Illinois Last Will and Testament Form

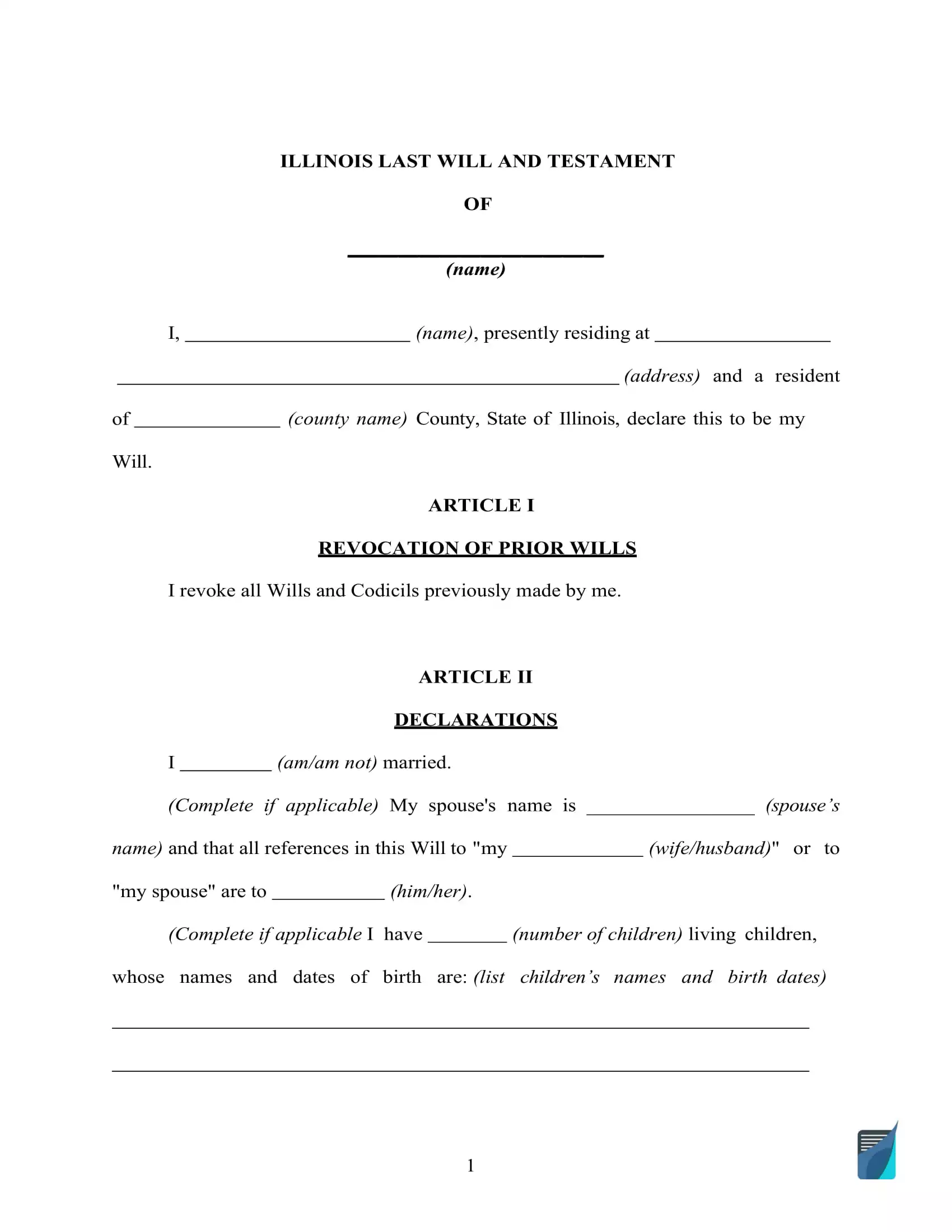

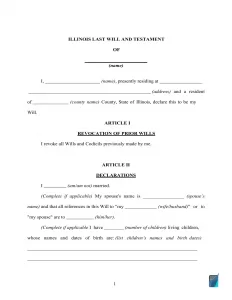

An Illinois last will is a legal document containing the details of an individual (called the “testator”) involving their assets’ distribution in case of death, signed and written in the form prescribed by the state law.

Typically, most will undoubtedly benefit from having such a document in place. Even if you don’t possess a lot of things or have a long life ahead, a last will and testament can really help your family situation and prove to be critical to your close relatives.

We offer a free Illinois last will and testament template available in PDF and Word (DOCX) formats below. Before creating a will, please check the signing requirements in your state.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Illinois Will Requirements and Laws

| Requirements | State laws | |

| Statutes | Act 5 – Probate Act of 1975 | |

| Definitions | Article I – General Provisions | |

| Signing requirement | Two witnesses | Sec. 4-3. Signing and attestation |

| Age of testator | 18 and older | Sec. 4-1. Capacity of testator |

| Age of witnesses | 18 and older | Sec. 4-3. Signing and attestation |

| Self-proving wills | Allowed | Sec. 6-4. Admission of will to probate |

| Handwritten wills | Might be recognized if witnessed according to the state law | Sec. 4-3. Signing and attestation |

| Oral wills | Not recognized | |

| Holographic wills | Not recognized | |

How to Write an Illinois Last Will and Testament

1. Consider your possible choices. Prior to starting out, you’ll want to decide if you would like to use the help of an attorney or create the entire document yourself. If you’re going to develop the last will yourself, choose the type you will go for: a handwritten (holographic) will or a free last will and testament form.

