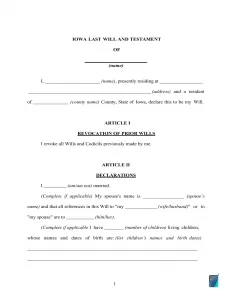

Iowa Last Will and Testament Form

An Iowa last will and testament is a document that contains the final directions of a person (called the testator) and establishes precisely how their estate will be distributed among their family. It is strongly recommended to make a will even if you don’t have a huge estate or have long years ahead.

If you are in need of a high-quality Iowa last will form, you can download it below in PDF and DOC formats. Besides that, we provide some tips on will writing and requirements and answer common questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Iowa Will Requirements and Laws

| Requirements | State laws | |

| Statutes | Chapter 633 – Probate Code; Subchapter VI – Wills | |

| Definitions | 633.3 Definitions and use of terms | |

| Signing requirement | Two witnesses | 633.279 Signed and witnessed |

| Age of testator | 18 and older | |

| Age of witnesses | 16 and older | 633.280 Competency of witnesses |

| Self-proving wills | Allowed | 633.279 Signed and witnessed |

| Handwritten wills | Might be recognized if witnessed according to state law | |

| Oral wills | Not recognized | |

| Holographic wills | Not recognized | |

| Depositing a will | Possible at the clerk of an Iowa county court office A fee is county-specific | 633.286 Deposit of will with clerk |

How to Make an Iowa Last Will (Writing Steps)

1. Consider your possibilities. One thing to decide upon, first, is if you wish to write the entire document by hand or utilize a fillable last will and testament form that we offer here. You can also create it via our tool, which will let you customize more things in your last will.

2. Specify your information. Fill in your full name and address (the city, county, and state of residence) to establish the testator of the will.

3. Establish the executor. Now is the time to choose the executor of your last will and testament, the person in charge of making sure that everything you lay out in this document gets done.

You will need to specify the executor’s full name, followed by their residential information (city, county, and state). Ensure that you choose a person who lives in the same state as you do. If you don’t, there’ll be more paperwork and unnecessary hassle connected with the procedure resulting from different special policies every state has with regards to out-of-state executors (Iowa – 633.64 Qualification of fiduciary — nonresident).

4. Appoint the guardian (optional). You are able to choose a trusted person as a guardian if you’ve got underage or dependent children that must be taken care of. If there are no directions regarding what person should take care of your children, the guardian will be chosen by the court.

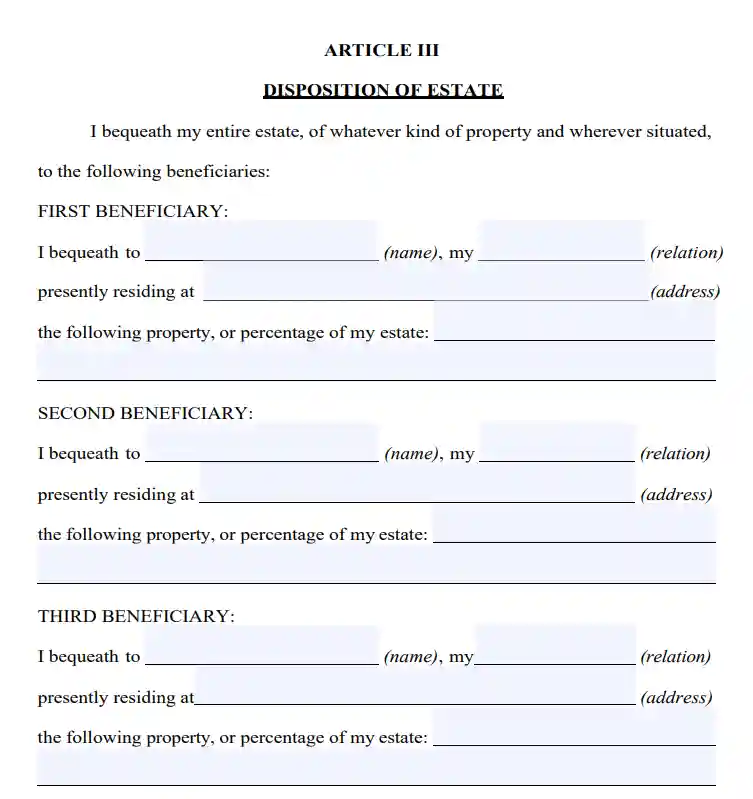

5. Specify your beneficiaries. This is where you indicate people who are going to receive your property. For every beneficiary, fill out these particulars: full legal name, address, and the way they are related to you. The beneficiaries are usually your closest loved ones, but you can also include your close friends or even charitable organizations.

