Florida Durable Power of Attorney Form

When a person faces an accident and suddenly becomes disabled, he or she still has finances to manage. In the US, this case requires having a special document that is called a Durable Power of Attorney (or DPOA form). With this document, a person assigns someone (an agent or a trusted attorney) who will have the power in finances’ management when they are unable or unavailable to do so. “Durable” means that if you sign this form, it will last until you either die or call it off.

DPOA has nothing to do with your health or physical condition. It only allows someone to be responsible for your money and property if you cannot manage them anymore due to your physical state. In the document, you will find various options of what your agent or attorney will or will not be able to do.

The rules for completing the durable power of attorney form are different and vary from state to state. Some states require calling a notary to verify the form and a witness additionally. Others, by law, require only the notarization. It is important that the individuals that sign the form are all in good conscience.

Florida power of attorney templates – look at other powers of attorney common in Florida.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

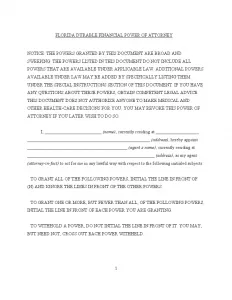

Florida DPOA Signing and Laws

As stated in Section 695.03 of the Florida Statutes and Constitution, the signing of a DPOA form should be accompanied by a notary and two witnesses. According to Section 709.2105(2) of the state law, a person to whom you grant the powers is to be over eighteen years old (or under this age but having the rights of an adult). The POA agent may also be an organization but with the right to conduct the required procedures.

If the document was signed before October 2011, the attorney-in-fact can’t act until a certain date or till the event described in the POA occurs. In the other case, the agent can act immediately after any accidents that happened to you.

You can rewrite or revoke your FL DPOA at any time you want, but it’s important to notify all the involved parties about your new decision. After creating a new durable power of attorney or after your death, the agent loses the power to make decisions on your behalf.

While creating a DPOA form in Florida, you will see a section with a list of actions (powers) that your agent will be able to conduct. You may opt for just some of them or choose all. This list includes various points regarding:

- Taxation matters

- Stocks and bonds

- Real estate management

- Bank operations

Among other powers that your agent can be able to attain. So, before signing the document, please ensure that you have analyzed all of the points and have chosen those powers that you think you might need a representative for.

When creating a DPOA form in Florida, do not forget to print out three copies of the document as recommended, choose the person you can trust with all your properties, and call a notary public. The official form is rather simple and contains only three pages.

Florida Durable Power of Attorney Form Details

| Document Name | Florida Durable Power of Attorney Form |

| Other Names | Florida Financial Durable Power of Attorney, FL DPOA |

| Relevant Laws | Florida Statutes, Sections 709.2101 to 709.2402 |

| Signing Requirements | Notary Public and Two Witnesses |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

POA templates are among the most frequently used ones in the US. The following are some of the more demanded durable POA papers.

Steps to Complete the Florida Durable POA Form

If you have questions and are afraid of making mistakes in the form, you may use our guide with the instructions for completing the official Florida durable power of attorney form step by step.

1. Open the Template

To start, you have to download the template of the DPOA form. You may also use our form-building software to simplify the process by pressing the “Create my Document” button.

