Alabama Promissory Note Template

The Alabama Promissory Note Template is used as a commitment between a lender and a borrower that the loaned money will be paid back with a defined interest rate. The sample promissory note template may be secured or unsecured depending on the terms and conditions negotiated by the parties. A Secured Note will make the borrower liable to transfer ownership of the property described in the paper unless they transmit the payment, interest rate, and late fees on time. An Unsecured Note does not impose this liability.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Usury Laws

Section 8-8-1 of the Alabama state law regulates the amount of usury rate. The legal interest rate normally equals 6% for one year, unless different conditions are provided in the paper for verbal agreements. If the contract is written and signed by both parties, the maximum interest rate cannot exceed 8%.

Alabama Promissory Note Form Details

| Document Name | Alabama Promissory Note Form |

| Other Name | AL Promissory Note |

| Max. Rate | 8% for written contracts; 6% for verbal agreements |

| Relevant Laws | Alabama Code, Section 8-8-1 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (often called debt note) is a handy money instrument used by businesses and individuals across all states as a funds resource and a substitute for loan providers. Learn about the most common US states searched by our users regarding promissory note forms.

Filling Out the Alabama Promissory Note

You may opt for the official form, where you need to submit the following:

- The maker’s and holder’s names

- The initial principal sum in US dollars

- The date the agreement becomes effective

- Promissor’s signature, mailing address, and social security number

- Two adult witnesses ’ signatures

To ensure the best result, you can use our form-building software and an alternative, more detailed Alabama Promissory Note template. Follow the steps below to complete it successfully.

- Enter the Date and Payment Amount

Input the date you are signing the agreement and the amount of money the principal is about to receive in US dollars.

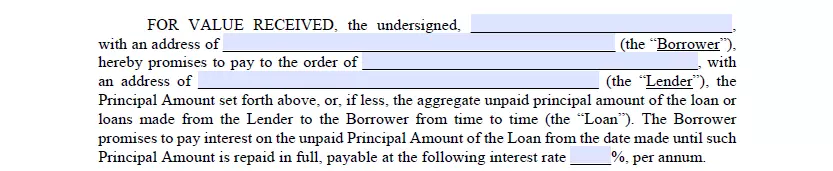

- Provide the Lender’s and the Borrower’s Data

Indicate the borrower’s full name and mailing address and the same information about the lender. Establish the interest rate per annum you have agreed upon.

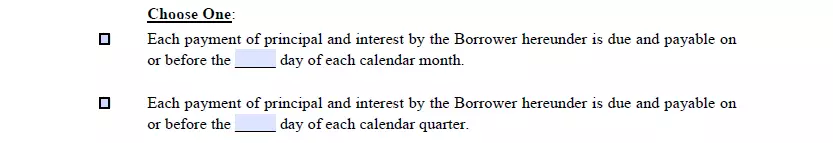

- Describe the Payment Policy

If the borrower pledges to transmit monetary funds every month, check the corresponding box. If the lender is supposed to receive the payments quarterly, select a related option. Indicate the sum you will get at a time (or the number of years given to the borrower for the debt compensation). The Maturity Date, or Due Date, should be entered as well.

- Establish the Note Type

Choose whether the Note is secured (along with the assets it is secured by) or unsecured.

- Indicate Your State

Write down that the document is being created in Alabama and is regulated by its laws.

- Sign and Witness the Paper

Two competent adults witnesses should append their signature, confirming that the information submitted is true and correct. Both parties have to provide their titles and full names.

We provide a variety of fillable Alabama documents to anybody seeking simplicity when filling out all sorts of papers.

Other Promissory Note Forms by State