6. Designate property. It’s possible to indicate which of the inheritors gets this or that piece of property. If you don’t, the assets are going to be allocated evenly among the beneficiaries. Money for arrearage, real estate, shares, company ownership, cash, as well as any material items of commercial worth in your possession can be mentioned in your last will and testament. But, any jointly acquired assets, as well as your life insurance, cannot go to your will.

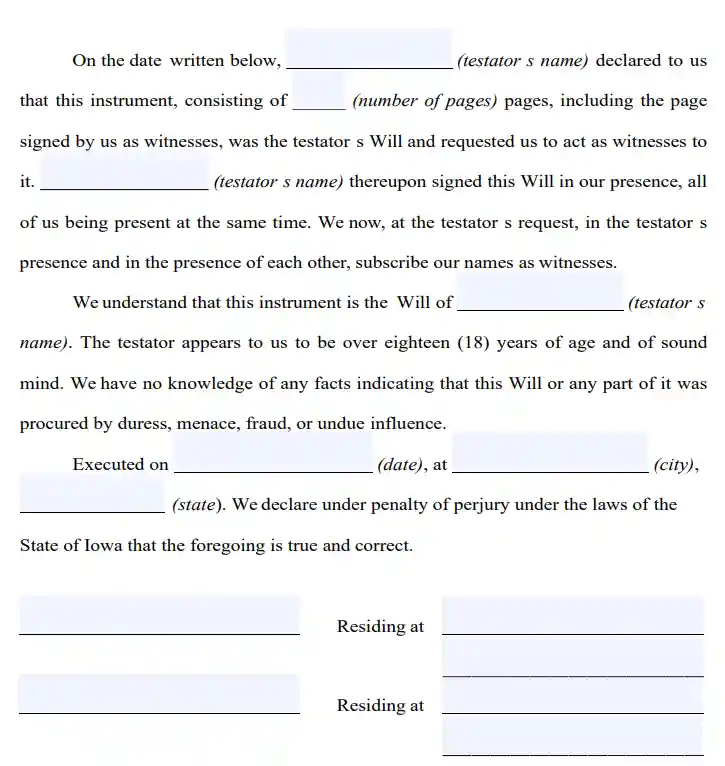

7. Ask witnesses to finalize the document. In accordance with the Iowa laws (633.279), for any last will to be considered valid, it needs to be signed by two witnesses. Only a person who isn’t your named beneficiary and is of 16 years or more could be selected as a witness. Now, you (and your two witnesses) must sign the paper after writing your full legal addresses and names.

Make a Free Iowa Last Will

Frequently Asked Questions

Is will notarization required by the Iowa statute?

In Iowa, you don’t have to notarize your last will and testament. But, you can make your will self-proving, and you’ll need to visit a notary in order to accomplish that. In case you make your last will self-proving, the court will not need to make contact with the witnesses to determine the credibility of the document, which will facilitate the probate.

What does it mean to be testamentary capable?

There are usually two requirements to fulfill: soundness of mind and being of a certain age. In Iowa, you’ve got to be over 18 years to create a last will. Being of sound mind means that you have a detailed knowledge of the property you own, your closest beneficiaries and family members (you must know and remember them), and understand clearly what a last will is and how it works.

Is spouse disinheritance possible in Iowa?

In Iowa, it is not possible to disinherit your spouse. Under Iowa Code § 633.238, a surviving spouse can always get a 1/3 of the diseased real property. Even if the spouse waives their inheritance rights in a prenup or a similar contract, it will still not be considered enforceable.

Can I alter my last will after it has been signed by all parties?

Yes, you’re allowed to alter it at any time by using a codicil (for minor changes) or creating a new will from scratch.

What will happen if a last will and testament is lost?

Iowa law offers a presumption that the absence of the will means it was revoked by the testator. And in most cases, it is very hard to prove the will’s existence. Nonetheless, it is possible, and here’s an example of such a case.

How can a physically impaired person sign his or her last will and testament?

Iowa Estate Code allows another person to sign your last will and testament only per your directive and in your presence. However, it must not be a beneficiary of your estate or a notary public verifying the document, who should also include certain wording in the acknowledgment (§9B.9).

| Related documents | When to make it |

| Codicil | There are a few minor changes you want to make to your will. |

| Self-proving affidavit | You want the probate to be quicker when it’s necessary. |

| Living will | You would like to state what health care you want if you cannot communicate that yourself. |

| Living trust | You want to skip probate by putting your assets in a trust. |

Last Will and Testament Forms for Other States