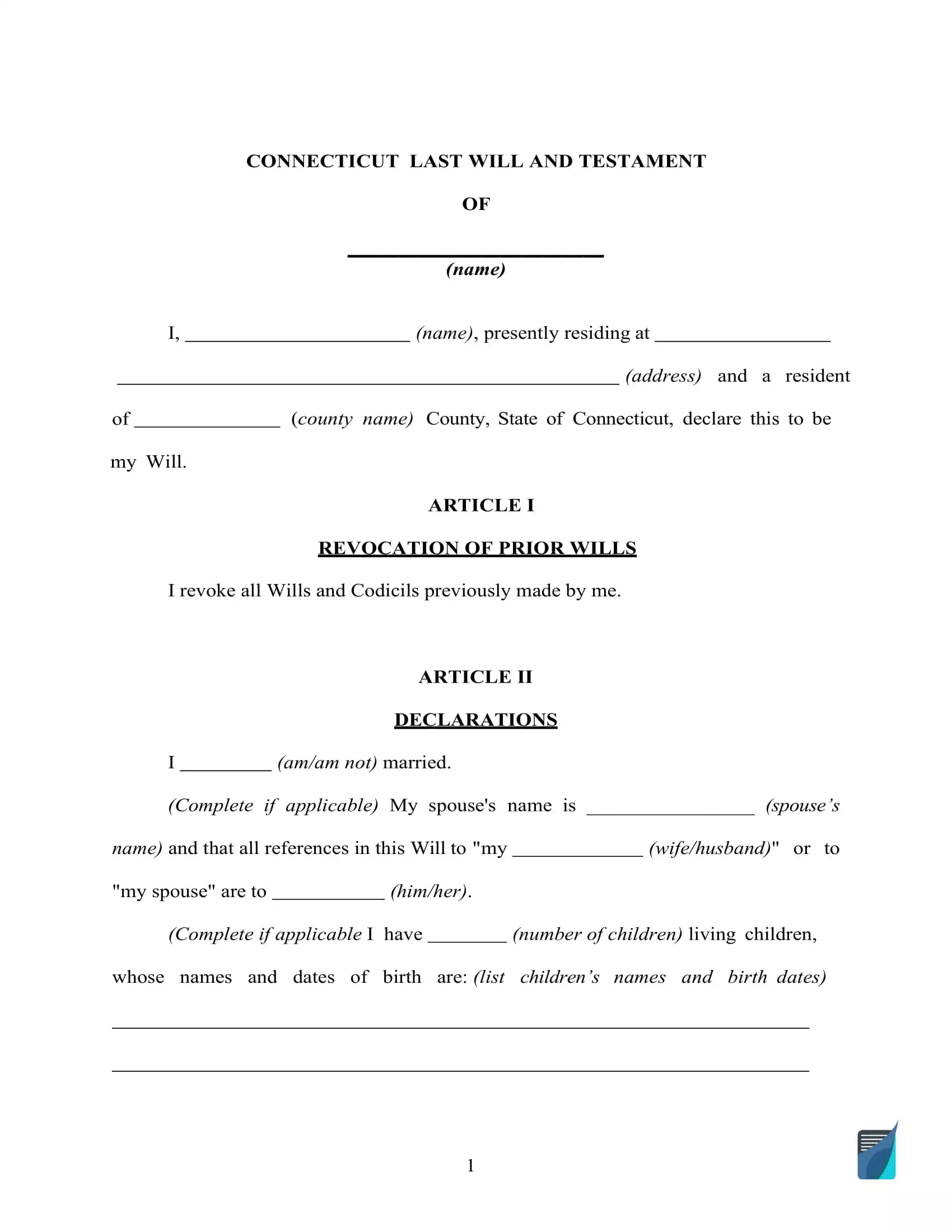

How to Write a Connecticut Last Will

1. Think about your possible choices. One important thing to keep in mind, first of all, is whether you wish to write the entire thing by hand (holographic will) or work with a fillable last will and testament form available online.

