Michigan Last Will and Testament Form

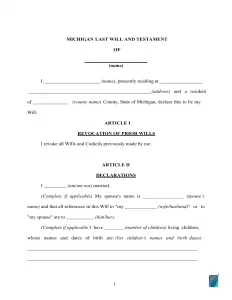

A Michigan last will and testament is an important legal instrument that reflects the last wishes of a testator (will’s creator) regarding their property and how they would want it to be distributed among their selected beneficiaries, which usually include close family members and friends.

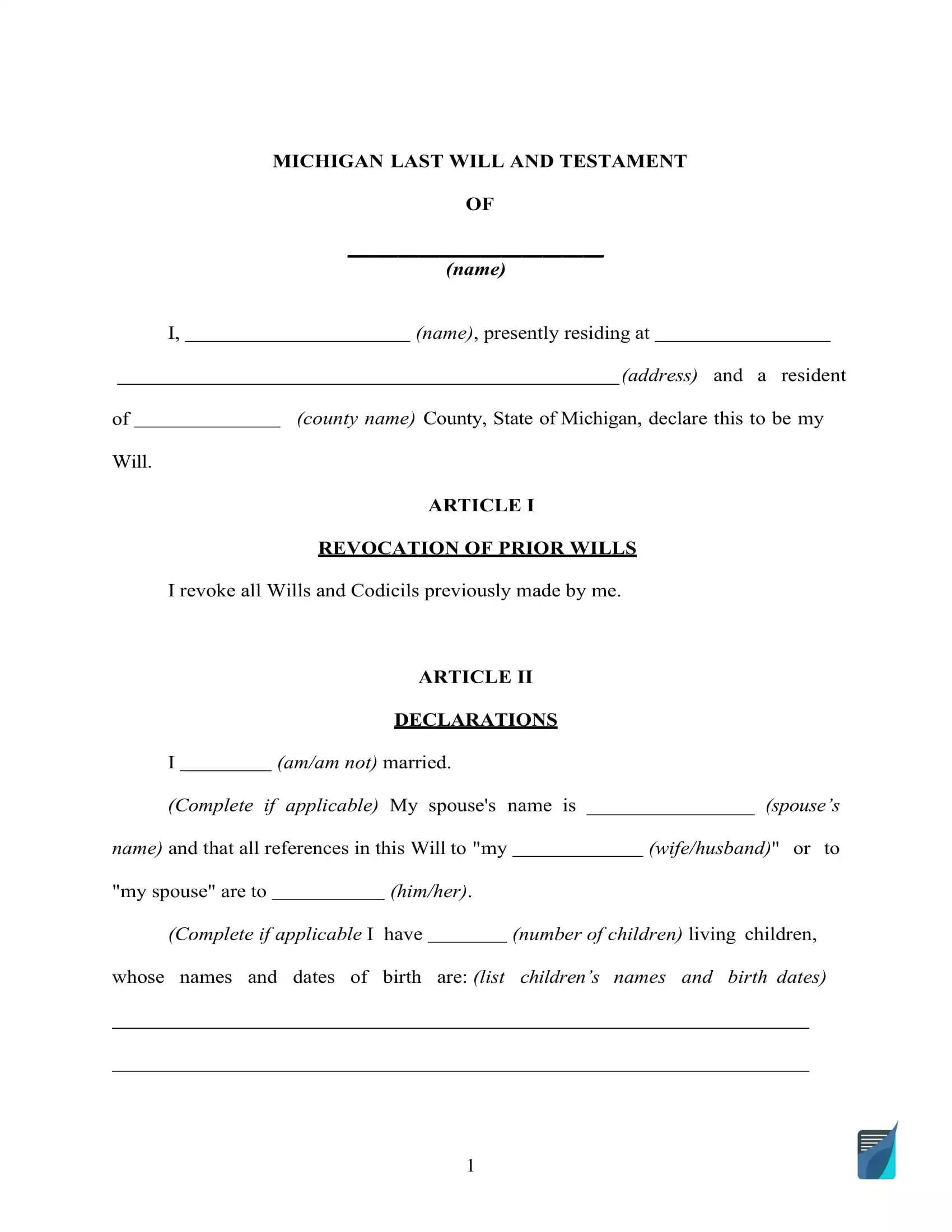

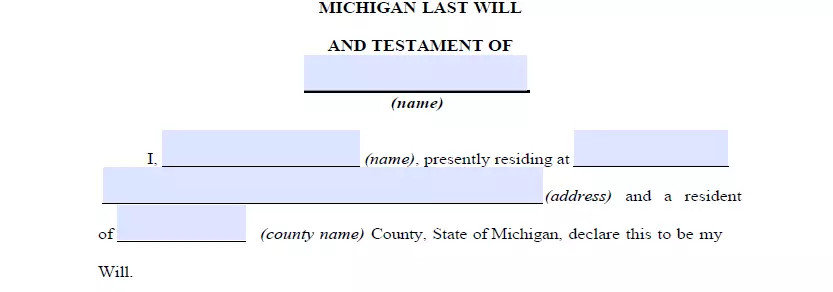

Below, you’ll be able to download a free Michigan will template in PDF and DOC formats that you can fill out and print yourself. Additionally, down the page, there’s a good amount of information pertaining to the will writing process and state requirements.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Michigan Will Requirements and Laws