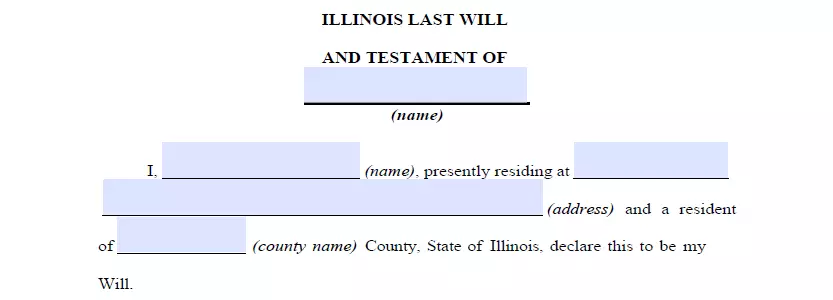

2. Specify your information. Establish the testator and their details: full name and residence (city, county, and state). Go over the information you wrote and the remainder of the section, including “Expenses and Taxes.”

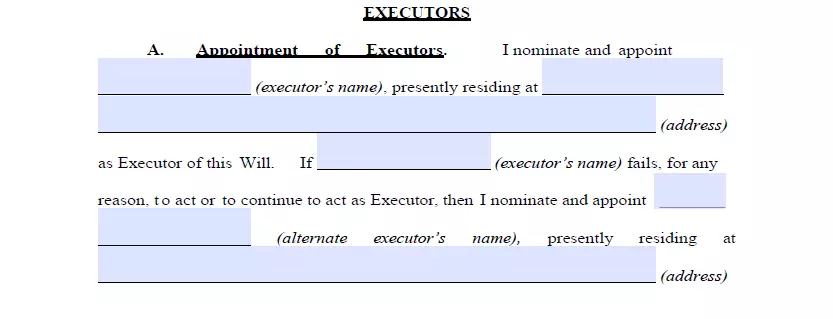

3. Indicate the executor (or executrix). In this passage, you establish who’s going to carry out your will by filling in their full name, along with their city, county, and state of residence. Most states have special restrictions associated with out-of-state executors and representatives, which usually implies extra headaches and paperwork. Thus, choosing someone who resides in the same state as you is advised. It could happen that your main representative will be unable to carry out your will due to sickness, death, unwillingness, or some other factors. The court will probably choose its own representative to undertake the duties in such a case. To avoid that, choose an additional executor by indicating the same information you did for the main one.

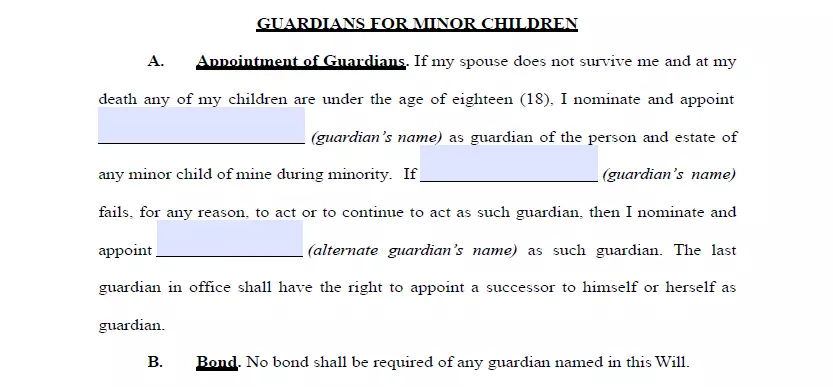

4. Establish the guardian (optional). In case that you have minor or dependent children and do not want the court to choose a guardian for the kids when you’re no longer on this Earth, you can specify a friend or acquaintance as a guardian for your children.

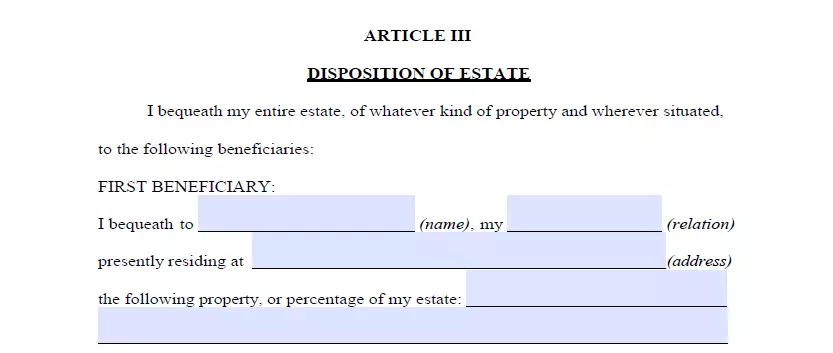

5. Specify your beneficiaries. This is where you specify those who are going to inherit your property. For each named beneficiary, specify these particulars: full legal name, address, and how they are related to you.

