Colorado Promissory Note Template

When you lend money to an individual, you usually want to be sure that you will receive the full sum back at some point. For such cases, a Colorado promissory note template is a handy instrument.

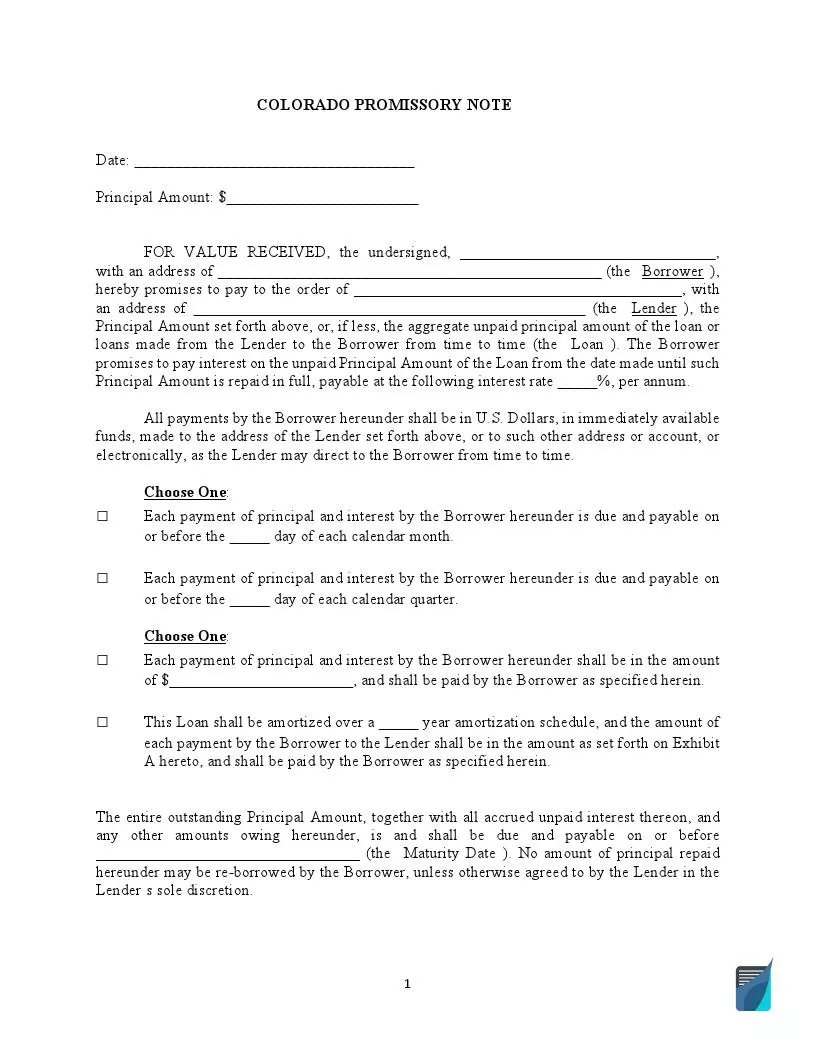

The promissory note form reveals the information about who has borrowed the money (or the borrower), the exact sum, who has lent the money (or the lender), the date when the borrower should give the money back, the interest rate, and other details.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

In the United States, there are two common types of promissory notes:

- Secured promissory notes.

When parties sign a secured note, the borrower must indicate what will cover the debt if they cannot return the money.

- Unsecured promissory notes.

This type is called “unsecured” for a reason: the borrower does not provide anything to cover the debt, and the lender should fully trust the borrower. This paper is an option when you lend money to your trusted friends or family members.

Each state has its own norms that regulate promissory notes, interest rates, and other related topics. Because the rules vary, the templates are also different.

Colorado Usury Laws

Title 5 of the Colorado Revised Statutes contains the laws regulating usury. Interest rates that one may set for loans in Colorado are prescribed in Article 12.

Each section of this article describes interest rates in various circumstances. Section 5-12-101 sets the rate of 8% per annum as the legal rate of interest.

