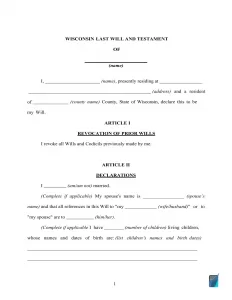

Free Wisconsin Last Will and Testament Form

A Wisconsin last will is a vital and legal instrument that represents the final wishes of a testator regarding their individual property and ways in which they would want it to be distributed among selected beneficiaries. It is typically smart to write a will.

In case you’re looking for a fillable and printable Wisconsin last will and testament form, you can find it on this site, as well as the tips on last will creation and solutions to common questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Wisconsin Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Chapter 853 – Wills | |

| Definitions | Subchapter 853.50 Definitions | |

| Signing requirement | Two witnesses | 853.03 Execution of wills |

| Age of testator | 18 or older | 853.01 Capacity to make or revoke a will |

| Age of witnesses | 18 or older | 853.07 Witnesses |

| Self-proving wills | Allowed | 853.04 Self-proved will |

| Handwritten wills | Might be recognized if witnessed according to the state law | 853.03 Execution of wills |

| Oral wills | Not recognized | |

| Holographic wills | Not recognized | |

| Depositing a will | Possible with a Wisconsin county circuit court A fee is $10 | 853.09 Deposit of will in circuit court during testator’s lifetime 814.66 Fees of register in probate |

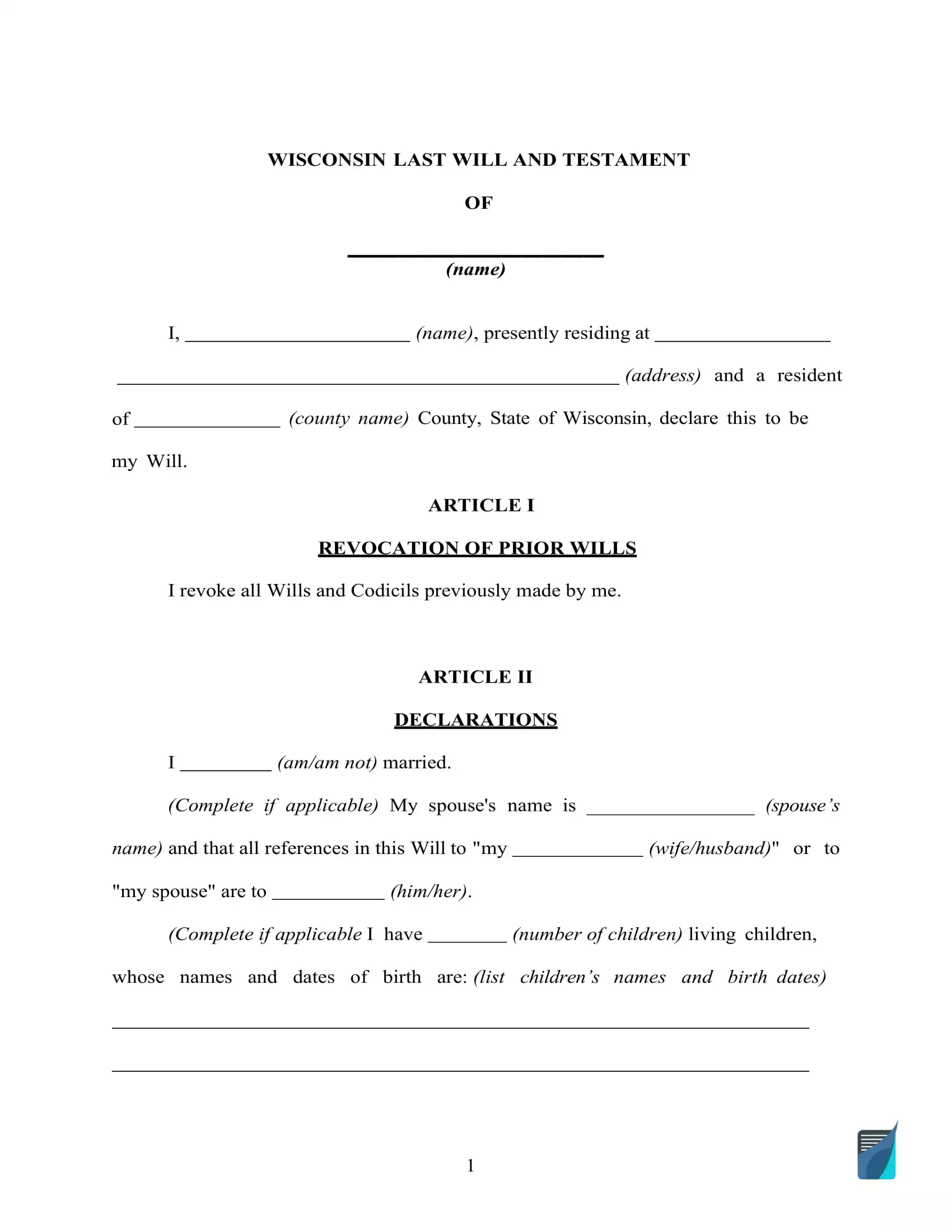

How to Write a Wisconsin Last Will

1. Consider your alternatives. One important thing to bear in mind, first, is whether or not you need to write the entire document by hand or utilize a fillable last will and testament form available online.