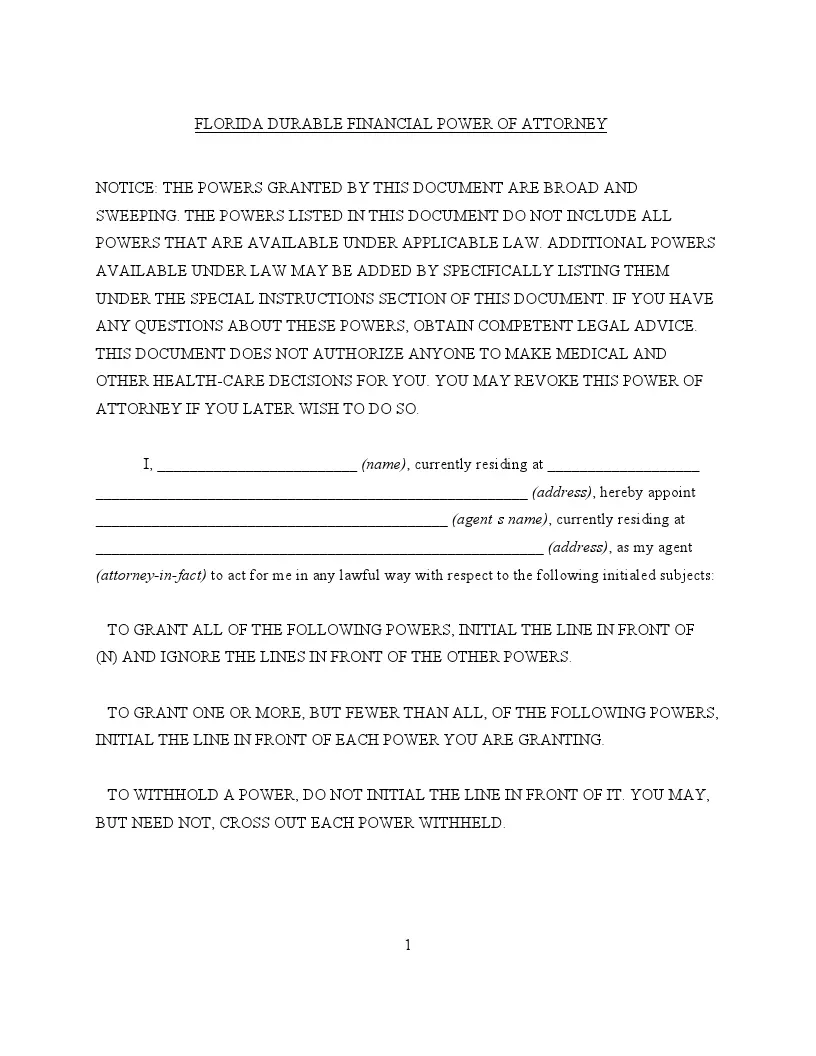

2. Include information about yourself and the agent

The next section is devoted to the principal (POA creator) and their agent. The first one is to put their full name and the county’s name, where one is registered. Then the agent is to specify the same information about themselves.

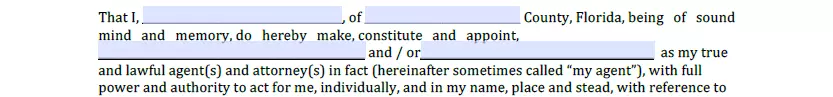

3. Choose the Powers of Your Agent

This section shows what your agent or attorney-in-fact will be responsible for: from dealing with banks and other financial institutions to paying your taxes. You will have to put your initials near every power that you want to grant. The list consists of the following points:

- Real property

- Banks and other financial institutions

- Insurance and annuities

- Tangible personal property

- Stocks and bonds

- Commodities and options

- Operation of entity or business

- Claims and litigation

- Taxes

- Personal and family maintenance

- Estates, trusts, other beneficial interests

- Retirement plans

- Benefits from governmental programs, civil or military service

If you don’t agree with some points, you should cross them out (the figure in the initial position).

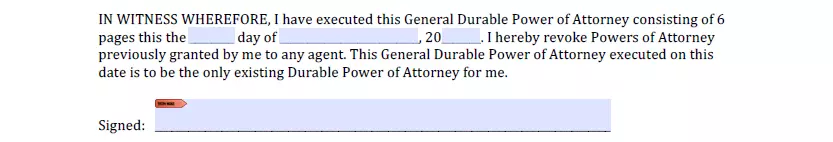

4. Sign the Form

As a principal, you will need to insert your name and signature. Do not forget to put the date of signing and your name in this section. The same information should be put by the agent. If you can’t sign the Florida DPOA due to physical inability, you can acknowledge it in front of the notary, who will sign it instead of you, as it is stated in section 117.05(14) of Florida state law.

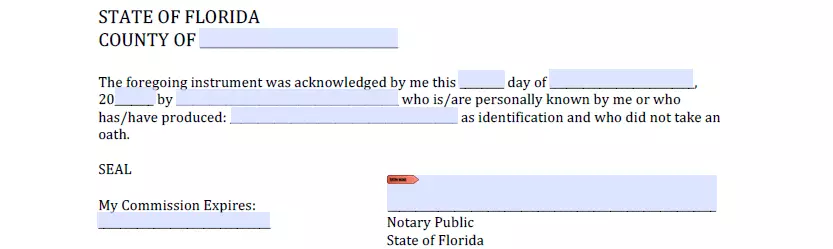

5. Notarize

Finally, a notary public should verify and seal (if applicable) the DPOA form, as required by Florida’s law. Only the notary who was present during the procedure can put the necessary information in this section. They must specify the county, where the procedure took place, the date of filling out the document, the signature, and the date when one’s commission will expire.

Looking for other Florida templates? We provide free forms and a simple personalization experience to anybody who wants less hassle when dealing with paperwork.