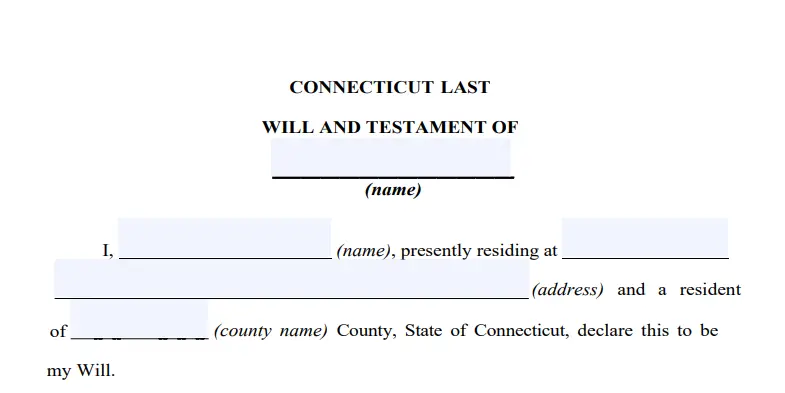

2. Indicate your details. The first step is establishing the testator by filling out their full name, along with the residential details (city, county, and state). Go through the remaining part of the passage, including the information you’ve written and the “Expenses and Taxes” paragraph.

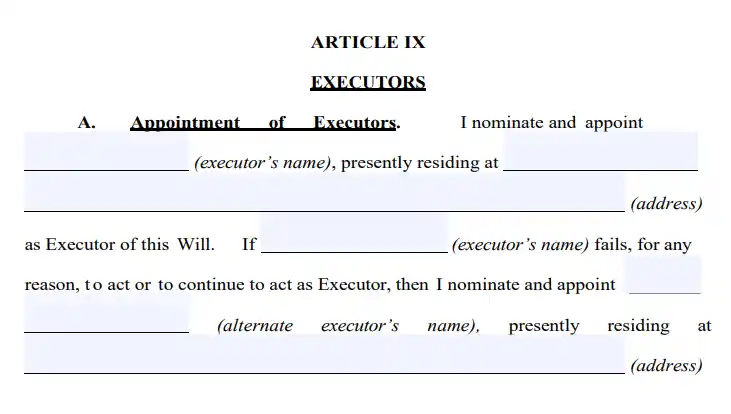

3. Choose the executor. In this particular passage, you choose who is going to carry out your will by entering their full name, together with their city, county, and state of residence. Most states have special policies regarding out-of-state representatives and executors, which in most cases would mean extra headache and red tape. That’s why it is advised to designate an individual who lives in the same state as you. Although it is not mandatory, it’s a wise idea to appoint an additional person to act as an executor in case the first one is unwilling or incapable of executing your last will.

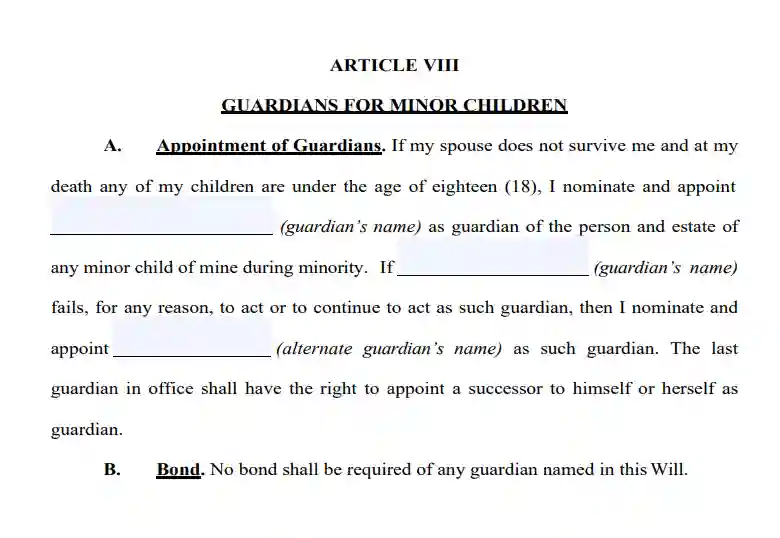

4. Determine the guardian (optional). You are able to choose a trusted person as a guardian if you’ve got underage or dependent children that need to be looked after. In case there are no instructions regarding exactly who should look after your kids, the guardian will be chosen by the court.

