Free Alabama Power of Attorney Forms

An Alabama power of attorney is a document that lets you delegate some specific tasks to another person you trust, also referred to as your agent, when you are unavailable due to various reasons. For example, with a certain POA, you may assign someone who will act instead of you when selling or buying real estate or vehicles in Alabama.

Here, we provide you with the power of attorney templates that will help you delegate certain important tasks in various cases. There are official templates given by the State of Alabama; they include a Statutory Durable Power Of Attorney, an Advance Directive for Health Care, a Delegation of Powers by Parent(s) or Guardian(s), form MVT 5-13 for vehicles, and form 2848A for tax matters.

Governing Laws:

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Alabama POA Templates by Type

Durable power of attorney form is an Alabama POA type that residents use to delegate various financial powers to their agents. The important thing to mention is that the form is valid only in case its signatory is unable to make decisions due to incapacity (for example, that happened because of severe disease or an accident).

| Also Known As | Alabama DPOA |

| Signing Requirements | Notary |

| Download | PDF Template |

Medical power of attorney in Alabama is officially called the Advance Directive for Health Care and allows you to designate an agent who will make decisions regarding your health care and medical procedures.

| Also Known As | Health Care POA or MPOA |

| Signing Requirements | Two (2) Witnesses |

| Download | PDF Template | Advance Directive for Health Care |

General power of attorney is a helpful document for those who wish to appoint an agent or a family member to deal with their financial issues in daily life. Unlike the DPOA form, the General power of attorney is valid until the signatory is incapacitated or dies.

| Also Known As | General (Financial) POA |

| Signing Requirements | Notary |

| Download | PDF Template |

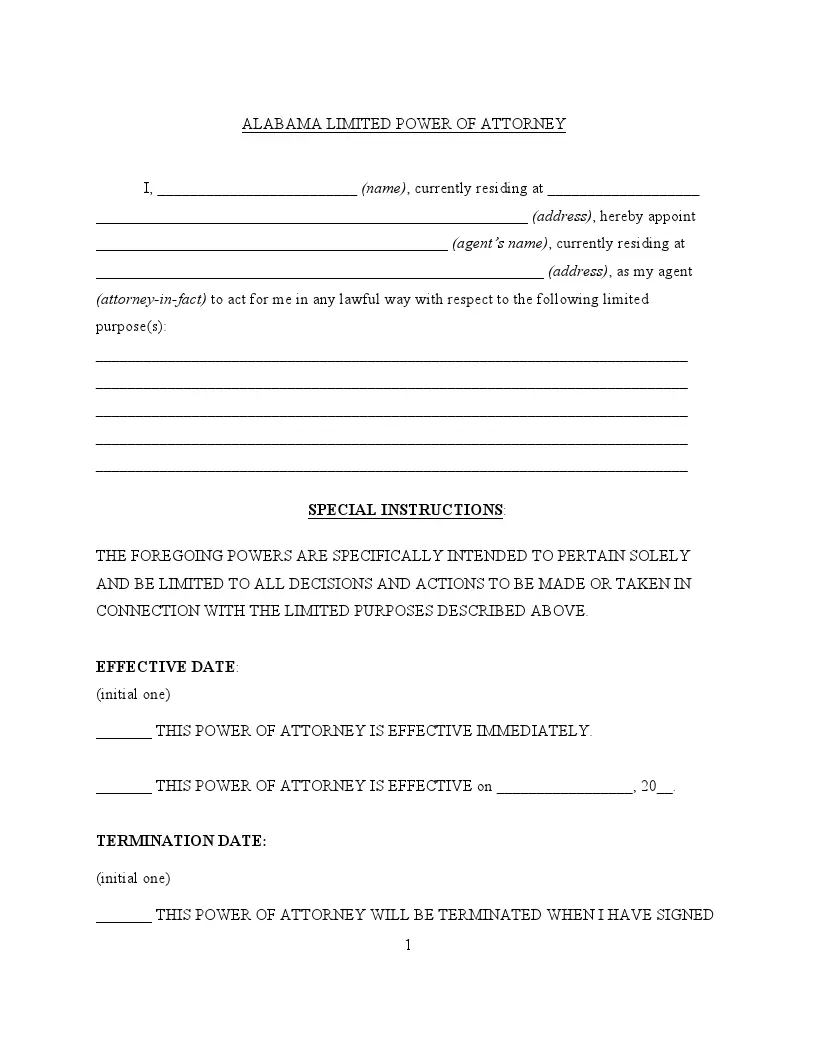

Limited power of attorney is a document you can use to delegate a specific matter (or matters) to someone. For one, you may choose your agent by this form if you need to conduct operations with real estate or any other valuable property.