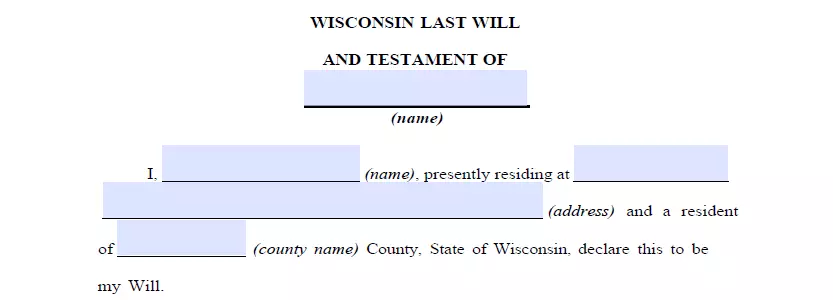

2. Indicate your information. The initial step is establishing the testator by entering their full legal name, along with the residential information (city, county, and state). Go through the remaining portion of the passage, including the information you have written and the “Expenses and Taxes” subsection.

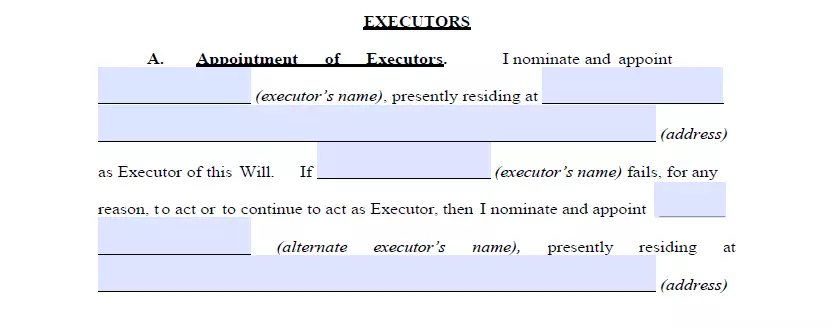

3. Determine the executor (or executrix). The next step is to select the executor of your last will, the person in charge of making sure all you write in this document gets done. To do this, you will need to specify the executor’s full name, together with their residence details (city, county, and state). Ensure that you appoint someone who lives in the same state as you do. If you don’t, there’ll be extra paperwork and unavoidable hassle in the procedure resulting from different special rules every state has when it comes to out-of-state executors. While not imperative, it’s a good idea to appoint one more person to be an executor in the event the first one is unwilling or not capable of carrying out your last will.

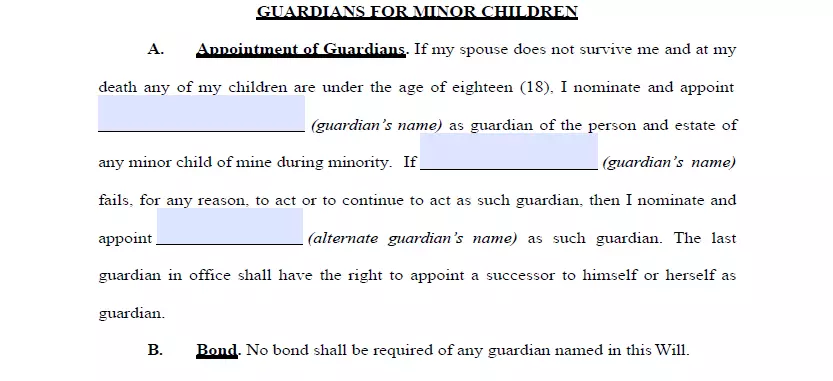

4. Choose the guardian (optional). You can choose a trusted person as a guardian in the event that you have minor or dependent children that need to be looked after. If there are no instructions regarding exactly who should look after your kids, the guardian will be appointed by the court.

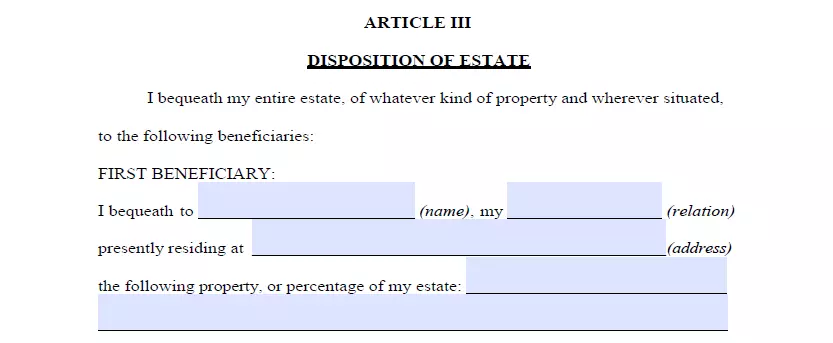

5. Indicate your beneficiaries. Now establish people to whom you wish to leave your property, that is, your beneficiaries. Fill out their full names, places of residence, and your connection to them (spouse, child, friend).

