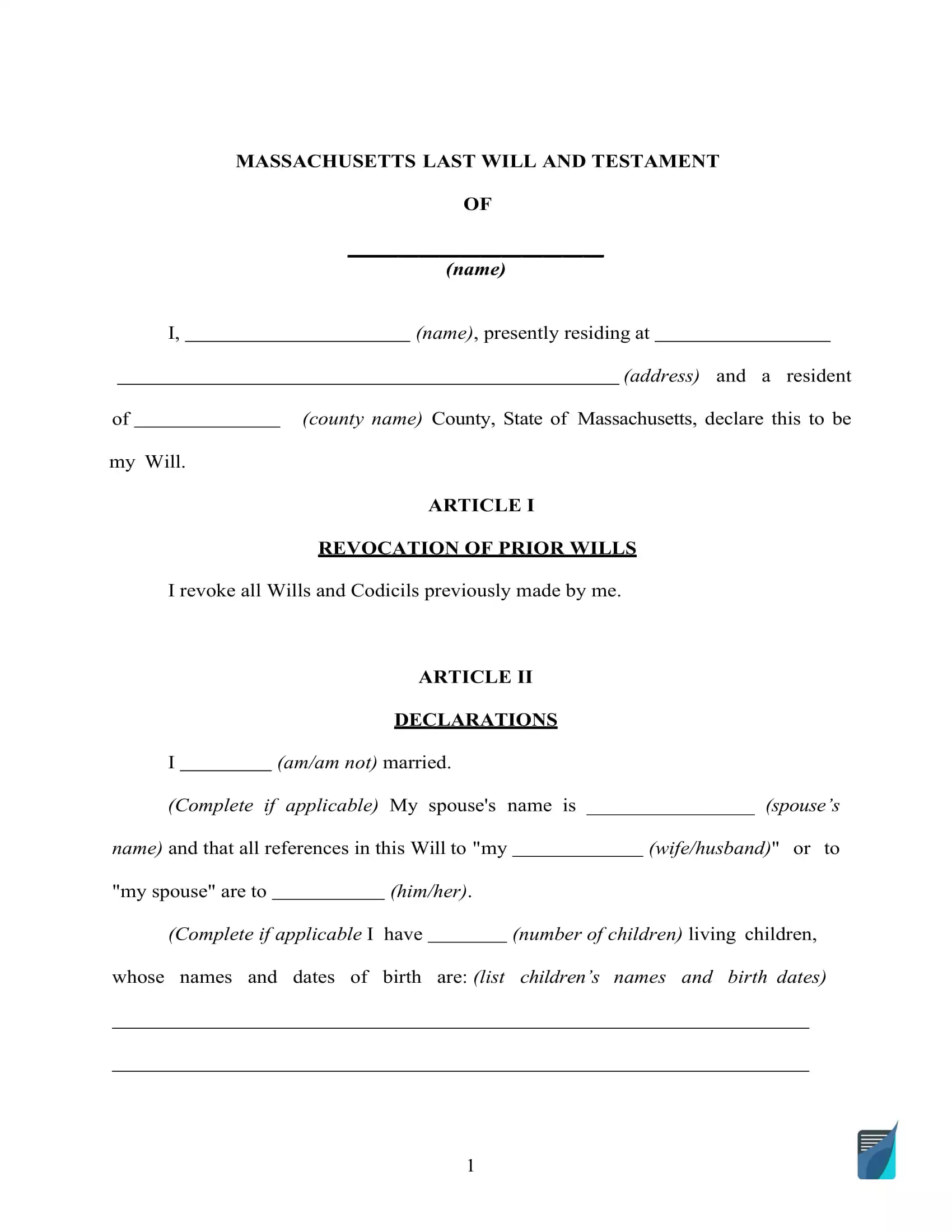

Massachusetts Last Will and Testament Form

A Massachusetts last will and testament is a document that contains the last wishes of its owner and creator (the testator) and determines the exact way their estate will be used in the event of their death. Making a last will is a wise choice for just about anyone who would like to avoid disagreements and confusion regarding their possessions.

Here, you’ll find a Massachusetts will template for download supported with some tips intended to remove your slightest questions pertaining to property planning, different types of wills, and state requirements for this document.