| Also Known As | Special POA |

| Signing Requirements | Notary |

| Download | PDF Template |

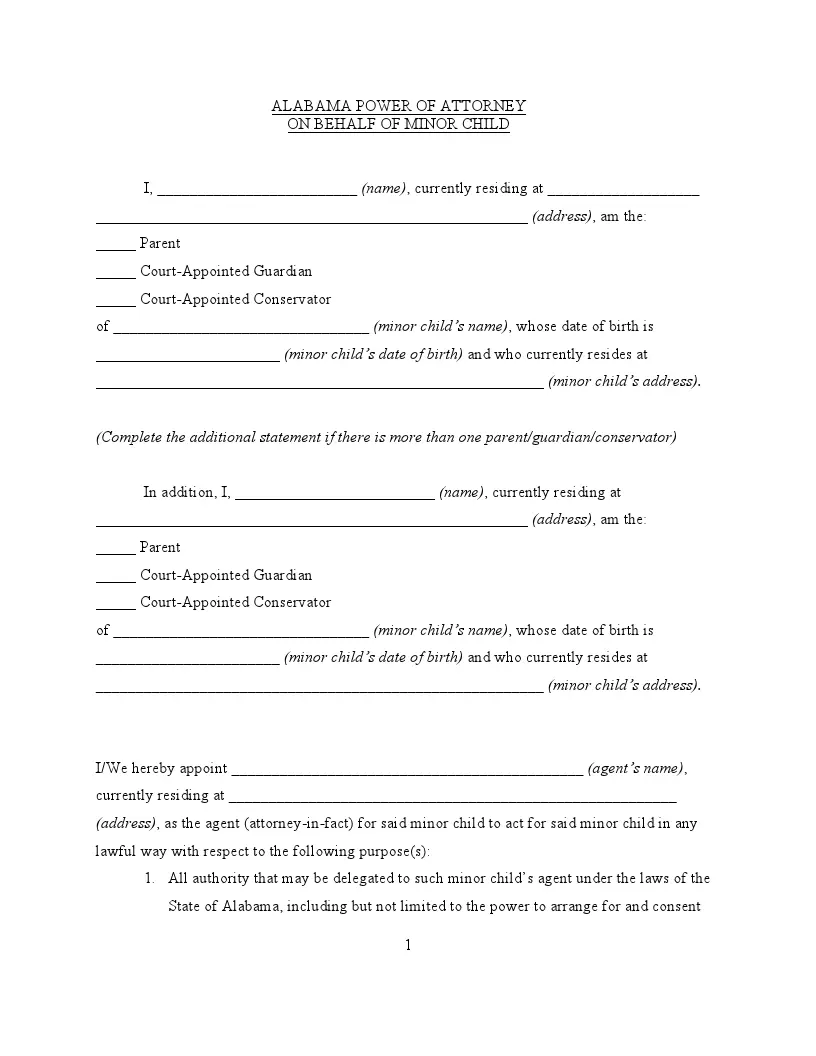

Child power of attorney in Alabama is officially named the Delegation of Powers by Parent(s) or Guardian(s). It is an essential form for parents or guardians who sometimes are absent. With the form, they can delegate keeping an eye on their child or children to someone they trust.

