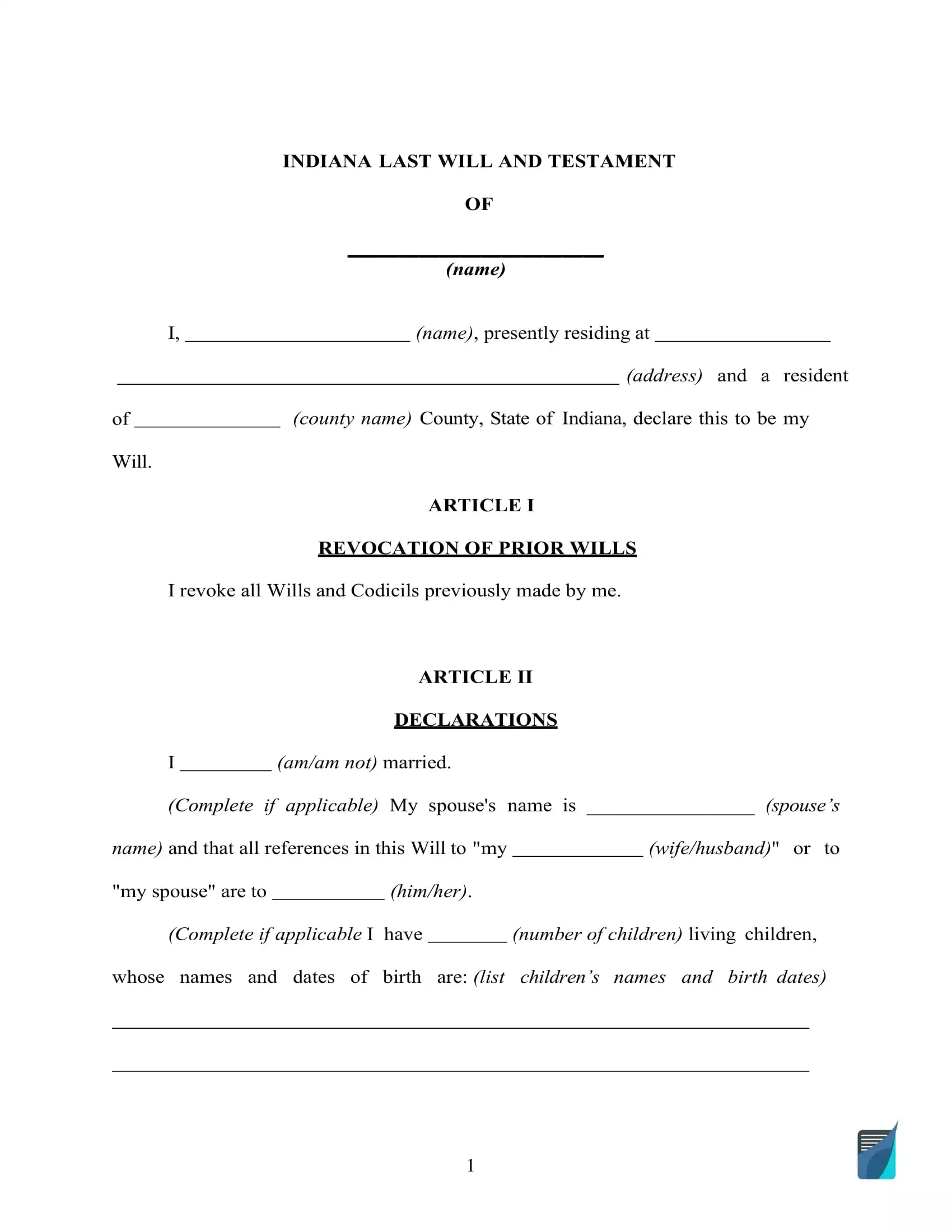

Indiana Last Will and Testament Form

An Indiana last will and testament is a document containing the last wishes of its creator (the testator) and determining how and by whom his or her estate will be used in the event of their death. Must be signed by two witnesses to be valid in this state.

Preparing a last will is a really sensible choice for anyone who would like to avert quarrels and misunderstandings regarding their possessions after they are gone. A thought-out and appropriately written will can be vital to your loved ones upon your passing even if you don’t have lots of assets. You can also leave detailed instructions regarding your burial wishes.

