Free Indiana Durable Power of Attorney Form

End-of-life planning requires a clear understanding of what decisions will be made in case an individual loses an ability to communicate or acquires any kind of mental disability. While a Living Will form is a way of directing your chosen proxy to opt for certain medical treatment, a Durable Power of Attorney allows one to convey finance-related responsibilities, such as managing bank accounts or deal with business matters. Each of the states regulates the creation of a durable power of attorney form differently. That is why it is highly advisable to explore all the necessary details before initiating this process.

The Indiana Durable Power of Attorney Form is a legal document providing an agent with the rights to take control over the principal’s financial affairs. The principal, as well as the witness, sign the paper under oath. The Indiana DPOA must be acknowledged by a licensed notary.

Indiana power of attorney templates – click to get more Indiana-specific power of attorney templates that you might require.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Indiana Signing Requirements and Laws

In accordance with the IC 30-5-4-1 law of Indiana, to be effective, the document should:

- Be in Writing;

- Name an Agent/Attorney in Fact (at least 18 years of age);

- Give the Agent/Attorney in Fact the Power to Act on Behalf of the Principal;

- Be Signed by the Principal (or at his direction);

- Be Notarized.

The key definitions mentioned in the DPOA are explained below:

- Attorney in Fact: a willfully designated, trusted adult, chosen by the principal to act on his behalf. There may be more than one agent named in the document, which implies that each of them possesses the right to act independently.

- Principal: an individual at least 18 years of age, a trustee, personal representative, fiduciary, as well as a corporation or partnership, who signs the DPOA and delegates the agent the management of money matters.

- Financial Exploitation: the unlawful or unauthorized act committed to obtain control over the principal’s money, assets, or property through the use of deception, intimidation, or under the influence.

- Account: any account used by the principal to transact business;

- Trusted Contact Person: an adult who is supposed to be contacted in need of the consultation about the principal’s money matters.

The document can be revoked or terminated any moment the principal expresses such a wish; otherwise, the DPOA loses validity upon the death of the principal. A specific date of termination might also be designated in the DPOA.

Indiana Durable Power of Attorney Form Details

| Document Name | Indiana Durable Power of Attorney Form |

| Other Names | Indiana Financial Durable Power of Attorney, IN DPOA |

| Relevant Laws | Indiana Code, Title 30, Article 5 |

| Signing Requirements | Notary Public |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

DPOA forms are probably the most widely used ones within the USA. The following are some of the most requested durable power of attorney papers.

Steps to Complete the Form

You will find a thorough guide, directing ones through the Indiana DPOA completion, below. Pay specific attention to checking all the data you are entering.

- Obtain the Form

The Indiana Durable Power of Attorney is easily accessed on any trustworthy source page. In order to successfully fill out the form, use our form building software.

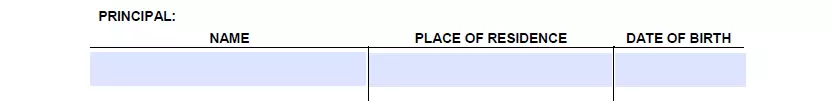

- Insert Principal’s Data

An individual who intends to create the DPOA form will need to begin with filling in his full name, place where he resides, and date of birth (month, date, year).

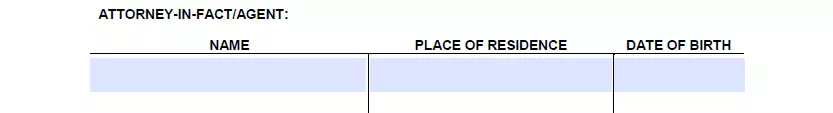

- Insert Agent’s Data

An agent (or attorney in fact) should provide the same information.

- Review the Powers Being Delegated

A section consisting of six parts is meant to describe which responsibilities exactly are given to the agent as a result of this legal agreement. Important: if the principal does not wish to deliver the rights mentioned in one of the paragraphs, he needs to cross it out. The same is required to be done if the principal is not expecting the agent to obtain the rights to a specific part of the powers described in a certain paragraph.

The first paragraph is related to the management of bank accounts. The second one authorizes the agent to make real property-related decisions. In the third paragraph, special powers concerning the principal’s personal property are defined. The fourth one empowers the attorney in law to regulate procedures of taking loans and borrowing money. Paragraph #5 is about providing the agent with the right to operate the principal’s business affairs. The last part of this section describes performing actions on the premises.

The principal needs to put his signature, affirming that all the paragraphs have been read, and he voluntarily grants the agent with the powers stated in this section.

- Confirm the Principal’s Intentions

The principal is required to indicate the date of the agreement, write down his full name, and, being first duly sworn, declare to execute the instrument to the agent chosen in advance.

- Witness the DPOA

One witness has to be present during the procedure of completing the document. He or she is supposed to be at least 18 years old and under no influence to sign the paper under oath.

- Notarize the Paper

The legal representative of the Notary Public should verify the provided information and establish its credibility. Once the form is notarized, the agent has obtained the right to handle his duties on behalf of the principal.

Listed below are some other Indiana forms completed by our users. Check out our step-by-step builder to personalize any of these documents to your needs.

Download a Free Indiana Durable Power of Attorney Form