| Also Known As | Minor POA |

| Signing Requirements | Notary |

| Download | PDF Template | Delegation of Powers by Parent(s) or Guardian(s) |

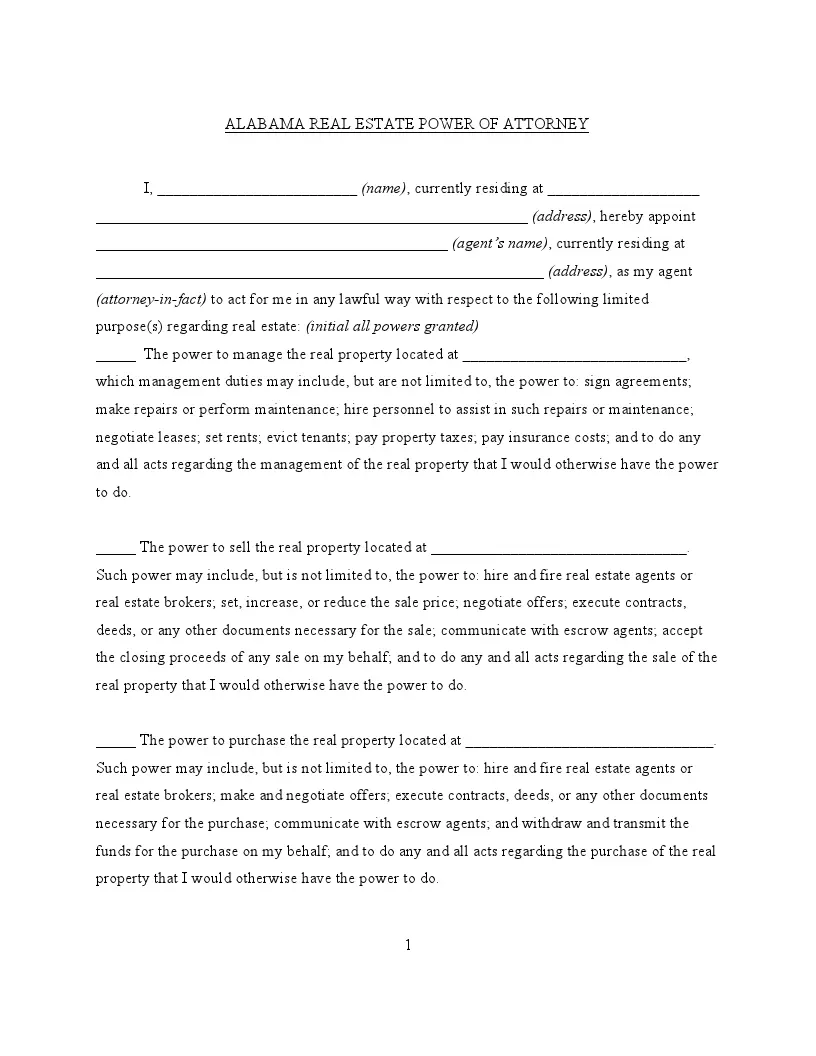

Real estate power of attorney can be used by a real property owner who wants to appoint someone else to conduct operations with the property. Among such operations are sales transactions, renting, and other actions.