| Requirements | State laws | |

| Statutes | Act 386 of 1998, Article II – Intestacy, Wills, and Donative Transfers | |

| Definitions | 700.1108 Definitions; U to Z. | |

| Signing requirement | Two witnesses | 700.2502 Execution; witnessed wills; holographic wills |

| Age of testator | 18 or older | 700.2501 Will; maker; sufficient mental capacity |

| Age of witnesses | 18 or older | 700.2505 Witnesses |

| Self-proving wills | Allowed | 700.2504 Self-proved will |

| Handwritten wills | Recognized if meeting certain conditions | 700.2502 Execution; witnessed wills; holographic wills |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | |

| Depositing a will | Possible with a Michigan county probate court A fee is $25 (Kalamazoo County example) | 700.2519 Statutory will (7) |

How to Write a Last Will in Michigan

1. Choose how you want to make it. Make a decision if you need to seek the services of lawyers (usually if your estate is quite complex) or go for a do-it-yourself last will (either by using a fillable last will and testament form or our document creation wizard).

2. Indicate your details (if you are the testator). Fill out your full name and address (the city, county, and state of residence) to determine the testator of the MI will.

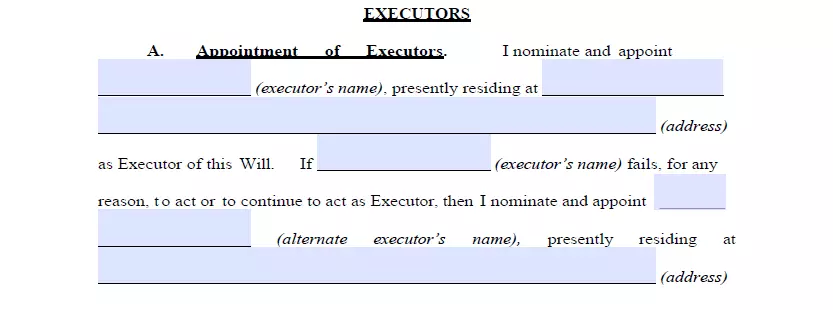

3. Establish the executor. In this particular section, you decide who will carry out your will by entering their full name, along with their city, county, and state of residence. It’s recommended to designate somebody who resides in the same state as you. Consider someone who is trustworthy and organized and make sure this person is willing to take the position before you indicate them in your will.

Although it isn’t compulsory, it’s wise to choose one more person to act as your executor if the first one is unwilling or incapable of carrying out their duties.

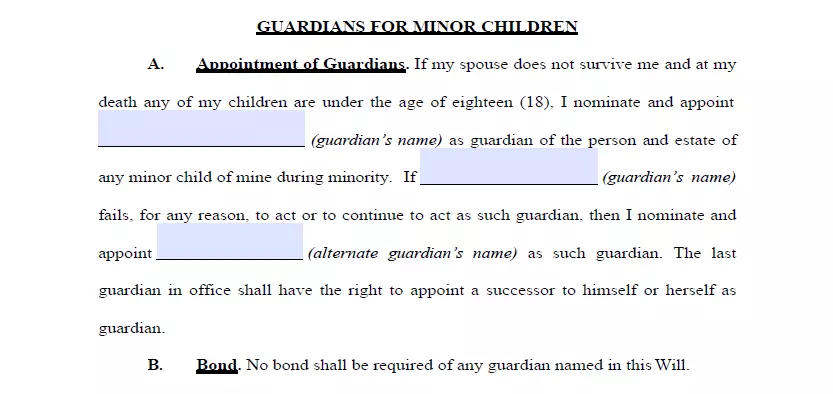

4. Appoint the guardian (optional). In case you have minor or dependent children and don’t want the court to choose a guardian for them when you’re no longer here, it’s possible to choose someone you know as a guardian for your children.

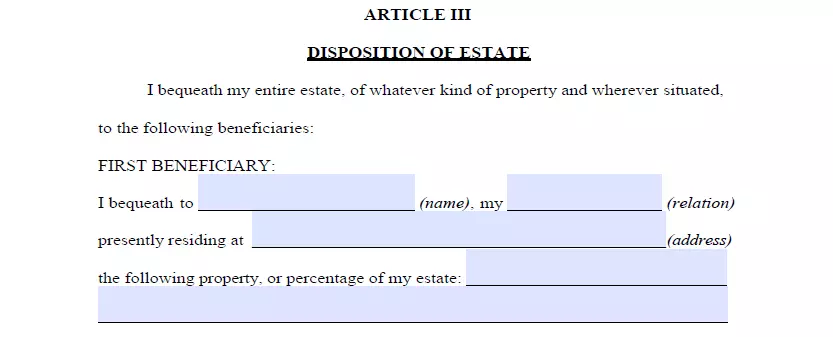

5. Establish your beneficiaries. Now specify those people (or organizations) to whom you wish to pass down your estate, that is, your beneficiaries. For every inheritor, define the next details: their full legal name, address, and how they are related to you.