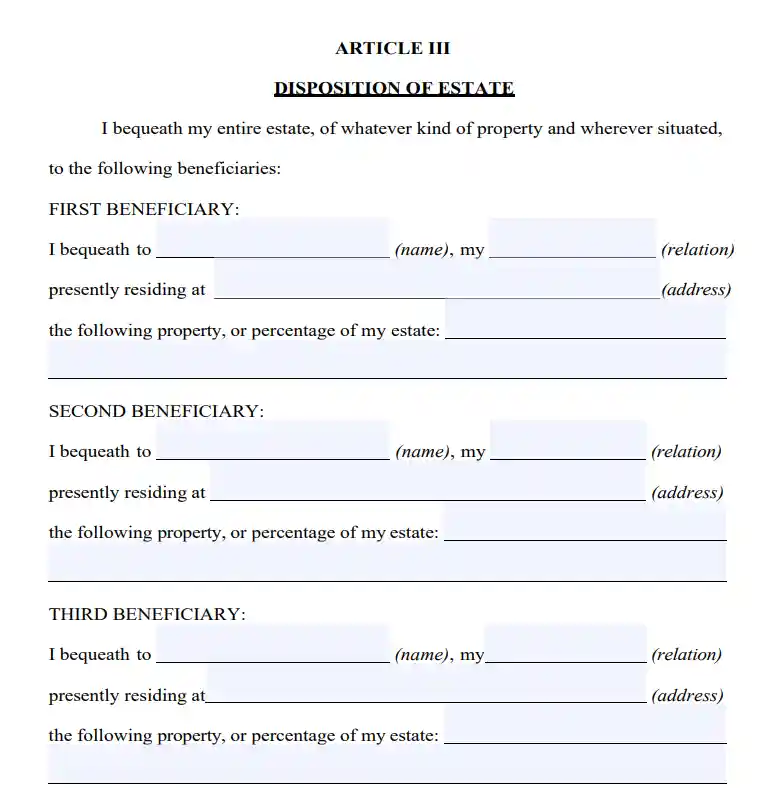

5. Establish your beneficiaries. This is where you indicate those who are going to receive your estate. For every named beneficiary, indicate the next details: full name, address, and the way they are related to you.

6. Allocate possessions. List your assets and describe precisely how you want to distribute them among your beneficiaries in case you’ve got something in mind other than dividing the property evenly. Cash, shares, realty, business ownership, money for unsettled debts, and any material items of financial worth you possess can be brought up in the last will. Please notice that there are things that can’t be distributed in the will, for instance, life insurance and joint and living will property.