| Also Known As | Limited Real Estate POA |

| Signing Requirements | Notary |

| Download | PDF Template |

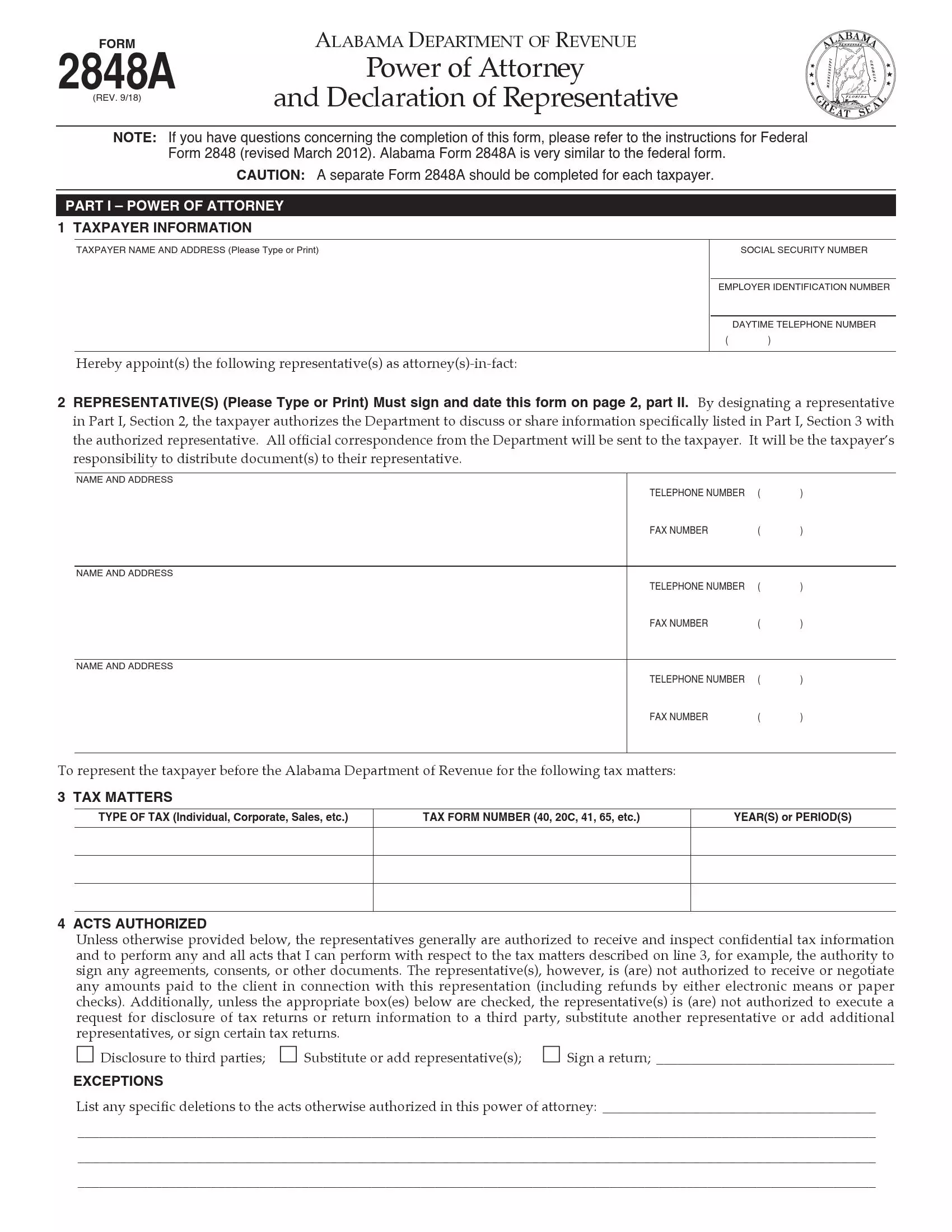

State tax power of attorney (Form 2848A) lets you delegate all your tax issues to the agent (or accountant) who will deal with your taxes and submit all the needed tax forms to the Alabama Department of Revenue.

| Also Known As | Tax POA |

| Signing Requirements | Principal and Agent |

| Download | Form 2848A |

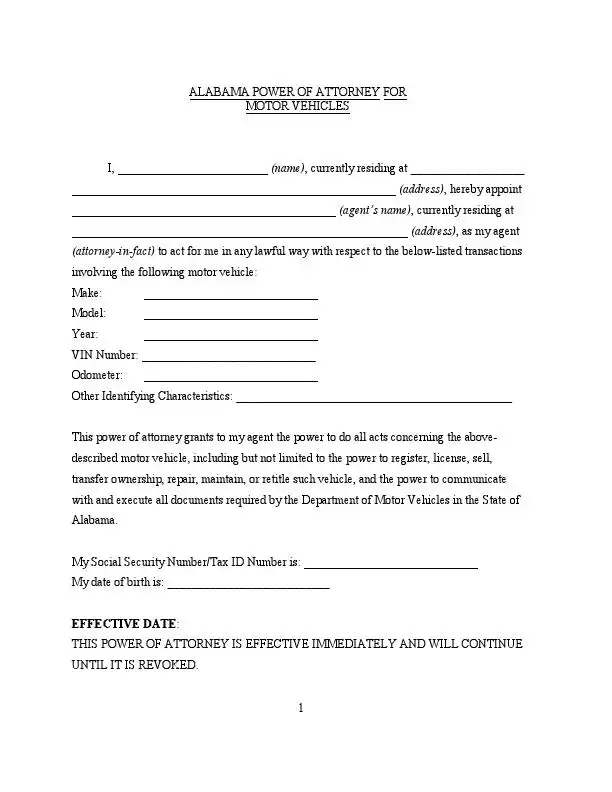

Vehicle power of attorney (Form MVT 5-13) allows you to transfer certain responsibilities regarding your vehicle (getting a title, registering, and so on) to someone else.