Massachusetts Will Requirements and Laws

| Requirements | State laws | |

| Statutes | Chapter 190B – Massachusetts Uniform Probate Code; Article II – Intestacy, Wills and Donative Transfers | |

| Definitions | Section 1-201: Definitions and inclusions | |

| Signing requirement | Two witnesses | Section 2–502. Execution of Wills |

| Age of testator | 18 or older | Section 2–501. Who May Make Will |

| Age of witnesses | 18 or older | Section 2–505. Who May Witness |

| Self-proving wills | Allowed | Section 2–504. Self–Proved Will. |

| Handwritten wills | Recognized if witnessed according to the state law | Section 2–502. Execution of Wills. |

| Oral wills | Recognized if meeting certain conditions | |

| Holographic wills | Not recognized | Section 2–502. Execution of Wills |

| Depositing a will | Possible with a Massachusetts county probate court A fee is $75 | Section 2–515. Deposit of Will With Court in Testator’s Lifetime |

How to Write a Will in Massachusetts

1. Think about your possibilities. Make a decision whether you need to seek the services of lawyers or prepare your last will by yourself (either by working with a free last will and testament form or using a do-it-yourself document builder).

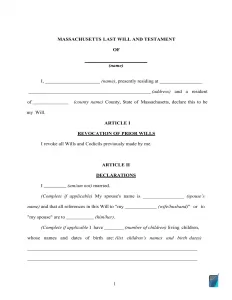

2. Specify your information. Establish yourself as the testator and indicate these particulars: full name and address (city, county, and state). Go over the information you wrote along with the remainder of the section carefully.

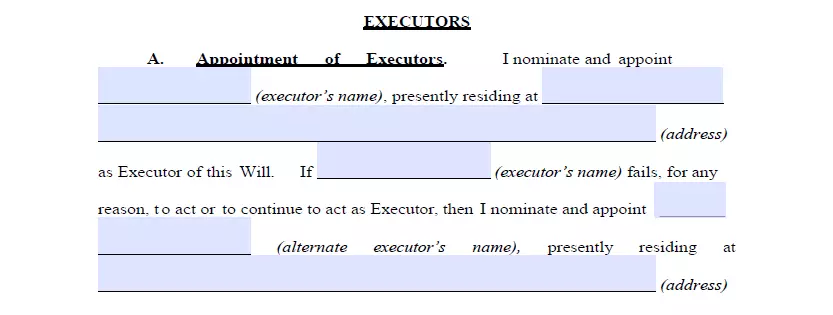

3. Designate the executor (or executrix). The next step is to decide on the executor of your last will and testament. This person will be your personal representative in charge of ensuring that every little thing you lay out in this document gets done. To do that, you will need to specify the executor’s full name, along with their residence information (city, county, and state).

Be sure you appoint a person who resides in the same state as you do. Massachusetts, unlike many other US states, does not have any restrictions or specific requirements for executors who live in a different state. However, this does not imply that appointing someone from another state is wise. It’s always better to name an executor who lives in the same state because dealing with their duties can take weeks, months, or sometimes even years.

As for the general requirements, your executor must be at least 18 years old and of sound mind. (Section 3-203)

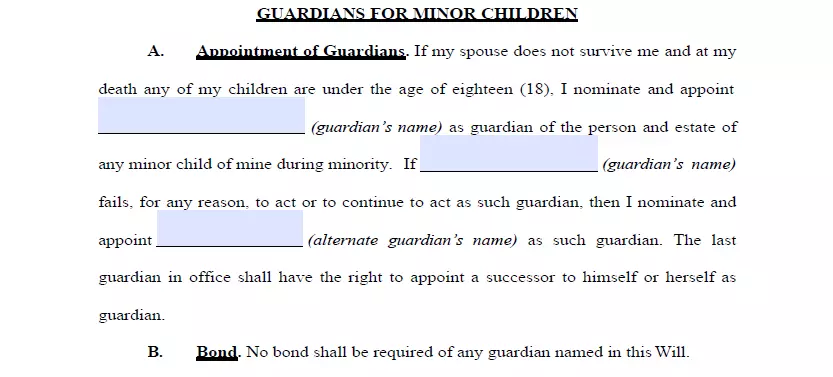

4. Choose a guardian (optional). It’s possible to appoint a trusted person as a guardian in case you have underage or dependent children that must be taken care of after your death. In case there are no instructions concerning who exactly should look after your children, the guardian will be selected by the local court.