In case you need a fillable and printable Indiana will form, you will find it on this page below, together with the guidelines for writing and all requirements and laws.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Indiana Will Requirements and Laws

| Requirements | State laws | |

| Statutes | Title 29 – Probate; Article 1 – Probate Code | |

| Definitions | Title 29 – Probate; § 29-1-1-3 | |

| Signing requirement | Two witnesses | 29-1-5-3. Signatures; videotape |

| Age of testator | 18 and older or younger person under certain circumstances | 29-1-5-1. Sound mind; age; armed forces |

| Age of witnesses | 18 and older | 29-1-5-2. Writing; witnesses |

| Self-proving wills | Allowed | 29-1-5-3.1. Self-proving clause |

| Electronic wills | Recognized if meeting certain conditions | 29-1-21-4. Attestation; electronic signature; self proving clause |

| Handwritten wills | Might be recognized if witnessed according to the state law | 29-1-5-2. Writing; witnesses |

| Oral wills | Not recognized | 29-1-5-4. Nuncupative will; requisites; limitations |

| Holographic wills | No statutes | |

How to Write a Will in Indiana

1. Think about your options. One thing to bear in mind is whether you wish to write the entire document by hand (holographic wills) or use a fillable last will and testament form that we provide. The latter comes in two formats (PDF and DOCX) so that you could have more options regarding editing it the way you need. You can also create a customized document by answering simple questions if you opt for our Indiana last will maker.

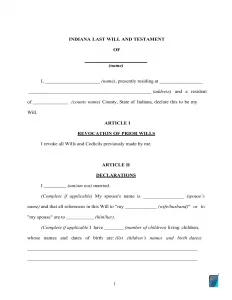

2. Indicate your information. Establish the testator and their particulars: full names and addresses (city, county, and state). Go through the details you wrote along with the remainder of the section.

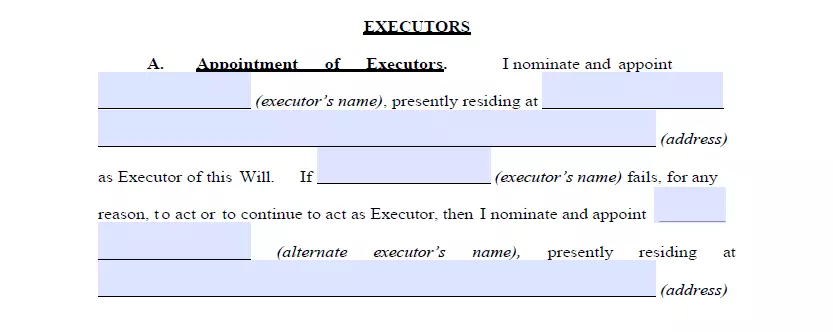

3. Choose the executor. In this section, you define an executor of the will who’s going to carry out your will. Enter their full legal name, as well as their city, county, and state of residence. It’s advised to choose somebody who resides in the same state as you. As a safeguard, it is possible to designate an alternative executor of your last will and testament. This way, you will be able to make sure that, even if the initially chosen person can’t perform their obligations, there’s a second dependable executor you can count on.

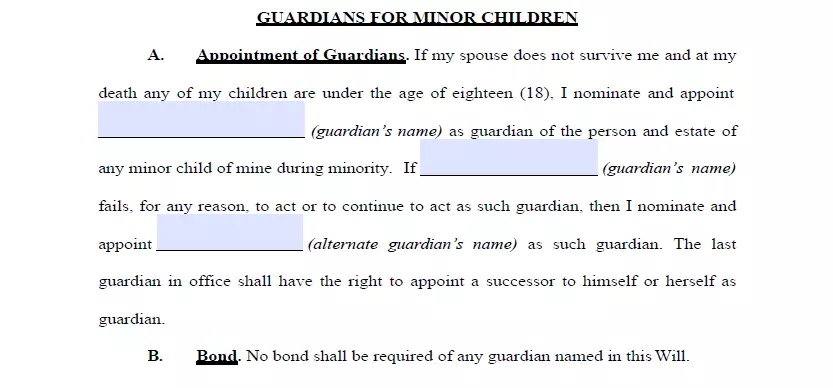

4. Indicate the guardian (optional). In case you’ve got minor or dependent children and do not want the court to select a guardian for them when you are no longer on this Earth, you can appoint somebody you know as a guardian for your children. It is also possible to assign someone who will take care of any pets you might have.

