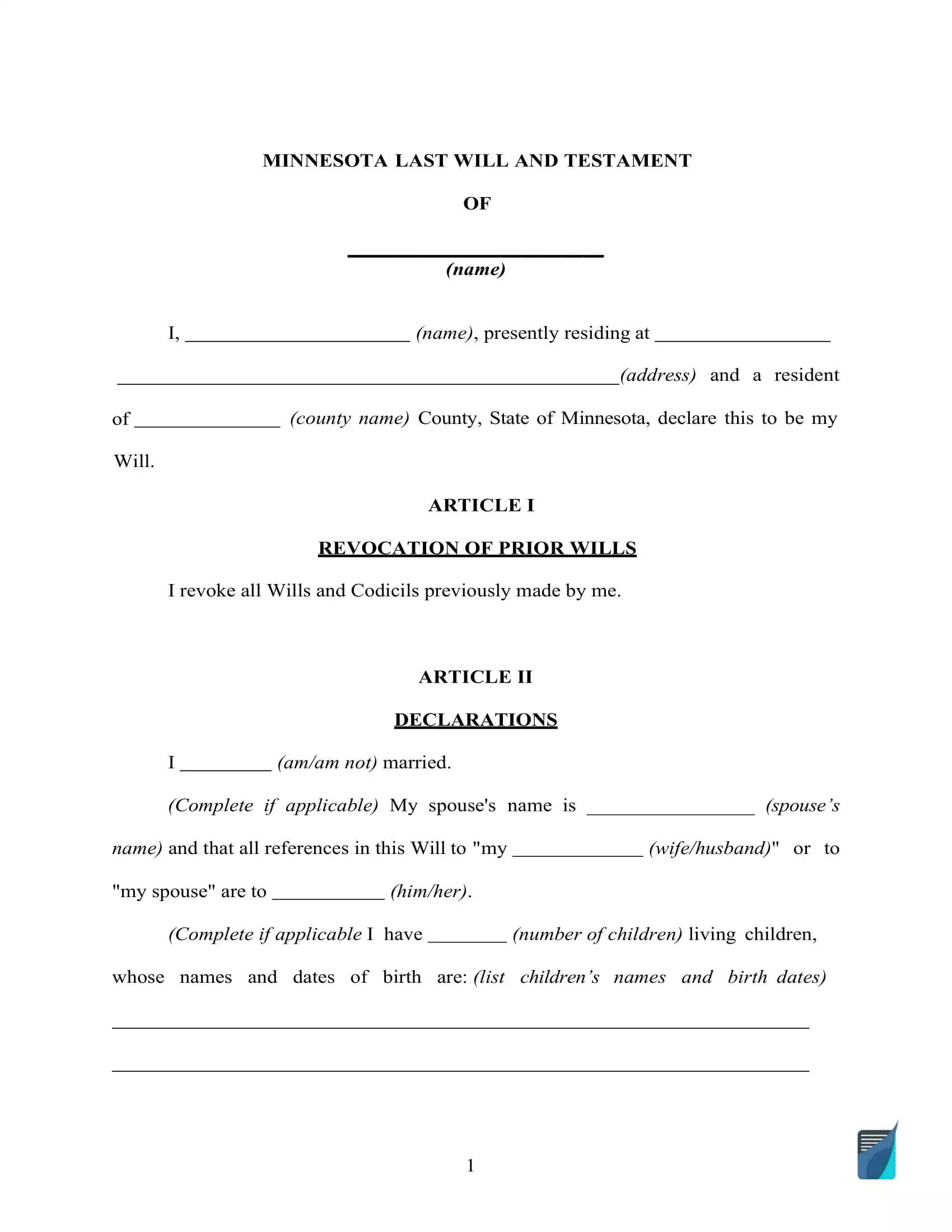

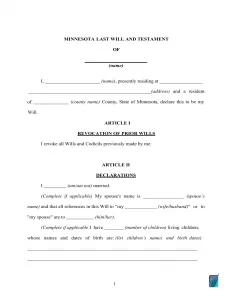

Minnesota Last Will and Testament Form

A Minnesota will is a document containing the last wishes of its creator (the testator) and determining precisely how and by whom their property will be used in the event of their death. You would need two disinterested witnesses to be present during the document signing to confirm that you have signed the will of your own volition.