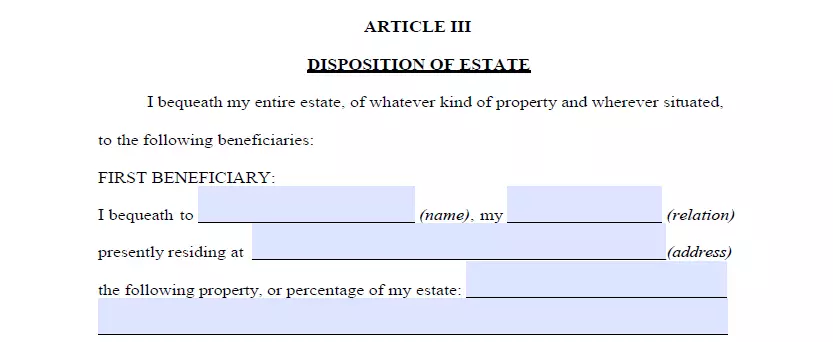

5. Specify your beneficiaries and what they get. This is where you indicate those who are going to receive your assets. Fill out their full names, addresses, and your relationship to them (spouse, child, friend).

Write down your assets and explain exactly how you would like to distribute them to your beneficiaries. Such property can include cash, shares, realty, company control, money for arrearage, as well as any physical items of commercial value you possess.

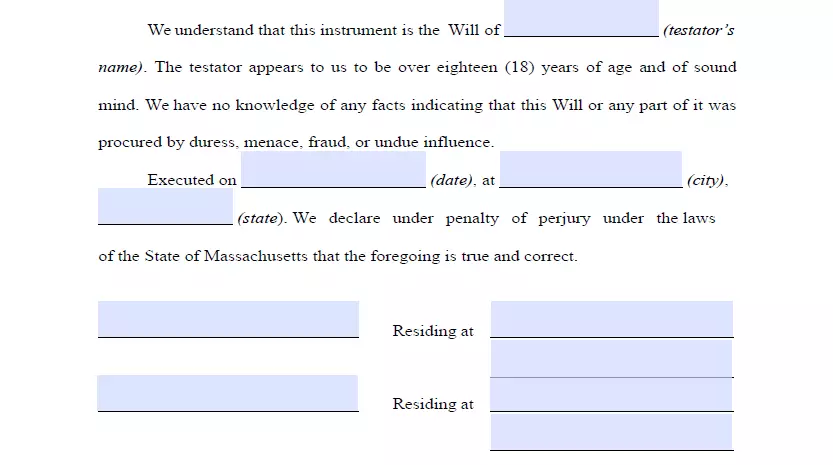

6. Proceed with the witnesses signing the document. According to Massachusetts General Laws, for a will to be considered legally correct, it has to be signed by two witnesses (Section 2–502). You may name a person as a witness provided that they’re over the age of 18 years and are disinterested in your heritage. After a complete review of every passage in your last will, all signatories (you and your two witnesses) must write their full names and full addresses and sign the will. These witnesses will have to be able to testify during probate when the time comes.

Make a Free Massachusetts Last Will and Testament

Frequently Asked Questions

Is will notarization required in Massachusetts?

No, Massachusetts law affirms that a last will can be valid without notarization. However, you could make your will self-proving by adding an affidavit to it. To do that, you will need to go to a notary public.

Why should I make my will selv-proved?

In case you decide to attach a self-proving affidavit to your will, it’ll help to make the probate process easier for your witnesses.

Can I disinherit my spouse in MA?

No, in the Commonwealth of Massachusetts, you cannot disinherit your spouse completely. If you leave nothing for your spouse in your last will, your spouse can challenge the document after your death and claim an elective part of the estate. The spouse will get a set part of the inheritance depending on the number of children. Getting a divorce is one of the better ways if you want to disinherit your spouse.

Also, a surviving spouse can waive their right to an elective share within six months after the will probate. (Section 15: Filing of waiver; rights upon waiver)

Am I allowed to change my last will and testament after I sign it?

Yes, in Massachusetts, if you haven’t entered into a contract mentioning the opposite, you’re allowed to repeal or alter your last will at any time. You can do it with a codicil that indicates the changes, which you must execute in the same way as your will and attach to the original document.

If something big happens in your life that can potentially affect your will (a new child is born, you buy a house, etc.), it is recommended to consider changing your last will or creating a new one.

| Related documents | When to create it |

| Codicil | Your last will needs one or a few small changes. |

| Self-proving affidavit | You want the probate to be easier when it’s necessary. |

| Living will | You want to make sure your end-of-life treatment is carried out according to your wishes. |

| Living trust | You would like to skip probate by having your assets in a trust. |

Last Will and Testament Forms for Other States