Free Oregon Durable Power of Attorney Form

The Oregon Durable Power of Attorney Form is a legal document, which states that certain financial responsibilities are conveyed from a specific adult to the chosen attorney in fact, if it is expected that the adult is going to get mentally incapacitated or unable to make decisions concerning his or her transactions due to other circumstances. The form is not meant to serve as a paper granting the agent any kind of end-of-life planning rights but only focuses on making this individual liable for money matters, such as managing bank accounts, lending, borrowing, etc. The durable power of attorney form mainly aims at senior adults possessing any type of business.

Two witnesses have to be present during the act of completing the document. The DPOA in Oregon needs notarization. The document is governed by Oregon law. The copies of the DPOA should be considered valid and reliable as well as the original.

Oregon power of attorney templates – browse powers of attorney related to other property types in Oregon.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Oregon Signing Requirements and Laws

Designating an individual to be in charge of your money management once you’ve become unable to is critical. It is utterly important to choose a trustworthy agent, you know well. The person should be at least 18 years of age, sound of mind, and willing to be executed as your attorney.

In accordance with the §127.005 Oregon State Law, when a principal authorizes another person to act as his or her agent on the principal’s behalf, he automatically delegates certain powers to this individual for an unlimited period of time until the principal passes away. Incapacitation of the specified adult does not affect the agent being accountable for performing as the principal’s financial fiduciary.

Oregon Durable Power of Attorney Form Details

| Document Name | Oregon Durable Power of Attorney Form |

| Other Names | Oregon Financial Durable Power of Attorney, OR DPOA |

| Relevant Laws | Oregon Revised Statutes, Chapter 127 |

| Signing Requirements | N/A |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

DPOA forms let you establish a representative who can manage your financial affairs even after you end up incapacitated. Below are the states DPOA forms are downloaded in most frequently.

Steps to Complete the Form

The document creation requires significant attentiveness. Make sure you have studied all the details prior to filling out the DPOA. Once you have chosen your agent(s), ready to perform their duties, and the witnesses, initiate the DPOA creation. Here is an ultimate step-by-step directive meant to help you during the procedure:

- Get the Template

The Durable Power of Attorney Form is comparably accessible on a number of web pages, so you may download it from one. To prevent the occurrence of any mistakes, use our form building software to complete your DPOA.