An appropriately written last will and testament is often essential to those you love and your relatives upon your passing and is a crucial part of estate planning.

Here, you can find and download a will template valid in MN (PDF or DOC) and the details intended to eliminate your doubts pertaining to writing a last will and the state requirements.

Minnesota Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Chapter 524 – Uniform Probate Code; Article 2 – Intestate Succession and Wills | |

| Definitions | 524.1-201 General Definitions | |

| Signing requirement | Two witnesses | 524.2-502 EXECUTION; WITNESSED WILLS |

| Age of testator | 18 or older | 524.2-501 WHO MAY MAKE A WILL |

| Age of witnesses | 18 or older | 524.2-505 WHO MAY WITNESS |

| Self-proving wills | Not allowed | 524.2-504 SELF-PROVED WILL |

| Handwritten wills | Recognized if witnessed according to the state law | 524.2-502 EXECUTION; WITNESSED WILLS |

| Oral wills | Not recognized | |

| Holographic wills | Not recognized | |

| Depositing a will | Possible with a Minnesota county probate court A fee is $27 | 524.2-515 DEPOSIT OF WILL WITH COURT IN TESTATOR’S LIFETIME |

How to Write a Will in Minnesota

1. Think about your possible choices regarding the format. Before starting, it’s best to determine if you’d like to use the services of a legal professional or do the whole document on your own. The former is advised if you have a large estate. In the event that you wish to make a will on your own, select the type you’ll go for: a fillable last will and testament template or a do-it-yourself builder that allows you to make a personalized will by answering a series of questions.

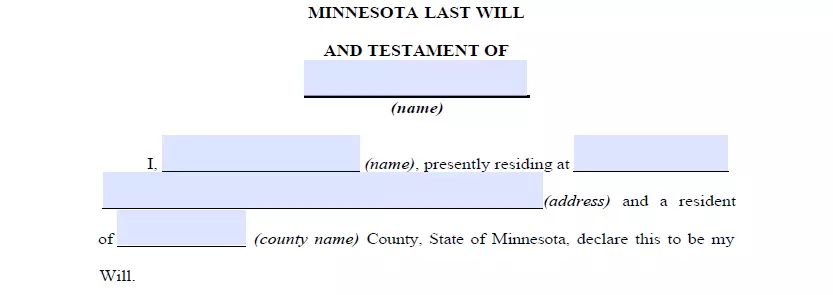

2. Specify your information. The first step is establishing you as the testator by writing your full name, along with the residential details (city, county, and state). Go through the information you wrote and check if everything’s correct.

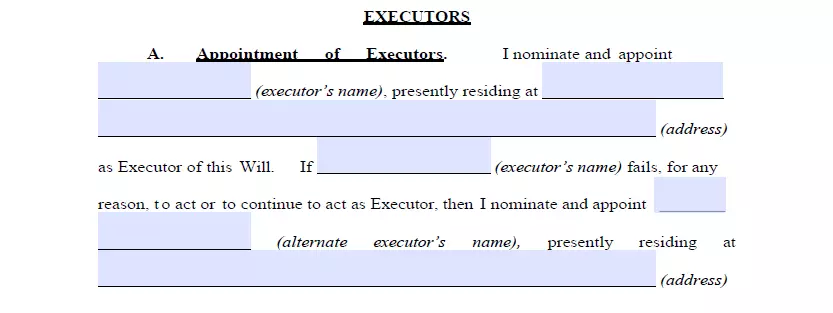

3. Choose the executor (personal representative). Appoint the executor of your estate (524.3-203) and enter their specifics: full name and place of residence, which will ordinarily be in the same state the testator lives in for the reason that almost all states enforce special regulations on out-of-state executors.

