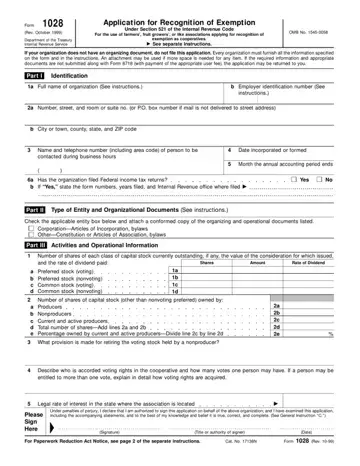

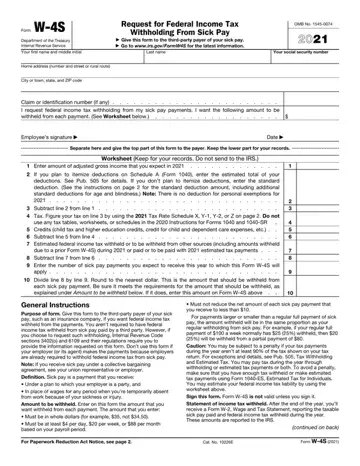

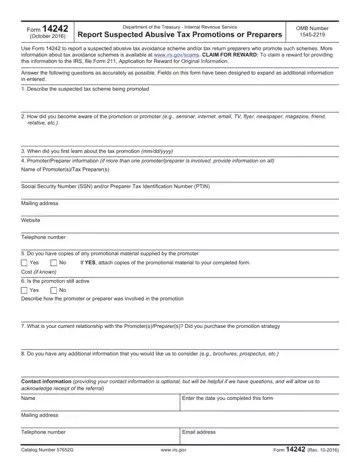

Internal Revenue Service (IRS) PDF Forms

Forms are an important part of the Internal Revenue Service (IRS) filing process. The forms you need to file your taxes depend on your individual circumstances. Some people may only need a few standard forms, while others may need to obtain several specialized forms. In this blog post, we will take a look at some of the most common IRS forms and provide you with information on how to obtain them. We also discuss some of the special circumstances that may require you to use other forms. Let's get started!