Colorado Promissory Note Form Details

| Document Name | Colorado Promissory Note Form |

| Other Name | CO Promissory Note |

| Max. Rate | 8% – legal rate of interest; 45% – general usury limit; 12% – for consumers |

| Relevant Laws | Colorado Revised Statutes, Sections 5-12-103 and 5-2-201 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

Businesses and individuals frequently require promissory notes to lend to or borrow money from other individuals and companies and avoid lending institutions. Below are some of the most popular regional promissory notes searched by the users of this site.

Filling Out the Colorado Promissory Note

The creation of legal documents in Colorado (and the US in general) may be difficult. We have prepared a brief guide to assist in the Colorado promissory note template completion.

Download the Template of the Note

First, get the file that contains the correct template. Our form-building software will help you download the Colorado promissory note template without any problems.

Insert the Date of Signing

On the top of the form, add the date when you and another party sign the form.

![]()

Describe the Lender and the Borrower

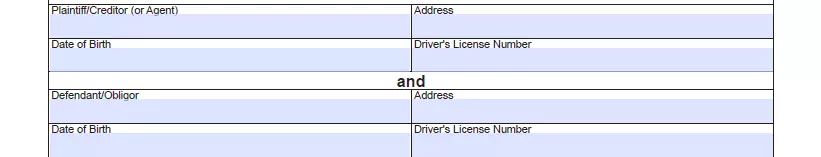

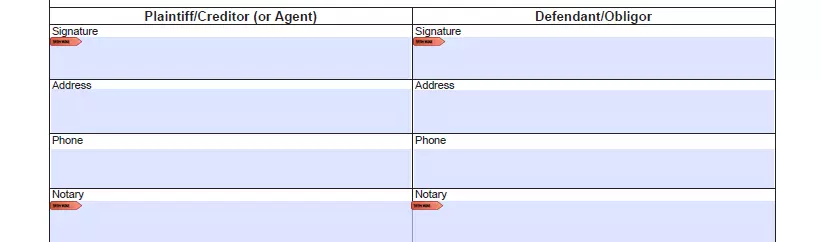

In the Colorado promissory note, the lender is also referred to as “plaintiff” or “creditor.” The borrower is called “obligor” or “defendant.” You have to begin by completing the blank space for the plaintiff: their name, date of birth, and address. You have to add the number of your ID card in some cases. The same data should be written for the obligor.

A promissory note in Colorado is often used when car accidents occur. When completing a document after an accident, you should insert the facts tied to that accident below the plaintiff and a defendant’s details.

Write the Borrowed Sum

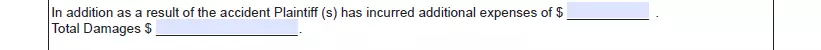

Then, write the sum (in US dollars) that a borrower should return.

For example, an individual who damaged someone’s car has to sign such a paper. In that case, the “borrowed sum” would be the sum that compensates for the damage. If the plaintiff has faced additional expenses, they should be included in the amount.

Set the Schedule of Payments

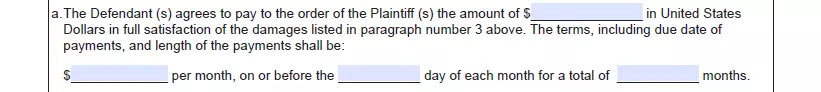

You have to set the schedule of the debt payments, including the sum per month, the day of payment, and the total number of months.

Read the Notice

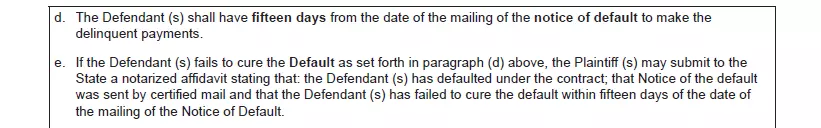

You will see several statements that both parties should read and accept.

Sign the Promissory Note

After completing all sections, add the date of signing again. Both the plaintiff and the obligor should sign the form and add their details again (phone numbers and addresses). Then, a notary has to verify the note to ensure its validity.

Other essential Colorado forms readily available for download and that can be personalized in our simple document builder.