New York Promissory Note Template

If you want to prove that you borrowed or lent money legally, the lender and the borrower should create and sign a certain document. The New York promissory note template increases the lender’s chances of getting the money back and describes the deal.

Typically, every promissory note template should contain:

- Information about the lender

- Information about the borrower

- The lent amount

- The interest rate

- The date when the borrower should refund.

Among the promissory note types, one may find two: a secured note and an unsecured note. If the lent amount is huge or you cannot rely on the borrower, a secured note is recommended. In such a document, the one who borrows the money will also provide an item to act as a security if the money is not refunded for some reason.

An unsecured note is less safe; it is common to sign such a form if you as a lender give the money to someone close (for instance, a relative, a spouse, or best friend).

The promissory note template is not unified because every state regulates borrower’s and lenders’ relations in its own way. The laws and allowed interest rates are different, too.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

New York Usury Laws

Laws and provisions tied to usury may be found in the New York Consolidated Laws: Article 5, Title 5 of the “General Obligations” and Article 2 of the “Banking.”

The interest rate limit in New York reaches 16%. The legal rate of interest in this state by law is 6%.

New York Promissory Note Form Details

| Document Name | New York Promissory Note Form |

| Other Name | NY Promissory Note |

| Max. Rate | 6% – legal rate of interest; 16% – general usury limit |

| Relevant Laws | New York Consolidated Laws, GOB Section 5-501; and BNK Section 14-A |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

In case you want to lend or borrow money, consider using a promissory note. It is a useful legal document largely drafted by companies and people in most states. Listed below are the state promissory note documents our users research the most.

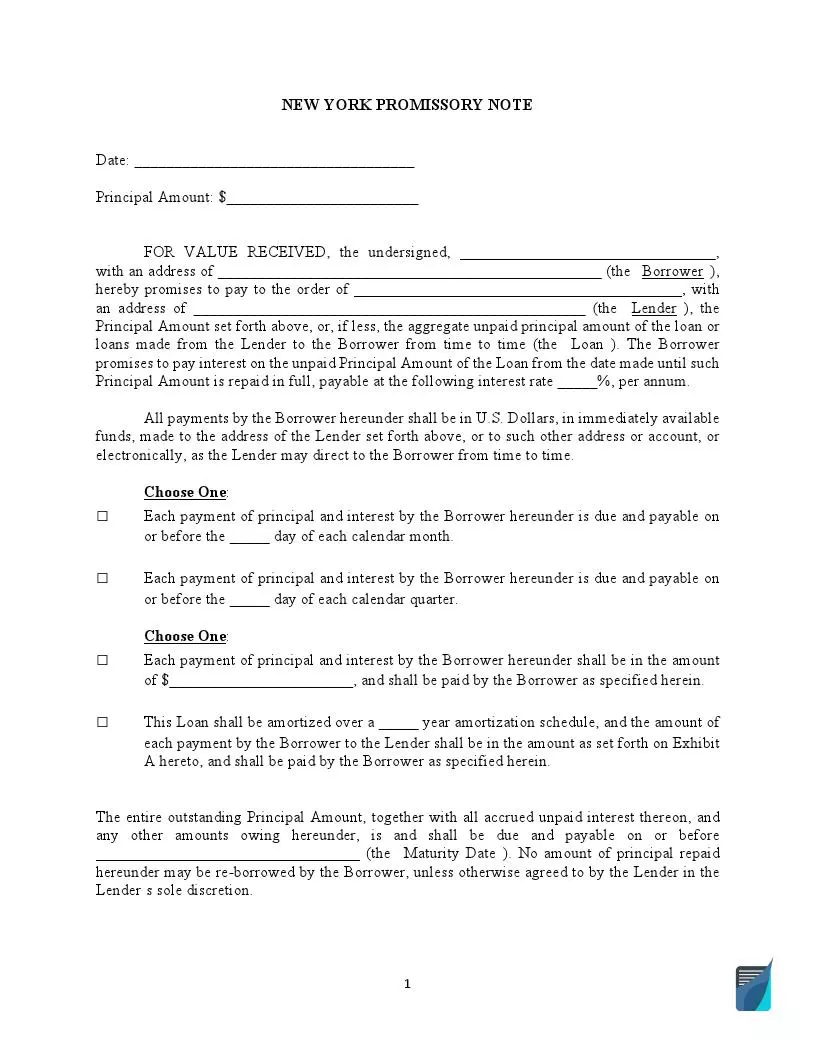

Filling Out the New York Promissory Note

You may face complications while completing legal forms in the United States. Check out our guide below to ensure the correct completion of the New York promissory note template.

Download the Form Template

You cannot complete any document without having a template. So, you may begin by using our form-building software to download the template of the New York promissory note.

Indicate the Date

The first sentence in the form should contain the date in the blank space.

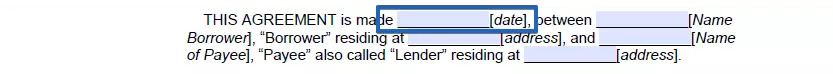

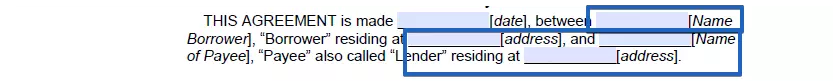

Name the Parties

Write the names and addresses of both the lender and the borrower. Another name for the lender in New York promissory note is the “payee.”

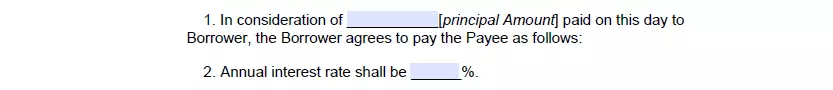

Describe the Debt

Below the details of the lender and the borrower, add the lent amount in US dollars. Then, indicate the interest rate.

Create a Schedule

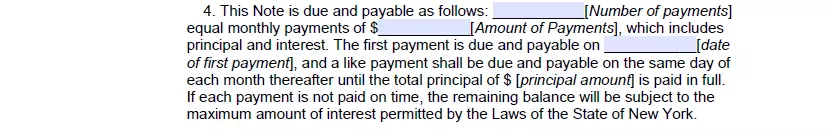

Then, you should describe the payment method, the date when the payment is due, the number of payments, and the dates of the first and the last payment. Discuss the schedule with another party who signs the note in advance.

Read the Statements

Once you have completed all previous sections as required, read the statements included in the template attentively. You should acknowledge everything written before signing the paper.

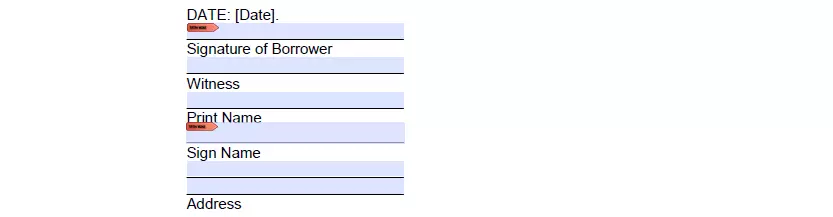

Sign the Form

In New York, the borrower’s signature in a promissory note is vital. His or her name and address should be added, too. Then, you may ask a witness to verify and sign the form.

Some other major New York templates available for download and that can be personalized in our hassle-free document constructor.