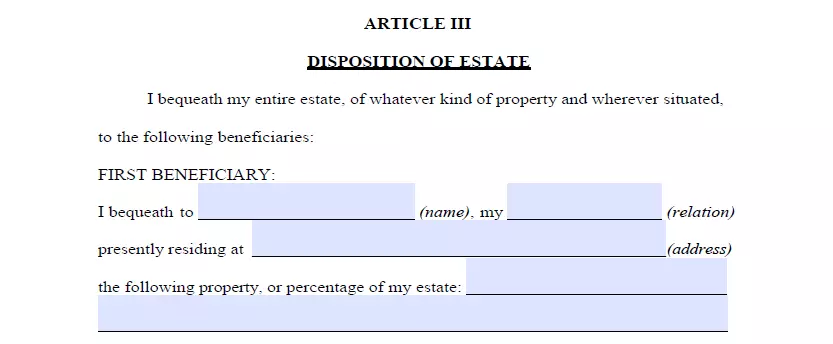

5. Specify your beneficiaries. At this stage, you establish people who are going to receive your assets. For each inheritor, specify these details: full name, address, and the way they are related to you. Charitable organizations can also be your beneficiaries.

6. Designate possessions. You can indicate which of your respective inheritors gets this or that piece of property. Otherwise, the assets will be divided evenly between the beneficiaries. Property can include cash, shares, realty, business ownership, money for unresolved arrears, and any tangible items of commercial value that count among your possessions.

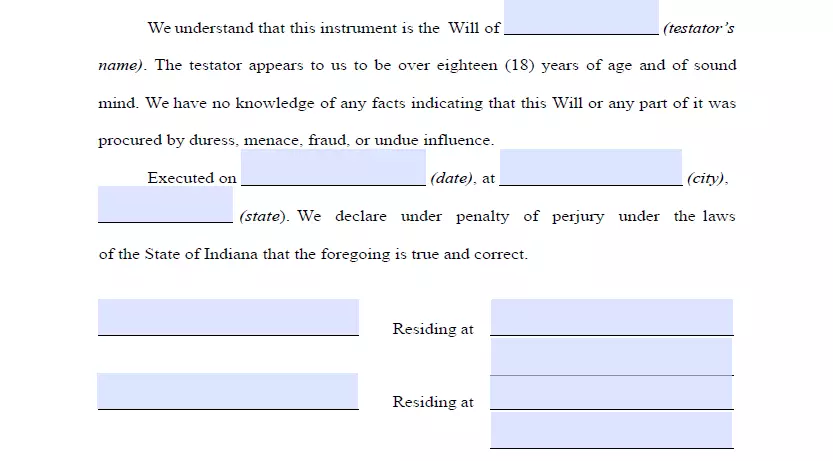

7. Ask witnesses to finalize the document. As per Indiana law, for a last will to be considered legitimate, it has to be signed by two witnesses. They should be over 18 years old and have no interest in your last will, which means they cannot be your beneficiaries. As an extra precaution against situations when the will is contested or any other problems, it makes sense to assign a witness who’s younger than you to ensure they will still be there after you are gone.

Make a Free Indiana Last Will and Testament

Frequently Asked Questions

Do I have to notarize my will in Indiana for it to be valid?

In Indiana, it’s not necessary to notarize your last will.

Is it mandatory (in Indiana) to add a self-proving affidavit to my will?

No, in Indiana, there isn’t such a requirement. But, attaching one could be rather useful since it eliminates the demand for witnesses’ testimony during probate, which eases the process substantially.

Can someone change my will?

No, only you can change your will. There is only one particular situation when a third party is allowed to get involved. In case you’re physically incapable of signing your last will and testament, someone can do it instead of you yet only in your presence and only with your clear consent given.

In Indiana, is it possible to change a last will after I sign it?

Yes, it’s possible to change a will in Indiana. You can adjust or revoke your last will if you’re not obliged to do otherwise by a legal agreement. Such agreements include prenups or divorce settlement contracts.

For minor changes, it is recommended to use a codicil. But if you want to change a lot of things, it is better to create a new will.

| Related documents | When to create one |

| Codicil | You would like to make one or a few slight modifications to your will. |

| Self-proving affidavit | You want to expedite the probate later on. |

| Living will | You want to establish what health care you expect if you’re unable to express that yourself. |

| Living trust | You would like to skip probate by putting your property in the possession of a trust. |

Last Will and Testament Forms for Other States