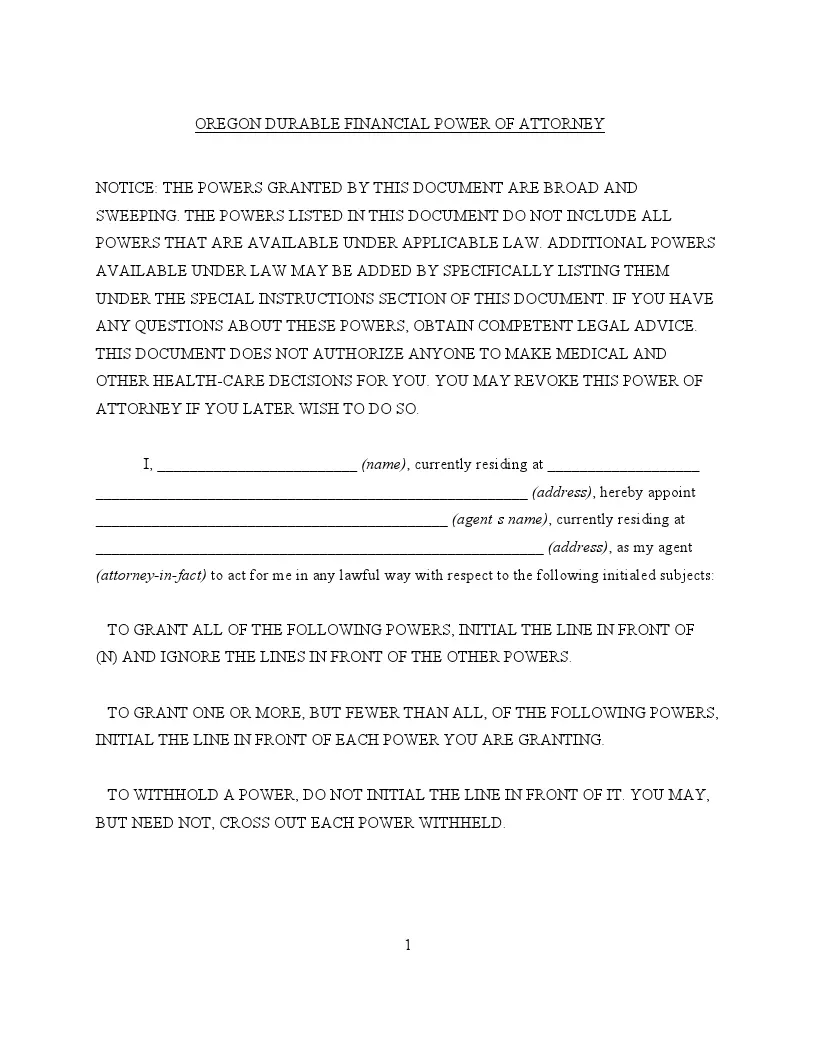

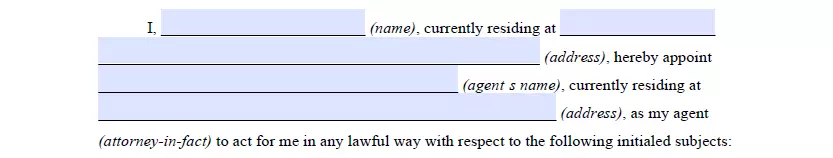

- Name the Agent

In the first part of the document, the principal has to fill out his or her full (legal) name and the complete address (including residential building number, street, unit number, city, and state). The principal continues with inserting the full name of a pre-chosen attorney, in fact, his or her address, and by doing this, affirms to have selected this individual to act in the principal’s state and for his or her benefit, revoking any previous financial powers been delegated.

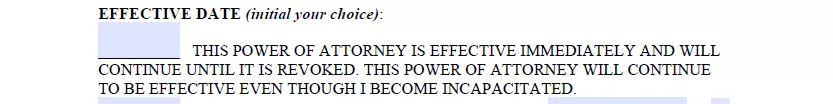

- Indicate the Effective Date

The principal is allowed to decide when the document comes into force. You can choose to delegate all the financial powers upon the execution of the paper. The document will become valid when your attending physician concludes in writing that you are no longer able to properly handle your financial affairs.

- Approve of the Powers You Are Delegating

A set of money-related powers are described in this part of the DPOA. The principal confirms to convey them to the agent (acting as fiduciary) by placing his or her initials next to each paragraph.

- The first paragraph provides the attorney, in fact, with the powers to operate the principal’s bank accounts, withdraw funds, pay for personal and business expenses, etc.

- The second one is about giving the agent a legal right to access the principal’s safe deposit box, permitting him or her to not only remove its contents but also surrender or relinquish the box.

- Managing loans is outlined in the next part of this section. The agent will receive the rights to lend and borrow money, give promissory notes or other obligations, and deposit or mortgage real estate or personal property on behalf of the principal if such permission is granted.

- The fourth paragraph is related to government benefits, which the attorney will be able to apply for and receive.

- If the principal chooses to initial the Retirement Plan section, the agent will become capable of contributing and get benefits of a retirement plan owned by the principal.

- Effectuating tax payments is described in the next paragraph.

- The next part of the section makes the agent obtain the right to engage or discontinue insurance policies in the name of the principal.

- If the principal wishes, he or she may authorize the attorney to acquire, purchase, lease, or sell real property if necessary.

- Not only real estate but also personal property management can be delegated to the agent, who will be in charge of purchasing, selling, or otherwise disposing of the property belonging to the principal.

- The next paragraph summarizes different powers concerning managing property powers the attorney in power may obtain.

- If the principal provides his or her initials in the corresponding box, the agent will get granted the powers to make gifts, grants, and other transfers.

- The last paragraph authorizes the attorney, in fact, to request and pay for any legal assistance needed on the principal’s behalf.

- Provide Special Instructions

If the principal does not fully agree with any information presented in the paragraphs above and intends to limit the powers described or give detailed instructions, he or she is required to write them down in this section.

- Put the Signature

The principal, being first duly sworn, shall indicate the date of the agreement and sign the paper, acknowledging that he or she has reviewed all the sections of the DPOA and makes the decision willfully and in the sound of mind.

- Provide Witnesses for the Document

Two witnesses must put their signatures, declaring that they have watched the process of the document completion, and the principal has signed the DPOA voluntarily, the sound of mind, and under no pressure.

- Notarize the Form

Once the document is filled out, a licensed notary is supposed to overview all the data and authorize it by submitting his or her credentials. Indicate the date of the expiration of the notary public’s commission.

- Supply the Specimen Signature and Acceptance of Appointment

Complete the section with the signature of the attorney, in fact, his or her full name, and enter the state, as well as the county where the procedure is being committed. The signature of the agent also requires notarization.

Here are other Oregon forms filled out by our users. Consider our step-by-step builder to personalize any of these forms to your requirements.

Download a Free Oregon Durable Power of Attorney Form