6. Allocate possessions. In the event that you’ve got an asset distribution under consideration that’s not even, it is possible to explain it within this part. Assets could include cash, shares, realty, company control, money for unresolved arrears, as well as any material items of monetary worth you own. But, joint and living will property and assets, as well as your life insurance, can’t go in your last will.

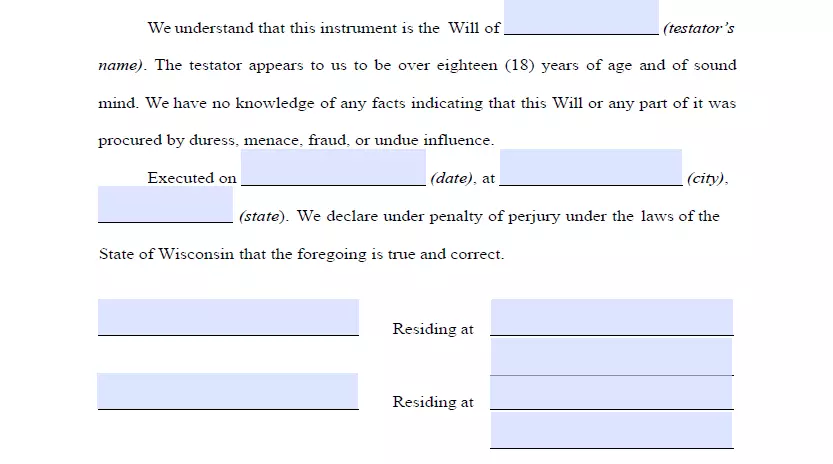

7. Ask witnesses to sign the document. Wisconsin Statutes stipulate that no less than two witnesses must sign a will so that it is regarded as legally binding. You can name someone as a witness only when they’re over the age of 18 years and are disinterested in your bequest. As an additional preventative measure against scenarios when the will is contested or some other problems, it might be wise to name a witness who is younger than you to ensure they’ll still be there after you die. After a thorough review of each section in your last will and testament, all parties involved (you and your two witnesses) have to fill out their names and full addresses and sign the will.

Get a Free Wisconsin Last Will Template

Frequently Asked Questions

Is will notarization necessary by Wisconsin law?

A last will and testament in Wisconsin is valid without notarization. However, if you would like to add a self-proving affidavit to your will, you must attest it. A self-proving last will helps make the probate more efficient since the court can accept it without getting in touch with the witnesses who signed it.

What is testamentary capacity?

Testamentary capacity is used to describe the testator’s (the individual writing the last will) legal and mental ability to write and change their last will and testament.

There are usually two requirements to fulfill: age and soundness of mind. In most states, you’ve got to be over 18 years old to create a will. Soundness of mind indicates that you are aware of your estate as well as the beneficiaries of your possessions and understand the aftereffects of your actions fully.

Is child or spouse disinheritance allowed?

In order to disinherit your marriage partner, it will most probably be impossible. Wisconsin is a community property state (sometimes called marital property). That is a type of asset ownership provided by the laws (§766.31). It expresses that 50 % of all properties and assets (and this includes debts) of one spouse belongs to another and stays such upon divorce.

Just those properties and assets you keep control of (your individual property) are determined by last will and testament disinheritance when it concerns your marriage partner.

The sole way to disinherit your marriage partner will be to conclude a prenuptial agreement with them before the marriage. In this document, you can alter the marital property and change the share of your partner.

With regard to other family members, it is possible to lawfully disinherit anyone else. This applies to your children and other relatives; only add disinheritance clauses to the last will.

Am I allowed to modify a typewritten last will and testament after I sign it (in Wisconsin)?

Yes, you can do that. A person who wrote the will is permitted to alter or revoke his or her last will at any time. The sole case that may not allow you to do it is if such doing is prohibited under the agreement you entered (for example, a prenuptial agreement).

Additionally, it is a good idea to revise your last will whenever you go through a major life event, including:

- Adoption or birth of a child

- You got divorced or married

- Real estate or a considerable piece of property has been purchased or sold

- Your financial situation has changed greatly

What will happen if I lose my last will?

In Wisconsin, the law (Subchapter 856.17 of the Code) claims that the court will accept a will in case it is destroyed or lost. However, the probate court is unlikely to admit anything other than the initial version of the last will and testament to probate.

Wisconsin law gives an assumption that the absence of the will implies it has been revoked. This places the obligation on the advocate of the last will and testament to provide proof of the mentioned will.

For holographic last wills, the situation may become much more problematic as sworn witnesses and testimony are required. The reason for not providing the last will and testament and its details has to be proven too.

| Related documents | Instances when you might need to create one |

| Codicil | There are several small adjustments you wish to make to your will. |

| Self-proving affidavit | You want the probate to be easier when it’s necessary. |

| Living will | You would like to express your wishes about the end-of-life health care and life-prolonging measures. |

| Living trust | You want to look at an alternative to a last will. |

Last Will and Testament Forms for Other States