| Also Known As | DMV POA |

| Signing Requirements | Notary |

| Download | PDF Template | Form MVT 5-13 |

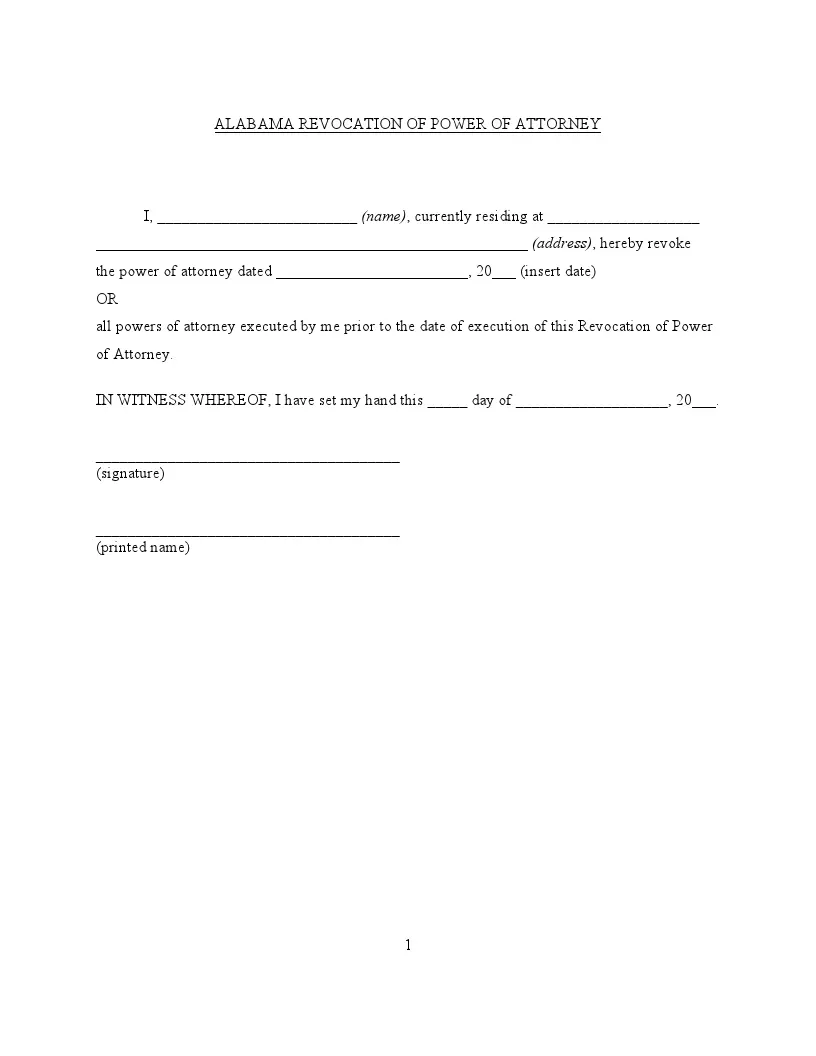

Revocation power of attorney form is necessary in case you have decided to substitute your existing agent or simply put an end to their right to act for you. When you sign such a form, you should also deliver its signed copies to the agent in question, so they know they are not responsible anymore.

| Also Known As | POA Termination Form |

| Signing Requirements | Notarization is Recommended |

| Download | PDF Template |

Other Alabama Forms

Need other Alabama templates? We offer free templates and straightforward customization experience to anyone who prefers less hassle when handling paperwork.

Other POA Forms by State