Massachusetts Promissory Note Template

The Massachusetts promissory note template is a handy tool when borrowing money. A person may feel uncomfortable when lending cash because there is no written guarantee that the sum will be returned. To avoid such situations, we recommend enhancing such agreements with legal documents, and a simple promissory note document is one of them.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Although we will review Massachusetts promissory note’, you may create this paper in any American state. Remember to follow the local rules and use the proper form. In every promissory note, you have to include essential data:

- The exact sum received by the borrower

- The date when the borrower should complete refunding

- The details (names, addresses, contact info) of both the borrower and the lender

In some cases, debtors include the description of items they will provide if there is no possibility to return the cash—for example, if the lent sum is significant or when parties do not know each other well. These notes are considered “secured.”

Another promissory note type is “unsecured.” This means the debtor does not propose any tangible item. This is a commonly used template when lending to relatives or friends. When the sum is relatively small, this type is preferred, too. However, you can pick any type.

If you are a creditor and a debtor postpones the refund or denies to repay, you can use a signed promissory court to begin a trial in court.

Massachusetts Usury Laws

Laws regarding usury are described in Part I (Title XV, Chapter 107) and Part IV (Title I, Chapter 271) of the Massachusetts General Laws.

Section 3 (Chapter 107) defines the legal rate of interest in Massachusetts as 6%.

Section 49 (Chapter 271) tells about criminal usury in the state of Massachusetts: an interest rate of more than 20% per year is considered unlawful.

Massachusetts Promissory Note Form Details

| Document Name | Massachusetts Promissory Note Form |

| Other Name | MA Promissory Note |

| Max. Rate | 6% – legal interest rate (unless a written contract exists); Over 20% is considered criminally usurious |

| Relevant Laws | Massachusetts General Laws, Chapter 107, Section 3; and Chapter 271, Section 49 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (often referred to as note payable) is considered a basic money template used regularly by both individuals and businesses throughout all states as a funding source and an alternative to banks. Find out more about the most popular US states requested by our website users concerning promissory note forms.

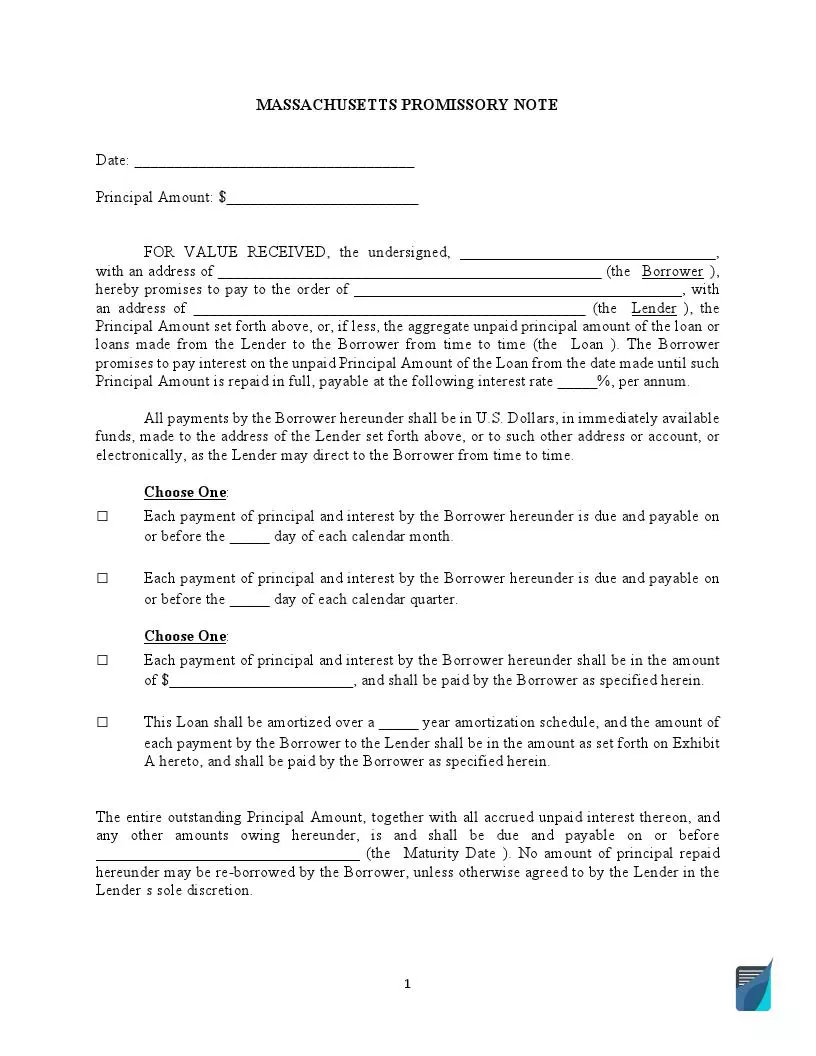

Filling Out the Massachusetts Promissory Note

It is common to use promissory notes in Massachusetts when individuals borrow money from other individuals. Entities also use the template. However, the details you reveal in the note are more or less the same. To complete the Massachusetts promissory note template correctly, read our helpful instructions.

- Find the Template

When you create legal documents in the US, obtaining the proper template is essential. Use our form-building software to get the one for Massachusetts.

Both parties of the agreement should receive a copy of such a note. So, get two copies.

- Write the Lent Amount

On the top of the page (on the left-hand side), write the exact sum lent to the debtor in US dollars.

![]()

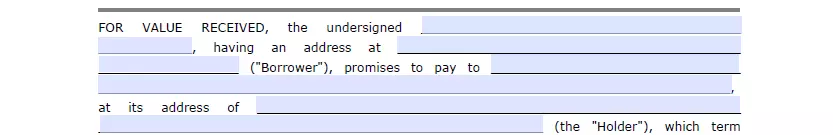

- Date the Note

Below the sum, add the date when the note is written.

- Indicate the City and State

Below the date, specify where the parties are making the deal, including the city and state.

- Name the Parties

Then, you have to introduce the borrower and the lender. Write their names and addresses. If the entities’ representatives sign the form, add the entities’ details.

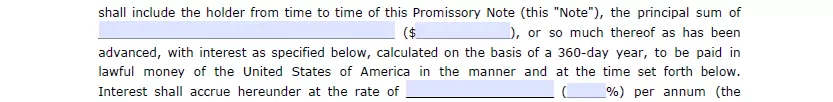

- Write the Amount Again

In suitable lines, write the lent amount again. Firstly, write it in words, then duplicate in numbers in the brackets nearby. After including the sum, enter the agreed interest rate (both in words and numbers).

- Define the Maturity Date

The date when the full refund should be done is called the maturity date. Write it in the note.

![]()

- Describe the Conditions

Then, you can describe the conditions under which the deal is conducted. For example, you may write what penalties will be applied if the borrower fails to pay on time. Also, you can schedule the payments.

- Ask the Borrower to Sign

At the bottom of the form, the borrower has to leave their signature. If the agreement is between entities, the CEO, president, or another relevant representative should sign.

- Complete the Supplement

In the supplement to the note, write the date, sum, and interest rate. Then, the borrower should sign again.

We provide a wide range of key Massachusetts documents to anybody in quest of convenience when filling out all sorts of agreements, contracts, and other paperwork.

Other Promissory Note Forms by State