6. Distribute assets. Write down your possessions and explain how you would like to distribute them among your inheritors if you have something in mind besides splitting the estate evenly. Money for arrearage, realty, stocks, business ownership, cash, and any material items of commercial worth in your possession can be mentioned in the will. Please be aware that there are things that can’t be distributed in the last will, for example, shared and living will property and life insurance.

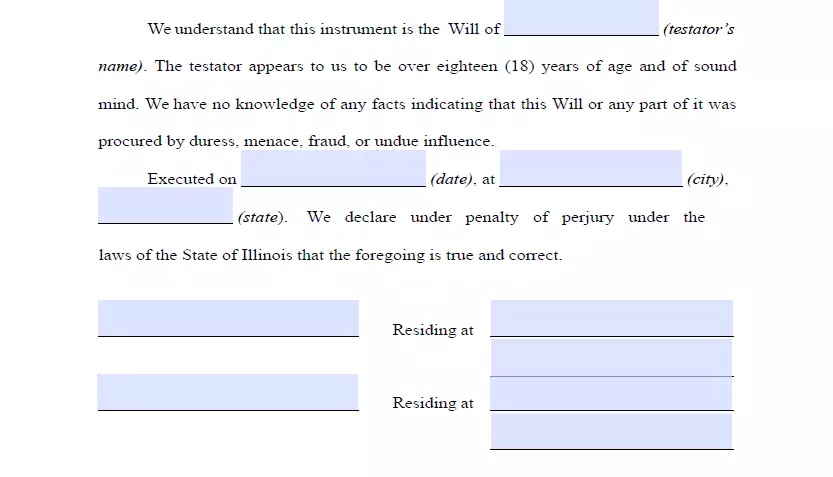

7. Ask witnesses to finalize the document. Following Illinois regulation, for any last will and testament to be legally correct, it has to be signed by two witnesses. They should be over 18 years of age and have no interest in your last will, which means they cannot be inheritors. As an additional precaution against cases when your will is challenged or some other problems, it’s a wise decision to appoint a witness who is younger than you to ensure they will be there after you depart this world. After carefully revising each passage in your last will, all parties involved (you and your two witnesses) will have to fill out their full names and full addresses and sign the document.

Create a Free Illinois Last Will

Frequently Asked Questions

Is an Illinois will form effective without a notary certification?

A will in Illinois is valid without notarization. To make your last will self-proving, notarization is not required either. A self-proved will makes probate more efficient since the court can acknowledge it without speaking to the witnesses involved.

Exactly what does it mean to be testamentary capable?

In order to create your last will and change it (to be testamentary capable), you must meet certain requirements with regards to your legal and mental capabilities (sound mind) first.

In the state of Illinois, to create a legal will, you have to be of sound mind and at least 18 years old. “Sound mind” indicates that you do not have any kind of psychiatric disorder (dementia, insanity, etc.) that does not allow you to fully understand what you are doing and what consequences your actions have.

Is a child or spouse disinheritance allowed in this state?

In regard to your marriage partner, it’s necessary to accentuate that Illinois is not a community property state, which indicates that the assets that were gained during the marriage or that improved with capital earned in the said marriage, are not owned by each of the marriage partners equally. This makes it possible to disinherit your spouse completely, but the surviving spouse can renounce the will, which is a procedure that might allow the spouse to get a portion of the testator’s estate – to learn more check (755 ILCS 5/2-8) (from Ch. 110 1/2, par. 2-8).

However, it is possible to bypass the renouncing by creating a prenuptial agreement where you would decide on the property distribution or where the other spouse waives the intestate rights. In Illinois, a prenup takes precedence over a last will.

Am I allowed to change a last will after signing it? (in Illinois)

Yes, you can do that. In Illinois, in case you haven’t concluded a contract that mentions otherwise, you are allowed to repeal or alter your will whenever you want.

It’s recommended to review your last will when a major event comes about in your life, such as childbirth, marriage, real estate purchase, etc.

What happens if a last will and testament is lost?

Illinois law offers a presumption that the will’s absence means it was repealed (755 ILCS 5/4-7). This puts the responsibility on the proponent of the last will to provide solid proof.

The following are some instances of scenarios when the revocation assumption might be overcome:

- There is evidence that the will was stored at home when the decedent perished in a house fire involving the said home.

- There is solid proof that the deceased never possessed the will, and the lack of the will cannot be explained by its revocation.

- After the testator’s death, the last will was lost or destroyed (deliberately changing, destroying, or concealing a will after the testator’s death can also be prosecuted as a Class 3 felony).

But in practice, the court will usually treat such cases following the state’s intestacy law.

| Related documents | When to create it |

| Codicil | You want to slightly change your will without writing a new document from scratch. |

| Self-proving affidavit | You want the probate to be quicker in due time. |

| Living will | You would like to indicate precisely what health care you expect if you can’t express that by yourself. |

| Living trust | You want to handle your end-of-life affairs without probate. |

Last Will and Testament Forms for Other States