South Carolina Promissory Note Template

The South Carolina Promissory Note Template is used to certify that the borrower will pay the loaned money back to the lender. The basic promissory note template establishes various terms and conditions that regulate the payments, including:

- Both parties’ personal data

- The borrowed amount

- The interest rate

- Means of compensating the indebtedness

- The amortization schedule

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

South Carolina Usury Laws

According to Section 34-31-10 of the state law, all accounts shall be expressed in US dollars. Section 34-31-20 states that the legal interest rate must not exceed 8,75% per annum.

South Carolina Promissory Note Form Details

| Document Name | South Carolina Promissory Note Form |

| Other Name | SC Promissory Note |

| Max. Rate | 8.75% – legal rate of interest |

| Relevant Laws | South Carolina Code of Laws, Section 34-31-20 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (often referred to as loan note) is considered a simple lending document used regularly by both individuals and businesses through all states as a funding source and a substitute for loan providers. Discover more about the most popular US states searched by our users with regards to promissory notes.

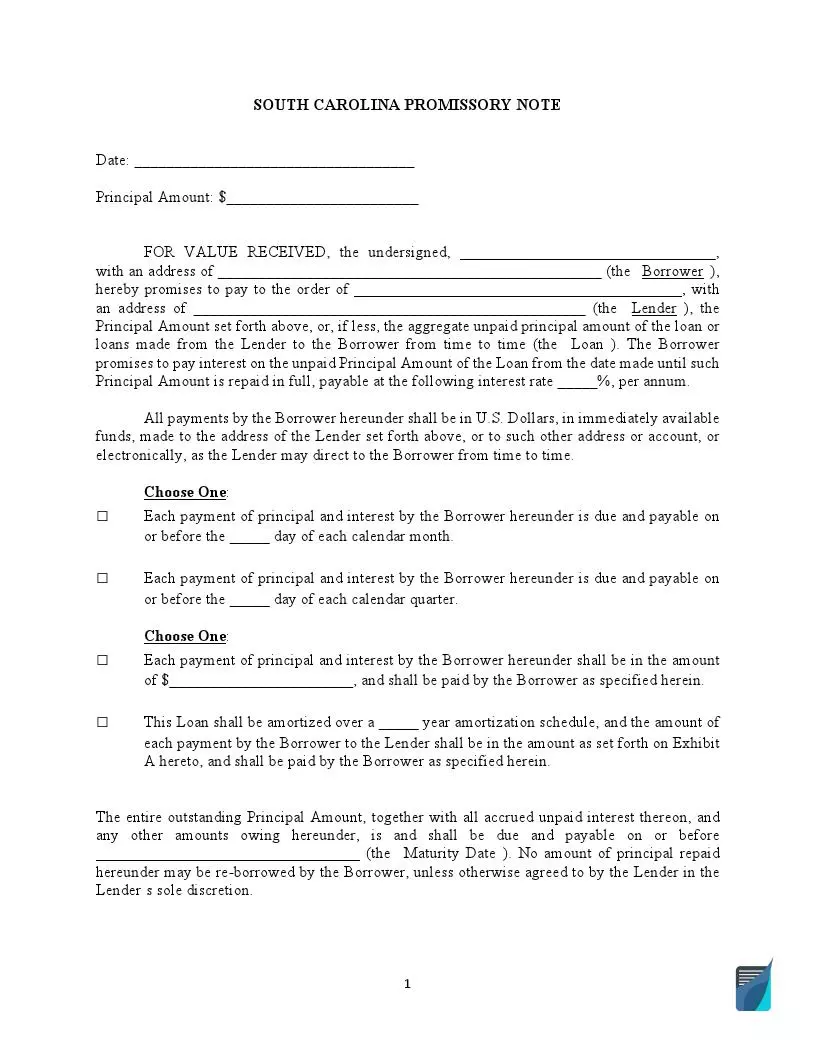

Filling Out the South Carolina Promissory Note

You may access the South Carolina Promissory Note Template on any reliable source page. Still, we advise you to use our form-building software to create the most recent personalized document. To complete the form successfully, follow the simple set of instructions below:

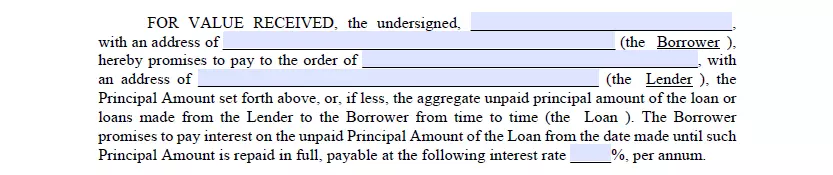

- Date the Paper

Indicate the date your agreement gains validity.

- Establish the Principal Amount

The loan in full should be provided in US dollars.

- Enter Both Parties’ Personal Information

The maker (or the borrower) and the holder (the lender) are supposed to write down their full names and residential addresses. Add the amount of usury rate you have agreed upon herein as well.

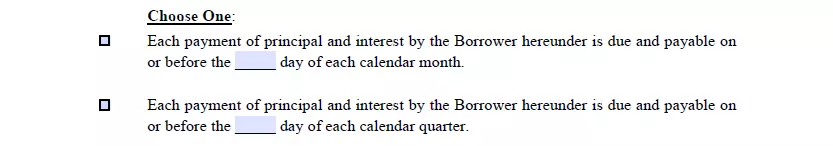

- Provide Details About the Payment

You can choose several options. If the lender accepts to receive monetary funds every month, indicate so in this section. Transmitting money every quarter may be selected, too. Indicate the amount of money, including the interest rate you wish to receive at a time, and additional information about the amortization schedule (if you establish one). The so-called Maturity Date has to be inserted after that.

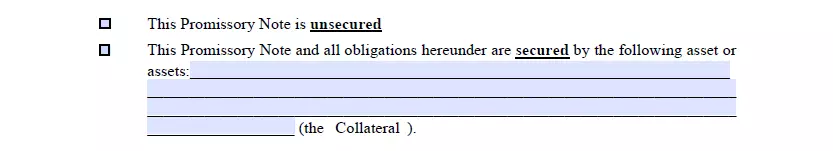

- Indicate the Promissory Note Type

The document may be secured or unsecured, depending on the amount of money the lender is owed and the borrower’s agreement to transfer ownership of the property mentioned in this section if they fail to provide the payment and late fees. The lender affirms to cease the lien right upon repayment.

- Name the State

Even if you reside out of South Carolina, this state’s laws control the document creation as long as the agreement is signed and witnessed here.

- Sign the Form

An adult witness should append their signature to confirm that the contract has been executed willfully and voluntarily. Both the maker and the holder should provide their titles and names.

Looking for more South Carolina documents? We provide free forms and straightforward personalization experience to anybody who wishes for less hassle when handling documentation.