Kentucky Promissory Note Template

One might experience a lack of monetary resources and could turn to someone they know for feasible assistance. Ensure to tailor a Kentucky promissory note template to protect both the helper’s contribution and one’s business honor.

A promissory agreement defines the relationship between the lender and the borrower (the debtor), the amount of money lent, methods and schedule of payment, interest rate, and the termination date. In some cases, the standard promissory note template contains information about the fine for late payment. If the borrower fails to follow the repayment’ schedule and is late with regular payments, as a rule, they have to face late payment charges. Both signatories should meet agreement regarding all conditions demanded by the Kentucky Promissory Note template and reflect their will in the document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

As a rule, a promissory document is a DIY agreement, and most states don’t offer official forms. For this reason, many US states do not require the mandatory presence of a notary public and witnesses. However, if the parties want to provide an extra layer of safety and prove each other’s identities, they may invite a licensed notary to verify the act and affix the sate seal.

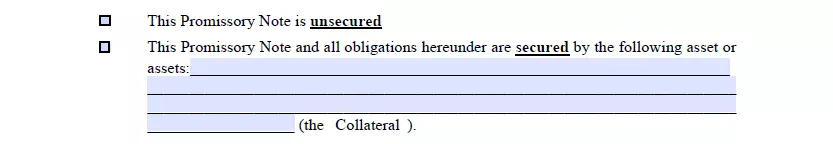

In Kentucky, residents are empowered to choose between a secured agreement or an unsecured one. The forms have many similar components, but the difference is vita —an immediate guarantee of reimbursement.

Secured Promissory Note

By opting to create a secured promissory note, the signatories establish a security asset that safeguards the lender’s funds if the borrower fails to repay the loan in full. Usually, the borrower offers a list of property assets (the collateral), including some estate property, vehicles, watercraft, or high-value items like jewelry or stocks.

If the borrower fails to return the full amount within the designated period, the lender obtains a legal right to claim compensation immediately.

Unsecured Promissory Note

The only difference between these two types lies in the absence of security assets in the unsecured promissory agreement. The note doesn’t contain conditions that guarantee immediate compensation should the borrower default. It means that in case the debtor refuses to reimburse the full amount of the loan, the lender will have to seek justice in court. The procedure could be very tiring; thus, ensure you tailor this type of document with a person you know well and find dependable.

Popular Local Promissory Note Forms

Individuals and companies often want promissory notes to borrow money from other individuals and businesses and keep away from lending institutions. Here are some of the most requested local promissory notes searched by people.

Kentucky Usury Laws

Kentucky usury laws are regulated by § 360.010 of the state Revised Statutes. Following the directions, the interest rate equals 8% per year. However, the signatories can determine another rate and register it in writing. Consider the paragraph for more details and terms.

Kentucky Promissory Note Form Details

| Document Name | Kentucky Promissory Note Form |

| Other Name | KY Promissory Note |

| Max. Rate | 8% – legal rate of interest; general usury limit – 4% greater than Federal Reserve rate or 19%, whichever is less |

| Relevant Laws | Kentucky Revised Statutes, Section 360.010 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Filling Out the Kentucky Promissory Note

Kentucky does not provide an official form for promissory agreements. We encourage you to use our advanced tools and generate a DIY template, including all inherent data online. Below are step-by-step guidance and advice on filling out the document.

- Define the Date and the Loan Amount

Start filling the agreement by inserting the current calendar date and the loan amount. The sum should be in US dollars.

- Enter the Parties’ Identities

Introduce the lender and the borrower, including their names, addresses.

- Insert the Interest Rate

Following the Kentucky usury laws, the interest rate is 8%. The parties can determine their preferred amount and register it in writing.

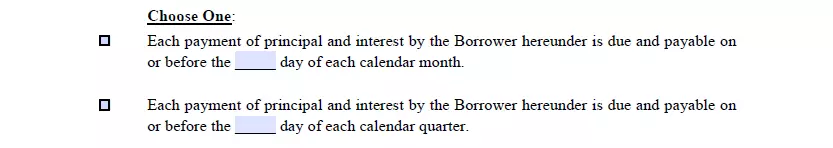

- Define the Regular Payment Dates

Select one alternative and check the appropriate box. You should specify the day when the borrower will render regular payments.

- Outline the Payments Amount and the Amortization

Select one preferable variant: determine the amount of each regular payment and the amortization schedule, if any. Submit the needed details in the Exhibit to the promissory note.

- Specify the Maturity Date

- Clarify when the loan should be paid in full.

- Select the Note Type

Choose the appropriate box and specify the list of assets if you select the secured promissory note.

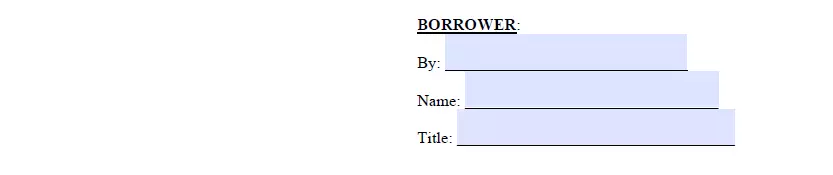

- Authorize the Promissory Note

Before appending signatures, you should enter the government state, Kentucky. Re-read the promissory note and append signatures if everything is correct.

Looking for some other Kentucky documents? We provide free forms and straightforward customization experience to anybody who wants less hassle when facing documents.

Other Promissory Note Forms by State