Most individuals who create a will name their marriage partner, an adult child, a family member, a close friend, or a verified attorney to serve as their personal representative, although basically anybody can be nominated in a last will. Because your executor will be in charge of your assets, be sure you choose someone you can trust.

It could also happen that the main representative will be unable to execute your will due to a health problem, death, disinclination, or other reasons. In this case, the court will appoint its own administrator to handle the fiduciary duties. In order to avoid that, it’s possible to choose an alternate executor by indicating the same particulars you did for the first one.

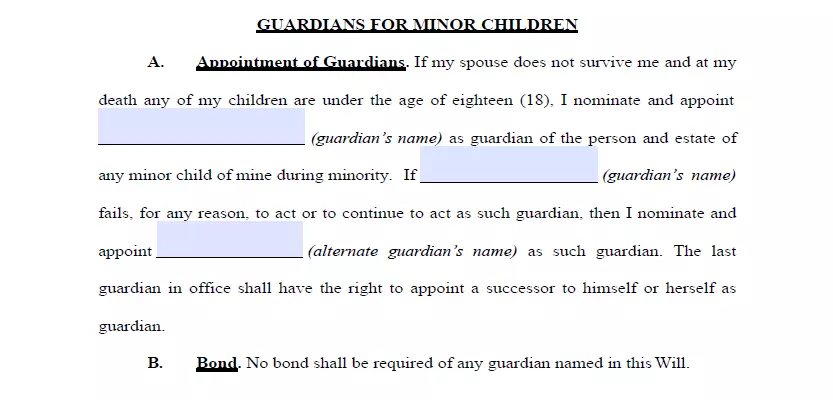

4. Determine the guardian (optional). Should you have underage or dependent children and do not want the court to select a guardian for them when you’re no longer here, it’s possible to specify a friend or acquaintance as a guardian for your children.

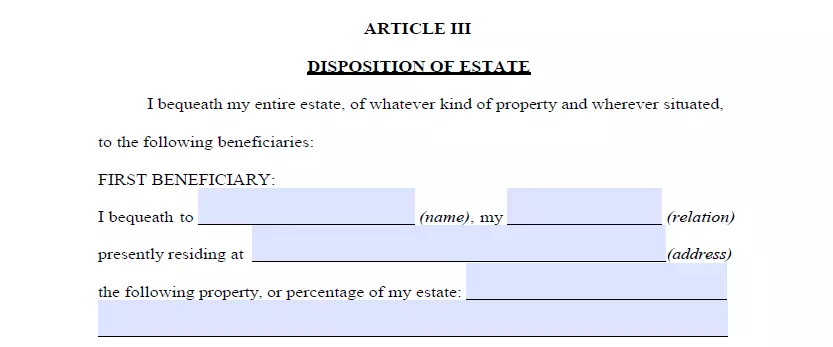

5. Indicate your beneficiaries. Now indicate all those to whom you leave your estate, that is, your beneficiaries. Write their full names, addresses, and your relationship to them (e.g., spouse, child, friend).

You can leave cash, shares, realty, business ownership, money for unresolved debts, as well as any tangible things of monetary worth you possess. Please be aware that there are things that can’t be distributed in the will, for example, life insurance and shared assets.