6. Designate the property. If you have got a property distribution under consideration that is not even, you’ll be able to elaborate on it in this section. Such distributable assets might include money for unsettled arrears, real estate, stocks, business ownership, cash, as well as any physical items of financial value.

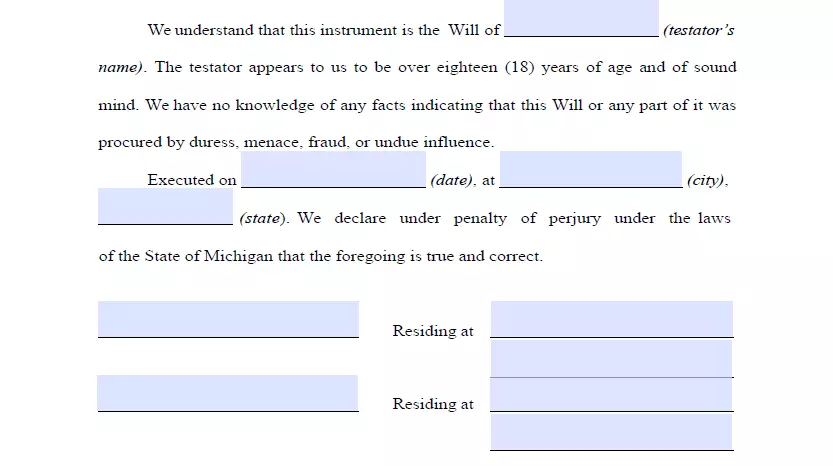

7. Proceed with the witnesses signing the document. Michigan Compiled Laws (700.2501) specify that at the least two witnesses have to sign a last will and testament along with the testator. Only someone who is of 18 years or older can be picked as a witness. Even your beneficiary can be a witness in Michigan (700.2505).

As an extra safety measure against situations when the will is contested or other problems, it’s wise to appoint a witness who’s younger than you to make sure they will still be there after you depart this life.

Make a Free Michigan Last Will and Testament

Frequently Asked Questions

Is last will notarization needed by Michigan statutes?

No, it is not. Michigan law (700.504) says that a will is valid without notarization. Having said that, you can make your will self-proving by attaching an affidavit, and you’ll have to visit a notary public if you wish to do this. Making your will self-proving is actually a good choice since it speeds up the probate and provides another level of certainty in case the will’s credibility is questioned.

What is testamentary capacity?

Testamentary capacity is a term used to describe the testator’s legal and mental capability (sound mind) to write and change their will.

You could be thought of as missing testamentary capacity in case you’re a minor (under 18 years old) or suffer from dementia, senility, insanity, or similar psychiatric disorders that don’t allow you to thoroughly understand your estate’s cost, beneficiaries, disposition, as well as the interrelationship of those elements. If extended, these requirements are as follows:

- The testator has the mental capacity to comprehend that they are signing a legal document that specifies how their assets will be allocated after their death.

- The testator can comprehend the nature and value of their assets.

- The testator is aware of the “natural objects of his or her bounty,” i.e., the family members or persons who would typically inherit the testator’s possessions.

- The testator can comprehend “in a reasonable manner the general nature and effect of his or her act in signing the will.”

Is it allowed to disinherit your child or spouse?

No, in Michigan, you cannot disinherit your spouse by not including them in your will or expressly stating their exclusion in the document. A surviving spouse in this state has the right to choose an elective share (half) of the decedent’s estate. One of the few ways to bypass it is by locking the property in a trust or creating a prenuptial agreement.

Michigan law enables you to disinherit any other family members. That applies to your adult children (of 18 years and above) and any other members of the family.

In Michigan, am I allowed to change my last will after signing it?

Yes, it is possible. You can make changes to your will at any moment before you die, as long as you have the adequate mental ability at the time. For minor changes, you can use a codicil, but for major changes, it is recommended to revoke your current will (make sure to destroy it and all its copies) and start fresh.

What happens when a will is lost?

According to Michigan law, the absence of the will can be regarded as its revocation. This implies that it must be proven in court that the testator didn’t want to revoke their will if there is only a copy.

What is one to do if they cannot physically sign their last will?

Michigan Notary Public Act (Section 33) permits a notary public to sign a last will on behalf of a person who is physically unable to do it solely per their directive and in their presence. There should also be a note that the signature has been affixed per Section 33.

| Related documents | When to make it |

| Codicil | Your last will requires one or a number of minor modifications. |

| Self-proving affidavit | You would like to save time and money for your witnesses. |

| Living will | You want to indicate what health care you prefer if you can’t communicate that by yourself. |

| Living trust | You would like to skip probate by putting your property in the possession of a trust. |