California Promissory Note Template

When a person borrows money from another individual or entity, there is a need to complete several documents confirming borrowing. A California promissory note template is used when the deal is sealed in the mentioned state under specific conditions.

This document usually describes:

- Who borrowed the money

- The borrowed amount

- Obligations to return the debt within a specific period

- The interest the borrower should pay.

There are two types of California promissory notes: secured and unsecured. The first type is used if a borrower suggests substitution for the money (when they cannot cover the debt). The second type is common when the borrower is a friend or a family member whom the lender trusts.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

California Usury Laws

California Constitution incorporates the provisions tied to the topic of usury (see Article XV).

You may find the information about the rate of interest there. The rate varies from 5% to 10% in California, depending on why the money is borrowed and other factors.

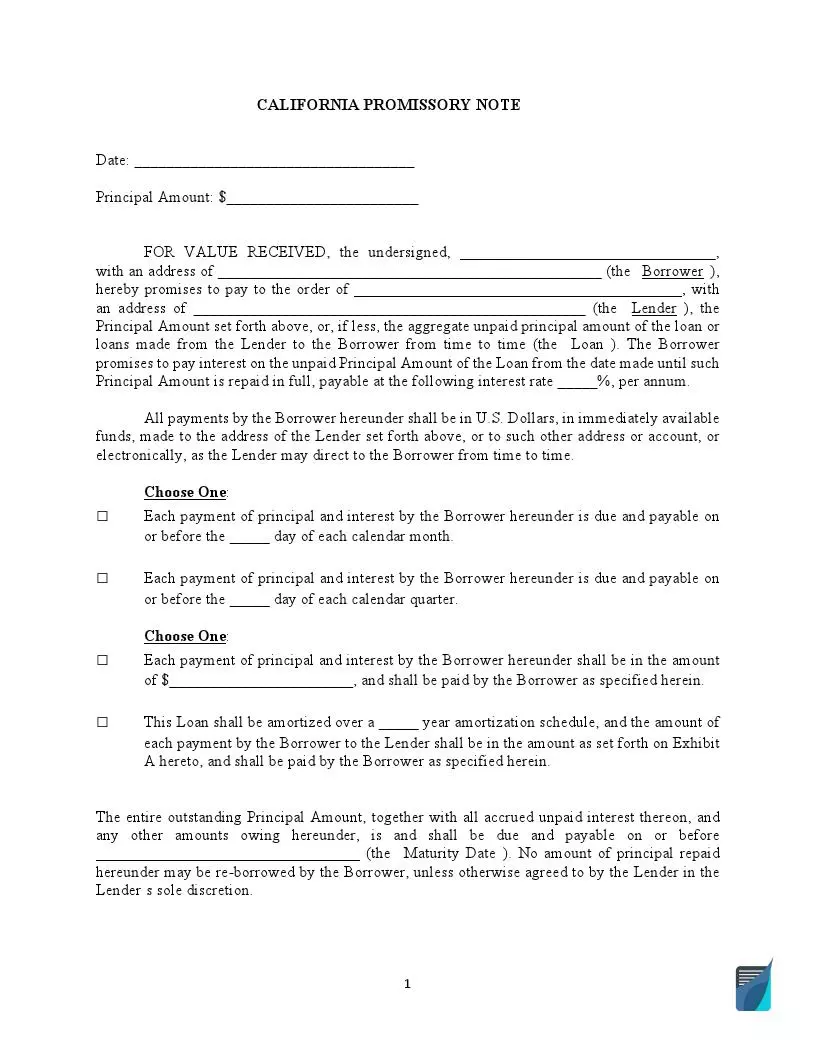

California Promissory Note Form Details

| Document Name | California Promissory Note Form |

| Other Name | CA Promissory Note |

| Max. Rate | 10% – for personal, family, or household purposes; For any other loans – allowable rate is the higher of 10% or 5% over amount charged by the Federal Reserve Bank of San Francisco |

| Relevant Laws | California Constitution, Article XV |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

Businesses and individuals usually require promissory notes to borrow money from other individuals and businesses and keep away from lending institutions. Below are some of the most common local promissory notes looked up by our users.

Filling Out the California Promissory Note

The completion of legal forms in the United States can be complicated. To fill out the promissory note template correctly, follow our guidelines below.

Download the Template

First, you should get the template that will suit the case. Use our form-building software to generate the file.

Write the Date

Below the heading of the form, add the date when you are signing it.

![]()

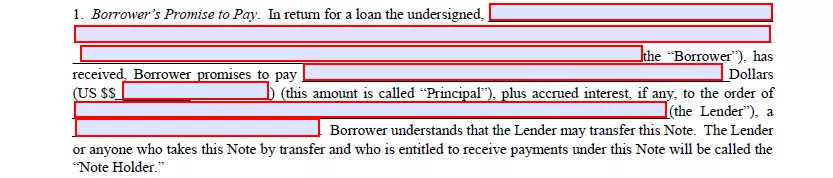

Name the Involved Parties and Indicate the Borrowed Sum

The form begins with information about the parties that sign it. The one who gives the money is also referred to as a lender. The one who receives the money and is obliged to pay it back is called a borrower.

In the relevant blank lines, write the names and the addresses of both the borrower and the lender. Also, write the amount of lent money in US dollars.

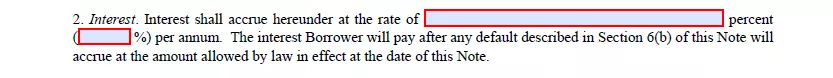

Define the Interest Rate

State the interest rate per annum for this debt in both words and numbers.

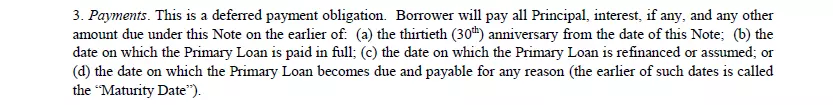

- Choose among the Given Statements

After inserting the interest rate, parties should agree on some statements, including when the payment is due (or the maturity date) and the sum to pay. Choose the items that suit your case and express the conditions that both parties have discussed and accepted.

- Read the Statements Attentively

Below the added details, you will see several statements regulating the relations between the lender and the borrower. Read them carefully and take them into account to avoid any kind of problems tied to the loan.

Sign the Form

Both the lender and the borrower should sign the promissory note to show their acknowledgment of the document.

Try our document builder to customize any form offered on our website to your preferences. Here’s a group of some other fillable California forms we provide.