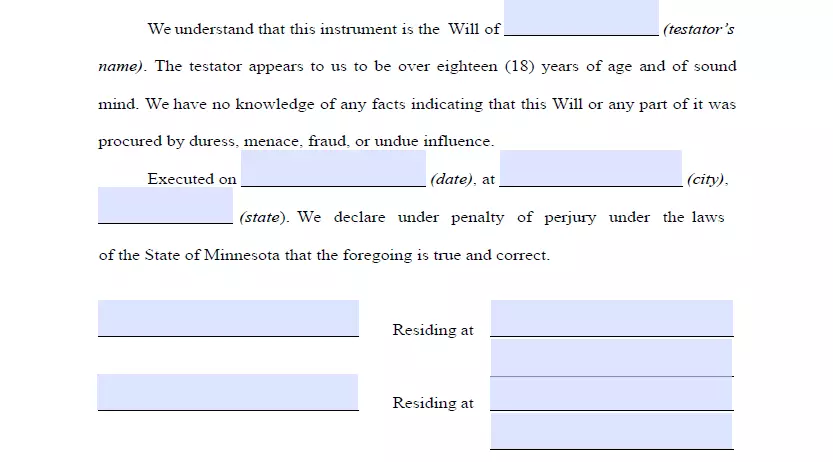

6. Continue with the witnesses putting the signatures at the end of the document. In accordance with the Minnesota legislation (524.2-505), for a will to be considered legally correct, it must be signed by at least two witnesses. Only somebody who is of 18 years or older could be selected as a witness. Although it is not prohibited by state law, it is recommended to choose a witness who is not a beneficiary of the signed will.

As a possible added safety measure against situations when your will is contested or some other problems, it’s advisable to name a witness who is younger than you to ensure they will be there after you die. After a complete review of each section in your last will and testament, all signatories (you and the two witnesses) will have to write their names and full addresses and sign the document.

Make a Last Will Valid in MN

Frequently Asked Questions

Should I notarize my last will in Minnesota for it to be effective?

No, a last will and testament in Minnesota is effective without notarization.

Exactly what does it mean to be testamentary capable?

Testamentary capacity is used to describe the testator’s legal (age) and mental capacity (sound mind) to write and change their last will. In the majority of states, you have to be over 18 years old in order to create a will. Being of sound mind translates that you are conscious of your property as well as the heirs of your possessions and realize the consequences of creating a will.

Should I attach a self-proving affidavit to my will in Minnesota?

It is not strictly necessary in Minnesota. Yet, in case you make a decision to attach a self-proving affidavit (524.2-504), it will be very advantageous because the document functions as an alternative for in-court testimony of witnesses in the course of probate. According to Minnesota law, any will that includes this affidavit, which has been properly executed, is immediately assumed to be a genuine will created and signed by the testator.

Is it possible to disinherit your spouse?

Can my will be modified without my consent?

No, it cannot be done without your involvement. There’s only one situation when someone else is permitted to get involved. In case you’re physically unable to sign your last will and testament, another person is allowed to do so instead of you but only in your presence and by your direction.

Can a signed last will and testament be changed in Minnesota?

Yes, in accordance with Minnesota law, it’s possible to alter or revoke a last will and testament in case you’re not bound by a legal agreement stating otherwise.

Consider how significant the change will be if you’re contemplating revising your will. Codicils are additions to a will that preserve the bulk of the original document. They can be helpful in situations where only minor alterations are necessary. For example, it is a suitable method to accomplish your objective if you merely need to update the name of your executor or guardian.

Suppose the changes are more extensive, such as a reorganization of property distributions or a complete rethinking of how you wish to treat particular heirs. In that case, it’s probably best to just prepare a new will to minimize possible misunderstanding.

In case I'm physically unable to sign my will, what do I have to do?

Solely per your directive and in your presence can another person sign your last will (See Minnesota Statutes, 359.091). You can give a corresponding directive by several means, which include voice communication, a positive response to a query, or sign. A notary public must be present during the procedure to certify the signature.

| Related documents | Times when you might want to create one |

| Codicil | There are a few minor modifications you wish to make to your will. |

| Self-proving affidavit | You want to save time and money for your will’s witnesses. |

| Living will | You want to state your wishes concerning the end-of-life treatment and life-prolonging measures. |

| Living trust | You would like to consider an alternative to a last will. |

Last Will and Testament Forms for Other States