Free North Dakota Durable Power of Attorney Form

The North Dakota durable power of attorney is a legal form that permits a person (the “principal”) to designate another individual (called the “agent” or “attorney-in-fact”) to oversee their financial activities. This legal provision is especially beneficial when the principal is unable to manage their financial responsibilities due to health issues, disability, or other reasons.

This power of attorney’s “durable” aspect means that the document remains in effect even if the principal becomes incapacitated. This is distinct from non-durable forms, which would automatically end if the principal loses the capacity to make decisions.

The durable POA in North Dakota includes extensive authority, such as managing bank operations, purchasing or selling property, overseeing investments, and addressing tax and insurance matters. It may become effective right after it is signed, or it can be arranged to activate only when the principal is deemed incapacitated.

At FormsPal, you can access all the North Dakota POA forms you need online to legally appoint someone to make your financial or health care decisions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

North Dakota Signing Requirements and Laws

The laws governing the signing and execution of a durable power of attorney are outlined under the North Dakota Century Code Title 30, Chapter 30.1-30 (Uniform Durable Power of Attorney Act). These requirements ensure the document adheres to legal standards and genuinely reflects the principal’s wishes under North Dakota law.

According to § 30.1-30-01, a durable POA must be in writing and include specific language that indicates it remains effective despite the principal’s subsequent disability, incapacity, or the passage of time. This language must clearly state that the power of attorney will not be affected by the principal’s subsequent disability or incapacity, or it may specify that it becomes effective upon such disability or incapacity.

While the North Dakota state code doesn’t explicitly require an acknowledgment for the durable power of attorney, it does necessitate notarization by a licensed official to ensure the document’s validity and enforceability. This formal notarization confirms the principal’s identity and their understanding of the document’s implications.

Furthermore, as per § 30.1-30-04, the principal retains the right to revoke the durable power of attorney at any time, provided they are competent to do so. This section ensures that the principal can retract the powers granted as long as they are mentally capable of understanding the decision to revoke.

North Dakota Durable Power of Attorney Form Details

| Document Name | North Dakota Durable Power of Attorney Form |

| Other Names | North Dakota Financial Durable Power of Attorney, ND DPOA |

| Relevant Laws | North Dakota Century Code, § 30.1-30-01 – 30.1-30-06 |

| Signing Requirements | N/A |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

Durable POA documents are used in each and every state. Take a look at other popular DPOA forms frequently filled out by Americans.

Steps to Complete the Form

Follow these step-by-step instructions to properly fill out the North Dakota durable power of attorney form.

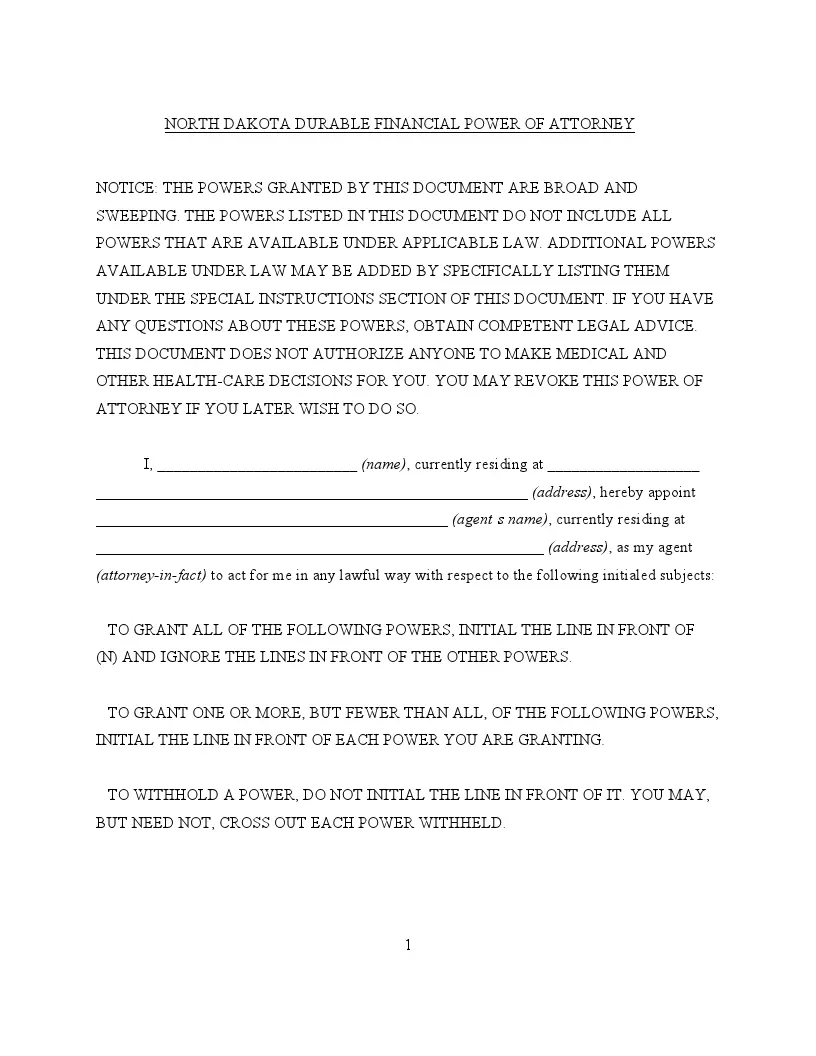

1. Principal’s Information

Begin by filling out your personal information. This part includes your legal name and your current residential address. Make sure to write clearly and accurately, as this information identifies you as the principal granting the power of attorney.

2. Agent’s Appointment

In the next section, provide the name and address of the individual you choose as your agent, also known as your attorney-in-fact. This person will be granted the authority to act on your behalf regarding the powers you assign. Choosing someone trustworthy and reliable is crucial, as they will manage your financial affairs.

3. Granting Powers

Review the potential powers you can delegate, such as real estate transactions, banking activities, and tax matters. You must initial next to each power you want to grant to your agent. If you prefer to authorize all listed powers without restriction, simply initial next to the option labeled (N) for granting all powers. Be mindful of the extent of authority you are comfortable giving.

4. Special Instructions

This section allows you to provide detailed instructions or limitations not covered by the standard options on the form. For example, you might specify conditions under which certain powers can be exercised or outline how you expect complex financial transactions to be handled. It allows you to customize the power of attorney to fit your needs and preferences.

5. Effective Date

Determine when the power of attorney will go into effect. You have several choices: it can become effective immediately, on a specific future date, or only if and when you become incapacitated. Then, initial next to your choice to indicate when the document should activate. This decision has significant implications for when your agent can start making decisions on your behalf.

6. Successor Attorney-in-Fact

If there is a possibility that your primary agent might not be able to serve in their role, it is wise to appoint a successor. Provide the name and address of an alternate person who will take over if the original agent is unable to fulfill their duties. It ensures continuity in managing your affairs without interruption.

7. Execution

Once all sections are completed to your satisfaction, sign the document in the presence of a notary public. The notary will verify your identity and witness your signature, which is legally binding to the agreement. Ensure the notary also completes the acknowledgment section, which officially documents the signature’s authenticity.

8. Notify Parties

Finally, inform institutions or individuals (like banks, brokers, or tax agencies) that will interact with your agent about the power of attorney. Providing them with a document copy can facilitate smoother transactions and help avoid legal confusion or delays in managing your affairs. This step is crucial for enabling your agent to act effectively on your behalf.

Listed here are various other North Dakota documents filled out by our users. Try our step-by-step builder to customize these forms to your needs.

Download a Free North Dakota Durable Power of Attorney Form