Wisconsin Promissory Note Template

In the United States, several legal documents regulate the relations between borrowers and lenders. The Wisconsin promissory note template is one of them. Signing this document guarantees the lender a refund or compensation for specific items.

Like any other legal form, a blank promissory note form requires specific mandatory information, including the borrowed sum, the lender’s and debtor’s personal details, and the interest rate. It is also vital to write the date when the borrower has to fully complete the refund.

If the debtor faces complications and cannot return the borrowed funds, the lender can use the signed promissory note in court.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

There are two types of promissory note template commonly used in the US:

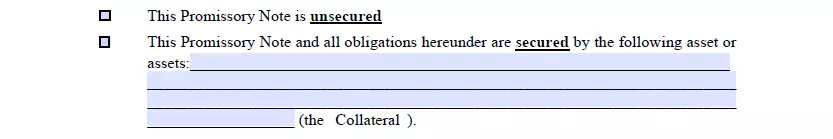

Secured Notes. In such notes, debtors specify what will be provided to substitute the money if they fail to repay the debtor as agreed.

Unsecured Notes. As the name implies, debtors do not give collaterals in these notes. If you lend the funds to people you can rely on, consider choosing this type. However, you are not obliged to do so and can choose any kind of promissory note.

Wisconsin Usury Laws

Norms outlining the topic of usury and money vary from state to state. To find out the rules in Wisconsin, one should consult Chapter 138 of the Wisconsin Statutes. This part is also called “Money and Rates of Interest.”

Wisconsin’s legal interest rate is 5% (see Section 138.04 of the Wisconsin Statutes). However, there are exceptions, and the parties may agree on another rate. It also depends on the loan type.

Wisconsin Promissory Note Form Details

| Document Name | Wisconsin Promissory Note Form |

| Other Name | WI Promissory Note |

| Max. Rate | 5% – legal rate of interest (but there are different rates exist for various types of loans |

| Relevant Laws | Wisconsin Statutes and Annotations, Section 138.04 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

Individuals and companies generally need promissory notes to borrow money from other people and companies and keep away from lending institutions. Below are some of the most popular regional promissory notes searched by the users of this site.

Filling Out the Wisconsin Promissory Note

One may find the completion of the Wisconsin promissory note template challenging. We have prepared the guidelines for your convenience.

Obtain the Relevant Template

We recommend using our form-building software to download the correct template. Prepare two copies of the promissory note. Both the creditor and the debtor should keep a copy.

Write the Date

The first blank lines you see in the form are located on the left-hand side (below the heading). Firstly, date the document. Then, write the sum given to the debtor in US dollars.

Identify the Debtor

Debtor’s personal details will be the next thing you write in the note. Name the debtor and add their full address.

Indicate the Creditor

You have to introduce the creditor using the same data.

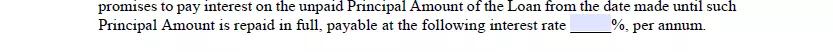

Specify the Rate of Interest

You have to insert the interest rate that the borrower and the creditor have discussed and accepted.

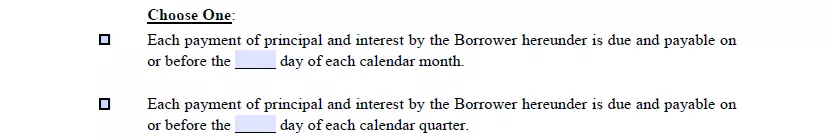

Delineate the Schedule

As we have mentioned before, you have to describe the payment schedule for the debtor. You should discuss The dates and the amounts to pay before signing the promissory note. Choose suitable options in the form and write the details in blank lines.

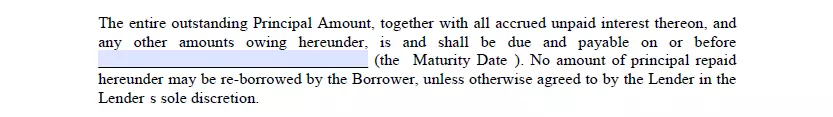

Define the Maturity Date

The last payment covering the debt in full is usually made on the “maturity” date. Write the date when the lender expects the payments’ termination.

Choose the Note Type

You have to indicate whether the note is secured or unsecured. We have explained the difference above.

When choosing a secured note, do not forget to include the “Collateral” (or the debtor’s items that may cover the debt).

Sign the Promissory Note

Lastly, append both parties’ signatures to the form. You may call a witness or a notary to sign if needed.

Take a look at other Wisconsin templates completed by FormsPal users. Consider our step-by-step tool to personalize any of these documents to your needs.

Other Promissory Note Forms by State