Connecticut Promissory Note Template

If someone borrows money from you, it is crucial to get some kind of confirmation that this has happened, and you will get the money back eventually. The Connecticut promissory note template allows you to stay calm and get the warranty of cash refund on a specific date.

The free promissory note form can be signed in Connecticut and other states. The one who gives funds is also referred to as a lender (or a creditor), while the recipient is called a debtor (or a borrower).

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

You may complete the promissory note regardless of the lent amount. There are several requirements for this document. In particular, you should describe:

- The lent sum (stated in US dollars)

- The creditor and the debtor (their names and addresses)

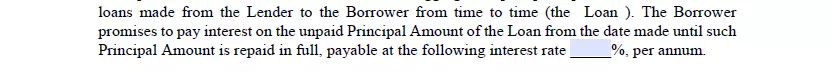

- The interest rate

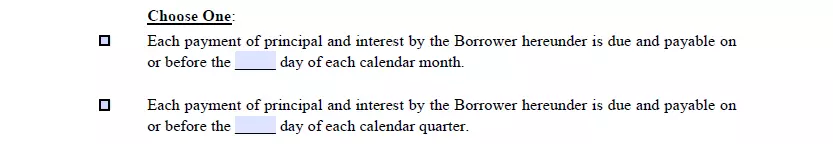

- The date when the borrower should cover the debt (with the timeline of payments)

Something may go wrong, and the debtor can find themselves in a difficult position, unable to repay the borrowed amount. Also, the borrower may halt payments without notifying or even vanish away. In such cases, the promissory note can be taken to court, and the borrower will be forced to refund.

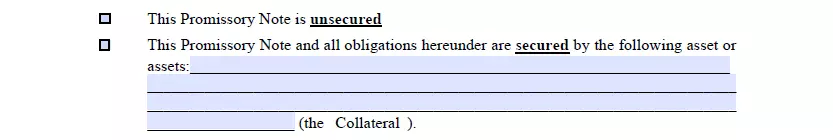

Each promissory note in the US is either secured or unsecured. When you, as a borrower, complete a secured note, you have to provide the info about items you give if unable to pay the debt.

None of such items is provided in an unsecured loan; the only thing the lender can do is rely on the debtor. Commonly, such notes are created in two cases: if the amount is small or if the borrower and lender have a close relationship.

Connecticut Usury Laws

When creating a promissory note, you should pay attention to the usury laws because they differ from state to state. In Connecticut, the topic is covered in Title 37, Chapter 673. This chapter is called “Interest.”

As written in Section 37-4, an interest rate higher than 12% is prohibited in the state of Connecticut.

Connecticut Promissory Note Form Details

| Document Name | Connecticut Promissory Note Form |

| Other Name | CT Promissory Note |

| Max. Rate | 12% |

| Relevant Laws | Connecticut Revised Statutes, Chapter 673, Section 37-4 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (often referred to as debt note) is considered a simple lending template used regularly by businesses and individuals around all states as a funding source and an alternative to banks. Learn about the most common US states requested by our visitors with regards to promissory note forms.

Filling Out the Connecticut Promissory Note

If you need to create a promissory note but have no idea how to do that, we have the answers to your questions. Below, you can check our detailed instructions: a list of steps you need to complete the Connecticut promissory note template correctly.

- Find the Connecticut Promissory Note Template

Because the document should inform about specific details, you have to find the correct template. Try using our form-building software that lets you get any template you need in a blink of an eye.

After you download the file, prepare two copies because each agreement party should keep the promissory note.

- Enter the Date of Signing

The first thing you will write is the date when this form is created.

- Write the Lent Amount

After dating the paper, write the borrowed amount in US dollars.

- Insert the Borrower’s Details

You have to add the borrower’s name and address.

- Insert the Creditor’s Details

After naming the borrower, write the same data for the lender.

- Add the Rate of Interest

Agreements that involve borrowing money presume an interest rate. State the chosen rate in the relevant blank space.

- Describe the Timeline

When people negotiate about the refund, they usually decide when the payments should be completed. Include this information in the document by choosing the statements and filling out the empty lines.

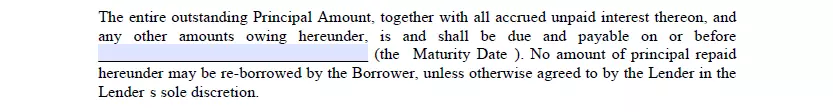

- State the Maturity Date

You have to state the maturity date (or the date when the borrower should terminate repaying).

- Indicate the Type

Choose whether the note is secured or unsecured. For a secured one, state the tangible items as the “Collateral.”

- Sign the Document

You have to sign the form along with the other party. Both the creditor and the debtor should keep this paper in their records. You also can notarize the promissory note if you prefer so.

Listed here are some other Connecticut documents completed by FormsPal users. Try out our simple tool to personalize any of these documents to your requirements.

Other Promissory Note Forms by State