Free Nevada Durable Power of Attorney Form

The Nevada durable power of attorney is a legal document that allows you to designate someone else (the “agent” or “attorney-in-fact”) to handle your financial affairs and make decisions on your behalf. This power of attorney remains in effect even if the person granting the power (the “principal”) becomes incapacitated or unable to make decisions due to illness, injury, or mental incapacity.

The agent is granted authority to manage the principal’s financial affairs, such as banking transactions, paying bills, managing investments, filing taxes, buying or selling real estate, and other money-related matters as specified in the durable POA. Moreover, the power granted can be broad or limited based on the principal’s preferences.

In Nevada, a durable power of attorney is generally revocable, meaning the principal can revoke or modify it as long as they are mentally competent. Please note that this document doesn’t allow an agent to make decisions about medical care, so you’ll need to consider the broader scope of Nevada POA forms.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Nevada Signing Requirements and Laws

The Nevada Revised Statutes (NRS), specifically sections 162A.200 to 162A.660, govern the signing requirements and laws for a durable power of attorney. Key aspects include:

- Signing Requirements. A power of attorney must be signed by the principal or another individual directed by the principal in their presence.

- Acknowledgment. The signature must be acknowledged before a notary public or another authorized individual.

- Effectiveness. It becomes effective upon execution unless specified otherwise.

As per NRS 162A.220, a power of attorney must be signed by the principal or, in their conscious presence, by another individual directed by the principal. The signature is presumed genuine if acknowledged before a notary public or authorized individual.

NRS 162A.270 outlines the termination of a power of attorney or an agent’s authority. A durable power of attorney terminates upon the principal’s death, incapacity (if not durable), revocation, an accomplishment of its limited purpose, or if the agent dies, becomes incapacitated, or resigns without a successor agent named. An agent’s authority terminates upon revocation by the principal, the agent’s death, incapacity, resignation, or termination of the power of attorney itself.

According to NRS 162A.260, a durable power of attorney is effective upon execution unless the principal specifies a future effective date or contingency. If it becomes effective upon the principal’s incapacity, and no authorized person is named to determine incapacity, a medical professional (e.g., physician or psychologist) can make that determination in writing.

These statutes outline the signing requirements, effective dates, termination conditions, and authority transfer for durable powers of attorney in Nevada, providing legal guidelines for their execution, validity, and use.

Nevada Durable Power of Attorney Form Details

| Document Name | Nevada Durable Power of Attorney Form |

| Other Names | Nevada Financial Durable Power of Attorney, NV DPOA |

| Relevant Laws | Nevada Revised Statutes, Section 162A.220 |

| Signing Requirements | Notary Public |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

Durable POA documents are used in each and every state. Take a look at other popular DPOA forms frequently filled out by Americans.

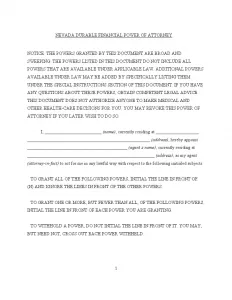

Steps to Complete the Form

Below are step-by-step instructions for completing the Nevada durable statutory power of attorney form.

1. Designation of Agent

You will begin by appointing your primary agent. Enter your full legal name where indicated. Then, provide the name, address, and telephone number of the person you designate as your agent. This individual will be able to handle your property and financial matters under the terms you specify.

2. Designation of Alternate Agent

If you wish to designate an alternate agent to act if your primary agent is unable or unwilling to perform their duties, complete this section. You are not required to appoint an alternate agent, but doing so can provide an additional safety measure. Enter the name, address, and telephone number for up to two alternate agents, specifying the order in which they should serve.

3. Grant of General Authority

This section requires you to specify which powers you are granting to your agent. You can choose specific areas such as real property, financial institutions, legal affairs, etc., or you can grant general authority over all listed subjects by initialing “All Preceding Subjects.” Be sure to initial next to each category you wish to include or provide blanket authority as desired.

4. Grant of Specific Authority

Here, you must decide if you want to give your agent specific powers that can significantly impact your property or estate planning. These powers include creating or amending trusts, making gifts, or changing beneficiary designations. Initial next to each specific authority you wish to grant. Exercise caution in this section, as these decisions can have profound implications.

5. Expression of Intent Concerning Living Arrangements

Express your wishes regarding your living arrangements if you become unable to live independently. You can specify whether you prefer to stay in your home or if you authorize your agent to arrange for alternative living arrangements. Indicate your preference by initialing the corresponding statement.

6. Special Instructions

Use this section to provide additional instructions or limitations on the agent’s authority that are not covered elsewhere in the document. It could include detailed directives on how to manage specific assets, additional stipulations on the powers granted, or any other personal instructions that are important to you.

7. Signatures and Notarization

After completing the form, sign and date it in the presence of a notary public. The form must be notarized to be valid. Provide the city and state where you are signing the document, and ensure that the notary completes their section with their seal and signature.

Remember, this power of attorney will automatically revoke any prior durable power of attorney documents you have created. If you have any doubts or need help clarifying any part of the form, consult a legal professional.

Listed here are various other Nevada documents filled out by our users. Try our step-by-step builder to customize these forms to your needs.

Download a Free Nevada Durable Power of Attorney Form