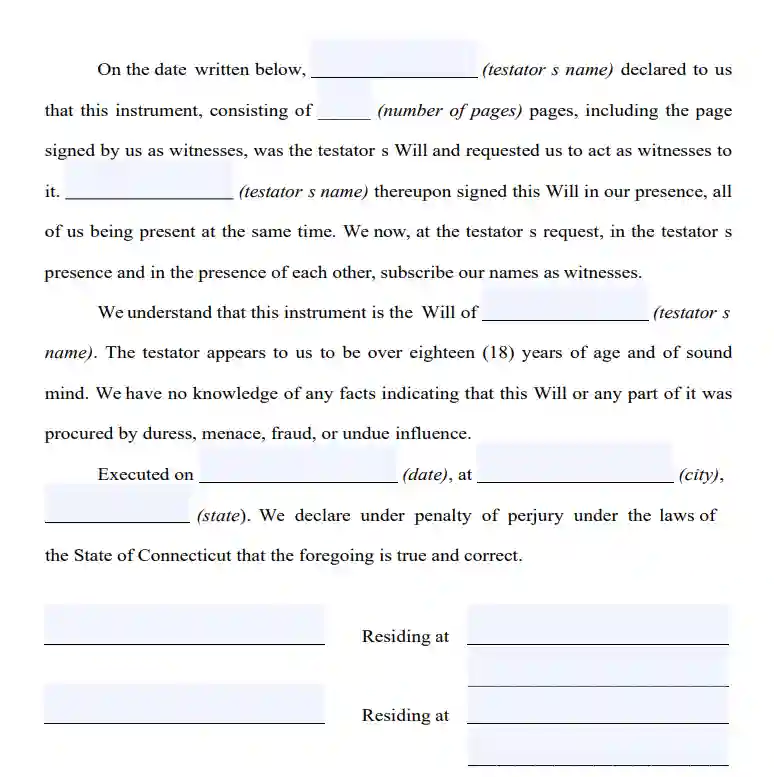

7. Continue with the witnesses putting the signatures at the end of the document. According to the Connecticut regulation, for a last will and testament to be considered legally correct, it must be signed by two witnesses. Only a person who is not your named beneficiary and is of 18 years or more can be chosen as a witness. Consider selecting witnesses younger than you to make sure that they can be present in the event the will is contested in the court or if some other problem takes place. At this point, you (and your two witnesses) must sign the will after writing your full legal addresses and names. Don’t forget to review every sentence thoroughly before finalizing the matter.

Create a Free Connecticut Last Will

Frequently Asked Questions

Is will notarization needed by the Connecticut Statute?

Connecticut law affirms that a last will can be valid without having a notary public certify it. But if you need to add a self-proving affidavit to the will, you’ll need to notarize it. A self-proving last will makes probate quicker because the court can accept it without speaking to the witnesses who signed it.

Is it required (in CT) to add a self-proving affidavit to my last will?

It is not necessarily in Connecticut. Nevertheless, if you choose to attach a self-proving affidavit, it’ll be rather advantageous because this document functions as an alternative for in-court testimony of witnesses in the course of probate.

Can you exclude your children or spouse from a last will and testament?

Should you want to disinherit your marriage partner, you will be able to do it without any obstacles. Connecticut is not a community property state (also known as marital property). The mentioned concept is a form of interest documentation presented by the law that claims that 1/2 of all assets (along with debts) of one marriage partner is owned by the other and remains such upon divorce.

Thus, in Connecticut, you can disinherit your marriage partner, but the law implies that your spouse is entitled to some minimum amount of your property.

Besides your spouse, Connecticut law lets you disinherit any other family members. Your adult children or other relatives can be lawfully disinherited completely in your last will. To do that, include corresponding paragraphs to your last will and testament.

In Connecticut, am I allowed to alter a typewritten will after signing it?

Yes, it is possible.

As outlined by Connecticut law, you can change or repeal your last will if you are not obligated by a legal agreement saying the opposite.

It’s recommended to modify your will if a significant event happens in your life. Those include but aren’t limited to:

- Birth or adoption of a child

- Divorce or marriage

- Real estate or major piece of property has been purchased or sold

- Your money situation has changed considerably

What should I do in case my last will has been lost?

If the last will and testament is lost or destroyed, according to the Connecticut law, the court will recognize it. But, the probate court will not be likely to accept anything other than the original of the last will and testament to probate.

By Connecticut law, the will’s absence is regarded as its revocation. This means the trustee will need to provide proof of the last will’s credibility, which in turn might be found to be somewhat problematic.

For a holographic will, you would need sworn witnesses and testimony to show. That makes the situation far more problematic. Furthermore, you are also to provide proof of the reason why the last will and testament and its elements can’t be provided in a way that will also prove it wasn’t repealed.

What does one have to do in case the testator is not physically able to sign his or her last will?

Solely per your directive and in your presence is another person allowed to sign your will (See Connecticut Estate Code). You can give a particular directive using a number of means, including verbal communication, a positive answer to a query, or gestures.

A notary public is allowed to sign the name of the testator if the latter is unable to do so due to a physical incapacity. The notary has to be directed to do it in the presence of a witness. It is worth noting that such witnesses are not allowed to have an interest (equitable or legal) in any of the assets being the concern or affected by this type of document (the last will).

Other Documents Related to Wills in Connecticut

| Related documents | When to create it |

| Codicil | There are a number of minor modifications you want to make to your will. |

| Self-proving affidavit | You would like the probate to be faster in due time. |

| Living will | You want to make sure your end-of-life treatment is done as outlined by your wishes. |

| Living trust | You want extra safety and confidentiality once the time to distribute your possessions comes. |

Last Will and Testament Forms for Other States